"The Struggle of a 'Turning Elephant,' Medical Giant's Stock Plummets by Over 25%!"

On February 27, global medical technology giant Teleflex (NYSE: TFX) announced a major strategic realignment: it plans to spin off its urology, acute care, and OEM businesses into an independent public company, NewCo, with the process expected to be completed by mid-2026; meanwhile, it is acquiring Biotronik's vascular intervention business for 760 million euros.

The company announced that it intends to restructure its business landscape through a "dual-core driven" strategy to address the rapidly changing market demands in the healthcare industry. This should have been a strategic adjustment aimed at "optimizing the portfolio and unlocking value," but it was overshadowed by underperforming financial results and a 25% drop in stock price.

Is the spin-off a case of "cutting off the arm to save the body" or "lightening the load to move forward"? Can it solve the common challenge for large enterprises — how to find a balance between economies of scale and agility in niche markets? Can this self-renewal help the "medical giant" escape the value trap?

Spin-off and Acquisition: "Slimming Down" and "Strengthening"

According to the company's announcement, the urology, acute care, and OEM businesses will be spun off to form a new public company, "NewCo." The remaining company, "RemainCo," will focus on vascular access, interventional therapy, and surgical businesses.

On February 27, global medical technology giant Teleflex (NYSE: TFX) announced a major strategic realignment: it plans to spin off its urology, acute care, and OEM businesses to form an independent public company, NewCo, with the transaction expected to be completed by mid-2026; meanwhile, it is acquiring Biotronik's vascular intervention business for 760 million euros.

The company stated that it intends to restructure its business landscape through a "dual-core drive" strategy in response to the rapidly changing market demands in the healthcare industry. This should have been a strategic adjustment aimed at "optimizing the portfolio and unlocking value," but it has been overshadowed by disappointing financial results and a 25% plunge in stock price.

Is the spin-off a case of "cutting off one's arm to save one's life" or "traveling light"? Can it address the common challenge faced by large corporations—how to strike a balance between economies of scale and agility in niche markets? Will this self-renewal help the "medical giant" escape the value trap?

On February 27, global medical technology giant Teleflex (NYSE: TFX) announced a major strategic realignment: it plans to spin off its urology, acute care, and OEM businesses into an independent publicly traded company, NewCo, with the process expected to be completed by mid-2026; at the same time, it will acquire Biotronik's vascular intervention business for 760 million euros.

The company announced that it intends to restructure its business landscape through a "dual-core driven" strategy to meet the rapidly changing market demands of the healthcare industry. This was supposed to be a strategic adjustment aimed at "optimizing the portfolio and unlocking value," but it has been overshadowed by financial results falling short of expectations and a 25% plunge in stock price.

Is the spin-off a case of "amputating to survive" or "lightening the load"? Can it address the common challenge of making a "giant dance"—how to find a balance between scale effects and agility in niche markets? Can this self-renewal help the "medical giant" escape the value trap?

On February 27, global medical technology giant Teleflex (NYSE: TFX) announced a major strategic realignment: it plans to spin off its urology, acute care, and OEM businesses into an independent publicly traded company, NewCo, with the process expected to be completed by mid-2026; at the same time, it will acquire Biotronik's vascular intervention business for 760 million euros.

The company announced that it intends to restructure its business landscape through a "dual-core driven" strategy to meet the rapidly changing market demands of the healthcare industry. This was supposed to be a strategic adjustment aimed at "optimizing the portfolio and unlocking value," but it has been overshadowed by financial results falling short of expectations and a 25% plunge in stock price.

Is the spin-off a case of "amputating to survive" or "lightening the load"? Can it address the common challenge of making a "giant dance"—how to find a balance between scale effects and agility in niche markets? Can this self-renewal help the "medical giant" escape the value trap?

▍Divestiture and Acquisition: "Slimming Down" and "Strengthening"

▍Divestiture and Acquisition: "Slimming Down" and "Strengthening"

▍Divestiture and Acquisition: "Slimming Down" and "Strengthening"

According to the company's announcement, it will spin off its urology, emergency care, and OEM businesses to form a new publicly traded company - "NewCo". The remaining company, "RemainCo", will focus on vascular access, interventional therapies, and surgical businesses.

According to the company's announcement, it will spin off its urology, emergency care, and OEM businesses to form a new publicly traded company - "NewCo". The remaining company, "RemainCo", will focus on vascular access, interventional therapies, and surgical businesses.

According to the company's announcement, it will spin off its urology, emergency care, and OEM businesses to form a new publicly traded company - "NewCo". The remaining company, "RemainCo", will focus on vascular access, interventional therapies, and surgical businesses.The acquired business from Biotronik covers the entire product portfolio of coronary and peripheral vascular interventions, including drug-eluting stents, drug-coated balloons, and absorbable stents, among other cutting-edge technologies. These products are highly complementary to Teleflex's existing interventional product lines, especially in the area of complex percutaneous coronary intervention (PCI). The acquisition of Biotronik's vascular intervention business will help strengthen Teleflex's strategic layout in the cardiovascular intervention market.

The core product lines of this acquisition include the following:

The acquired business from Biotronik covers the entire product portfolio of coronary and peripheral vascular interventions, including drug-eluting stents, drug-coated balloons, bioresorbable stents, and other cutting-edge technologies. These products are highly complementary to Teleflex's existing interventional product lines, especially in the field of complex percutaneous coronary intervention (PCI). Acquiring Biotronik's vascular intervention business will strengthen Teleflex's strategic layout in the cardiovascular intervention market.

The core product lines involved in this acquisition include:

The acquired business from Biotronik covers the entire product portfolio of coronary and peripheral vascular interventions, including drug-eluting stents, drug-coated balloons, bioresorbable stents, and other cutting-edge technologies. These products are highly complementary to Teleflex's existing interventional product lines, especially in the field of complex percutaneous coronary intervention (PCI). Acquiring Biotronik's vascular intervention business will strengthen Teleflex's strategic layout in the cardiovascular intervention market.

The business of Biotronik that has been acquired covers the entire product portfolio of coronary and peripheral vascular interventions, including cutting-edge technologies such as drug-eluting stents, drug-coated balloons, and bioresorbable stents. These products are highly complementary to Teleflex's existing interventional product lines, especially in the field of complex percutaneous coronary intervention (PCI). The acquisition of Biotronik's vascular intervention business is beneficial for strengthening Teleflex's strategic layout in the cardiovascular intervention market.The core product lines of this acquisition include the following:

The core product lines of this acquisition include the following:

Orsiro™ Mission Drug-Eluting Stent: Known for its ultra-thin design and excellent deliverability, it is suitable for a variety of coronary artery diseases.

Orsiro™ Mission Drug-Eluting Stent: Known for its ultra-thin design and excellent deliverability, it is suitable for a variety of coronary artery diseases.

Orsiro™ Mission Drug-Eluting Stent: Known for its ultra-thin design and excellent deliverability, it is suitable for a variety of coronary artery diseases.

Orsiro™ Mission Drug-Eluting Stent: Known for its ultra-thin design and excellent deliverability, it is suitable for a variety of coronary artery diseases.

Pantera™ Lux™ Drug-Coated Balloon Catheter: For the treatment of vascular stenosis, reducing the risk of restenosis.

Pantera™ Lux™ Drug-Coated Balloon Catheter: For the treatment of vascular stenosis, reducing the risk of restenosis.

Pantera™ Lux™ Drug-Coated Balloon Catheter: For the treatment of vascular stenosis, reducing the risk of restenosis.

Pantera™ Lux™ Drug-Coated Balloon Catheter: For the treatment of vascular stenosis, reducing the risk of restenosis.

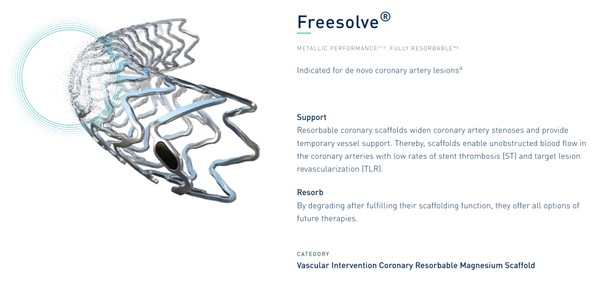

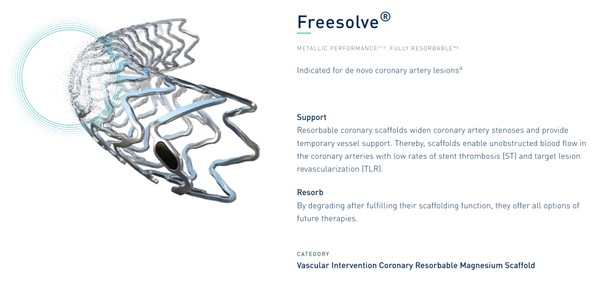

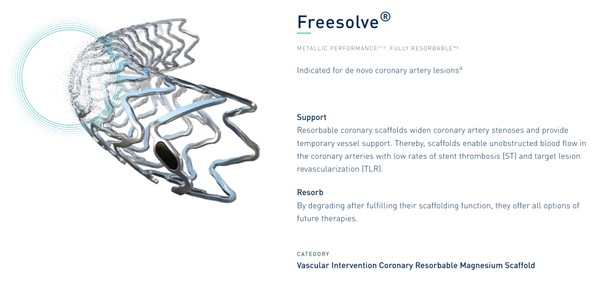

Freesolve™ Absorbable Magnesium Alloy Stent: A globally leading absorbable stent technology that uses a sirolimus-eluting absorbable metal stent, which has received CE certification in February 2024.

Freesolve™ performed excellently in clinical trials, achieving complete stent absorption within 12 months without any definite or probable stent thrombosis. This technology not only lays the foundation for Teleflex to develop the next generation of degradable vascular devices but also provides the possibility for entering the US market.

Moreover, Biotronik has a strong market presence in Europe, the Middle East, and Africa. In 2023, coronary intervention accounted for 75% of the revenue from vascular intervention business, while peripheral intervention accounted for 25%. Through this acquisition, Teleflex can leverage Biotronik's channel advantages to significantly increase its share in the global coronary and peripheral vascular intervention markets, further expanding its global market influence.

Freesolve™ Absorbable Magnesium Alloy Stent: A globally leading absorbable stent technology that uses a sirolimus-eluting absorbable metal stent, which has received CE certification in February 2024.

Freesolve™ performed excellently in clinical trials, achieving complete stent absorption within 12 months without any definite or probable stent thrombosis. This technology not only lays the foundation for Teleflex to develop the next generation of degradable vascular devices but also provides the possibility for entering the US market.

Moreover, Biotronik has a strong market presence in Europe, the Middle East, and Africa. In 2023, coronary intervention accounted for 75% of the revenue from vascular intervention business, while peripheral intervention accounted for 25%. Through this acquisition, Teleflex can leverage Biotronik's channel advantages to significantly increase its share in the global coronary and peripheral vascular intervention markets, further expanding its global market influence.

Freesolve™ Absorbable Magnesium Alloy Stent: A globally leading absorbable stent technology that uses a sirolimus-eluting absorbable metal stent, which has received CE certification in February 2024.

Freesolve™ Absorbable Magnesium Alloy Stent: A globally leading absorbable stent technology, utilizing a sirolimus-eluting absorbable metal stent, has obtained CE certification in February 2024.Freesolve™ demonstrated excellent performance in clinical trials, achieving complete stent absorption within 12 months without any definite or probable stent thrombosis. This technology not only lays the foundation for Teleflex to develop the next generation of degradable vascular devices but also paves the way for its entry into the US market.

Freesolve™ demonstrated excellent performance in clinical trials, achieving complete stent absorption within 12 months without any definite or probable stent thrombosis. This technology not only lays the foundation for Teleflex to develop the next generation of degradable vascular devices but also paves the way for its entry into the US market.Moreover, Biotronik has a strong market presence in Europe, the Middle East, and Africa. In 2023, 75% of the revenue from vascular intervention business came from coronary interventions, while 25% was from peripheral interventions. Through this acquisition, Teleflex can leverage Biotronik's channel advantages to significantly increase its share in the global coronary and peripheral vascular intervention markets, further expanding its global market influence.

Moreover, Biotronik has a strong market presence in Europe, the Middle East, and Africa. In 2023, 75% of the revenue from vascular intervention business came from coronary interventions, while 25% was from peripheral interventions. Through this acquisition, Teleflex can leverage Biotronik's channel advantages to significantly increase its share in the global coronary and peripheral vascular intervention markets, further expanding its global market influence.

▍Divide and Conquer, Unlocking Potential

▍Divide and Conquer, Unlocking Potential

▍Divide and Conquer, Unlocking Potential

The spin-off plan and the Biotronik acquisition form a strategic combination of "one step back, one step forward," with the core logic being to divest low-growth businesses, focus on high-potential sectors, and simultaneously strengthen weaknesses and channels through acquisitions.

