Tax Rebate Exit, EVA Takes the Lead: A Photovoltaic Shift Hidden in Film

In early 2026, the Ministry of Finance and the State Taxation Administration issued an announcement stating that starting from April 1, the export tax rebate for photovoltaic modules would be completely canceled. As soon as the news broke, the entire photovoltaic industry chain was shaken—especially the upstream materials that are often overlooked by the public, such as EVA encapsulant.

Many people may not know.EVA (ethylene-vinyl acetate copolymer) is a key material for photovoltaic module encapsulation, directly affecting the lifespan and power generation efficiency of the modules. Interestingly, the domestic EVA market has recently seen a "wait-and-see" situation with many agents worried that concentrated export demand after April will lead to tight supplies, prompting them to halt spot sales and prioritize the delivery of earlier orders. The market is experiencing scattered and chaotic price quotes, with prices soaring, but actual transactions are few. As one trader put it: "It's not that we don't want to sell now, but we're afraid that if we sell out, we won't have any left, and the prices will be even higher later."

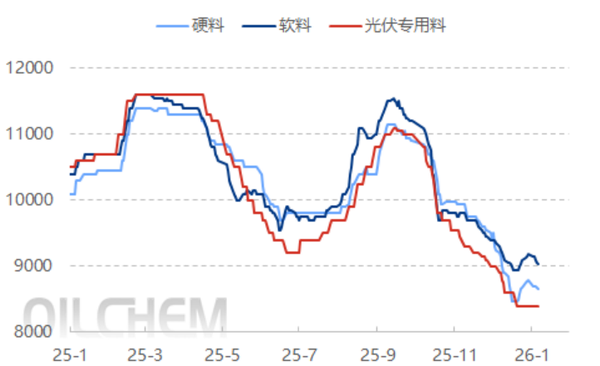

EVA Price Chart

So the question arises: how does the adjustment of export tax rebates affect...EVA?

First, the policy providesA 3-month transition period means that all component manufacturers wishing to continue enjoying tax refunds must complete export customs clearance by March 31. Consequently, a "race to export" has rapidly ignited. In order to deliver before the deadline, component manufacturers are placing frantic orders and stocking up in advance, leading to a sudden spike in demand for EVA film. This short-term concentrated demand has directly driven up the price of EVA, making those traders who have inventory highly sought after.

The deeper impact lies in the shift in industry logic. In recent years, China's photovoltaic modules have been able to sweep the global market at low prices largely due to the export tax rebate."Implicit subsidies." With subsidies now withdrawn, costs can no longer be absorbed by policy and must be passed on to overseas customers. The result is that components can no longer compete solely on low prices and must rely on performance. The penetration of high-efficiency battery technologies such as TOPCon and HJT is rapidly increasing, and they have higher requirements for encapsulation materials—ordinary EVA is insufficient; it must be photovoltaic-grade EVA with high transparency, aging resistance, and strong adhesion. As a result, high-quality EVA has shifted from being an "optional" choice to a "necessary" one, fundamentally changing the demand structure.

For EVA traders, this is also a major reshuffle. The days of making money by exploiting information gaps and buying low to sell high are over. Now, it's a competition based on who has stable supply sources, who has inventory allocation capabilities, and who can collaborate with component manufacturers to win the "race against time." Smaller players without supply chain strength are likely to be eliminated in this round of policy adjustments.

Ultimately, the cancellation of export tax rebates appears to be a challenge for the solar industry."Reducing interest rates" is actually forcing the entire industry chain to "increase capacity." For the EVA market, the short term is characterized by a spike in exports, the medium term sees a structural strengthening of high-quality products, and the long term will be a true competition of resources and efficiency. This change, ignited by policy, may be a key step for China's photovoltaic industry to move from "quantity" to "quality."

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories