[This Week's Plastics Market] Continues Weak Trend: POM Plunges by 500, ABS/PA66 Drop Up to 200

Summary: Weekly Market Review and Forecast for General-purpose and Engineering Plastics from July 18th to 24th! Most general-purpose resin markets trended downward, with PE and PS spot prices falling slightly. ABS continued to decline, dropping by 20-200. PP prices rebounded slightly, up by 31-51, driven by expectations of higher coal costs and reduced supply. The engineering plastics market remained weak. PC demand was sluggish, with the market showing slight weakness. PBT operated on the weak side, with some grades down by 110. POM prices softened, with some declines of 300-500. PA6 saw individual declines of 180, and PA66 edged down by 100-200. PMMA remained range-bound, while PET showed a slight upward trend within a narrow range.

General material

PE: Spot prices in the polyethylene market declined slightly.

1. Summary of the Market Situation This Week

International oil prices fell this week, as OPEC+ may continue to maintain a significant increase in production in September. Meanwhile, concerns over U.S. tariff policies continue to put pressure on the oil market.

This week, orders from sample enterprises for PE packaging film were partially delivered. There was a differentiated performance in following up new orders for finished products, with most short-term agreements providing limited replenishment.

③ In the absence of clear directional guidance in the polyethylene market and without significant improvement on the demand side, a cautious and wait-and-see attitude continues to prevail, resulting in increased inventory levels.

2. Review of the Polyethylene Market Trends This Week

This week, the domestic polyethylene spot market prices slightly declined, with decreases ranging from 6 to 53 yuan/ton. The market was strongly influenced by policy factors; the domestic anti-overcompetition campaign advanced, the petrochemical industry’s outdated equipment assessment and the National Energy Administration’s coal mine production inspection work were successively carried out. The black commodity sector led the market gains, improving market sentiment for polyethylene. However, the supply and demand pattern showed no improvement, demand follow-up was weak, and both buyers and sellers became cautious, limiting the price increase of polyethylene and maintaining narrow fluctuations. HDPE film prices stood at 7,930 yuan/ton, down 33 yuan/ton from last week; LDPE film prices were 9,409 yuan/ton, down 53 yuan/ton from last week; LLDPE film prices were 7,405 yuan/ton, down 6 yuan/ton from last week.

3. Polyethylene Market Outlook

The polyethylene price in the next period is expected to tentatively rise, mainly maintaining narrow fluctuations. Key points to focus on: 1. Cost aspect. It is expected that the support from oil-based costs will weaken, while the support from coal-based costs will strengthen; 2. Supply aspect. Next week involves the restart of facilities such as Fujian United, Daqing Petrochemical, Yanchang China Coal, and E-Energy Chemical, with only the newly planned maintenance of Jin Hai Chemical expected to increase. The total production next week is anticipated to be 646,300 tons, an increase of 31,200 tons compared to this week; 3. Demand aspect. The overall operating rate of PE downstream industries next week is expected to increase by 0.26%. Demand changes are relatively minor, and there is still room for periodic restocking in the market. Demand for packaging in daily chemicals, food, and other sectors remains relatively continuous, and some stocking conditions still exist, extending the number of days orders can be produced. Overall, the pressure on polyethylene supply is increasing, while demand support is limited. The policy of assessing old production capacity might drive the market to some extent, but changes in the demand side still need attention, and prices may tentatively rise.