The spin-off plan and the Biotronik acquisition form a strategic combination of "one step back, one step forward," with the core logic being to divest low-growth businesses, focus on high-potential sectors, and simultaneously strengthen weaknesses and channels through acquisitions.

The spin-off plan and the Biotronik acquisition form a strategic combination of "one step back, one step forward," with the core logic being to divest low-growth businesses, focus on high-potential sectors, and simultaneously strengthen weaknesses and channels through acquisitions.RemainCo's product portfolio covers the following three core areas:

RemainCo's product portfolio covers the following three core areas:

RemainCo's product portfolio covers the following three core areas:

RemainCo's product portfolio covers the following three core areas:-

Vascular Access: Provides a variety of devices including Arrow brand catheters, catheter navigation and tip location systems, as well as intraosseous access systems, aimed at reducing vascular-related complications. -

Interventional Therapies: Covers a range of coronary catheters and structural heart disease support devices for the diagnosis and treatment of coronary and peripheral vascular diseases. In addition, with the acquisition of Biotronik's vascular intervention business, RemainCo will significantly expand its product portfolio in coronary and peripheral catheter lab procedures. -

Surgical: Offers single-use and reusable surgical instruments, including metal and polymer ligation clips, fascial closure systems for laparoscopic surgery, percutaneous surgery systems, and powered bariatric staplers.

NewCo will inherit Teleflex's urology, emergency care, and OEM businesses, with an expected revenue scale of about $1.4 billion. NewCo is expected to better identify, invest in, and capitalize on unique opportunities in end markets through a simplified operating model and enhanced management focus.

NewCo's business covers the following three major areas:

-

Urology: Includes UroLift minimally invasive technology, Barrigel hyaluronic acid gel-based rectal spacer products, and Rüsch brand catheters and bladder management products. -

Emergency Care: Covers most of Teleflex's anesthesia products, respiratory products, intra-aortic balloon pumps, and other products. -

OEM: Focuses on providing design, manufacturing, and supply of equipment and instruments for medical device manufacturers, with products including custom extrusions, micro-diameter film cast tubing, diagnostic and interventional catheters, balloons, and balloon catheters.

▍"Elephant Dance" Balancing Act, Market Reaction Complex

-

Vascular Access: Provides a variety of devices including Arrow brand catheters, catheter navigation and tip location systems, as well as intraosseous access systems, aimed at reducing vascular-related complications. -

Interventional Therapies: Covers a range of coronary catheters and structural heart disease support devices for the diagnosis and treatment of coronary and peripheral vascular diseases. Additionally, with the acquisition of Biotronik's vascular intervention business, RemainCo will significantly expand its product portfolio in coronary and peripheral catheter laboratory procedures. -

Surgical: Offers both single-use and reusable surgical instruments, covering metal and polymer ligation clips, fascial closure systems for laparoscopic surgery, percutaneous surgical systems, and powered bariatric staplers, among others.

NewCo will inherit Teleflex's urology, emergency care, and OEM businesses, with an expected revenue scale of about $1.4 billion. NewCo is expected to better identify, invest in, and leverage unique opportunities in end markets through a simplified operating model and enhanced management focus.

NewCo's business covers the following three areas:

-

Urology: Includes UroLift minimally invasive technology, Barrigel hyaluronic acid gel-based rectal spacer products, and Rüsch brand catheters and bladder management products. -

Emergency Care: Covers most of Teleflex's anesthesia, respiratory, and intra-aortic balloon pump products, among others. -

OEM: Focuses on providing design, manufacturing, and supply of equipment and instruments for medical device manufacturers, with products including custom extrusions, micro-diameter film cast tubing, diagnostic and interventional catheters, balloons, and balloon catheters, etc.

▍The "Dance of the Elephant" Balancing Act, Market Reaction Complex

-

Vascular Access: Offers a variety of devices including Arrow brand catheters, catheter navigation and tip location systems, as well as intraosseous access systems, aimed at reducing vascular-related complications. -

Interventional Treatments: Covers a range of coronary catheters and structural heart disease support devices for the diagnosis and treatment of coronary and peripheral vascular diseases. In addition, with the acquisition of Biotronik's vascular intervention business, RemainCo will significantly expand its portfolio in coronary and peripheral catheter lab procedures. -

Surgical Procedures: Provides both disposable and reusable surgical devices, including metal and polymer ligation clips, fascial closure systems for laparoscopic surgery, percutaneous surgery systems, electric weight loss nails, and more.

