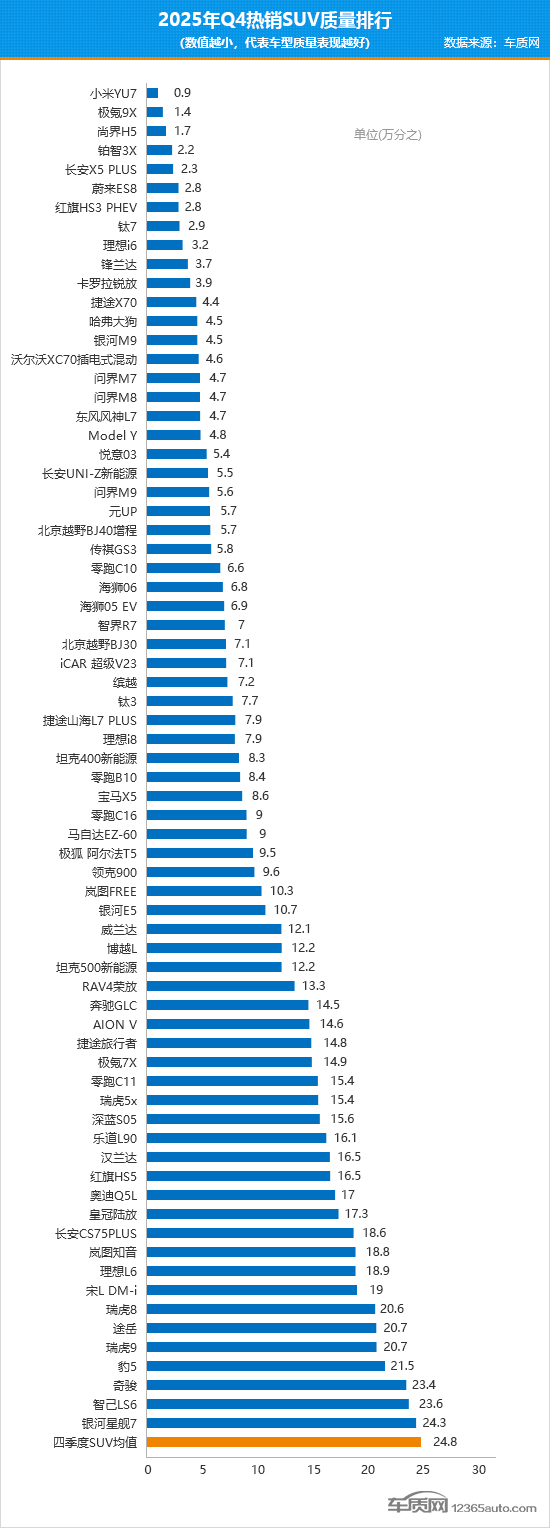

Top-Selling SUV Quality Ranking in China for Q4 2025

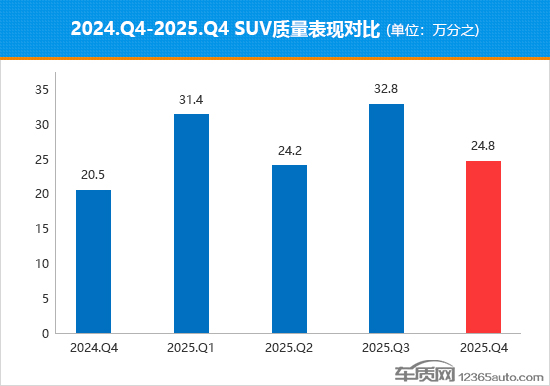

According to Chezhi.com, a leading platform for collecting information on defective automotive products and handling consumer complaints in China, a total of 11,984 quality complaints for domestic SUVs were received in Q4 2025. During the same period, data from the China Passenger Car Association showed that domestic SUV sales (excluding imported vehicles) were approximately 3.386 million units, covering 358 models. To ensure data accuracy, Chezhi.com only counted the first quality complaint cases for these 358 models. The calculated average quality complaint-to-sales ratio for SUVs in Q4 2025 was 24.8 complaints per 10,000 vehicles, a significant decrease from Q3, indicating an accelerating overall improvement in quality performance.

71 top-selling models outperformed the class average in quality complaint-to-sales ratio.

Chezhi.com utilizes a "complaint-to-sales ratio" evaluation system to analyze domestic SUV products in the fourth quarter of 2025. According to statistics, the average SUV sales volume in China in the fourth quarter was 9,458 units (average monthly sales of approximately 3,153 units). Among the 358 models with sales data support, 108 models exceeded this average, becoming best-selling SUV models in the fourth quarter. Among them, 71 models performed better than the average domestic SUV complaint-to-sales ratio of 24.8 per ten thousand in the fourth quarter. These models possess a solid reputation basis among the best-selling SUV models in China, with product quality performing better than other domestic SUV models. The specific complaint-to-sales ratios of these best-selling models are shown below:

Complaint volume declines, sales climb, and quality performance accelerates its recovery.

SUV quality complaints in the fourth quarter showed a trend of rising and then falling, decreasing by 19.7% compared to the previous quarter, and increasing by 11.2% year-on-year. During the same period, SUV market sales achieved quarter-on-quarter growth for three consecutive quarters, with fourth-quarter sales reaching the peak of the year, rising by 11% compared to the previous quarter and decreasing by 7.9% year-on-year.

Driven by the dual impact of declining complaint volumes and surging sales, the ratio of quality complaints to sales for SUVs in the fourth quarter dropped significantly compared to the third quarter. While quality performance showed a short-term recovery, it remained at a relatively high level compared to the same period in 2024.

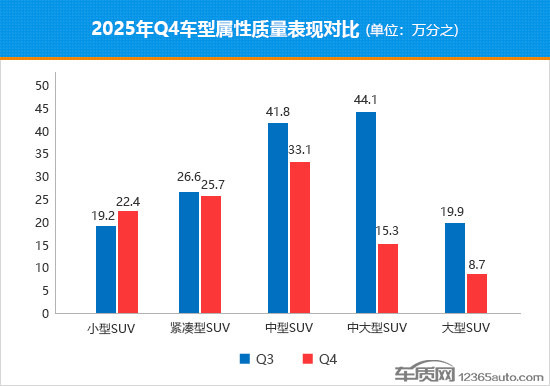

Small SUV quality performance continues to worsen; Medium- and Large-sized SUV quality reputation shows significant improvement.

This quarter, the complaint volume of all models decreased to varying degrees compared to the previous quarter, with large SUVs showing a particularly significant reduction, down 49.5% quarter-over-quarter. In contrast, small SUVs experienced the smallest decrease, with complaint volume remaining at a high level.

In stark contrast to the general decline in complaint volume, sales of all vehicle types except small SUVs and compact SUVs achieved positive quarter-on-quarter growth this quarter. Among these, large and mid-size SUVs led the surge, with an 88.3% increase compared to the third quarter. Furthermore, mid-size SUVs marked a milestone breakthrough, surpassing the one million unit mark in sales for the first time in a year, with a quarter-on-quarter growth of 8.6%.

From the change in the quality complaint-to-sales ratio, it can be seen that although the number of complaints for small SUVs slightly decreased month-on-month, the significant drop in sales led to it being the only vehicle type with an increased ratio this quarter. In contrast, large and mid-size SUVs performed outstandingly, with their ratio falling sharply month-on-month to the lowest level in nearly a year, demonstrating significant short-term improvements in quality reputation.

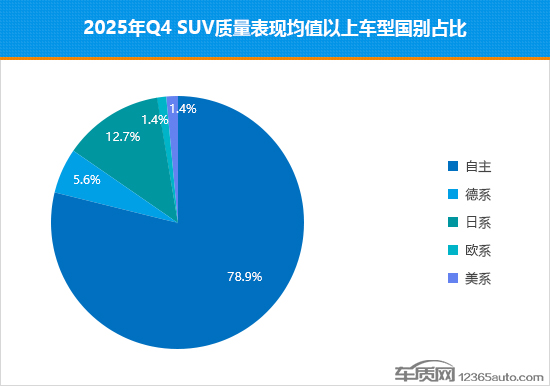

Japanese brands perform remarkably well, while domestic brands firmly hold the "C" (leading position).

In the fourth quarter, the share of Japanese models on the list rebounded, increasing by 2.5 percentage points compared to the third quarter. During the same period, independent brands maintained an absolute lead, with their share rising by 0.7 percentage points quarter-on-quarter. In contrast, German brands underperformed this quarter, with their share shrinking by 3.4 percentage points to reach its lowest point of the year.

Data Highlights

This quarter, Japanese brands performed better overall in terms of quality compared to the third quarter. Not only did the number of models on the list increase, but some models also saw significant improvements in their rankings, with two models even making it into the top ten. In terms of brands featured, Geely Auto was particularly outstanding, successfully taking over from Great Wall Motors. A total of 8 models from Geely entered the list, making it the brand with the most models on the list this quarter. Chery Auto also performed well, with 6 models on the list, but their rankings generally declined compared to the previous quarter.

Specifically, among the models on the list, the Xiaomi YU7 successfully topped the rankings with its outstanding market performance. Its quality complaint-to-sales ratio remained consistent with the previous quarter, indicating commendable short-term quality performance. The GAC Toyota BZ3X, launched in March 2025, achieved a steady performance by being included in the list for three consecutive quarters. This quarter, it reached a highlight, soaring to the 4th position, successfully leading all joint-venture brand models on the list, with its continuously improving quality performance being noteworthy. Even more impressive is the brand-new model, the Shangjie H5, launched at the end of September 2025. It entered the list for the first time and immediately secured a spot among the top three, thanks to its exceptional quality reputation and market achievements. It is hoped that it will continue to build on this success and maintain its performance.

Compared to the improving quality performance of some models, the fourth-quarter list also saw some models perform poorly. The most representative of these is the Lynk & Co 09, whose ranking fell from 11th place to the lower-middle of the list. Affected by both increased complaints and decreased sales, its quality performance has significantly declined compared to the third quarter. In addition, the Dongfeng Aeolus L7 also fell out of the top ten this quarter, with a sharp drop in sales being the main reason for its ranking to decline.

In contrast, traditional luxury brands on the list showed a starkly different performance compared to the sedan segment, with only four models making the list this quarter—one fewer than in the third quarter. Specifically, the Volvo XC60 plug-in hybrid, launched in September 2024, delivered a standout performance, significantly outranking the three competing models from BMW, Benz, and Audi to break into the top 20. Additionally, while the BMW X5's ranking remained largely unchanged from the previous quarter, its complaints-to-sales ratio retreated to single digits, indicating an improvement in quality performance.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories