"Thousands of Battery Recycling Enterprises Rush for the 'Narrow Bridge' as the Industry Surges: Who Will Be Crowned King?"

Recently, BASF announced that its Black Mass plant in Schwarzheide, Germany, has successfully commenced commercial operations. This advanced facility marks a significant milestone for BASF's battery recycling business. It is one of the largest Black Mass commercial plants in Europe, with an annual processing capacity of up to 15,000 tons of end-of-life lithium-ion batteries and production waste, equivalent to approximately 40,000 electric vehicle batteries per year.

Image source: BASF

Battery recycling is also a topic of concern in China.

On April 18, 2025, China Resources Recycling Group Battery Co., Ltd. was officially established, vigorously expanding its power battery recycling business and establishing four major platforms: the National Battery Data Center, the National Engineering Technology Center/Laboratory, the National Battery Bank, and the National Battery Recycling Demonstration Base.

In March 2025, CATL launched the "Global Energy Recycling Program." According to the 2024 annual report, CATL has established recycling bases covering the globe, forming a large-scale and extensive recycling network system, with an annual processing capacity of 270,000 tons of waste batteries. The recovery rates of nickel, cobalt, and manganese metals can reach 99.6%, and the lithium metal recovery rate can reach 93.8%.

Why are many leading companies increasing their focus on battery recycling? Let's interpret this from three aspects: regulations, technology routes, and industrial impacts, as presented by Monomers Vision.

Source: Network

1. Policy pressure and resource anxiety: recycling is imperative.

The urgency of battery recycling has become unprecedentedly clear by 2025.

First, there is regulatory pressure on a global scale.

EU New Battery RegulationClear requirements: By 2030, the proportion of recycled cobalt in new batteries should be at least 12%, with lithium and nickel each accounting for 4%; by 2035, this proportion will increase significantly to 20%, 10%, and 12%, respectively. The battery passport requirement mandates that all new batteries be equipped with a digital passport (recording material sources, recycled content, and carbon footprint). Starting from 2025, batteries entering the EU market will need to have full lifecycle data traceability.

In the United States,"Inflation Reduction Act"(IRA) It isbattery critical minerals valued must meet: 50% from North America or free trade partners by 2024, rising to 60% in 2025, and reaching 80% by 2027. Additionally, battery manufacturers using recycled metals from North America are eligible for a tax credit of $45 per kWh (comprising a $35 tax credit per cell and $10 per module), which encourages companies like Tesla to accelerate their investments in recycling facilities.

In China, the State Council passed in February 2025."Action Plan for Improving the Recycling System of New Energy Vehicle Power Batteries"Mandatory digital traceability across the entire "production-sales-recycling-regeneration" chain for batteries, with enterprises failing to connect to the system being ineligible for the whitelist qualification. This marks the official entry of China's battery recycling industry into a new phase of standardization and scale.

Under policy pressure, establishing recycling chains has become a survival imperative for companies.

Actually,“Urban MinesValue emerges.

BASFThe "Black Mass" processed at BASF's Schwarzheide plant is an intermediate product rich in critical metals extracted from spent batteries. By refining Black Mass through chemical methods to produce new cathode active materials (CAM), it not only enables the recycling of strategic resources such as cobalt, nickel, and lithium but also significantly reduces the carbon footprint compared to using primary raw materials.

Finally, as the world's largest new energy vehicle market, China's new energy vehicle population has exceeded 31.4 million by 2024, with the first batch of battery warranties approaching their expiration. According to reliable forecasts, the retirement volume of power batteries in China will reach 820,000 tons in 2025, and will exceed 4 million tons per year starting from 2028.Drive the recycling market scale to exceed2800Billion yuan.

II. Leading Enterprises Make Moves: Technological Pathways and Ecosystem Closure

Faced with a trillion-dollar blue ocean and policy pressures, leading companies like BASF are making frequent moves in 2025, with technological pathways and strategic collaborations becoming the focus of competition.

The recycling of power batteries is mainly divided into two categories: cascade utilization and regeneration utilization.

When the battery capacity is between 50% and 80%, retired power batteries are disassembled and reassembled for cascade utilization. After screening and reassembly, retired batteries can be applied in fields with lower requirements such as energy storage, backup power, and low-speed electric vehicles, extending the full lifecycle value of the batteries.