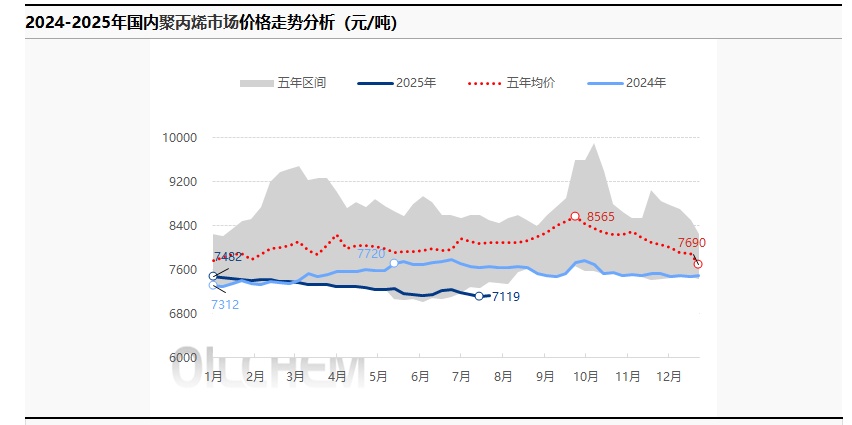

PP: Macro Positive Factors Drive the Market, Polypropylene Prices Rebound

1. This Week's Market Focus

1 ) ProductionThis week, domestic polypropylene production was 773,600 tons, a decrease of 3,300 tons or 0.42% compared to last week's 776,900 tons; compared to the same period last year (653,000 tons), it increased by 120,600 tons, a rise of 18.47%. Production losses among manufacturers remained high during the week, with no new capacity added for the time being, resulting in only a narrow adjustment in polypropylene output.

2 ) The demand: The average operating rate of downstream industries for polypropylene decreased by 0.07 percentage points to 48.45%. The rise in polypropylene prices provides some support for polypropylene products. However, the off-season effect of terminal consumption will become more prominent, and demand will continue to remain weak.

3 As of July 23, 2025, China's total commercial inventory of polypropylene stood at 814,400 tons, an increase of 33,200 tons from the previous period, representing a month-on-month rise of 4.24% and a year-on-year increase of 17.60%. The total inventory of production enterprises increased by 2.62% month-on-month; sample traders' inventory rose by 9.36% month-on-month, and sample port warehouse inventory increased by 6.50% month-on-month. In terms of inventory by type, the inventory of raffia-grade polypropylene increased by 2.05% month-on-month, and fiber-grade polypropylene inventory rose by 3.29% month-on-month.

2. This week's market analysis

The current spot price of polypropylene is running strong, with a price fluctuation range of 7099-7141 yuan/ton. The domestic efforts to counter involution are progressing, with assessments of outdated installations in the petrochemical industry and inspections of coal mine production by the National Energy Administration gradually being carried out. The ferrous metal sector leads the market, with polypropylene prices rising due to expectations of increased coal costs and reduced supply. However, the supply-demand situation has not improved, and demand is not following up well. Market transactions are concentrated among intermediaries, leading to an accumulation of inventory throughout the week. 。

3. Market Forecast for Next Week

It is expected that polypropylene consumption will increase in the next period. Maintain the supply-demand trading logic and focus on identifying the transaction center of gravity. Key points of focus: 1. Supply-side expected increase: Yulong Petrochemical's production line will stop within the week, while Zhejiang Petrochemical's production line will start within the week. The supply and demand sides of the market continue to engage in a tug-of-war, influencing market variables. 2. Weak demand: Both domestic and foreign trade are under pressure, with downstream general products such as plastic weaving and plastic film in the off-season, insufficient order follow-up is dragging down market transactions. 3. Cost-side loosening expectations: With OPEC+ expected to increase production and geopolitical tensions easing, there is an expectation of loosening in international oil prices; in August, Saudi CP is expected to decline, and the cost support for PDH production is weakening. 。

PS: The market first rises then falls, fluctuating within a narrow range.

1. This Week's Hot Topics

During this period, the domestic PS market first rose and then fell, with a fluctuation of around 50 yuan/ton.

2) This week, China's PS industry output was 79,000 tons, with an industry capacity utilization rate of 51.6%, an increase of 1% compared to last week.

This week, China's PS finished product inventory was 90,000 tons, a decrease of 3.2% compared to last week.

2. Market Review of the Week

During this period, the domestic PS market first rose and then fell. On the cost side, macro policies boosted market bullish sentiment, leading to a rise in styrene prices. However, with inventories continuing to accumulate, spot prices came under pressure and declined. In terms of supply and demand, some plants in Guangdong underwent maintenance, but Lianyungang Petrochemical gradually restarted operations, resulting in a slight increase in industry supply. Some low-priced shipments performed well, and finished product inventories declined slightly. According to Longzhong Information, on July 24, 2025, the price of GPPS in East China increased by 50 yuan to 7,850 yuan/ton, while HIPS remained stable at 8,750 yuan/ton.

3. Market Forecast for Next Week

The PS market is expected to consolidate weakly in the next period. On the cost side, the supply and demand for styrene are broadly balanced, and the spot and near-term are under supply pressure, lacking upward price support, and may fluctuate at a low level next week. On the supply and demand side, industry supply is showing a recovery trend, while downstream demand remains relatively unchanged in the off-season, leading to a slightly relaxed supply and demand situation, providing limited support for prices.

ABS: Market transactions were average this week, and market prices continued to decline.

1. This Week's Hot Topics:

1)Market prices fell across the board this week.

2)The industry's output increased this week.

3)The inventory of the petrochemical plant increased this week.

2. This Week's ABS Market Trend:

ABS PriceContinues to decline This week's macro trend is bearish, with styrene and acrylonitrile prices declining, ABS. The manufacturer's cost support has weakened. From the supply side, the operating rate of Liaoning Jinfa’s plant this week Continue Promotion, ABS Overall industry output increases, supply increment. From the demand side, it is currently the off-season for end-user demand, and the ABS industry is clearly experiencing an oversupply situation; from the sentiment perspective, traders generally have a pessimistic outlook with strong bearish sentiment, making it difficult for prices to rise. Overall, prices fell by 5 this week. 0-2 00 yuan/ton. In terms of market prices, the range for domestic materials is 9150-10. 0 The above content translates to: "00 yuan/ton, the combined material range is 10150-10" 50 0 yuan/ton.

3. Market Forecast:The ABS supply and demand are expected to remain in surplus in the next period, with macro crude oil weakening, and transactions are expected to be demand-driven next week. Key focuses: 1. Supply side. The operating load of Dalian Hengli's facilities will continue to increase next week, with an expected increase in ABS supply. 2. Demand side: Currently entering the off-season for ABS procurement, demand expectations are weakening; 3. Cost side: Prices of acrylonitrile, styrene, and butadiene continue to weaken, with little support expected from the cost side next week. Sentiment: With new capacity release expectations and consumption gradually entering the off-season, market pessimism is prevalent, and the domestic ABS market price is expected to remain weak next week.

Engineering materials

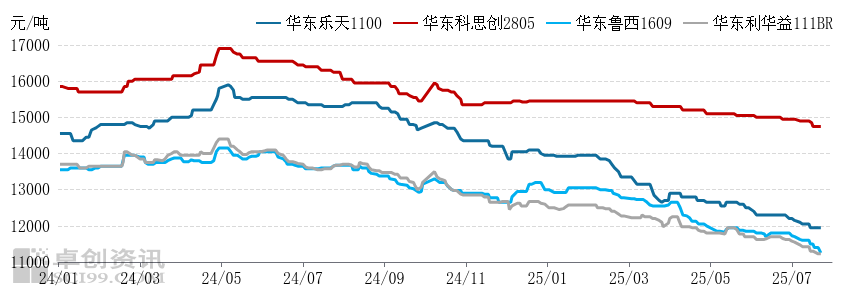

PC: Weak demand performance, market trading in a narrow and weak range

1. Review of the Domestic PC Market: Market Declines Within a Narrow Range

This week, the domestic PC market saw a slight decline. As of July 24th, taking Covestro 2805 (imported source, East China market) as an example, the closing price was 14,700–14,800 RMB/ton, with an average weekly price of 14,750 RMB/ton, down 0.67% week-on-week. For domestic product Luxi 1609 (East China market) as an example, the closing price was 11,200–11,300 RMB/ton, with an average weekly price of 11,335 RMB/ton, down 1.78% week-on-week.

2024-2025 PC Price Trends Comparison

2. Analysis of Driving Factors: Continuous Game Between Supply and Demand

This week, the domestic PC market remained slightly weak, mainly due to sluggish trading sentiment. Most factories kept their offers stable, with a few slightly lowering prices, and traders generally followed market trends in their quotations. The off-season in downstream demand persists, with mainly small-volume just-in-time orders being placed, and actual transaction prices for certain sources have slightly declined. During the week, the upstream BPA (bisphenol A) market saw a slight rebound due to sellers' strong pricing intentions, providing some bottom support for the PC market. However, the overall positive impact on the PC market was limited.

