[This Week's Plastics Market] Fluctuating Operation! ABS Drops Up to 200, PC Rises Up to 350

Summary: Weekly Market Review and Forecast for General and Engineering Plastics from September 19 to 25!General materialsPE prices fell by 3-35, PS continued to decline, with a range of 50-190; ABS fluctuated lower, with some drops of 20-200; PVC fell before rising; PP and EVA showed weak narrow adjustments. In terms of engineering materials, PC prices increased, with some rising by 50-350; PET saw some declines of 30; PBT and PA66 fluctuated narrowly; PA6 market declined, with some drops of 90-165; PMMA and POM were negotiated for discounts, maintaining a steady operation.

General Material

PE: The spot price of polyethylene in the market has declined.

1. Summary of Market Conditions This Week

This week, international oil prices rose due to the ongoing Russia-Ukraine conflict, which has raised potential supply risks, coupled with a decrease in U.S. commercial crude oil inventories, providing support for oil prices.

This week, orders in the PE film market are slowly progressing, with stable production in large enterprises and a slight increase in the operating rate of small and medium-sized enterprises.

The polyethylene production for this period is 642,700 tons, an increase of 11,800 tons compared to the previous period. The total production for the next period is expected to be 678,500 tons, an increase of 35,800 tons compared to this period.

2. Review of the Polyethylene Market Trends This Week

This week, the domestic polyethylene spot market prices have decreased, with a range of 3-35 yuan/ton (weekly average). Following the news of the Federal Reserve's 25 basis point interest rate cut, market expectations have receded, resulting in a significant pullback. Additionally, with the National Day holiday approaching, suppliers are actively reducing inventory, but the downstream demand is limited, leading suppliers to lower prices for sales, which has caused the price drop. The price of HDPE film is 7,675 yuan/ton, unchanged from last week; the price of LDPE film is 9,609 yuan/ton, a decrease of 30 yuan/ton from last week; and the price of LLDPE film is 7,419 yuan/ton, a decrease of 28 yuan/ton from last week. (Note: Sample data for HDPE film prices has been adjusted.)

3. Market Forecast for Polyethylene

The polyethylene price is expected to mainly fluctuate with a slight decline in the next period. Key points to focus on: 1. Cost aspect. The support from oil-based costs is expected to weaken, while coal-based costs remain stable; 2. Supply aspect. Market supply involves planned restarts of facilities such as Lianyungang Petrochemical, Sinochem Quanzhou, and Baolai LyondellBasell, with only Zhenhai Refining planning maintenance, expecting an increase. The total production for the next period is estimated to be 678,500 tons, an increase of 35,800 tons compared to the current period; 3. Demand aspect. The overall operating rate of PE downstream industries is expected to decrease by 3.14% next week. Some downstream factories may stop work during the holiday, but according to past patterns, agricultural film demand usually enters a concentrated period after the holiday. To ensure production continuity after the holiday, downstream enterprises generally have varying degrees of stocking demand, so polyethylene demand is still expected to increase. In summary, as the holiday approaches, the pressure to destock in the market intensifies, and merchants are likely to increase sales at a discount, with prices possibly fluctuating slightly downward, ranging from 5 to 40 yuan/ton.

PP: The market has dropped and consolidated this week, and it is expected to have a weak and narrow adjustment next week.

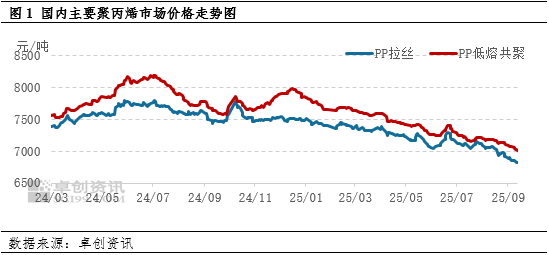

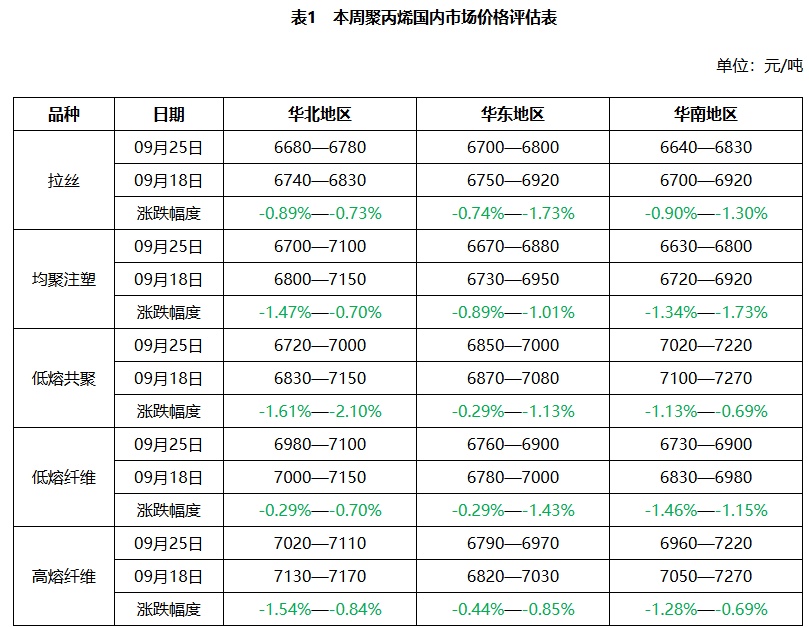

1Market Review: This week's market declined and then consolidated, with the price focus continuing to decline.

This week's domestic PP marketAfter the decline, the price level continues to slide downwards.As of this Thursday, the average price of wire drawing in East China is 6,773 yuan/ton, down 57 yuan/ton from last week, a decline of 0.83%. The price difference in the wire drawing region has slightly narrowed. In terms of varieties, the low-melt copolymer has seen a larger decline than wire drawing due to insufficient support from the fundamentals, and the price difference between the two continues to narrow.

2Market Outlook: As the National Day holiday approaches, there is insufficient fundamental driving force.

The PP market is expected to be weak and stable next week. Taking East China as an example, the price range for wire drawing is expected to be between 6,680-6,800 RMB/ton, with an average price estimated at 6,760 RMB/ton. The price range for low melting copolymer is expected to be between 6,830-7,000 RMB/ton, with an average price estimated at 6,910 RMB/ton.On the cost side, crude oil is expected to fluctuate, providing limited guidance for PP. On the supply side, there are no new capacity impacts expected next week, but maintenance facilities are expected to decrease, leading to a slight increase in supply. On the demand side, with the upcoming holiday, most downstream players have completed pre-holiday purchases and are expected to adopt a wait-and-see approach, making it difficult for demand to provide support. In terms of inventory, production enterprises and traders are actively promoting sales to reduce inventory ahead of the holiday, which is expected to weaken market support. Overall, the market's support from the supply and demand fundamentals is relatively weak next week, and prices are expected to have a slight downward adjustment.

Supply:The expected reduction in maintenance devices will lead to a slight increase in supply.Next week, there will be no new capacity impact. In terms of plant maintenance, there are no planned new maintenance facilities next week, and some existing maintenance facilities are expected to restart, leading to a decrease in overall maintenance intensity. The expected loss for next week is 161,300 tons, a decrease of 18.12% compared to the previous week. Overall, supply is expected to increase next week. Regarding inventory, due to the increased pressure on post-holiday inventory, production companies are actively shipping before the holiday, and inventory is expected to slightly decline. As for trader inventory, they need to undertake planned quantities for the holiday period in advance, while downstream procurement is gradually ending as the holiday approaches, leading to increased resistance in trader shipments. Therefore, inventory is expected to increase next week. At the port, domestic prices remain low, and the domestic and foreign markets continue to be inverted. Coupled with ample domestic supply, PP imports are limited. On the export side, overseas demand constraints limit PP export growth. Overall, port inventory for PP is expected to remain stable next week, ranging from 39,000 to 40,000 tons.

Demand: Downstream completes stocking before the holiday, short-term demand is weak.Currently, the follow-up on new orders from downstream is still relatively limited. Recently, raw material prices have been hovering at low levels. After a slight recovery in downstream profits, there has been increased market activity to complete pre-holiday stocking. With the holiday approaching next week, the festive atmosphere in the market is gradually intensifying, and the enthusiasm for downstream procurement is expected to weaken, leading to weaker demand.

Cost:Next week, the average price of WTI crude oil is expected to be $64 per barrel, with a fluctuation range of $62 to $65 per barrel.Ukraine's frequent attacks on a refinery within a certain European country have led to restrictions on that country's oil product exports. Meanwhile, former U.S. President Trump publicly urged this European country to cease importing oil from the said European nation, aiming for a complete break from energy dependence on it. This poses a short-term risk of changing global trade flows, but the risk of actual supply disruptions is relatively low. Regarding the Middle East situation, the U.S. has demanded that Israel refrain from annexing the West Bank and called for peace talks with Saudi Arabia, Qatar, and others, which reduces the risk of escalation. As a result, geopolitical disruptions are providing support to oil prices, but there is an expectation of cooling, leading to potential volatility in oil prices. From a risk perspective, the main concerns are the escalation of the Russia-Ukraine situation and the de-escalation of Middle Eastern geopolitical tensions. Crude oil prices are expected to be mainly volatile, offering limited guidance for the cost side of polypropylene (PP).

PVC: Fundamentals and Macro Factors Alternately Influence, Prices Fall First and Then Rise

1. Market Review of the Week: Initially Rising then Falling, Downstream Low-Price Demand Replenishment.

This week, the domestic PVC powder market experienced a decline followed by an increase, with the overall price level moving within a narrow range. As of September 25, the weekly average price of domestic carbide-based PVC powder SG-5 was 4,746 yuan/ton, a decrease of 4 yuan/ton compared to the previous week, reflecting a drop of 0.08%. The weekly average price shifted from an increase to a decrease. Downstream product companies have been replenishing their inventory due to basic demand at lower prices, but the enthusiasm for pre-holiday stocking is generally moderate, resulting in a steady trading atmosphere.

2. Market Outlook for Next Week: Fundamentals Remain Weak, Prices May Experience Weak Fluctuations

Overall:Overall, the fundamental pressure on PVC powder has increased. Downstream sectors generally have more holidays during the National Day, leading to a lower willingness to stock up before the holiday and an expectation of increased inventory accumulation after the holiday. On the macro level, news against over-competition provides some support for market sentiment. It is expected that the PVC powder market will experience fluctuations and adjustments next week, with little change in the focus of spot prices.