When the battery capacity decays to below 40%, it is disassembled, crushed, and processed to extract raw materials such as lithium, cobalt, and nickel, which are then "reincarnated" into new batteries.This is the core path for recycling critical metals.

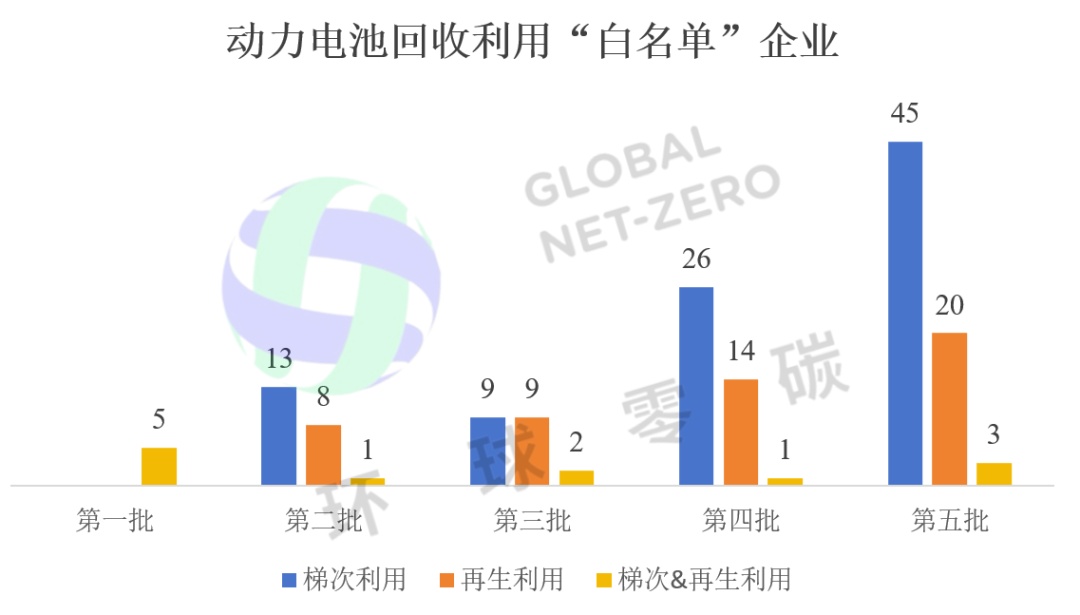

Since 2018, the Ministry of Industry and Information Technology has successively recognized 156 enterprises in five batches that comply with the "Industry Norm Conditions for the Comprehensive Utilization of Waste Power Batteries from New Energy Vehicles" as part of the "white list." Among them, 93 enterprises, accounting for 59.6%, are engaged in echelon utilization; 51 enterprises, accounting for 32.7%, are involved in recycling utilization, and 12 enterprises possess dual qualifications for both echelon and recycling utilization.

Image source: Global Zero Carbon

ZhuanSu World noticed,In the field of battery recycling,Building an ecological closed loop has become an important choice for leading companies.

During the 2025 Shanghai Carbon Neutrality Expo,BASFForming a quadruple strategic partnership with HeFei Guohuan High-Tech (battery production), China Gas (energy and potential recycling channels), and (positive electrode materials) aims to create a "closed-loop eco-chain of the new energy industry." This will cover the entire value chain from material production, battery manufacturing, to recycling and regeneration.

In China, this practice of cooperation in battery recycling between different types of enterprises is also very common among leading companies.

December 2024,BYD China First Automobile Group CorporationSign the agreement to integrate both parties' nationwide 4S stores and service center resources, establish a retired battery recycling network covering 300 cities, and share dismantling and recycling technologies. BYD will provide cascade utilization batteries for FAW's commercial vehicle energy storage systems.

January 2025,Tianneng Group Co-develop a "lifetime archive" system for ride-hailing vehicle batteries, coding and archiving the batteries of 500,000 electric vehicles under Didi. After retirement, the batteries will be collected by Tianneng for targeted recycling, and the used batteries will be utilized in Didi's battery swap network.