3. Market Outlook: The market may operate at a low level.

The domestic PC market is expected to remain sluggish at a low level next week. On the supply side, previously overhauled units will gradually resume operations, leading to an overall surplus in industry supply. Downstream demand is still in the off-season, with only small, just-in-time orders supporting the market, resulting in ongoing supply-demand negotiations. Currently, the PC market is at a relatively low level. Coupled with a slight uptick in the raw material bisphenol A market, sellers are cautious about selling at excessively low prices. Therefore, the PC market is expected to fluctuate slightly next week. In the short term, prices of domestic PC sources in East China are expected to range between 11,200 and 11,900 yuan/ton.

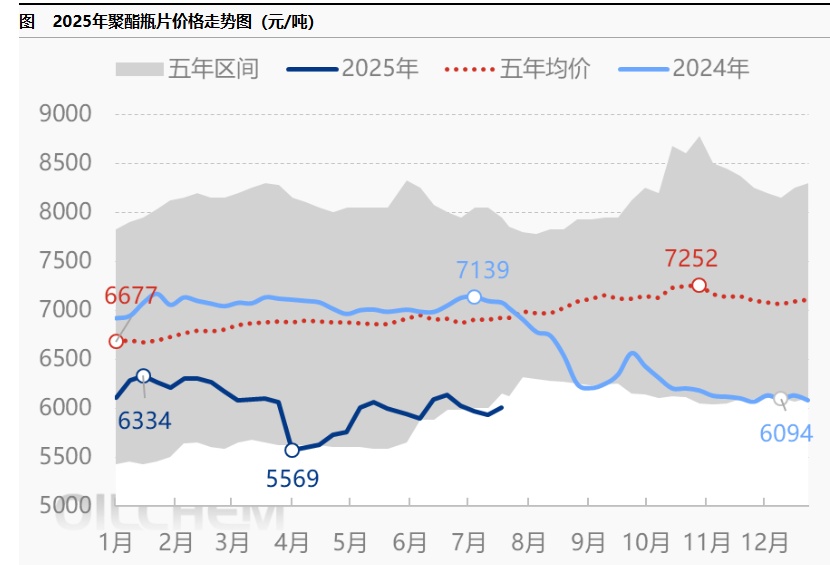

PET: Polyester Bottle Chip Market Prices Rise

This weekMarket Focus:

Production: Capacity utilization rate is 70.12%.

Raw material: PTA industry opensLabor 80.76%.

2. Market Analysis

3. Post-production forecast:

Supply side:No equipment changes for the time being. SupplyStay stable

Demand Side:During the peak season for terminal demand, the downstream soft drink industry operates steadily. 85-95% The operating rate of oil plants in the range may slightly increase to 67. % left and right ; PET The sheet industry is in operation. 65-75%

Cost aspect:Crude oil is expected to decline, the main raw material PTA Performance is relatively weak. 。

Next week's forecast: The macroeconomic outlook is relatively positive, and it is expected that the price of polyester bottle chips in the East China market will rise in the next period.Fluctuating with a strong bias, the main market in East China is expected to fluctuate strongly, with spot prices for water bottle material at 5950-6050 yuan/ton. 。

PBT: No positive fundamentals released for PBT, dragging the market's downward trend to continue.

1. Market Review of the Week

This period, the East China PBT market continued its downward trend, with mainstream prices of low to medium viscosity PBT resin closing at 7900-8300 yuan/ton. On the supply side, the Nantong Xingchen PBT facility is under maintenance, while other previously maintained facilities have resumed operations, resulting in an overall increase in supply. On the raw materials side, the BDO market continued to decline this week, while the PTA market weakly rebounded. The overall cost support continued to weaken this week, with the consecutive drop in raw material BDO significantly impacting the market sentiment for PBT. Feedback from downstream and end-users indicates that the primary downstream sectors of PBT are significantly affected by the off-season in demand, leading to a noticeable decrease in overall operating rates and a continuous reduction in raw material consumption. The PBT market fundamentals did not release any positive signals, and market participants maintain a bearish sentiment, dragging the market focus downward.