PS: Lack of cost support leads to continued market decline.

This week's hot topics of interest

During this period, the domestic PS market continued to decline, with a decrease of 50-190 yuan/ton.

This week, China's PS industry production was 93,000 tons, a decrease of 3,000 tons compared to last week, with an industry capacity utilization rate of 59.1%, down 2.1% from the previous week.

This week, China's PS finished product inventory was 89,000 tons, a decrease of 1,000 tons from last week, a decline of 1.1%.

2. Market Review of the Week

Figure 1 PS for 2023-2025DailyEast China Market Price Trend Chart (Unit: Yuan/Ton)

![[PS周评]:成本缺乏支撑 市场继续下跌(20250919-0925)](https://oss.plastmatch.com/zx/image/c7967877bd6f4f6587d94dd9c9bf4faf.png)

This week, the domestic PS market continued to decline, with a range of 50-190 yuan/ton. On the cost side, although supply and demand are tightly balanced, the continuous accumulation of inventory at ports has led to increased bearish sentiment in the market, with short positions adding pressure on prices. On the supply and demand side, the impact of the typhoon has resulted in reduced production or maintenance shutdowns of facilities in Shantou, Huizhou, and Zhanjiang, Guangdong, leading to a decrease in industry output. This has improved low-level sales in the market, and with the pre-holiday inventory clearance rhythm, inventories have slightly decreased. According to Longzhong Information data, on September 25, 2025, the East China market saw a decrease of 190 yuan to 7,380 yuan/ton for GPPS and a decrease of 50 yuan to 8,350 yuan/ton for HIPS.

3. Market Forecast for Next Week

It is expected that the PS market may stop falling and experience a slight increase in the next period. On the cost side, both supply and demand for styrene have decreased during the National Day holiday, but the reduction of short positions may drive prices to fluctuate strongly before the holiday, providing some cost support. On the supply and demand front, maintenance of certain facilities in East and South China is impacting the industry, and there is still an expectation of a decline in supply, which temporarily alleviates supply pressure and may support a slight attempt to increase prices.

ABS: Supply Remains High, Prices Fluctuate and Decline This Week

This week's hot topics of interest:

1) This week's market prices have fluctuated and declined.

2) This week's industry output has slightly increased.

3) This week the inventory of the petrochemical plant increased.

2. This week's ABS market trends:

In this period (September 18, 2025 - September 25, 2025), ABS prices have fallen across the board. This week, some manufacturers are experiencing increased shipping pressure, offering low prices to agents, and some agents are selling at low prices, leading to a drop in market prices. In terms of raw materials, the three major raw materials for ABS have collectively decreased in price, allowing ABS manufacturers to improve their profits. Some manufacturers have increased their operating load, and the industry's supply remains high. The market sentiment is mostly pessimistic, with insufficient stocking demand before the holiday, leading to fluctuating and declining prices. In terms of market prices, domestic materials are priced between 8,880-9,250 yuan/ton, while composite materials are priced between 9,650-9,900 yuan/ton.

3. This week's raw material market trends:

In the afternoon, with raw materials and the main market slightly softening and consolidating, the styrene market saw narrow trading consolidation. In the Zhejiang market, there were negotiation intentions reported at 6970/7010 yuan/ton, with specific negotiations on actual transactions.

As of the time of writing, the ex-tank self-pickup price of butadiene in Jiangyin, Jiangsu is approximately 8950-9000 yuan/ton, remaining stable compared to the previous period. Downstream inquiry intentions are cautious, and the market trading atmosphere is relatively sluggish. A few traders are offering stable prices, primarily waiting for buying interest.

In September 2025, the average monthly price of acrylonitrile at East China ports in China was 8,380 yuan/ton (calculated from August 26 to September 25, excluding public holidays), which represents an increase of 138 yuan/ton compared to the average price in the same period in August, with a growth rate of 1.67%.

4. Market Forecast:

The expected production and sales of ABS in the next period will continue to be in surplus, with overall transactions driven by essential demand. Key points to focus on: 1. Supply side: It is anticipated that the overall supply in the industry will remain high next week, with increased operating loads at Shandong Yulong, Zhejiang Petrochemical, and Shandong Haijiang facilities, leading to an expected continued increase in supply. 2. Demand side: ABS purchasing demand remains weak; 3. Cost side: The price trends of styrene, butadiene, and acrylonitrile are on the weak side, and it is expected that the cost support will be moderate next week. Sentiment: There is a prevailing pessimistic sentiment in the market due to expectations of new capacity release and continued off-season consumption. It is anticipated that ABS market prices will maintain narrow fluctuations or continue to show slight declines in some areas in the near term. Longzhong Information ABS Weekly Report.

EVA: Phase supply-demand mismatch, EVA prices slightly decline.

1. Market Review for This Week: EVA Market Prices Weakly Consolidate

This week's EVA prices are weakly consolidated, and overall transactions are relatively weak.Reference prices: Rigid foamed materials range from 10,700 to 11,400 yuan/ton, flexible foamed materials/cable materials range from 10,800 to 11,600 yuan/ton, hot melt adhesives range from 11,000 to 11,800 yuan/ton, and photovoltaic materials range from 11,000 to 11,300 yuan/ton.