In March 2025,Ningde Times GCL GroupJointly establish "Times GCL Renewable Technology" to build a comprehensive facility integrating photovoltaic storage, charging, and battery swapping stations with battery recycling centers in the Yangtze River Delta region. Retired batteries, after inspection, can be used as energy storage batteries or disassembled for recycling.

May 2025,GEM Mercedes-Benz- The only designated battery recycling service provider in China, responsible for the recovery of retired power batteries from its nationwide dealer network, and uses wet processing technology to extract high-purity nickel and cobalt (purity ≥ 99.8%) through extraction. Note: The phrase "" seems to be incorrectly placed or formulated in the original sentence. If it is meant to describe how the high-purity nickel and cobalt are extracted, a more accurate translation might be: "... and uses wet processing technology toextract high-purity nickel and cobalt (purity ≥ 99.8%)." However, I have translated it as directly as possible based on the provided text.

As a result, various types of collaborations have emerged, such as between automakers and recycling companies, battery manufacturers and energy groups, operators and recycling companies, as well as material suppliers and energy service providers.

III. Industrial Impact: The Hidden Worries and Restructuring Behind the Prosperity

The explosive growth of the battery recycling industry is profoundly reshaping the landscape of the new energy industry chain, but it also faces severe challenges.

Hidden worries of overcapacity:Qichacha data shows that there are more than 172,000 battery recycling-related companies currently existing in China, over 60% of which were established in the past three years. As of May 1, 2025, more than 10,000 new companies were registered within the year. However, the "White Paper on the Development of China's Lithium-ion Battery Recycling and Reuse Industry (2025)" reveals a chilling reality: as of the end of 2024, the nominal capacity of the white-listed enterprises in China reached 4.233 million tons/year, but the actual amount of batteries recycled in 2024 was only 654,000 tons.The overall industry capacity utilization rate is as low as 15.5%.The reckless expansion like land enclosure has led to severe structural overcapacity.

Accelerated normalization process:Behind the low capacity utilization rate are small and scattered enterprises with outdated technology, non-compliance with environmental standards, and difficulties in entering the formal "white list" system. With the strong implementation of China's "Action Plan" and the stringent regulations of the European Union, the requirements for recycling technology, environmental standards, and data traceability will continue to increase.“ Regular Army" "Small workshop"Substitution and industry reshuffling are inevitableFull digital traceability will become standard.

The profitability of the battery recycling industry:The profitability of the battery recycling industry is not always ideal. Although used lithium batteries contain strategic metals such as lithium, cobalt, and nickel, which have high recovery value, the costs and risks involved in the recycling process cannot be ignored. The average profit margin in the industry is around 10%, and after deducting labor costs and other operating expenses, the actual profit space is limited. In addition, recycling companies also face high risks and pollution issues, leading to high environmental costs.

Technical barriers determine the outcome:The core of future competition lies in recycling efficiency, metal recovery rates (especially lithium), environmental friendliness, and cost control. Companies need to make continuous breakthroughs in new technologies such as bioleaching, automated disassembly, and efficient extraction of black mass in order to occupy a favorable position in the global resource recycling system.

“"Urban Mine"The value reassessment:Efficient battery recycling will significantly reduce dependence on primary mineral resources, enhancing the security of resource supply. The proportion of recycled metals in Translation continuation: The proportion of recycled metals in materials will continue to rise, and resource cycling itself will become an important component of industrial competitiveness. (Note: The last sentence was split and continued to ensure grammatical correctness and flow in English.)

IV. Epilogue: The Essential Question in the Era of Circular Economy

Battery recycling is no longer just an environmental issue; it has become a nexus of resource strategy, industrial competition, and technological innovation. Leading companies are seizing the initiative by strategically laying out their technologies and creating closed ecological loops. Meanwhile, the continuous tightening of policies and regulations, along with the intensifying market consolidation, is driving the entire industry towards a more efficient, standardized, and sustainable future.

Only when every retired battery can be reborn through precise industrial processes can humanity truly achieve a closed-loop transition to a sustainable energy future.

Editor: Lily

Source of materials: Global Zero Carbon, China Gas Holdings Limited announcements, Greeenery announcements, Tianneng Group official website news, BASF official website, GCL-Poly Energy official WeChat account, "China Automotive News" and other public reports.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track