[This Week in the Plastics Market] Weakness Persists! General Purpose Materials Fluctuate Weakly, Engineering Plastics Fall Across the Board, PMMA Drops Up to 200

Summary: Weekly market review and forecast for general-purpose and engineering plastics from August 8 to August 14! General-purpose plastics showed mixed trends, with PE, PP, and PS experiencing narrow fluctuations; ABS operated weakly, with some prices dropping by 10-165. Engineering plastics weakened across the board, with PC continuing to bottom out, with some prices dropping by 100; PET experienced weak fluctuations, with some prices dropping by 50; PBT continued to decline, with some prices dropping by 135; PMMA trended weakly, with some prices dropping by 50-200; PA6 and PA66 faced downward pressure, with some prices dropping by 100-110; POM underwent weak adjustments.

General material

PE Weekly Review: Spot Prices of Polyethylene Show Mixed Movements

1. Summary of Market Situation This Week

This week, international oil prices declined as geopolitical tensions are expected to ease further, coupled with the International Energy Agency's downward revision of global demand growth forecasts, all of which exert pressure on the oil market.

This week, sample enterprises of PE packaging film are seeing relatively low profit margins for some products. Finished goods inventories remain at low levels, and production is guided by orders.

The polyethylene production for this period is 661,200 tons, an increase of 1,000 tons compared to the previous period. The total production for the next period is expected to be 638,100 tons, a decrease of 23,100 tons compared to this period.

2. BookReview of the Polyethylene Market Trends

This week, the domestic polyethylene spot market prices showed mixed changes, ranging from an increase of 8-64 yuan/ton (weekly average). Recently, there has been macroeconomic support, with little change in polyethylene supply. LDPE and LLDPE prices have remained strong, but some HDPE products have experienced slight price declines due to increased supply and obstacles in sales. The price of HDPE film is 7,969 yuan/ton, up 11 yuan/ton from last week; the price of LDPE film is 9,583 yuan/ton, up 64 yuan/ton from last week; and the price of LLDPE film is 7,466 yuan/ton, up 13 yuan/ton from last week.

3. Polyethylene Market Forecast

The price of polyethylene is expected to fluctuate slightly upwards in the next period. Key points to watch: 1. Cost aspect. It is anticipated that the support from oil-based costs will weaken, while the support from coal-based costs will remain relatively unchanged; 2. Supply side. Next week's market supply will involve planned maintenance at new facilities such as Fushun Petrochemical, Wanhua Chemical, and Lianyungang Petrochemical, which is expected to reduce supply. The total production for the next period is expected to be 638,100 tons, a decrease of 23,100 tons compared to the current period; 3. Demand side. The overall operating rate of downstream PE industries is expected to decrease by 0.57% next week, with relatively stable demand changes. Enterprises are operating steadily, with some products having low-profit margins, and finished product inventories remain low. Production is guided by orders. Overall, the fundamental supply and demand pressure is easing, and recent macroeconomic support is relatively favorable. Market sentiment is relatively positive, and prices may mainly fluctuate slightly upwards, with a range of 5-45 yuan/ton.

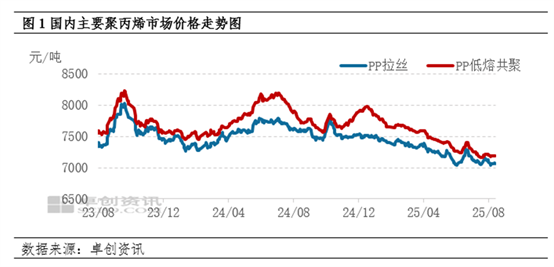

PP Weekly Review: The market consolidated within a narrow range this week and may experience slight downward adjustment within a narrow range next week.

1The market review: The domestic PP market showed narrow fluctuations, with the price focus stabilizing compared to the previous period.

This week, the domestic PP market showed a narrow range consolidation, with prices stabilizing on a weekly basis.As of this Thursday, the average weekly price of East China wire drawing is 7,068 yuan/ton, an increase of 3 yuan/ton compared to the previous week, with an increase of 0.04%. The price difference in the wire drawing region continues to expand. In terms of products, the difference between wire drawing and low-melting copolymer has not changed significantly from the previous week.