2. Driver Factor Analysis: Periodic Supply and Demand Mismatch, Slight Increase in Supply Pressure

During the October 1st holiday, some petrochemical companies released their production capacities, combined with some traders in the trade sector taking profits and concentrating on shipments, resulting in a slight increase in market supply pressure. On the demand side, the price transmission in the non-photovoltaic downstream is obstructed, and under high prices, companies' speculative intentions are low, while weak orders constrain rigid demand. Photovoltaic demand is still acceptable, and spot supply remains tight. However, recently, with the increase in photovoltaic material output by companies, the shortage situation has slightly eased.

3. Market Outlook for Next Week: Focus on the Impact of Sales Strategies of Manufacturing Enterprises on the Market.

Supply and Demand:From the supply side, the operating load of the EVA plant this period is 80.09%, a decrease of 1.52 percentage points compared to the previous period. This week's supply volume is normal to slightly low. However, considering the National Day period, production facilities are operating normally, while holiday demand is limited, leading to a temporary mismatch between supply and demand. Some companies pre-sold before the holiday, and production during the holiday increased short-term market supply pressure. As for the current sales situation of production companies, post-holiday inventory pressure is not significant, which is expected to provide some support to petrochemical ex-factory prices. On the demand side, the follow-up of new orders from downstream is insufficient, and the high price of EVA particles limits the downstream transmission capability, restricting demand. Supply and demand were slightly unbalanced before the holiday, but a rebalancing process is expected post-holiday. Against the backdrop of tight supply and demand, market sentiment, trader behavior, and petrochemical pricing strategies have a significant impact on the market.

Cost and upstream:Next week, the average price of US crude oil is expected to be $64 per barrel, with a fluctuation range between $62 and $65 per barrel. Frequent attacks by Ukraine on refineries within a certain European country have led to restrictions on petroleum product exports. Meanwhile, former US President Trump has publicly urged European countries to stop importing oil from this European country, aiming to eliminate energy dependence on it. This poses a risk of a short-term shift in global trade flows, although the risk of actual supply disruptions remains low. Regarding the Middle East situation, the US has requested Israel not to annex the West Bank and has urged peace talks with Saudi Arabia, Qatar, and others, thereby reducing the risk of escalation. Consequently, geopolitical disturbances may support oil prices, but cooling expectations exist, suggesting that oil prices are likely to experience a range-bound movement. From a risk perspective, the key factors are the escalation of the Russia-Ukraine situation and the fading of Middle Eastern geopolitical tensions.

After the National Day, the EVA market price is expected to undergo weak consolidation. The market is in a tight supply-demand balance, but the sentiment among industry participants is bearish. If some participants engage in pre-sales, it could increase the post-holiday market supply. Meanwhile, downstream demand has not shown significant improvement, and the downstream sentiment is also bearish, with low speculative intention. It is initially expected that the EVA market price will remain stagnant and consolidate after the holiday. Attention should be paid to petrochemical sales strategies and the behavior of traders for further market guidance after the National Day. It is initially estimated that the price of foaming hard materials may be around 10,700-11,600 yuan/ton.

Engineering materials

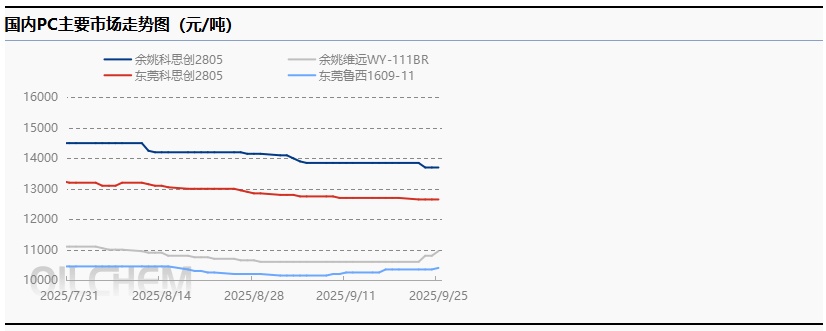

PC: The price of domestic PCs continued to rise this week.

This week's market focus.

This week, the price of domestic PC materials fluctuated and rose, while the price of raw material bisphenol A declined, leading to a significant recovery in industry profits.

This week, the operating rate of 2 sets of PC devices decreased, leading to a decline in the overall industry capacity utilization rate compared to last week.

In the fourth quarter, multiple PC units have maintenance plans, and the supply benefit may continue to be released.

2. This week's PC marketMarket Analysis

During this period (September 19, 2025 - September 25, 2025, hereinafter referred to as "the period"), the price of domestic PC material increased. As of the close on September 25, the negotiated price of domestic PC material in the East China market was referenced at 9,950-11,300 yuan/ton, maintaining the same level or increasing by 50-350 yuan/ton compared to last week, with a range of 0.44%-3.30%. This week, domestic PC factories maintained a firm increase strategy, with ex-factory prices stable or raised by 100-200 yuan/ton. On Tuesday, Zhejiang Petrochemical's auction opened flat with three rounds of transactions, maintaining stability compared to last week, and multiple PC factories announced their fourth-quarter maintenance plans. In terms of the spot market, at the beginning of the week, the market continued a dull consolidation pattern. With the release of news about the maintenance of major PC factories in Shandong, coupled with the bottoming atmosphere of PC prices, the spot price of domestic material subsequently fluctuated upwards, with the East China market showing more noticeable gains. However, before the double festival holiday, downstream demand for PC was limited, and overall spot transactions remained stable. Market participants adopted a cautious and observant attitude, with quotations moderately raised but primarily focused on selling alongside market trends. The spot price increase during the week was mostly between 100-200 yuan/ton.

3. Market forecast for next week

The reduction in supply is the dominant positive factor, and the domestic PC market is expected to maintain a relatively strong fluctuating pattern next week. The price of domestic materials is likely to continue to rise.Key Focus: 1. Supply Side. In the short term, Lihuayi Weiyuan's PC plant will enter its scheduled maintenance period after the National Day holiday. Zhejiang Petrochemical's PC plant will shut down one production line for maintenance from mid-month, and Hainan Huasheng's PC plant will maintain low-load operation. The reduction in supply of medium and low-end materials is relatively noticeable, thereby providing strong support for low-end PC prices. 2. Demand Side. The situation for terminal orders is not favorable. Before the double holiday, most downstream in-market stocking purchases were not apparent, and the overall market trading pace remained stable. Post-holiday purchasing conditions are pending follow-up and are unlikely to be the main driving force for boosting the market. 3. Cost Side. Next week, Bisphenol A is expected to see price decreases due to its own supply-demand pressure. However, its recent trend has been somewhat detached from PC's phase, and thus the impact of the cost side on PC's trend is subsequently reduced.

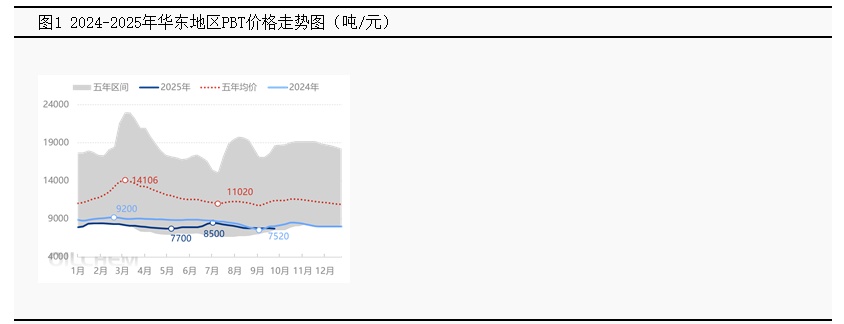

PBT: Pre-holiday stocking sentiment is average, PBT market fluctuates within a narrow range.

1. Weekly Market Review

During this period, the East China PBT market fluctuated within a certain range, with the mainstream price of medium to low viscosity PBT resin in East China closing at 7600-7900 yuan/ton. On the supply side, there were little changes in the PBT facilities, and the supply remained stable compared to the previous period. On the raw material side, This week, the BDO market is running steadily, while the PTA market... The trend of "first suppress and then rise." This week, the raw material PTA showed slight fluctuations, but it had little impact on the sentiment of the PBT market. As the National Day holiday approaches, the stocking atmosphere in the market is generally mild, with some manufacturers increasing their intention to ship before the holiday. The market focus fluctuates within a range, maintaining an overall stable pattern.

2. Analysis of Market Influencing Factors

The PBT device continues the previous operating status.Supply remains stable 。

Demand is slowly improving, the pre-holiday PBT stocking atmosphere is average, and the supply side's willingness to ship has increased.

The cost side is experiencing narrow fluctuations, overall still providing stable price support for PBT.

3. Market Forecast for Next Week

The PBT market is expected to undergo narrow adjustments in the next period, with stable cost support continuing. Due to limited trading during the National Day holiday, the PBT market will experience range-bound fluctuations. Key points of focus: 1. Supply side. The PBT unit in Meizhou Bay, Fujian is expected to complete maintenance, leading to a slight increase in supply. 2. Demand side. The demand-side consumption volume is slowly increasing, and market trading is limited during the National Day holiday. PTA The market continues to rebound; after the holiday, the bullish and bearish factors of BDO are offsetting each other, leading to a stalemate in the market, which overall provides stable support for PBT market prices.

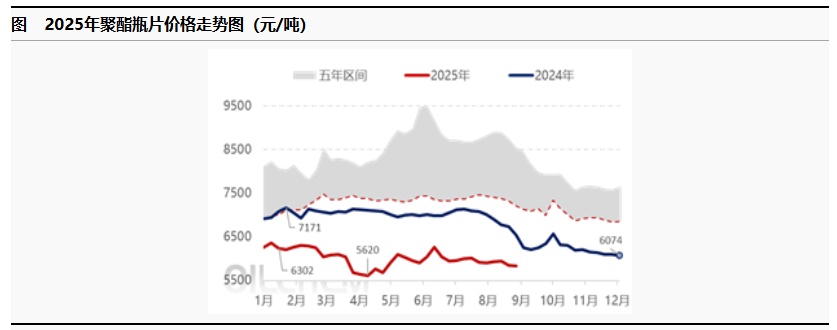

PET: The polyester bottle chip market is operating weakly.

1. This weekMarket focus:

Production: Capacity utilization rate is 70.14%.

Raw materials: PTA industry opening76.48%.