NewCo will inherit Teleflex's urology, acute care, and OEM businesses, with an expected revenue scale of approximately $1.4 billion. By streamlining its operating model and enhancing management focus, NewCo is expected to better identify, invest in, and leverage unique opportunities in end markets.

NewCo's business covers the following three major areas:

-

Urology: Including UroLift minimally invasive technology, Barrigel hyaluronic acid gel-based rectal spacer products, and Rüsch brand catheters and bladder management products. -

Acute Care: Covering most of Teleflex's anesthesia products, respiratory products, intra-aortic balloon pumps, and other products. -

OEM: Focusing on providing design, manufacturing, and supply of equipment and instruments for medical device manufacturers, including custom extrusions, micro-diameter film cast tubing, diagnostic and interventional catheters, balloons, and balloon catheters.

▍"Elephant Dance" Balancing Act, Complex Market Reaction

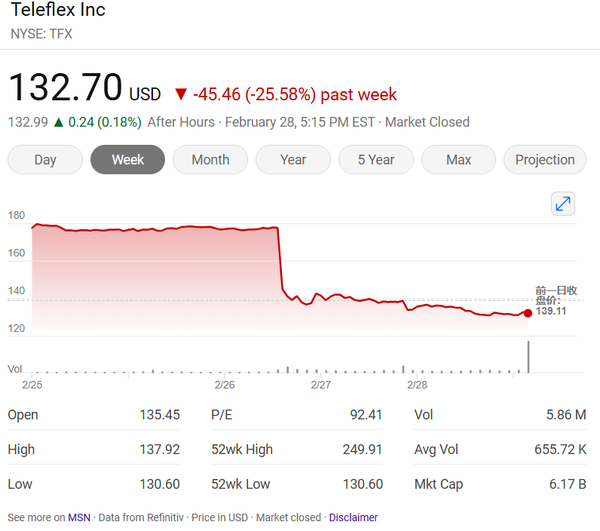

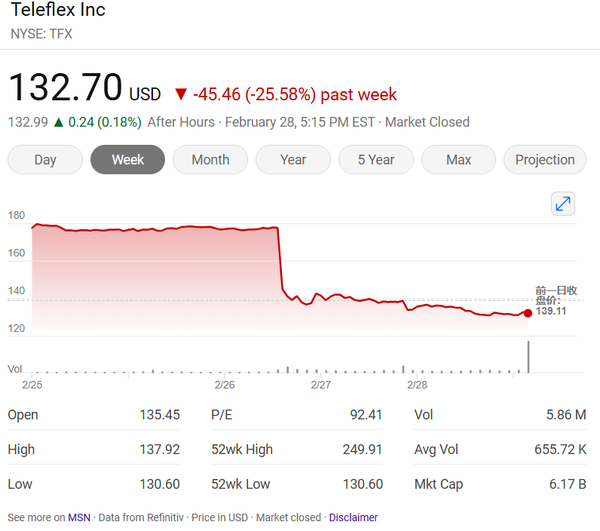

▍"Elephant Dance" Balancing Act, Complex Market ReactionThe market reaction was complex after the announcement of the spin-off plan and acquisition news. Although the company emphasized that the spin-off would optimize business positioning and enhance shareholder value, investors expressed concerns about the fourth-quarter 2024 results not meeting expectations and the weak guidance for 2025.

From a financial perspective, the fourth-quarter revenue was $795.4 million, up 2.8% year-over-year but below the market expectation of $813.14 million. Adjusted earnings per share (EPS) were $3.89, slightly above the analyst expectation of $3.86. According to GAAP, the company reported a net loss per share of $2.95 in the fourth quarter.

The company's full-year 2025 guidance is conservative. It expects adjusted constant currency revenue growth to be only 1% to 2% year-over-year, with GAAP revenue growth expected to be between -0.4% and 0.7%. The 2025 adjusted EPS is projected to be between $13.95 and $14.35, below Wall Street's expectation of $15.23.