2. Market Forecast for Next Week

The PBT market price is expected to remain weak and decline slightly in the next period, with insufficient cost support and increased supply. In the short term, the PBT market lacks positive stimuli, and market prices may continue to be weak. Key focus: 1. Supply side. The PBT device remains largely unchanged, with supply volume continuously accumulating. 2. Demand side. The demand side continues to be influenced by the off-season, with downstream and end-users mainly replenishing just-in-time inventory, and there may be opportunities for purchasing at low prices. 3. Cost side. The PTA market continues its weak and fluctuating pattern; the imbalance in BDO supply and demand is intensifying, and the market focus is expected to shift downwards, further weakening support for PBT market prices.

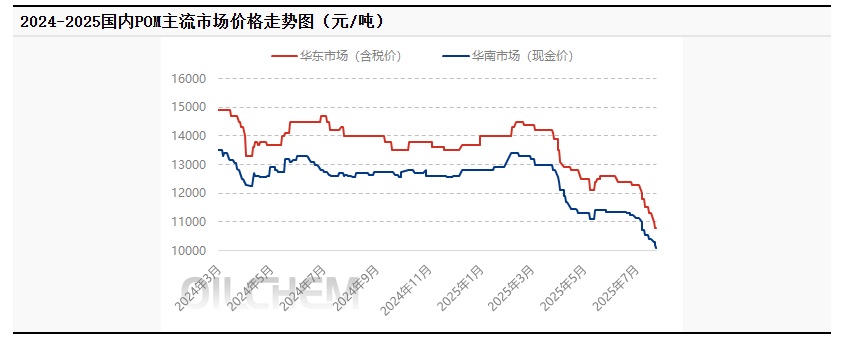

[POM Weekly Review] Concentrated Price Reductions in Domestic Materials, Market Focus Shifts Downward

1. Market Focus This Week

1) The ex-factory price of domestic materials has been reduced by 200-500 RMB/ton.

2) The behavior of low-price replenishment in the market is increasing. ;

3) Import offers continue to decline 。

2. Analysis of This Week's Market Situation

Domestic POM Market Weekly Price Change Table

Unit: Yuan/ton

|

Market |

This week |

Last week |

Rise and fall |

|

East China Region |

10800 |

11300 |

-500 |

|

Southern China |

10100 |

10400 |

-300 |

Data source: Longzhong Information

The POM market has been under pressure and declined this period. During the week, POM prices fell more sharply across various regions. Tianjin Bohai Chemical’s POM unit was shut down for maintenance. In the first half of the week, domestic product ex-factory prices were collectively lowered by 200-500 RMB/ton. Traders' market sentiment was largely suppressed, and the market atmosphere became increasingly bearish. Domestic product offer prices continued to decline, with mainstream grades dropping by 200-700 RMB/ton. In the second half of the week, as POM prices approached the cost line, traders showed increased willingness to restock at low levels, and inquiry activity within the market was relatively active. Downstream users made small purchases as needed, with actual transactions negotiated based on quantity.

3. Market Forecast for Next Week

The POM price is expected to rebound slightly in the next period. Key points to focus on: 1. Supply side. The POM plant of Tianjin Bohua is undergoing maintenance and shutdown, and due to the centralized digestion of petrochemical plant inventories, short-term support will be enhanced. 2. Demand side. During the traditional off-season in the next period, terminal factories will maintain low-load operations. However, stimulated by market speculation, downstream users will replenish stock, following actual demand. 3. Cost side. The price of upstream raw material methanol has slightly rebounded, and profit margins will continue to shrink. 4. Macro side. It is reported that Korea Kolon has the intention to lower its POM ex-factory price, and import offers will gradually decline. The market price competition remains fierce, with transactions being flexibly negotiated.

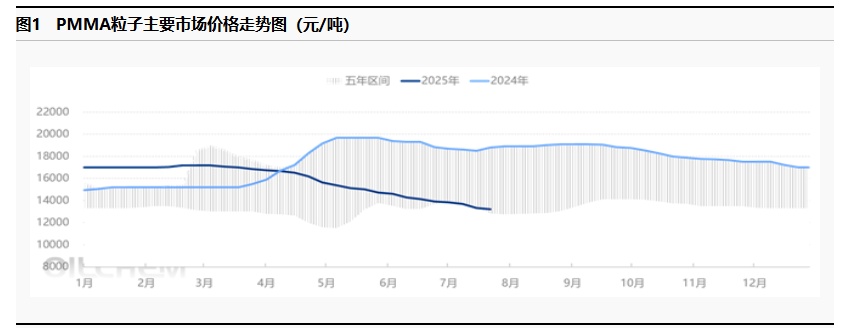

PMMA: Trading within a market range

1. Market Focus This Week

1) Production: This week, the PMMA capacity utilization rate was 64%.

2) Raw materials: The recent decline in MMA prices has led to another reduction in costs.

3) Demand: Downstream demand only maintains basic needs, and market transaction volume is sluggish.

2. Market Analysis for This Week

The domestic PMMA market operated within a range this week. As of July 24, the price of domestic supply ranged from 12,900 to 14,000 yuan/ton; the price of imported supply ranged from 13,000 to 13,800 yuan/ton.

In the past two weeks, PMMA prices have continuously declined, leading to a slight change in sentiment among industry players, with overall market fluctuations becoming more moderate. However, during the week, both upstream and downstream PMMA markets softened, and the overall market sentiment remained cautious. Downstream resistance at high levels limited actual trading fluctuations. In the latter half of the week, raw material MMA continued to decline, with both buyers and sellers mostly adopting a wait-and-see approach, causing the market trading atmosphere to cool down.

3. Market Forecast for Next Week

The probability of a weak PMMA market in the next period is high. Key Focus: 1. Supply Side. There is no expectation for the resumption of previously reduced or overhauled facilities, and there are no clear production reduction plans for those in operation. It's expected that industry supply will not change significantly next week. 2. Demand Side. Most downstream end-users are adopting a wait-and-see attitude, spot trading is scarce, and long-term demand is insufficient. 3. Cost Side. The overall market for raw material MMA is slightly declining, providing insufficient cost support for PMMA.

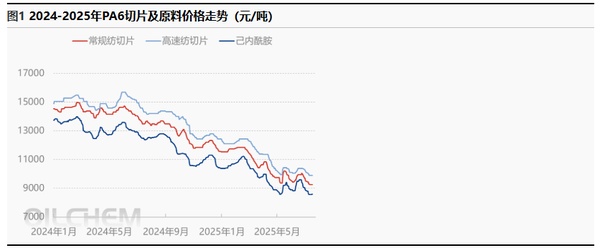

PA6: Cost and Supply-Demand Game PA6 Market Consolidation

1. Market Focus This Week

On July 11, the Sinopec benzene price in East and South China refineries increased by 100 yuan/ton, now at 5950 yuan/ton. The Sinopec caprolactam weekly settlement is 9050, Shenyuan's weekly listing is 9100, and the caprolactam spot price in East China is 8600. (Unit: yuan/ton)

2) Conventional PA6 spun chips in East China and Central China are priced at 9,050-9,450 RMB/ton for spot cash short delivery, while some high-end chips range from 9,100-9,600 RMB/ton for cash self-pickup. PA6 high-speed spun ordinary chips are priced at 9,000-9,200 RMB/ton for spot cash ex-factory, and premium chips range from 9,500-9,800 RMB/ton for acceptance bill delivery. (Unit: RMB/ton)

3) Supply and demand situation: According to Longzhong statistics, the production of caprolactam this week is 131,800 tons, and the production of polyamide 6 slice is 128,200 tons. The operating rate of nylon filament is 79.5%. This week, the operating rate of the domestic weaving industry is 55.59%, a decrease of 0.24% compared to last week.

2. This Week's Market Analysis

During this cycle, the PA6 chip market price remained stable, with the mainstream price at 9,250 RMB/ton for spot delivery. The caprolactam market, influenced by cost and supply-demand pressures, remains temporarily stable, resulting in continued cost pressure on the chips. On the supply side of the chips, some enterprises that were previously under maintenance have restarted and increased their load, leading to an increase in market supply compared to last week. In the first half of the week, downstream sentiment was cautious, but in the second half, downstream just-in-time replenishment led to an improvement in the trading atmosphere for some low-priced chips. This cycle, the PA6 high-speed spinning chip market price declined, with the mainstream price range between 9,650-9,900 RMB/ton for spot delivery. The caprolactam market saw slight fluctuations at a low level, and the high-speed spinning chip sector is experiencing significant cost pressure due to profit losses. However, some downstream spinning enterprises mainly replenish based on demand, with limited demand, causing aggregation enterprises to experience shipment pressure and negotiate sales.

3. Forecast for next week:

The price of PA6 is expected to fluctuate within a narrow range in the next cycle. The mainstream price of regular spun cutting chips is likely to remain in the range of 9,200-9,300 RMB/ton for spot cash delivery. The mainstream price of high-speed spun cutting chips of premium grade is expected to consolidate in the range of 9,500-9,700 RMB/ton for acceptance delivery. 。 Key Focus: 1. Supply side. Next period supply is expected to increase slightly, with some polymerization enterprises possibly raising their operating rates. 2. Demand side. Downstream production enterprises mainly replenish based on rigid demand, with overall demand likely limited; 3. Cost side. The caprolactam market is expected to undergo slight consolidation in the next period, with costs and supply-demand dynamics leading to a stalemate and consolidative operation. Going forward, attention should be paid to the impact of costs and supply-demand on market sentiment.

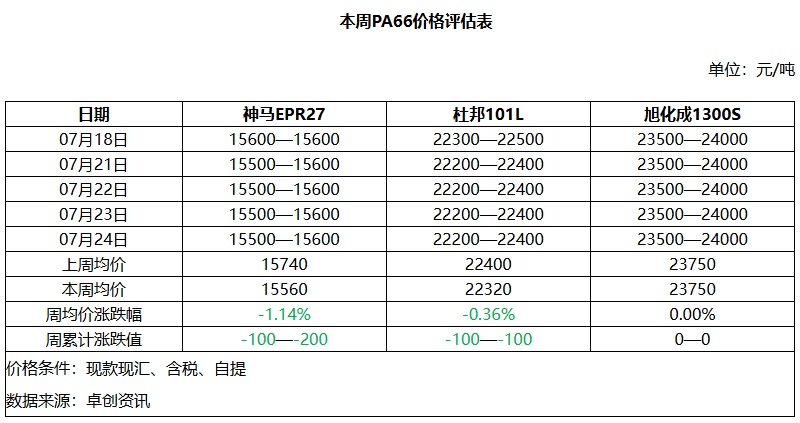

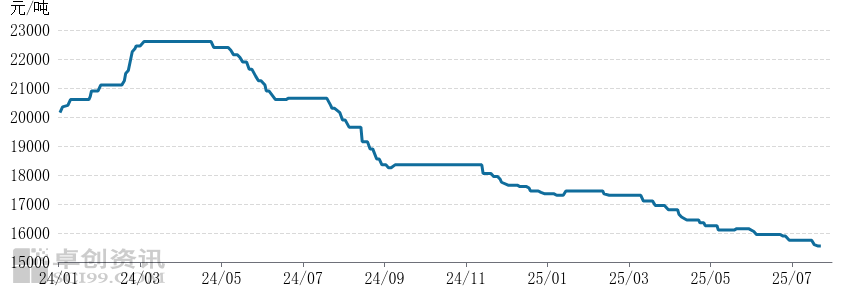

PA66 Weekly Review: Supply and Demand Game, Market Slightly Declines

1. Market Review of the Week:The average price of PA66 market declined this week.

This week, the domestic PA66 market price declined. As of the close on July 24, the market price of Shenma EPR27 in East China was 15,500-15,600 RMB/ton (cash), with the lower end down by 100 RMB/ton and the upper end down by 200 RMB/ton compared to last Thursday’s closing price. The average price this week was 15,560 RMB/ton, a decrease of 1.14% from last week’s average. The supply-demand imbalance in the market persists, with little support from the cost side, leading to a downward shift in price focus.

Domestic PA66 (EPR27) Price Trend Chart

2. Market Outlook for Next Week: PA66 Prices Slightly Lowering

The PA66 market is expected to slightly decline next week. The demand from downstream terminals is anticipated to remain sluggish, and trading in the PA66 market may still be moderate, with resistance in transactions. The supply of PA66 remains abundant, and the supply-demand contradiction is still prominent. The cost aspect is likely to remain stable, providing little support for PA66 prices. Overall, the PA66 market is expected to exhibit weak fluctuations next week, with the average market price of EPR27 in East China possibly around 15,500 yuan/ton, and the price range is likely to be between 15,400-15,600 yuan/ton.

(The above is compiled from Longzhong and Zhuochuang.)

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track