2. Market Analysis

During the period from September 19 to September 25, 2025, the price of polyester bottle chips initially declined and then rose weakly. On Thursday, September 25, the spot price of water bottle-grade polyester bottle chips in the East China market was 5,790 yuan/ton, down 30 yuan from last week, a decrease of 0.52%. Specifically, during this period, the East China polyester bottle chip market experienced a weak performance with prices fluctuating between 5,650 and 6,000 yuan/ton. The international crude oil supply pressure increased, the commodity atmosphere was not favorable, and the domestic and international supply expectations for PX were poor, leading to a decline in cost support and a continued weakening of the market. Downstream and traders made large purchases when prices were low, and factories increased sales volume. In the middle and later part of the week, as costs rebounded and supply was reduced due to the impact of a typhoon, market prices were supported to rise, resulting in an overall volatile and weak market performance.

3. Market Influencing Factors Analysis

In this trading cycle (from September 19 to September 25, 2025), the production of polyester bottle chips is 323,500 tons, a decrease of 1.19% compared to the previous period.

During this trading cycle (from September 19 to September 25, 2025), according to the production cost calculation model of Longzhong Information, the weekly average profit of polyester bottle chips is -189.4 yuan/ton, an increase of 7.09 yuan/ton compared to the previous period. The average polymerization cost is 5337.4 yuan/ton, a decrease of 85.09 yuan/ton or 1.57% from last week.

4. Later Forecast:

SupplyFace:The impact of the typhoon on the device has led to a negative outlook, with supply maintaining a low level of operation as in previous periods.

Demand side: After intensive restocking by terminals last week, procurement may be relatively rigid. The operating rate of the downstream soft drink industry is weak, ranging from 82% to 95%. Due to holiday influences, oil plants are expected to operate at around 67%. The PET sheet industry operates at 65% to 75%.

Cost perspective: Crude oil is expected to decline, the main raw material PTA has low processing fees to support it, and supply may decrease. The recent market is viewed as rebounding, while the supply-demand structure of ethylene glycol is weakening. Overall, the cost side of polyester may see a short-term rebound, but long-term support is limited.

Forecast for next week: After downstream and traders concentrated on buying at low prices during the week, the subsequent demand is expected to be relatively rigid. With the expectation of a decline in crude oil and low-level supply operation, the pre-holiday buying momentum for polyester raw materials has picked up, and prices are expected to rebound. Overall, it is expected that the market price of polyester bottle chips in East China will maintain a volatile rebound trend in the next period.

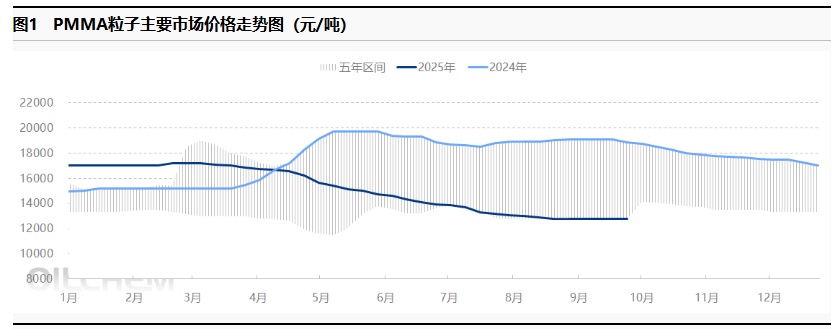

PMMA: The PMMA market is operating steadily.

1、This week's market focus

The raw material MMA has risen again, showing strong cost performance.

The PMMA particles are operating steadily, with a capacity utilization rate of 65%.

Downstream players have a low willingness to enter the market, and negotiations for purchases remain focused on just-in-time orders.

2. Market Analysis for This Week

The domestic PMMA particle market remained stable this period, with price fluctuations ranging between 12,600-13,800 yuan/ton. Throughout the week, the overall market trend was steady. The raw material MMA saw a wide increase, while another key raw material, methyl acrylate, slightly softened, but the overall cost pressure did not diminish. Major suppliers generally followed the market trend and stabilized prices, while holders were flexible in negotiations to facilitate transactions. Smaller factories faced difficulties in sales, with some showing willingness to offer discounts to move goods, leading to a certain price difference in spot quotations. On the demand side, order growth was not apparent, continuing the previous lukewarm atmosphere. Industry players were not keen on stocking up, and there was pressure to lower prices during negotiations for immediate needs, with discussions mostly involving small orders and a lack of enthusiasm for stocking up.

3. Market Influence Factors Analysis

During this period, the average weekly profit for PMMA was 907 yuan/ton, a decrease of 346 yuan/ton compared to the average price of the previous period. 。

The operating rate of the PMMA industry this week is 65%.

4. Next Week's Market Forecast

It is expected that the PMMA particle market will stabilize in the next period. The raw material MMA market shows a strong trend, and the cost support for PMMA particle factories remains.However, due to poor new order intake, the factory's pricing adjustment space is limited, and intermediaries have a low intention to sell at low prices. The focus of the quotations is likely to remain firm, and it is necessary to observe the main factories' operational trends and the follow-up of demand.

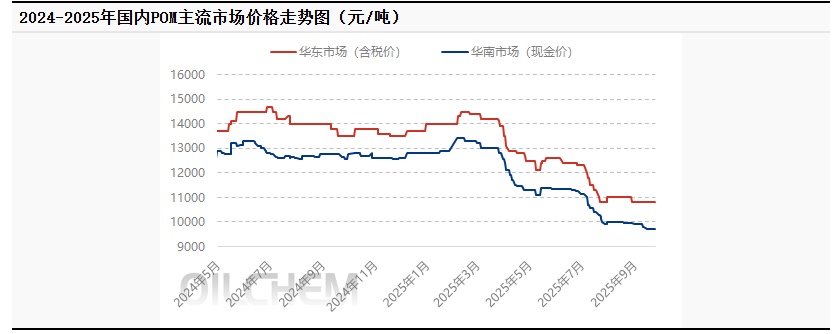

POM: Weak market transactions, price concessions and negotiations.

