Supply increment release, polypropylene market enters wide fluctuation pattern

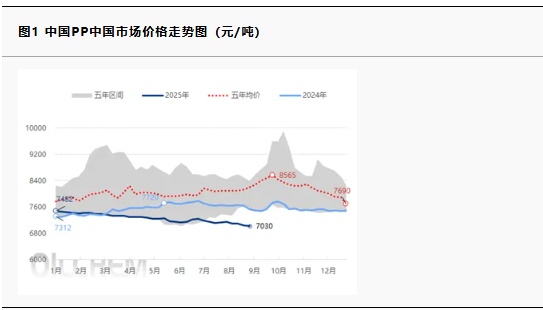

This week, the polypropylene market experienced wide fluctuations, with the operating range between 6,960-7,100 yuan/ton. The global central bank meeting released expectations of a rate cut in September, leading to a significant rise in overseas stock markets. The start of the rate cut cycle brought favorable conditions to the commodities market, with PP prices continuously rising. From a fundamental perspective, the domestic supply remains ample, while the characteristics of the peak season in the downstream gradually become evident. In the first half of the week, market offers cautiously followed the trend. On Wednesday, geopolitical tensions eased, leading to a decline in crude oil premiums, weakening cost factors, and cooling speculative sentiment, causing the market to turn weaker. Some market offers followed the downward trend. The strong macro expectations continue to contend with the weak industrial reality. In the short term, the cost side is expected to fluctuate repeatedly, and the downside space for PP is limited, maintaining a strategy of buying on dips.

Recent focal points in the polypropylene market:

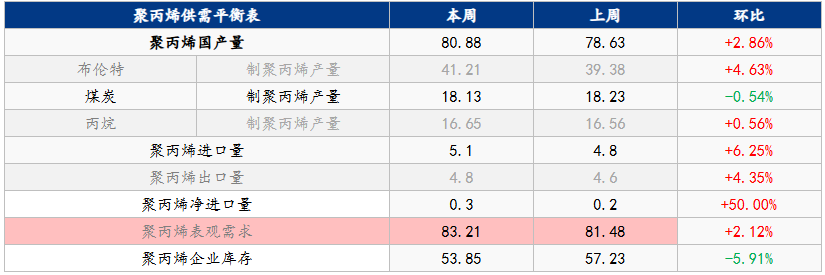

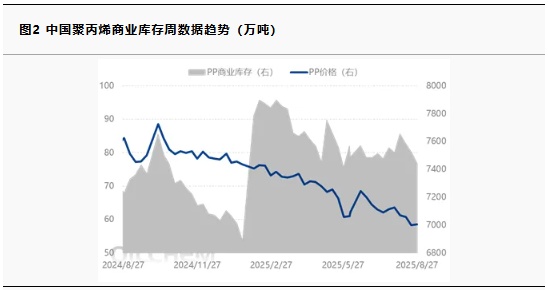

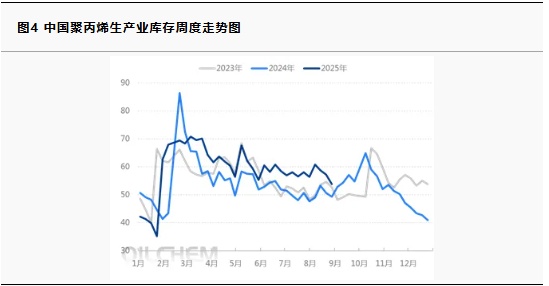

As of August 27, 2025, China's total commercial inventory of polypropylene stood at 767,000 tons, a decrease of 33,600 tons from the previous period, representing a month-on-month decline of 4.20%. As the end of the month approaches, most intermediaries have completed their order plans, leading to a downward transfer of upstream inventory, resulting in a slight reduction in production enterprises' inventories during the week. Supply-side pressure is rising, and the upstream petrochemical sector has increased its efforts to reduce inventories, causing a smaller reduction in traders' inventories. The return of maintenance facilities in Southeast Asia and South Asia has increased the supply pressure, leading to an increased allocation of low-priced resources in China. Some imported resources have arrived at ports, causing a buildup of port inventories. Overall, the total commercial inventory for the week has decreased.

This week's domestic polypropylene production is 786,300 tons, an increase of 3,200 tons from last week's 783,100 tons, a rise of 0.41%. Compared to the same period last year, which was 667,900 tons, it has increased by 118,400 tons, a rise of 17.73%. During the week, the commissioning plan for Daxie Petrochemical's new facility was delayed, but the data on production losses due to maintenance at manufacturing enterprises continued a high-level narrow decline trend, and the polypropylene production data maintained a slight upward trend.