Following the announcement of the spin-off plan and acquisition news, the market reaction was mixed. Although the company emphasized that the spin-off would optimize business positioning and enhance shareholder value, investors expressed concerns over the fourth quarter 2024 performance falling short of expectations and the weak guidance for 2025.

From a financial perspective, the fourth-quarter revenue was $795.4 million, up 2.8% year-over-year but below the market expectation of $813.14 million. The adjusted earnings per share (EPS) were $3.89, slightly above the analyst forecast of $3.86. According to GAAP, the company reported a loss per share of $2.95 in the fourth quarter.

The company's full-year 2025 business outlook is conservative. It expects adjusted fixed-currency revenue to grow by only 1% to 2% year-over-year, with GAAP revenue growth projected between -0.4% and 0.7%. The expected adjusted EPS for 2025 is between $13.95 and $14.35, below Wall Street's estimate of $15.23.

Following the announcement of the spin-off plan and acquisition news, the market reaction was mixed. Although the company emphasized that the spin-off would optimize business positioning and enhance shareholder value, investors expressed concerns over the fourth quarter 2024 performance falling short of expectations and the weak guidance for 2025.

Following the announcement of the spin-off plan and acquisition news, the market reaction was mixed. Although the company emphasized that the spin-off would optimize business positioning and enhance shareholder value, investors expressed concerns over the fourth quarter 2024 performance falling short of expectations and the weak guidance for 2025.From a financial perspective, the fourth-quarter revenue was $795.4 million, up 2.8% year-over-year but below the market expectation of $813.14 million. The adjusted earnings per share (EPS) were $3.89, slightly above the analyst forecast of $3.86. According to GAAP, the company reported a loss per share of $2.95 in the fourth quarter.

From a financial perspective, the fourth-quarter revenue was $795.4 million, up 2.8% year-over-year but below the market expectation of $813.14 million. The adjusted earnings per share (EPS) were $3.89, slightly above the analyst forecast of $3.86. According to GAAP, the company reported a loss per share of $2.95 in the fourth quarter.The company's full-year 2025 business outlook is conservative. It expects adjusted fixed-currency revenue to grow by only 1% to 2% year-over-year, with GAAP revenue growth projected between -0.4% and 0.7%. The expected adjusted EPS for 2025 is between $13.95 and $14.35, below Wall Street's estimate of $15.23.

The company's full-year 2025 business guidance is conservative. It is expected that the adjusted fixed currency revenue for 2025 will grow by only 1% to 2% year-over-year, with GAAP revenue growth forecasted between -0.4% and 0.7%. The adjusted earnings per share for 2025 are projected to be in the range of $13.95 to $14.35, which is below Wall Street's expectation of $15.23.

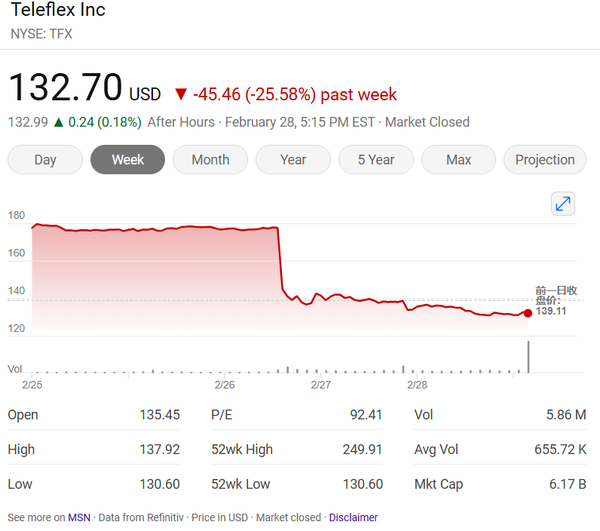

On February 27, due to the impact of earnings below expectations, weak performance guidance, and a spin-off plan, Teleflex's stock price plummeted by 21.3% in a single day, closing at $139.78. On February 28, the stock price continued to fall by 4.57%, closing at $132.75, with a total market value of approximately $6.17 billion.

The stock price has fallen 25% in the past week, as the market is concerned about the short-term costs of the spin-off, such as restructuring expenses and management changes, as well as doubts about long-term synergies. In addition, the complexity of the spin-off and acquisitions also makes some investors uneasy.

Despite market skepticism, the company remains confident in its long-term growth after the spin-off. Looking back, there are indeed positive cases. For example, after Agilent spun off Keysight in 2014, both companies achieved an increase in market capitalization, and the spin-off could become a catalyst for value release.

In the long run, the spin-off can be seen as a positive adjustment, through which the company splits into two firms focused on different businesses, potentially enhancing operational efficiency. The market needs to observe the first financial report after the spin-off, paying close attention to the gross margin of RemainCo and the order growth rate of NewCo.

Teleflex's spin-off plan, to some extent, reflects the classic dilemma of "the elephant dancing." It must maintain economies of scale while also responding to competition in niche markets. In the future, the success or failure of this spin-off strategy will depend on finding the right balance between "slimming down" and "strengthening." When scale is no longer a moat, only by focusing on core competencies and embracing market changes can one carve out a path in the niche market.

On February 27, due to the impact of multiple factors such as earnings below expectations, weak performance guidance, and the spin-off plan, Teleflex's stock price plummeted by 21.3% in a single day, closing at $139.78. On February 28, the stock price continued to fall by 4.57%, closing at $132.75, with a total market value of about $6.17 billion.

The stock price has plummeted 25% in the past week, with the market questioning the short-term costs of the spin-off, such as restructuring expenses and management changes, as well as long-term synergies. In addition, the complexity of the spin-off and acquisitions has also made some investors uneasy.

Despite the market's doubts, the company is confident in its long-term growth after the spin-off. Looking back, there are indeed positive cases. For example, after Agilent spun off Keysight in 2014, both companies' market values increased, and the spin-off may serve as a catalyst for value release.

In the long run, the spin-off can be seen as a positive adjustment, with the potential to improve operational efficiency by splitting into two companies focused on different businesses. The market needs to observe the first financial report after the spin-off, focusing on the gross margin of RemainCo and the order growth rate of NewCo.

Teleflex's spin-off plan, to some extent, reflects the classic dilemma of "dancing elephants." It must maintain economies of scale while also dealing with competition in niche markets. The success or failure of this spin-off strategy in the future depends on finding a precise balance between "slimming down" and "strengthening up." When scale is no longer a moat, only by focusing on core capabilities and embracing market changes can one carve out a path in niche markets.

On February 27, due to the impact of multiple factors such as earnings below expectations, weak performance guidance, and the spin-off plan, Teleflex's stock price plummeted by 21.3% in a single day, closing at $139.78. On February 28, the stock price continued to fall by 4.57%, closing at $132.75, with a total market value of about $6.17 billion.

The stock price has plummeted 25% in the past week, with the market questioning the short-term costs of the spin-off, such as restructuring expenses and management changes, as well as long-term synergies. In addition, the complexity of the spin-off and acquisitions has also made some investors uneasy.

Despite market skepticism, the company is confident in its long-term growth post-split. Looking back, there are positive examples. For instance, after Agilent spun off Keysight in 2014, both companies saw an increase in their market values, indicating that a split could act as a catalyst for value release.

Despite market skepticism, the company is confident in its long-term growth post-split. Looking back, there are positive examples. For instance, after Agilent spun off Keysight in 2014, both companies saw an increase in their market values, indicating that a split could act as a catalyst for value release.

In the long term, the split can be viewed as a positive adjustment, with the potential to improve operational efficiency by dividing into two companies focused on different businesses. The market will need to watch the first financial report after the split, paying close attention to the gross margin of RemainCo and the order growth rate of NewCo.

In the long term, the split can be viewed as a positive adjustment, with the potential to improve operational efficiency by dividing into two companies focused on different businesses. The market will need to watch the first financial report after the split, paying close attention to the gross margin of RemainCo and the order growth rate of NewCo.

Teleflex's spin-off plan, to some extent, embodies the classic dilemma of "dancing elephants." It needs to maintain economies of scale while also addressing competition in niche markets. In the future, the success or failure of this spin-off strategy will depend on finding a precise balance between "slimming down" and "strengthening up." When scale is no longer a moat, only by focusing on core capabilities and embracing market changes can one carve out a path in niche markets.

Teleflex's spin-off plan, to some extent, embodies the classic dilemma of "dancing elephants." It needs to maintain economies of scale while also addressing competition in niche markets. In the future, the success or failure of this spin-off strategy will depend on finding a precise balance between "slimming down" and "strengthening up." When scale is no longer a moat, only by focusing on core capabilities and embracing market changes can one carve out a path in niche markets.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track