1. This week's market focus

1) The Xinjiang Xinlianxin POM unit has resumed operation.

There are many instances of high reporting and low movement in the market. ;

3) Import quotations continue to decline. 。

Market Analysis for This Week

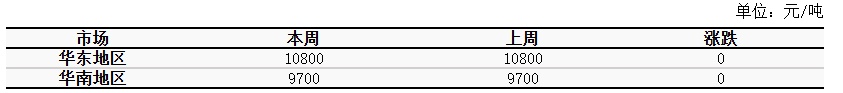

Domestic POM Market Weekly Price Fluctuation Table

The POM market fluctuations are limited this period. This week, spot circulation is slow, and the total inventory of petrochemical plants continues to accumulate. There is no clear guidance from the fundamentals, and bearish sentiment among traders is increasing. Due to weak demand, terminal inventory is slow to be consumed, and downstream users are not actively purchasing. The market trading atmosphere is dull, and some merchants are offering small discounts to relieve inventory pressure, with a range of 50-100 yuan/ton, with actual transactions negotiated by quantity.

3. Market Impact Factors Analysis

1) This week, the POM market is stable with a slight decline, while mainstream grades remain stable compared to last week.

2) This week, the capacity utilization rate of China's POM industry is 85.13%, an increase of 4.11% compared to last week.

3) This week's average gross profit for domestic POM is 47.28 yuan/ton, an increase of 28 yuan/ton compared to last week.

4. Market Forecast for Next Week

The POM price is expected to be under pressure and decline in the next period. Key focus areas: 1. Supply side. The next period will coincide with the National Day holiday, and the Xinjiang Xinlianxin POM plant will resume full production. Given the relatively slow shipping situation of petrochemical plants, some manufacturers may implement volume and price policies to relieve inventory pressure. 2. Demand side. Affected by the holiday, some downstream users may engage in restocking activities before the holiday, showing high purchasing enthusiasm. During the holiday, end factories will gradually shut down for vacation, and trading atmosphere across regions will plummet to a low point. 3. Cost side. The price of upstream raw material methanol is declining, leading to a sustained increase in POM profit margins, providing some short-term positive support. 4. Macro side. Due to the impact of a reduction in import quotations, the pressure on domestic material shipments will increase, and market transaction resistance will intensify.

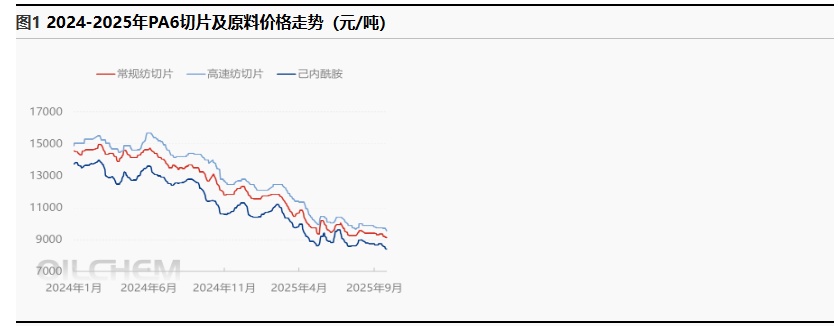

PA6: Market negotiation prices are trending lower. The PA6 market is declining.

1. Key Market Focus of the Week

Sinopec's price for pure benzene in East China and South China refineries is reduced by 100 yuan/ton, now set at 5900 yuan/ton, effective from September 4th. Sinopec's caprolactam monthly settlement price is 9080 yuan/ton, Shenyuan's weekly listing price is 9100 yuan/ton, and East China spot price for caprolactam is 8400 yuan/ton. (Unit: yuan/ton)

2) Regular PA6 spinning chips in East China and Central China are priced at 8950-9300 cash on short delivery, while some high-end chips are priced at 9100-9200 cash on self-pickup. PA6 high-speed spinning ordinary chips are priced at 9050-9150 cash ex-factory, and premium chips are priced at 9400-9700 on acceptance for delivery. (Unit: yuan/ton)

3) Supply and demand situation: According to Longzhong statistics, this week's caprolactam production is 135,800 tons, and polyamide 6 slice production is 128,000 tons. The operating load of nylon filament is 78%. This week, the domestic weaving industry's operating rate is 63.12%, an increase of 0.93% compared to last week.

2、 Weekly Market Analysis

During this period, the PA6 chip market declined, with mainstream prices at 9,125-9,200 yuan/ton for spot cash delivery. The ample supply of raw material caprolactam put pressure on the market, and caprolactam prices continued to fall, weakening the cost support for chips. Additionally, downstream buyers were cautious about pre-holiday stocking, focusing mainly on moderate replenishment, resulting in significant pre-holiday sales pressure for polymerization enterprises and leading to lower negotiated prices. During this period, the PA6 high-speed spinning chip market also declined, with mainstream prices at 9,550-9,700 yuan/ton for delivery on acceptance. Raw material prices continued to fall, weakening cost support, and there remained cost pressure from losses in high-speed spinning chip profits. However, polymerization enterprises faced significant pre-holiday sales pressure and negotiated shipments, while downstream spinning enterprises mainly engaged in moderate replenishment at lower prices.

3、 Market Impact Factor Analysis

1 In terms of raw materials, the spot market price of caprolactam in East China declined this period, with prices ranging from 8,400 to 8,575 yuan/ton. This week, the main bearish factor in the market remains the supply side. Many previously suspended production facilities have resumed normal operations, leading to a continuous increase in the supply of caprolactam and a relaxed supply structure. Additionally, with the National Day holiday approaching, some sellers are actively adjusting their sales pace, putting further downward pressure on spot prices. Downstream PA6 polymerization companies are becoming more cautious in their purchasing, primarily signing contracts based on low prices and on-demand. As of Thursday, the spot price of caprolactam in the East China market is 8,400 yuan/ton, delivered on acceptance.

2)As of September 25, 2025, the price of caprolactam liquid sources is 8,400 yuan/ton (delivered against acceptance), and the price of PA6 conventional spinning regular slices is 8,950-9,300 yuan/ton cash ex-factory. Based on this, the weekly average profit for PA6 conventional spinning slices is -110 yuan/ton. As of September 25, 2025, the spot price of caprolactam is 8,400 yuan/ton delivered to East China, the monthly settlement price of Sinopec caprolactam is 9,080 yuan/ton, and the quoted price of PA6 high-speed spinning premium chips is 9,400-9,700 yuan/ton acceptance delivered to East China. Based on this, the weekly average profit of PA6 high-speed spinning premium chips is -410 yuan/ton.

4. Forecast for next week:

The PA6 market is expected to operate weakly in the next cycle, with mainstream prices for conventional spinning chips likely to remain in the range of 9,000-9,100 RMB/ton (cash, short delivery). The mainstream price for high-speed spinning premium chips is expected to be in the range of 9,500-9,650 RMB/ton (acceptance, delivery included). 。 Focus points: 1. Supply side. The overall supply for the next period is expected to decrease, mainly due to some production line maintenance at Zhongjin High-Speed Spinning, with increased output from Yangmei and Guangxi Hengyi, but the maintenance volume exceeds the increase, leading to an overall reduction in supply for the next period. 2. Demand side. Some downstream production is entering the National Day holiday, resulting in limited demand. 3. Cost side. It is expected that the caprolactam market will have both bullish and bearish factors coexisting in the next period, with market prices tending to weaken and cost support continuing to diminish. Future attention should be paid to the impact of costs and supply-demand on market sentiment.

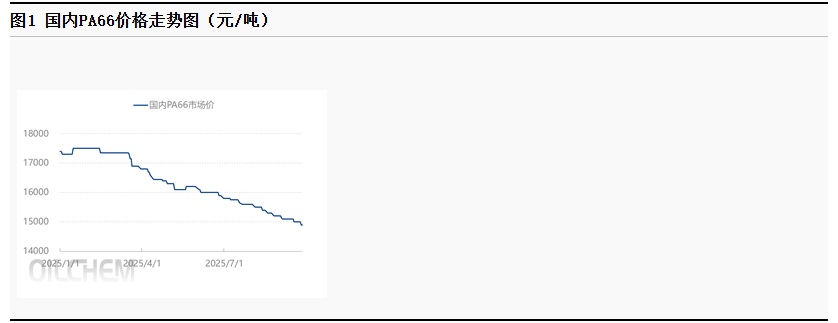

PA66: High prices hinder transactions, market fluctuates and weakens.

1. Market Focus of the Week

1) Production:In this period, the production of PA66 was 16,700 tons, and the capacity utilization rate was 61%, showing a slight increase compared to the previous period.

Demand: The terminal market demand is generally low, and downstream customers often purchase based on their needs.

2、 Market Analysis for This Week

In this period, the spot price of PA66 in East China has been operating weakly, with an average weekly price of 14,960 yuan/ton, a decrease of about 0.66% compared to last week. During the week, the raw materials adipic acid and hexamethylenediamine showed weak fluctuations, lacking support from the cost side. Downstream demand has been moderate, while the supply of spot market has increased, leading to a cautious industry sentiment and a downward trend in market prices.

3. Market Impact Factor Analysis

The raw materials adipic acid and hexamethylenediamine are experiencing weak fluctuations, with a lack of supporting power from the cost side.

The terminal market demand is generally low, and downstream purchases are mostly made based on demand.

The capacity utilization rate of 66 aggregated enterprises has slightly increased, and the market spot supply is sufficient.

4. Next Week's Market Forecast

The structural supply-demand contradiction in the PA66 spot market is expected to persist in the next period, leading to weak fluctuations in the market.Key focus: 1. Supply side.The new production capacity continues to be released, and Liaoyang Petrochemical is expected to... 10 The monthly production of products, combined with the restart plans of previously halted units, leads to strong expectations of an increase in the supply of spot market goods.2. Demand side.Downstream factories are still primarily purchasing on demand, and there are no clear signs of a market rebound overall, with limited growth momentum on the demand side. 。 3. Cost aspect.The market prices of raw materials such as adipic acid and hexamethylenediamine are fluctuating, bringing significant cost pressure to polymerization enterprises. 。

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track