This week, PP remained largely stable with minor fluctuations, and market transactions faced pressure.In terms of the import market, PP futures showed a warm transition over the week before stabilizing, while fluctuations in crude oil prices provided limited support to PP costs. There were few offers from overseas suppliers to China, and the price disparity between domestic and foreign markets remained inverted, resulting in limited market changes. Most traders tended to stabilize and follow market trends. The downstream sector has not yet fully emerged from the off-season, with limited new orders and a moderate pace of finished goods inventory reduction, leading to insufficient confidence in the market. Purchases were mainly made at low prices to meet essential production needs. In the domestic market, mainstream offers for August-September shipments of raffia were between $840-870/ton, and mainstream offers for homo-injection were in the same range. For copolymer transparency, mainstream dollar prices for August-September shipments ranged from $890-910/ton. In the export market, the FOB intention offer range for Chinese homo-PP raffia this week was $855-885/ton. The ample supply at the front end of the market increased sales pressure in the export market, leading some export companies to slightly lower their quotes for large-volume orders, while overall quotations tended to remain stable. Overseas market demand was weak, and the tariff policies of the United States on Southeast Asian countries affected the market, resulting in a lackluster performance in the export market during the week.

3Outlook: Fundamentals remain weak; the market may continue to fluctuate within a weak and narrow range.

The PP market is expected to fluctuate narrowly with a weak trend next week.For East China, the expected operating range for raffia prices next week is 6,980-7,150 yuan/ton, with an average price forecast of 7,050 yuan/ton. The operating range for low-melt copolymer prices is expected to be 7,100-7,250 yuan/ton, with an average price forecast of 7,160 yuan/ton. On the cost side, crude oil is expected to fluctuate widely, providing little guidance for PP costs. On the supply side, new capacities are impacting the market while the intensity of facility maintenance is expected to weaken, leading to an increase in supply. On the demand side, downstream operations are hovering at low levels in the short term, and procurement of supplies remains cautious, indicating weak demand. Overall, market support from supply and demand fundamentals is weak, and there is no clear guidance from the cost side for the market. Based on this, the PP market is expected to show a slight weak adjustment next week.

PS Weekly Review: Weak Demand and Hindered Market Transactions

1. Market Review of the Week: Insufficient Demand, Sluggish Transactions

This week's domestic PS market shows a differentiated trend between general-purpose polystyrene (GPPS) and impact-resistant polystyrene (HIPS), with overall narrow-range fluctuations. The average price of GPPS in East China is 7,828 RMB/ton, down 42 RMB/ton from the previous period, a decrease of 0.53% compared to the previous period; the average price of HIPS in East China is 8,533 RMB/ton, up 2 RMB/ton from the previous period, a slight increase of 0.02%.

2. Market Outlook for the Next Period: Costs Expected to Decline & Supply-Demand Pressure May Keep the PS Market in a Weak Stalemate

The domestic PS market next week may remain weak and stagnant. The general GPPS operating range is 7750-7900 yuan/ton, with an average price expected at 7800 yuan/ton; the general HIPS operating range is 8300-8700 yuan/ton, with an average price expected at 8500 yuan/ton. On the cost side, the styrene market may operate weakly, providing a bearish expectation for PS cost guidance; on the supply and demand side, production lines that restarted this week are running stably, and domestic PS supply is expected to continue increasing next week, maintaining relatively ample spot supply. However, in the traditional off-season for demand, downstream procurement remains sluggish. In summary, although there is still some bottom support on the cost side, the supply and demand structure remains weak, and the PS market may remain weak and stagnant.

ABS Weekly Review: Insufficient Trading Activity, Market Runs Weak

1. Market Review of the Week: This week, the ABS market prices underwent weak consolidation, and trading was relatively light.

The ABS market price remained weak and consolidated this week. As of now, the mainstream price for domestic materials is around 9,100-10,400 RMB/ton. The low-end price has dropped by 50 RMB/ton compared to last Thursday, while the high-end price remains unchanged. Trading activity is subdued.

2. Market Outlook for Next Week: Costs May Weaken, Limited Changes in Fundamentals, ABS Prices May Weaken and Narrowly Consolidate

The ABS market price is expected to be weak and narrow next week. The estimated domestic mainstream price range is between 9,050-10,400 yuan/ton, with the low-end price down by 50 yuan/ton compared to Thursday this week, while the high-end price remains basically the same as Thursday this week; the average price might be around 9,720 yuan/ton. Next week, a few production lines in places like Shandong will increase production, with a slight rise in output. After August 20th, due to transportation and other reasons, a slight decline in industry operations is expected, but the overall supply volume is anticipated to remain at a high level for the year, with no significant reduction trend in supply sources. In the second half of August, downstream operations may have a slight upward momentum. With the tariff extension, some new export orders are being negotiated, but since some demand has already been brought forward, the actual increase might be limited. The upstream market may operate weakly, with limited short-term changes in the supply-demand structure. Therefore, the short-term ABS market is expected to mainly run weakly.

Engineering materials

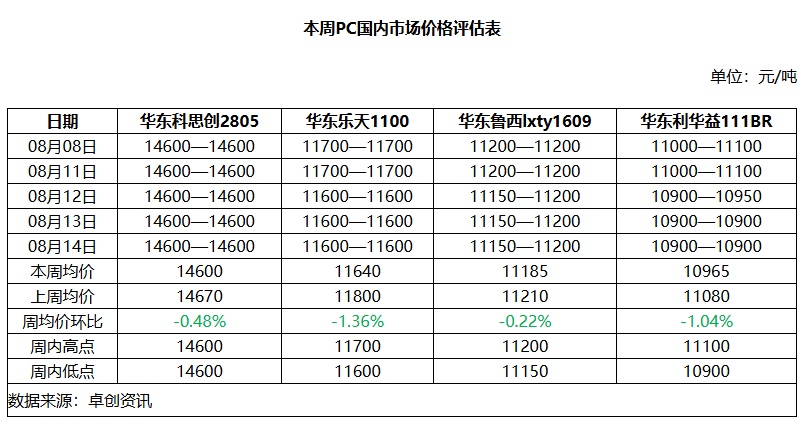

PC Weekly Review: The Market Continues to Explore New Lows

1. Review of the Domestic PC Market: Market Focus Shifts Downward

The domestic PC market has weakened this week. As of August 14, taking the East China market for foreign-sourced products as an example, the closing price of Covestro 2805 was between 14,600 and 14,600 RMB/ton, with a weekly average price of 14,600 RMB/ton, down 0.48% week-on-week; for domestically sourced products in the East China market, taking Luxi 1609 as an example, the closing price was between 11,150 and 11,200 RMB/ton, with a weekly average price of 11,185 RMB/ton, down 0.22% week-on-week.

2. Market Outlook: The market may operate at a low level.

The domestic PC market is expected to fluctuate at a low level next week. From the supply perspective, industry operating rates are close to 80%, and market supply is generally sufficient; from the downstream demand perspective, with some rigid purchases made this week, it is expected that downstream players will focus on inventory digestion next week. As the PC market has fallen to the lowest point of the year, short-term sellers are cautious about selling at too low prices. It is expected that the short-term price of domestic PC supply in East China will range between 10,800 and 11,400 yuan per ton.

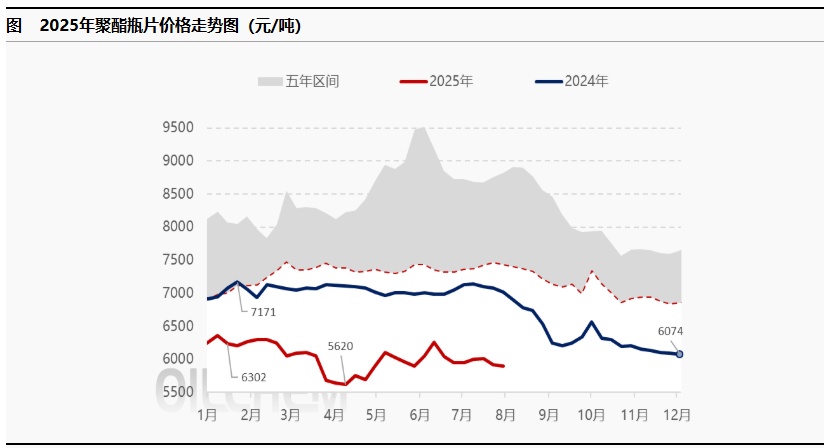

PET Weekly Review:narrow decline

1. This week Market Focus:

Production: Capacity utilization rate is 70.89%.

