Tax Cuts! Starting January 1st, Imported Plastic Raw Materials and High-End Equipment Will Be Cheaper

This adjustment aims to enhance the synergetic effects of domestic and international markets and resources, expand the supply of quality goods, and promote industrial upgrading and green development through precise tax leverage.

The plan clearly states that one of the adjustment directions is to "promote high-level technological self-reliance and strengthen the construction of a modern industrial system", which includes reducing import tariffs on key products such as advanced materials and packaging machinery.

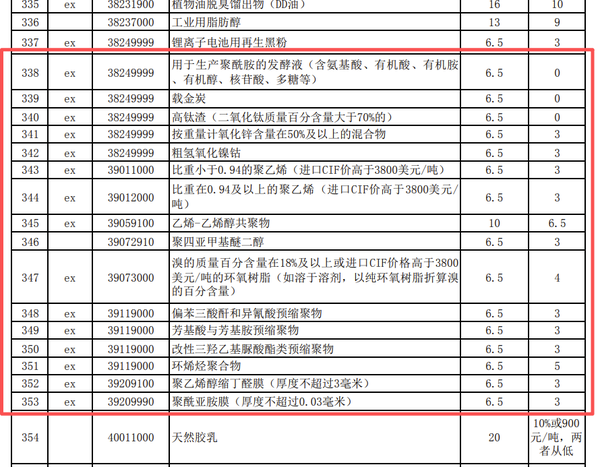

The tax rates for various plastics and their related raw materials have been selectively reduced.

Under this policy direction, the tax rates on multiple plastics and related raw materials have been specifically lowered to reduce the costs for downstream manufacturing and enhance the competitiveness of the industrial chain.

Case 1: Bulk Basic Raw MaterialsPolyethyleneTariff number==:39011000)

- Item of MerchandisePolyethylene with a specific gravity of less than 0.94 (tariff number ex 39011000, imported CIF price higher than 3800 USD/ton).

- Tax rate changesImport provisional tax rate from6.5%Drop to3%。

- Policy considerationsPolyethylene is one of the most widely produced and used general-purpose plastics, relevant to packaging, agriculture, construction, and numerous industrial fields. This significant tax reduction on high-end grades of polyethylene that meet specific price standards directly lowers the import costs of raw materials for relevant processing and manufacturing enterprises.Enhance the quality of supply and price competitiveness in the domestic market.The above content translates to: "This aligns with the goal of 'enhancing the intrinsic momentum of the domestic circulation' in the 'Plan,' by reducing the cost of key basic materials to support the stability and development of downstream manufacturing industries."

Case 2: High Value-Added Specialty MaterialsEthylene-Vinyl alcohol copolymerTariff Code:39059100)

- Product ItemEthylene-vinyl alcohol copolymer (HS code ex 39059100).

- Tax Rate ChangesTemporary import tariff rates from10%Lower to6.5%。

- Policy ConsiderationsEthylene-vinyl alcohol copolymer is a polymer material with excellent gas barrier properties, widely used in high-performance packaging (such as food and pharmaceuticals), automotive fuel tanks, and other fields, classified as an "advanced material" emphasized in the "scheme." The tax rate will be reduced from 10% to 6.5%.Significant declineThis clearly reflects the policy's encouragement of the import of high-tech and high value-added materials. This helps domestic industries such as food preservation, new energy, and high-end manufacturing to more economically acquire key functional materials.Promote technological advancement and product upgrading in related industries."Promoting high-level technological self-reliance and self-improvement, and facilitating the construction of a modern industrial system" is a specific implementation in the field of materials.

Case 3: Cycloolefin PolymersTariff Classification 39119000)

- Tax rate changeImport provisional tax rate from6.5%Lower to5%。

- Policy Background and ImpactCycloolefin polymers (such as cycloolefin copolymer COC/COP) are high-performance transparent optical materials that possess high light transmittance, low birefringence, low water absorption, and excellent biocompatibility.Mainly applied in high-end pharmaceutical packaging (such as pre-filled syringes), optical lenses, and semiconductor wafer carriers.The recent tax rate reduction directly responds to the urgent demand for key basic materials in advanced manufacturing industries such as biomedicine and electronic information. Lowering import costs will help to...Enhance the stability and competitiveness of the relevant industrial chain in our country.This is the specific implementation of the goal "promoting high-level technological self-reliance and self-strengthening, and facilitating the construction of a modern industrial system" in the field of advanced materials as outlined in the "Plan".

Case 4: Polyimide film, thickness not exceeding 0.03millimeterTax code list 39209990)

- Tax Rate ChangeThe temporary import tariff rate from6.5%Reduced to3%。

- Policy Background and ImpactPolyimide film (PI film) is known as the "golden film," especially in ultra-thin specifications (≤0.03mm).Flexible displays, flexible printed circuit boards, new energy batteries, and aerospace are indispensable core materials in strategic emerging industries.The tax rate will be significantly reduced from 6.5% to 3%.Drop exceeding50%The policy support signals are extremely clear. This move will significantly reduce the manufacturing costs of downstream industries such as OLED panels and high-end electronic components.Encourage the introduction and adoption of advanced materials to accelerate the research and development and industrialization process of related products.A strong support for "building a modern industrial system" and "comprehensive green transformation of economic and social development."

II. Reduction of Packaging Machinery Tax Rate

Packaging machinery is also involved.Such as:

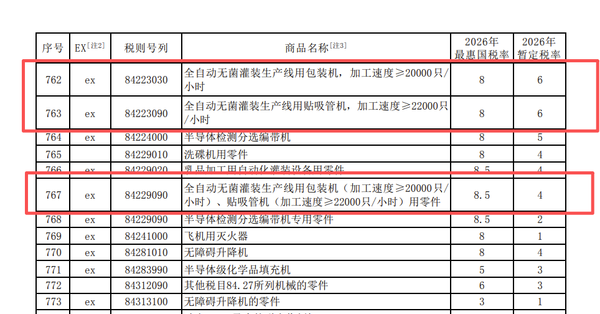

Case 1: Fully Automatic Aseptic Filling Production Line Packaging Machine

Product ItemPackaging machine for fully automatic aseptic filling production line, processing speed ≥ 20,000 units/hour (tariff code ex 84223030).

- Tax rate changesThe provisional import tariff will be set at the most-favored-nation rate.8%Lower to6%。

- Policy Background and ImpactThis type of high-speed aseptic filling and packaging machine is the core equipment in the production of liquid foods (such as juices and dairy products), directly affecting product safety, freshness, and production efficiency.Lowering import costs helps domestic food and beverage companies introduce advanced international production lines at a more economical price, enhancing overall production automation levels and product quality to meet the increasingly upgraded consumer demands.This directly echoes the goal in the "Plan" to "promote high-level scientific and technological self-reliance and strength, and facilitate the construction of a modern industrial system."

Case 2: Automatic Straw Attaching Machine for Aseptic Filling Production Line

- Product ItemFully automatic sterile filling production line with straw attaching machine, processing speed ≥ 22,000 pieces/hour (Tariff code ex 84223090).

- Tax rate changesThe provisional import tariff rate from the most-favored-nation rate.8%Drop to6%。

- Policy Background and ImpactThe high-speed straw attaching machine is a key piece of equipment in the post-packaging process for Tetra Pak and other beverage packages. Its efficiency and compatibility with the entire line are crucial. Synchronizing the tax rate reduction for it.It reflects the policy's consideration of the completeness of the industrial chain, ensuring the overall efficiency improvement from filling to downstream packaging.Support the food and beverage industry in achieving efficient and intelligent continuous production, which is also a specific measure for building a modern industrial system in the consumer goods manufacturing sector.

Case Three: Specialized PartsSerial Number 767)

- Product ItemThe above-mentioned packaging machine and straw labeling machine's special parts (tariff number ex 84229090).

- Tax rate changesProvisional import tariff rate from the most-favored-nation tariff rate8.5%Lower to4%。

- Policy Background and Impact:The tax rate reduction for specialized parts (exceeding)50%The policy intention is particularly evident, far exceeding the whole machine.Lowering import tariffs on key components can significantly reduce the maintenance costs and lifecycle usage costs of production equipment.To ensure the stable operation of the newly introduced advanced production lines and enhance the resilience and sustainability of the domestic related manufacturing supply chain.This move accurately implements the requirement in the "Plan" to "enhance the internal driving force of domestic circulation" by reducing costs in key areas, thereby providing support for the stable development of the real economy.

3. Conclusion

Overall, the tariff adjustments in 2026 are not a simple across-the-board reduction, but rather precise adjustments centered around national development strategies. From polyethylene to ethylene-vinyl alcohol copolymers, from cyclic olefin polymers to polyimides, and then to packaging machinery.,The reduction in tax rates clearly conveys a dual signal: on one hand, it ensures the stable supply and cost-effectiveness of bulk raw materials, strengthening the foundation of the manufacturing industry; on the other hand, it vigorously supports the import of advanced materials and high-end machinery with high technological content and added value, injecting momentum into industrial upgrading.

Editor: Lily

Source: Ministry of Finance of the People's Republic of China

The image in the text is sourced from the Ministry of Finance of the People's Republic of China.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories