Summary: Summary of prices and forecasts for general and engineering plastic materials in the plastic market on August 26.General materialIn terms of aspects, macro policies provide support, leading to a slight increase in PE prices in some areas; the PP market sees a small drop of 10-20; the PVC market experiences weak fluctuations, with some prices dropping by 20; ABS slightly weakens, dropping by 10-50; PS sees some prices decrease by 20-50; the EVA market remains stable with some adjustments in quotations.Engineering materialsIn terms of this aspect, PC continued to explore lower, with some dropping by 50-100; PA6 showed weak fluctuations, locally dropping by 100; PET narrowly declined by 10-30; PA6, POM, PBT, and PMMA markets remained stable and quiet.

General material

PE:Macroeconomic policy support, with prices mainly experiencing slight increases.

1 Today's summary

① On August 25th, attacks by Ukraine on Russian energy facilities continued, and the instability of the Russia-Ukraine situation brought potential supply risks, causing international oil prices to rise. NYMEX crude oil futures for the October contract closed at $64.80 per barrel, up $1.14 per barrel, a week-on-week increase of 1.79%. ICE Brent crude futures for the October contract closed at $68.80 per barrel, up $1.07 per barrel, a week-on-week increase of 1.58%. China's INE crude oil futures for the October 2510 contract rose by 2.5 yuan to 493.5 yuan per barrel during the day session, and increased by 5.7 yuan to 499.2 yuan per barrel during the night session.

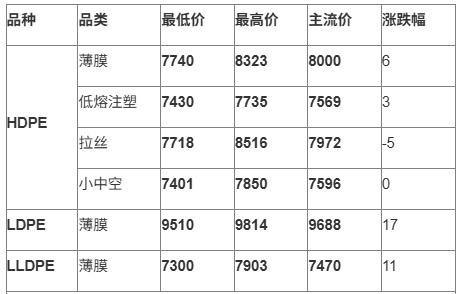

The market price of HDPE changed by -5 to -6 yuan/ton, the market price of LDPE increased by 17 yuan/ton, and the market price of LLDPE increased by 11 yuan/ton.

2 Spot Overview

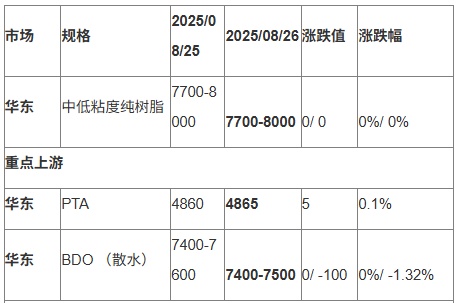

Table 1 Summary of Domestic Polyethylene Closing Prices (Unit: Yuan/ton)

Today, the spot market price of polyethylene in China fluctuated and increased. Driven by guidance, the price of LLDPE products rose somewhat today. However, from the perspective of transactions, some buyers remained cautious, resulting in slightly lower quotes in the afternoon compared to earlier in the day. HDPE product prices struggled to rise due to supply pressure, mostly remaining stable, with some actual orders offering discounts. The prices of LDPE products showed little overall change.

3、Price forecast

In the short term, as the end of the month approaches, the supply of spot resources will decrease while the pre-sale resources will increase. However, after entering September, the peak season for downstream consumption of polyethylene will arrive, coupled with the recent clear intention of enterprises to support prices, it is expected that market prices will still have an upward trend.

PP:The PP market is stable with a slight easing.

1、Current Spot Overview

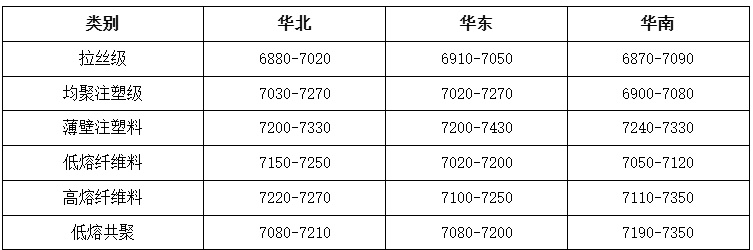

Table 1 Domestic Polypropylene Price Summary (Unit: RMB/ton)

2.Market Overview

Today, the domestic PP market remained generally stable with slight softness, with some prices dropping by 10-20 yuan/ton. In the morning, futures fluctuated and failed to provide clear guidance for the spot market. Most upstream producers kept their factory prices stable, and traders saw little change in costs, resulting in limited adjustments to quotations. In the afternoon, as futures prices declined, holders became more active in selling, and some quotations softened slightly. Downstream buyers mainly made low-priced, just-in-need purchases. Overall, market inquiries and transactions weakened compared to yesterday.

3.Key factors affecting future market price changes.

Based on the analysis of driving factors, it is expected that PP will fluctuate within a narrow range in the near term. The specific reasons are as follows:

Demand: Translate the above content into English and output the translation directly without any explanation.At present, there is still no significant improvement in new downstream orders. The operating rate has increased only slightly compared to the previous period, procurement of goods remains cautious, and support from the demand side is limited.

Supply:Recently, the second lines of Quanzhou Guoheng and Jingbo Petrochemical have restarted, with maintenance efforts on the units weakening compared to the previous period. Additionally, the stable commissioning of new units has been realized, and supply-side pressure is expected to increase.

Cost:The United States will impose more sanctions on a certain European country, and Ukraine's attacks on the energy infrastructure of this European country may disrupt supply. European and American crude oil futures have risen for four consecutive trading days, and the support from the PP cost side remains.

PVC:In Asia, the September price increase was lower than expected, and the PVC market fluctuated weakly.

1. Today's Summary

The ex-factory prices of domestic PVC producers remained generally stable, with minor adjustments in some cases.

② Maintenance at Zhenyang, Huayi, Formosa Plastics Ningbo, Zhongjia, and Huatai plant areas; Qingdao Haiwan plans to start production of new units this week.

③. The September shipping quotations from major Asian producers increased by $10-30/ton.

2 Spot Overview

Table 1 Summary of Domestic PVC Spot Prices (Yuan/Ton)

Based on the Changzhou market in East China, today's spot cash price for carbide method Type V in East China is 4,770 yuan/ton, unchanged from the previous trading session.。

The domestic PVC spot market is weak and fluctuating, with fixed spot prices remaining stable for the time being. During the trading session, prices tend to decline with transactions mainly at lower levels. Insufficient policy stimulus in sectors such as real estate has led to a stalemate in the PVC supply and demand fundamentals. In September, major producers in Asia quoted prices lower than expected, putting pressure on export price competition. In East China, the cash delivery price for carbide-based Type V PVC stands at 4,720-4,850 RMB/ton, while ethylene-based PVC is priced at 4,850-5,100 RMB/ton.

3、Price forecast

In September, Asian PVC manufacturers raised their pre-sale quotations. However, the market's regional expectations were limited. There was increased competition in export prices to the Indian market, and due to the impact of anti-dumping policies, clients in the market became more cautious. The domestic spot market fundamentals remained unchanged, with upstream supply stable due to maintenance and domestic demand steady. In North China, some industries saw a slight decrease in short-term operations, contributing to an increase in inventory pressure in the market. However, the rise in cost prices provided stronger support for the bottom level. It is expected that the market will predominantly experience weak range-bound fluctuations in the short term. The cash-on-delivery prices for the carbide-based Type 5 in East China are anticipated to be in the range of 4,700-4,850 yuan/ton.

ABS:The market transaction today is average, and prices continue to show a weak trend.

1 Today's summary:

①. Today, the prices in the East China market experienced a slight local decline; the prices in the South China market also saw a slight local decline, with market transactions driven by immediate demand.

② The monthly ABS production in August increased month-on-month.

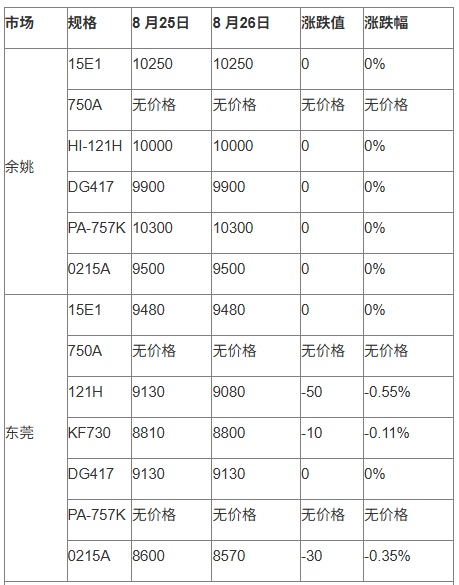

2 Spot Market OverviewTable 1 Domestic ABS Price Summary (Unit: RMB/ton)

Based on Yuyao and Dongguan regions, prices in the East China market have slightly declined, and prices in the South China market have also slightly declined.Today, market transactions remain sluggish with numerous bearish factors present. Low-priced goods are frequently seen in the market. It is expected that domestic ABS market prices will continue to show localized weak declines tomorrow.

3、Price Prediction

Based on Yuyao and Dongguan regions, prices in the East China market have partially declined, while prices in the South China market have also partially decreased.Today's market transactions were average, end-user demand was weak, and traders offered discounts to sell. It is expected that ABS prices will continue to decline tomorrow.

PS:Styrene prices surged and then fell back, with the market slightly lowering prices to sell goods.

1Today's Summary

Today, the East China GPPS fell by 30 to close at 7,750 yuan/ton.

② On Tuesday, the styrene market in East China dropped by 30 yuan to close at 7,325 yuan/ton, South China fell by 30 yuan to close at 7,380 yuan/ton, and Shandong remained stable at 7,245 yuan/ton.

2Spot Overview

Table 1 Domestic PS Price Summary (Unit: RMB/ton)

Today, the GPPS price in East China dropped by 30 yuan to close at 7,750 yuan/ton.The price of raw material styrene rose sharply and then fell back. The market is dominated by a wait-and-see sentiment, with slight price reductions to promote sales. Industry supply is increasing, downstream purchases are mainly for rigid demand, and overall trading activity is average.

3、Price Prediction

The price of raw material styrene surged and then fell back, weakening the cost support. As industry production recovers, downstream purchasing enthusiasm decreases, and the short-term PS (polystyrene) market may primarily focus on slightly reducing prices to facilitate sales. It is expected that the price of transparent modified styrene in the East China market will be around 7,700-8,600 yuan/ton.

EVA:Market offers remain steady with slight adjustments; profit-taking dominates selling activities.

1Today's Summary

This week's EVA petrochemical ex-factory prices have rebounded, and the auctioned goods sold well.

This week, the EVA petrochemical unit at Tianli Gaoxin is scheduled for shutdown, and the Hongjing PV3 unexpectedly shut down.

Table 1: Summary of Domestic EVA Prices (Unit: Yuan/Ton)

Today, the domestic EVA market is running steadily with adjustments. The supply side is stable with petrochemical firms maintaining prices firmly, and traders' offers are mainly stable. However, downstream foam factories are resistant to high-priced sources. The market is primarily focused on selling profitable inventories, with transactions centered around negotiations. Mainstream prices: Soft materials are priced at 10,900-11,400 RMB/ton, and hard materials at 10,300-11,100 RMB/ton.

3. Price Prediction

Currently, in the market, photovoltaic orders on the supply side are selling well. EVA manufacturers are mainly fulfilling previous orders, and petrochemical inventories are sufficient, supporting strong price holding. Downstream demand from the main photovoltaic sector provides good support, but foam-end users are resistant to high-priced sources. With profit-taking and a mindset of securing gains, sellers are actively shipping out goods, putting pressure on prices. Therefore, it is expected that in the short term, the EVA market may operate with stable to slightly fluctuating trends, and there is a possibility of a slight downward movement in the market.

Engineering materials

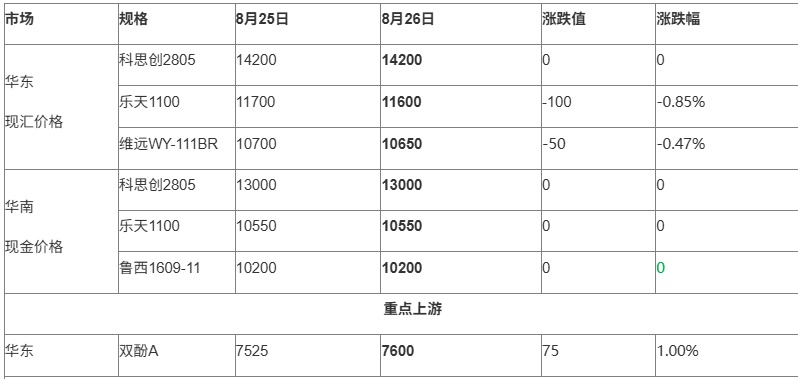

PCThe market is further digging downwards.

1 Today's Summary

On Monday, international crude oil rose, with the ICE Brent futures October contract increasing by $1.07 per barrel to $68.80.

The closing price of raw material bisphenol A in the East China market was 7,600 yuan/ton, up 75 yuan/ton compared with the previous period.

This week, some domestic PC factories have lowered their ex-factory prices by 50-200 yuan/ton.

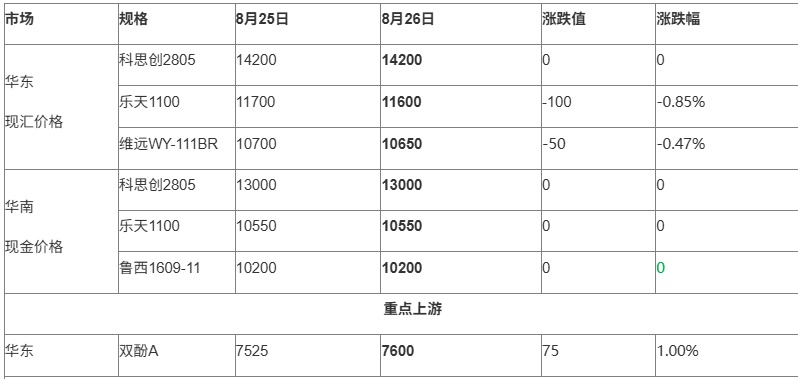

2 Spot Overview

Table 1 Domestic PC Price Summary (Unit: Yuan/Ton)

The domestic PC market remained weak and low today. As of the afternoon close, the mainstream negotiation prices for low-end PC materials used in injection molding in East China were referenced at 9,700-13,450 yuan/ton, while mid-to-high-end materials were negotiated at 14,200-15,300 yuan/ton. The focus of domestic material prices mostly fell by 50 yuan/ton compared to yesterday, with some experiencing larger declines. This week, the latest factory ex-works prices for domestic PC were lowered by 50-200 yuan/ton to varying degrees. Zhejiang Petrochemical's auction opened low and concluded after three rounds, down 400 yuan/ton compared to last week. From the spot market perspective, both East and South China continued to test lower levels. Although the raw material side has temporarily stopped falling and stabilized, the cost pass-through is lagging and has not provided significant support to PC prices. The overall industry supply and demand pressure remains, market sentiment is still predominantly bearish, and trading activity is slow.

3.Price Forecasting

The raw material bisphenol A has stopped falling and started to rise again, but this has limited impact on the polycarbonate (PC) market. The PC industry is still facing strong supply and demand imbalance pressure, leading to further significant declines in market prices. The overall atmosphere remains cautious and difficult to boost, with trading becoming increasingly sluggish. In the short term, the PC market is expected to have some room for further decline. Attention should be paid to the actions of PC factories after the cost pressure transmission and changes in market sentiment.

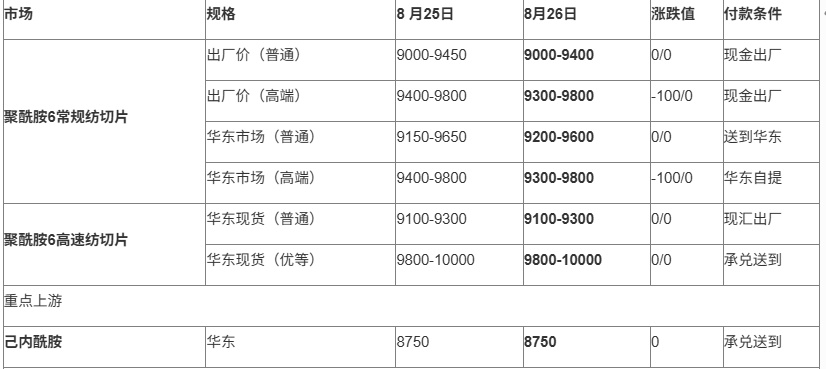

PA6:Downstream replenishes as needed at lower prices; the PA6 market is running steadily.

1 Today's summary

Sinopec's high-end caprolactam August 2025 settlement price is 9,330 yuan/ton (liquid premium grade, six-month acceptance, self-pickup), up 270 yuan/ton compared to the July settlement price.

② Sinopec's pure benzene prices for refineries in East China and South China have been increased by 100 yuan/ton, now set at 6,150 yuan/ton, effective from August 12.

2 Spot Overview

Table 1 Summary of Domestic Polyamide 6 Prices (Unit: Yuan/Ton)

Today, the polyamide 6 (PA6) market is running in a consolidated manner. The cost pressure from losses in chip production profits still exists. Polymerization enterprises are quoting prices according to market trends, while downstream buyers mainly replenish stocks as needed at lower prices, with market transactions under negotiation. In East China, conventional spinning PA6 is quoted at 9,200–9,600 yuan/ton (cash, short delivery), and high-speed spinning spot goods are quoted at 9,800–10,000 yuan/ton (acceptance, delivered). In Chaohu, the cash ex-warehouse price is 8,550–8,650 yuan/ton.

3、Price Prediction

From the cost perspective, the caprolactam market is undergoing consolidation, and the cost pressure remains due to losses in chip profits. From the supply and demand perspective, the internal supply is decreasing, and there are plans for further production cuts by some companies in the future. However, downstream demand remains limited, with buyers mainly restocking at lower prices as needed. It is expected that the PA6 market will see slight adjustments in the near term.

PA66:Fundamentals remain stable, and the market is consolidating.

1 Today's Summary

1. On August 25th, attacks by Ukraine targeting Russian energy facilities continue, and the instability of the Russia-Ukraine situation brings potential supply risks, causing international oil prices to rise. NYMEX crude oil futures for the October contract rose by $1.14 per barrel to $64.80, an increase of 1.79% compared to the previous period; ICE Brent crude futures for the October contract rose by $1.07 per barrel to $68.80, an increase of 1.58% compared to the previous period. China's INE crude oil futures for the 2510 contract rose by 2.5 yuan to 493.5 yuan per barrel, with the night session increasing by 5.7 yuan to 499.2 yuan per barrel.

Today, the domestic PA66 capacity utilization rate is 62%, with a daily output of approximately 2,430 tons. Despite cost and demand pressures, the capacity utilization rate of domestic PA66 polymerization enterprises remains stable. However, downstream demand is average, and the supply of PA66 in the domestic market is sufficient.

2 Spot Overview

Table 1 Summary of Domestic PA66 Prices (Unit: RMB/ton)

Based on the Yuyao market in East China, today's EPR27 market price is referenced at 15,100-15,300 yuan/ton, stable compared to yesterday's price.。 Raw material prices fluctuate, providing stable cost support. Downstream buyers purchase as needed, and market transactions are moderate, leading to a steady market trend.

3. Price Prediction

The downstream demand is weak, market supply continues to increase, and industry players lack confidence in the future market. It is expected that the domestic PA66 market will continue to fluctuate weakly in the short term.

PBT:Raw material prices fluctuate while the PBT market operates steadily with a weak trend.

1 Today's Summary

This week, PBT manufacturers' quotations remained generally stable.

This week, there are few PBT unit maintenance activities.

The PBT output for this period was 22,600 tons, an increase of 400 tons from the previous period, representing a growth of 1.80%. The capacity utilization rate was 53.14%, down 0.84% from the previous period. This week, the average gross profit for domestic PBT was -471 yuan/ton, a decrease of 30 yuan/ton compared to last week.

2 Spot Overview

Table 1 Summary of Domestic PBT Prices (Unit: Yuan/Ton)

The mainstream price of low to medium viscosity PBT resin in the East China region is 7,700-8,000 yuan/ton today, unchanged from the previous working day.Today, the PBT market operated steadily with a slight decline, the PTA market showed a narrow range of strength, and the BDO market weakened and declined. The raw material prices showed mixed fluctuations, providing only moderate support to PBT. The market focus continued to remain stagnant, with strong cautious sentiment among participants. According to statistics, the price of medium to low viscosity pure PBT resin in the East China market ranged from 7,700 to 8,000 yuan per ton.

3. Price Prediction

The PBT market is expected to remain in a wait-and-see mode. On the raw material side, with PTA plants in East China shutting down for maintenance, supply has dropped significantly, while demand has seen little change. The supply-demand balance is shifting further towards destocking, leading to tighter raw material supply and a stronger market focus. Driven by costs, the PTA spot market is expected to continue its relatively strong and volatile trend in the short term. For BDO, short-term supply-side support remains weak, and there is no significant increase in downstream demand. Supply pressure persists, so traders are cautious and slightly bearish, with actual deals tending to be negotiated at mid-to-low levels, and the market focus remains weak and volatile. Overall, cost-side support is mediocre. As the peak demand season approaches, market participants are likely to remain on the sidelines, with the market focus fluctuating within a range. Therefore, it is expected that the price of medium-to-low viscosity PBT resin in the East China market will be around 7,700-8,000 RMB/ton tomorrow.

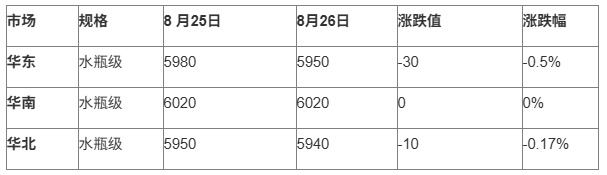

PET:Costs rose first and then fell, and polyester bottle chip producers are cautious in following the price increase.

1 Today's Summary

① Some factory prices remain stable, while others have increased by 20-50 yuan/ton.

②. Today's domestic polyester bottle chip capacity utilization rate is 70.89%.

2 Spot Market Overview

Table 1 Summary of Domestic Polyester Bottle Chip Prices (Unit: RMB/ton)

Based on the East China region, the spot price of polyester bottle-grade flakes for water bottles closed at 5950 today, down 30 from the previous working day, in line with the morning expectations.

In the morning, costs fluctuated, and bottle chip transactions declined. Later, driven by the positive impact of unexpected maintenance on polyester raw material units, costs rose, and factory offers increased by 20-50 yuan accordingly. However, the willingness to chase higher prices for bottle chips was weak, resulting in a decline in transactions toward the market close. The offer range for goods from August to October was 5930-6120 yuan, with counter offers ranging from 5890 to 6030 yuan.

3. Price Prediction

The current market is dominated by the core contradiction of "cost support" and "weak demand": the supply side remains stable, with previously tight factory supply gradually easing, leading to weakened supply support; downstream peak season demand continues to be weak, with "weak chasing of price increases" becoming the norm, and purchasing only occurring at low prices for rigid replenishment. Trading activity is subdued, making it difficult to push prices upward. Although the short-term market is still driven by cost logic, the overall range is weak due to weak supply and demand. It is expected that tomorrow's spot prices for polyester bottle chips and water bottle materials in the East China market will be 5,880-5,950 RMB, slightly lower at 5,870-5,890 RMB, and slightly higher at 6,030-6,400 RMB, with a weak and volatile range. Going forward, attention should be focused on changes in raw materials.

POM:Fundamental support is limited; negotiations are flexible.

1. Today's Summary

① Spot market circulation under pressure.

②. The market mainly focuses on negotiation and sales.

2 Spot Overview

Table 1 Summary of Domestic POM Prices (Unit: RMB/ton)

Based on the Yuyao region, today the price of Yun Tian Hua M90 is 11,000 yuan/ton, which is stable compared to the previous period.Today, the POM market remains stable and watchful. Petrochemical plants are experiencing slow sales, and there has been no improvement in shipments across various regions. Most traders are selling based on market trends, with some offering negotiation room of 100-200 RMB/ton for quotations, allowing for flexible transactions. As of market close, the tax-inclusive price of domestic POM in the Yuyao market is 8,100-11,200 RMB/ton, while the cash price in the Dongguan market is 7,300-10,400 RMB/ton.

3. Price Forecast

The fundamentals remain stable, but short-term support is relatively limited. Petrochemical plants currently have no pressure to sell. However, markets across various regions continue to be weak, providing operators with relatively flexible trading space. Some offers continue to negotiate sales, with room for adjustment between 100-200 yuan/ton. End-users are generally in a wait-and-see mood, with low purchasing enthusiasm, leading to sporadic actual transactions. As of the close, the tax-inclusive price of domestic POM in the Yuyao market is 8100-11200 yuan/ton, while the cash price of POM in the Dongguan market is 7300-10400 yuan/ton.

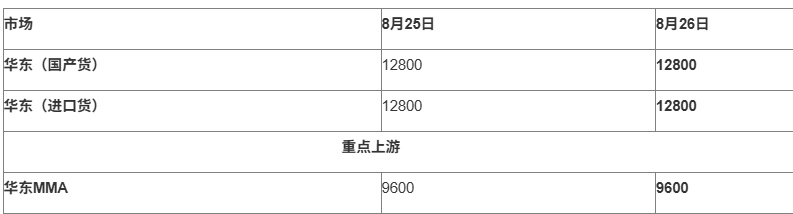

PMMA:PMMA Particle Range Sorting

1 Today's Summary

①. Today, the PMMA particle market is stable.

Today, the domestic utilization rate of PMMA granules remains at 62%.

2 Spot Overview

Table 1 Summary of Domestic PMMA Particle Prices (Unit: RMB/ton)

Based on the East China region, today's PMMA particles closed at 12,800 yuan/ton, remaining stable compared to the previous working day, in line with the morning expectations.Today, PMMA particles operated stably. The raw material acetone was arranged to run, with cost support being average. Market participants felt pressured, and holders quoted prices following the market trend. Downstream continued to place orders mainly based on rigid demand, resulting in limited actual transaction volumes.

3. Price Forecast

The raw material side remains in a stalemate with both sides holding their ground, and cost support is modest. Downstream sentiment is predominantly bearish. Most holders are mainly testing the market with stable prices, quoting based on their own inventory levels. To stimulate sales, some may offer discounts. Attention is focused on low prices in the market. In the short term, the PMMA granule market is expected to fluctuate within a range.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.