Raw material: PTA industry opens75.01% of work.

2. Market Analysis

During this period (August 8, 2025 to August 14, 2025), the price of polyester bottle chips experienced a slight decline. On Thursday, August 14, the spot price of polyester bottle-grade chips in the East China market was 5,890 yuan/ton, down 50 yuan/ton from last week, a decrease of 0.84%. This period, East China... The polyester bottle chip market fluctuated weakly, with prices ranging between 5,830 and 5,980 yuan per ton. 。 At the beginning of the week, the maintenance of polyester raw material units and macroeconomic favorable factors boosted cost trends. However, as the macroeconomic benefits gradually faded, demand in the polyester bottle chip market remained lukewarm. Downstream users and traders mostly made small, rigid purchases at low prices. Fortunately, the short-term supply of some goods is relatively tight, supporting the short-term trend of the polyester bottle chip market. Polyester bottle chip prices declined slightly within a narrow range.

3. Post-production Forecast:

Supply Side: There are no plant changes for the time being, and supply remains stable.

Demand side: Peak season for terminal demand, with downstream soft drink industry operating rates stable at 85-95%. Oil plant operating rates may slightly decline to around 62%. PET sheet industry operating rates are at 65-75%.

Cost perspective: Crude oil inventories are expected to decline, and main raw materialsThere are expectations of increased PTA supply, and considering cost pressures, the polyester cost side is expected to remain weak.

Forecast for next week: With weakened support from raw materials and downstream sectors maintaining replenishment based on rigid demand, it is expected that the polyester bottle chip market in East China will fluctuate weakly in the next period. The spot price of water bottle grade material is expected to be around 5,800–5,980 RMB/ton.

PBT Weekly Review: Cost Support Weakens, Spot Prices Continue to Decline

1. Market Review of the Week: Cost support weakens, PBT spot prices decline.

This week, both BDO and PTA prices continued to decline, leading to lower cost support for PBT. In addition, PBT demand has remained sluggish recently, resulting in a drop in PBT spot prices during the week. As of August 14, the mainstream transaction range for 1.0 viscosity pure resin PBT in the East China market was 7,600-8,000 yuan/ton, with a weekly average price of 7,840 yuan/ton, down 1.69% compared to the previous week's average.

2. Outlook for Next Week: With weakening cost support combined with sluggish demand, PBT spot prices are likely to fluctuate weakly.

Next week, the PBT market price is expected to fluctuate weakly. From the cost side, the market lacks new substantial positive driving factors; PTA supply is abundant, and PTA prices are predicted to decline slightly next week. In addition, BDO contract holders remain cautious during the delivery period, awaiting clearer policies, resulting in weak and consolidating prices. Overall, the PBT cost side is weak. From the supply side, there are no planned changes to facilities; attention will be given to whether some PBT units restart. PBT capacity utilization is expected to remain stable next week. From the demand side, downstream order placements are slow, and PBT demand is likely to remain subdued. With costs decreasing and supply ample, PBT is expected to fluctuate weakly in the short term, with the mainstream transaction reference range between 7,500 and 8,000 RMB/ton.

POM Weekly Review: Spot Market Faces Pressure, Traders Adopt Flexible Selling Strategies

This Week's Market Focus

1) Support from low inventory levels at petrochemical plants;

2) The market sales are slow. ;

3) Downstream cautious sentiment dominates 。

2. Weekly Market Analysis

Domestic POM Market Weekly Price Fluctuation Table

Unit: RMB/ton

|

Market |

This week |

Last week |

Rise and fall |

|

East China |

11000 |

11000 |

0 |

|

Southern China |

10000 |

10000 |

0 |

Data Source: Longzhong Information

The POM market saw a slight decline during this period. This week, POM prices varied across regions. Although petrochemical plants maintained low inventory levels, the market is currently in the traditional off-season, leading to relatively sluggish spot circulation and increased sales pressure. Mainstream offers for domestic materials remained stable, while high-priced imported materials faced difficulty in transactions, with some offers dropping by 200-500 yuan/ton. Constrained by weak demand, more traders adopted the practice of quoting high but selling low. Downstream users predominantly held a wait-and-see attitude, and the overall buying and selling atmosphere remained unoptimistic.

3. Market Forecast for Next Week

The POM price is expected to decline within a narrow range in the next period. Key points to watch: 1. Supply side: Petrochemical plants have no inventory pressure in the next period; however, with slower sales across regions, manufacturers will face increased pressure to sell. 2. Demand side: Demand will remain weak in the next period. Due to sluggish order conditions, downstream buyers are relatively reluctant to take on inventory, making it difficult for large orders to follow in the short term. 3. Cost side: Upstream raw material methanol prices remain high, strengthening cost support. 4. Macro aspect: Import material prices are high, actual transactions are difficult, and traders may continue to increase discounting, leading to a continued short-term downward trend.

PMMA Weekly Review: The PMMA Market Shows a Weakening Trend

1. This Week's Market Focus

Recently, the raw material MMA first rose and then fell, providing limited cost support for PMMA.

② The PMMA supply side is stable, with a capacity utilization rate of 64%.

The demand-side buying interest is insufficient, and the focus of downstream counteroffers remains low.

2. Market Analysis for This Week

This week, the domestic PMMA market showed a weak trend. As of August 14, the price of domestic supply was between 12,600-13,800 yuan/ton; the price of imported supply was between 12,400-13,400 yuan/ton.

The price of raw material MMA rebounded after a decline, but it provided limited confidence boost to PMMA manufacturers. Coupled with low enthusiasm for terminal purchasing, the spot inquiry atmosphere remained weak. Negative signals from downstream transmission exerted pressure on holders' pricing space. Some intermediaries and manufacturers increased shipments following the market trend, resulting in more low-priced goods in the market. However, transaction volume remained limited, and the focus of actual order trading shifted downward.

Table 1: Weekly Fluctuation Table of PMMA Industry Chain Products (Unit: Yuan/Ton)

3. Market Forecast for Next Week

The next period is expected to see weak performance in PMMA particles. Key focus areas: 1. Supply side: The spot supply of PMMA particles remains ample, with sellers primarily focused on reducing inventory through sales. 2. Demand side: Downstream terminal operating rates are low, with minimal changes in overall PMMA particle consumption, resulting in insufficient trading signals in the spot market. 3. Cost side: It is expected that...MMA MarketStable operation, with a possible increase in the cost of PMMA particles.

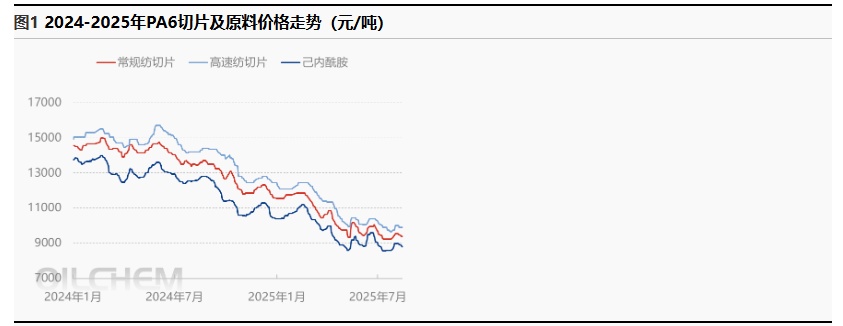

PA6 Weekly Review: Raw Material Prices Decline and Limited Demand Lead to Initial Drop Followed by Stabilization in the PA6 Market

1. Market Focus This Week

Sinopec has increased the price of pure benzene by 100 yuan/ton at refineries in East China and South China, setting the price at 6,150 yuan/ton, effective from August 12. The monthly settlement price for Sinopec's caprolactam is 9,575 yuan, Shenyuan's weekly settlement is 9,500 yuan, and the spot price for caprolactam in East China is 8,800 yuan/ton.

2) Conventional PA6 spun chips in East China and Central China are short-delivered at 9150-9650 RMB/ton in cash settlement, while some high-end chips are available at 9400-9800 RMB/ton for cash self-pickup. PA6 high-speed spun regular chips are priced at 9200-9400 RMB/ton for cash factory delivery, and premium chips are offered at 9800-10000 RMB/ton with acceptance payment delivery. (Unit: RMB/ton)

3) Supply and Demand Situation: According to Longzhong statistics, this week’s caprolactam production was 135,900 tons, and nylon 6 chip production was 131,200 tons. The operating rate of nylon filament was 78%. This week, the domestic weaving industry's operating rate was 58.04%, up by 2.29% compared to last week.

2. This Week's Market Analysis

During this period, the PA6 chip market first declined and then stabilized, with mainstream prices at 9,400-9,500 yuan/ton for spot delivery. The cost and demand game continued, downstream demand was limited, and buyers mainly replenished at lower prices. Polymerization enterprises had slow sales with slight negotiations for shipments, but chips were sold at a loss, limiting the scope of market negotiations. Some low-priced chips saw improved transactions this week, but overall trading was average. During this period, the PA6 high-speed spinning chips market remained weak, with mainstream prices at 9,900 yuan/ton for spot delivery. Some downstream spinning enterprises mainly replenished based on demand, and some polymerization enterprises continued to negotiate shipments, but chip profits were negative, limiting the extent of negotiations.

3. Forecast for Next Week:It is expected that the PA6 market will operate steadily in the next cycle. The mainstream price of conventional spinning chips is likely to remain in the range of 9,300-9,400 yuan/ton (cash, short delivery), while the mainstream price of high-speed spinning premium chips will be in the range of 9,800-9,900 yuan/ton (acceptance, delivered). 。 Key Focus: 1. Supply Side. The supply volume is expected to decrease in the next period, with planned maintenance at Weiming Petrochemical and Shanxi Yangmei. 2. Demand Side. Downstream production enterprises mainly engage in periodic just-in-time replenishment, with potential replenishment at low prices due to just-in-time needs. 3. Cost Side. The caprolactam market is expected to undergo slight adjustments in the next period, and cost pressure from chip losses remains. Attention should be paid to the impact of costs and supply-demand on market sentiment moving forward.

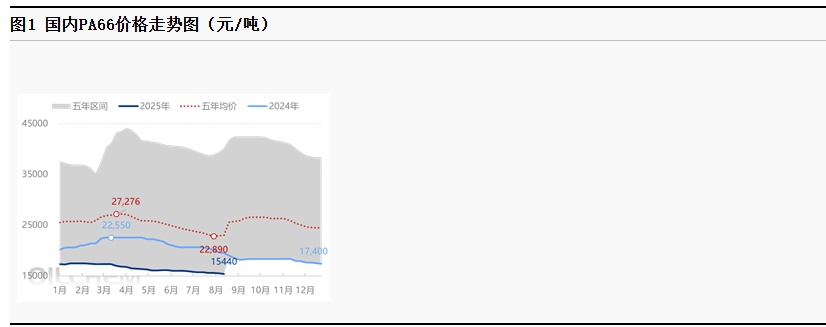

PA66 Weekly Review: Downstream Purchases as Needed, Market Runs Weak

1. Market Focus of the Week

Production:The PA66 output for this period is 16,300 tons, with a capacity utilization rate of 60%, which is stable compared to the previous period.

Demand: The terminal market demand is generally moderate, with downstream buyers mostly purchasing as needed.

2. This week's market analysis

In this period, the spot price of PA66 in East China showed a weak trend, with the weekly average price at 15,440 RMB/ton, a decrease of about 0.52% compared to last week. Raw material prices fluctuated during the week, providing insufficient cost support. Terminal market demand was average, with downstream buyers mainly purchasing as needed, while market supply was abundant. High-priced sales were sluggish, and transaction prices declined.

3. Market Forecast for Next Week

The PA66 supply and demand are expected to be weakly balanced in the next period, with the market lacking supportive news for a boost, and the market is likely to continue weak consolidation. Key points to focus on: 1. Supply side. The capacity utilization rate of polymer enterprises is stable, with expectations of new capacity additions, and the market has ample spot supply. 2. Demand side. End-market demand is average, expected to maintain just-in-time purchasing. 3. Cost side. Raw material prices are fluctuating, providing stable cost support.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track