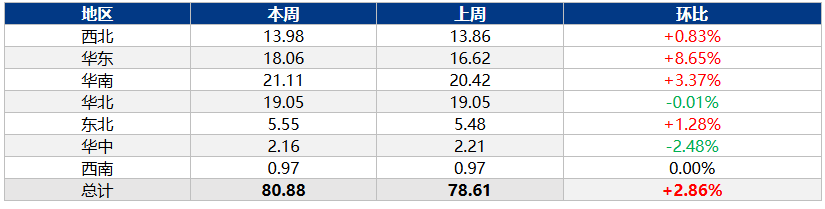

This week, domestic polypropylene production reached 808,800 tons, an increase of 22,500 tons compared to last week's 786,300 tons, representing a growth of 2.86%. Compared to the same period last year, which was 692,300 tons, there was an increase of 116,500 tons, marking a growth of 16.83%. During the week, previously shut-down facilities at Quanzhou Guoheng, Jingbo Polyolefins, Yanchang China Coal, Zhongyuan Petrochemical, and Hengli Petrochemical resumed operations. Additionally, the second phase, second line 450,000 tons/year new facility at Daxie Petrochemical commenced production, leading to a significant increase in polypropylene supply. The weekly production data surpassed the 800,000-ton mark for the first time, setting a new historical high.

New production capacity continues to be realized, and the market is trapped in a pattern of wide fluctuations.

This week, the polypropylene market experienced wide fluctuations, with the operating range between 6,960-7,100 RMB/ton.Global central bank meetings have set expectations for a rate cut in September, leading to a significant rise in overseas stock markets. The start of a rate cut cycle brings positive news to the commodity market, with the PP (polypropylene) market continuously rising. From a fundamental perspective, the domestic supply remains ample, and the peak season characteristics in the downstream sector are gradually emerging. In the first half of the week, market quotations cautiously followed the market trend. On Wednesday, the easing of geopolitical tensions led to a retraction of the oil premium, weakening cost factors and cooling speculative sentiment, causing the market to weaken. Some market quotations followed the decline. There is an ongoing tug-of-war between strong macro expectations and weak industry realities. In the short term, cost factors are expected to fluctuate repeatedly, leaving little room for PP to fall. The strategy is to maintain a buy-on-dip approach.

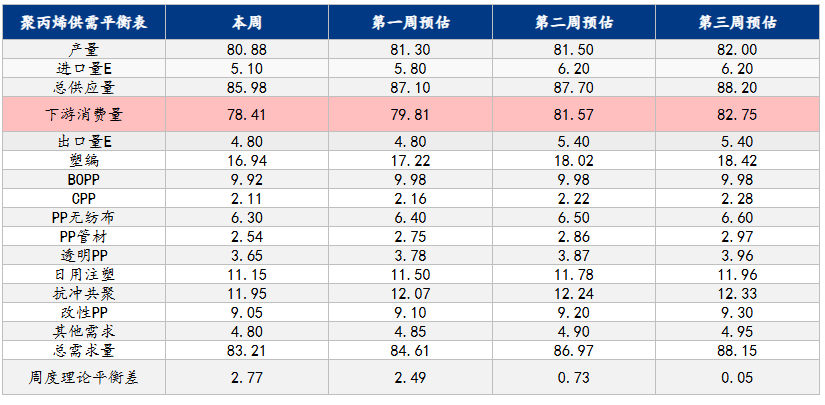

Table 1 Domestic Polypropylene Weekly Supply and Demand Balance Sheet

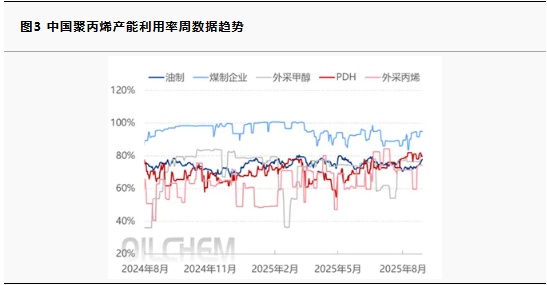

2. Gradual Restoration of Equipment Maintenance and Operating Capacity Utilization RateNarrow upward movement

Prediction: The average polypropylene capacity utilization rate for this period is 80.00%, an increase of 1.78% month-on-month; Sinopec's capacity utilization rate is 83.45%, a decrease of 0.39% month-on-month. Although no Sinopec units were shut down during the week, reduced load operations at units such as Sino-Korean Petrochemical and Maoming Petrochemical led to a slight decline in Sinopec's capacity utilization rate. The restart of the 400,000 tons/year second line at Jingbo Polyolefin and the 300,000 tons/year second line at Yanchang Zhongmei contributed to the increase in the average polypropylene capacity utilization rate.

1By the end of the month, the billing plan is completed, and commercial inventory has slightly decreased.

As of August 27, 2025, China's total commercial polypropylene inventory stands at 767,000 tons, a decrease of 33,600 tons from the previous period, representing a month-on-month decline of 4.20%. As the end of the month approaches, most intermediaries have completed their order plans, resulting in an upstream inventory transfer downstream, leading to a slight decrease in production enterprise inventories during the week. The pressure on the supply side is increasing, and the intensity of upstream petrochemical destocking has risen, reducing the destocking range for traders. With the return of maintenance units in Southeast and South Asia, the supply pressure has increased, leading to a higher allocation of low-cost Chinese resources. Some imported resources have arrived at ports, resulting in an accumulation of port inventories. Overall, the total commercial inventory has declined this week.

2、Partial equipment restart. Polypropylene capacity utilization rate rises

The average polypropylene capacity utilization rate for this period is 80.00%, an increase of 1.78% compared to the previous period. Sinopec's capacity utilization rate is 83.45%, a decrease of 0.39% compared to the previous period. Although there were no shutdowns of Sinopec facilities during the week, the reduced operations of facilities such as Sino-Korean Petrochemical and Maoming Petrochemical caused a slight decline in Sinopec's capacity utilization rate. The restart of the second line of Jingbo Polyolefin with an annual capacity of 400,000 tons and the second line of Yanchang Zhongmei with an annual capacity of 300,000 tons contributed to the increase in the average polypropylene capacity utilization rate.

Table 2: Weekly Production of Polypropylene in Various Regions of the Country

3Upstream inventory shifts downstream, and the inventory of manufacturing enterprises narrows slightly.

As of August 27, 2025, the inventory of polypropylene production enterprises in China stands at 538,500 tons, a decrease of 33,800 tons from the previous period, representing a month-on-month decline of 5.91%. As the end of the month approaches, most intermediaries have completed their order plans, leading to the downward transfer of upstream inventory, resulting in a slight decrease in the production enterprises' inventory during the week.

3. As the peak demand season arrives, the operating rates of downstream industries are steadily increasing.

:In this period, the average operating rate of downstream industries for polypropylene mostly showed an upward trend, with only BOPP experiencing a slight decline. In the BOPP film sector, the traditional peak season demand was below expectations, and both downstream and traders showed general interest in replenishing stocks. The market had a strong wait-and-see atmosphere, and orders declined month-on-month, leading to a downward trend in industry operations. In the packaging and food sectors, peak season stocking has gradually started, and with previously halted enterprises resuming operations, the CPP industry's operating rate is on the rise. In the PP pipe industry, with temperatures dropping, construction and infrastructure projects have slightly increased their operations, but due to the broader environment, operations remain low. Additionally, the arrival of the third batch of national subsidy funds, along with the traditional peak demand season, has led to a slight increase in demand for automobiles and home appliances, providing small support for the operating rate of the modified PP industry. In the plastic weaving sector, demand for fertilizer bags, cement bags, and other products has slightly improved, leading to an increase in the industry's operating rate. As the peak demand season of September and October arrives, most orders in the polypropylene product industry are showing an upward trend, but overall demand is below expectations. It is expected that next week the industry's operating rate may show a slight upward trend.

The follow-up on terminal orders is limited, and market trading remains stable.

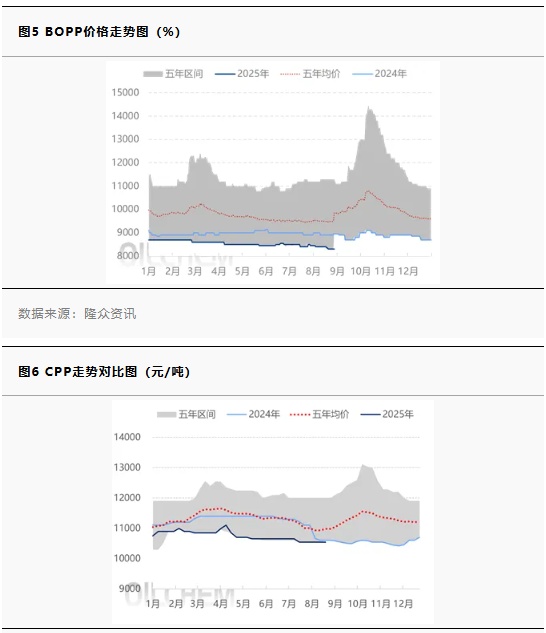

This week, BOPP prices have been relatively stable with adjustments. As of August 28, the mainstream ex-factory price for thick light film in East China is between 8,300-8,500 yuan/ton, remaining flat compared to the previous period. After a drop, crude oil prices have risen, PP futures have declined, and the spot market is on a downward trend. Some petrochemical ex-factory prices have been slightly adjusted as well, leading to weakened cost support. Film manufacturers are mostly maintaining stable ex-factory prices. While mainstream market prices remain stable, actual transactions often involve discounts to promote orders. Downstream overall inquiry interest is not high, with new transactions mainly consisting of small orders, and there is no significant improvement in restocking. Within the week, some film companies in East and North China have seen a slight decrease in industry operations due to equipment changes, but market supply remains stable, and film companies are delivering orders quickly. In North and Southwest China, there might be a short-term release of new production capacity, which is expected to increase market supply pressure further. Meanwhile, some anticipated production facilities have entered the assembly stage. In the short term, film prices may remain stable with adjustments.

The price of low-temperature composite film in East China remained stable this period, with the market sentiment still cautious. The futures market experienced weak fluctuations, and the raw material market saw slight fluctuations in quotations. At the end of the month, many merchants followed the market trend to sell goods, with insufficient market drivers providing limited support for CPP. According to research, as the traditional peak season of September approaches, some enterprises have entered the Mid-Autumn Festival stocking stage in advance, releasing demand in core areas such as terminal food and packaging. However, the current economic environment is not favorable, and consumers' purchasing power for food and daily necessities has declined. Overall, the demand recovery is moderate, and the number of order days has decreased year-on-year. As of August 28, the mainstream price of ordinary composite film in East China was 9,550 yuan/ton, down 100 yuan/ton from last week.

4. Insufficient follow-up on demand recovery: Polypropylene profits fluctuate.

This week, coal-based and methanol-based PP profits have recovered, while oil-based, outsourced propylene-based, and PDH-based PP profits have declined. On the cost side, in the international crude oil market, the unstable Russia-Ukraine situation presents potential supply risks. The decline in U.S. commercial crude oil inventories exceeded expectations, and the benefits of the traditional fuel consumption peak season continued. This week, the average international oil price slightly increased, and oil-based PP profits declined to -327.71 yuan per ton. In the thermal coal market, end-users are currently maintaining a wait-and-see approach with overall demand insufficient to keep pace. Coupled with the gradual decline in the producing areas market, bearish sentiment in the market has increased, leading to a slight decrease in thermal coal prices. Coal-based PP profits rose to 519.73 yuan per ton.

In terms of China's polypropylene category profits for this period, the weekly average profit for yarn-grade PP is -327.71 yuan/ton, a decrease of 60.73% compared to the previous period's -123.82 yuan/ton. The weekly average profit for impact copolymer PP is -133.96 yuan/ton, a decrease of 233.90% compared to the previous period. The weekly average profit for transparent PP is 171 yuan/ton, a decrease of 40.83% compared to the previous period. Analyzing the category-specific profits, due to the continued sanctions by the United States on certain oil-producing countries, the average price of international oil has slightly increased. As a result, the profits of oil-based PP in different categories have generally declined this period. Currently, the market has an ample supply of yarn-grade and copolymer resources, making it difficult for transaction prices to rise, leading to a significant drop in profits for oil-based yarn-grade and impact copolymer PP. The price of transparent PP remains relatively firm, resulting in a comparatively limited profit decline of 40.83%.

The pattern of increased supply and weak demand is difficult to break, and polypropylene is under short-term pressure.

Table 3 Domestic Polypropylene Supply and Demand Balance Expectations

Supply: Pressure on the supply side is rising as maintenance devices restart.

During the week, the previously shut down facilities at Guoheng in Quanzhou, Jingbo, Ju Polyolefin, Yanchang Zhongmei, Zhongyuan Petrochemical, and Hengli Petrochemical resumed operations, along with the commissioning of a new 450,000-ton/year facility (second line of the second phase) at Daxie Petrochemical. This led to a significant increase in polypropylene supply. Weekly production figures surpassed the 800,000-ton mark for the first time, setting a new historical high. This week, domestic polypropylene production reached 808,800 tons, an increase of 22,500 tons or 2.86% compared to last week's 786,300 tons, and an increase of 116,500 tons or 16.83% compared to the 692,300 tons for the same period last year.

Demand: Demand recovery is weaker than supply growth, and the supply-demand imbalance still exists.

In terms of downstream consumption, although export demand has slightly increased and most areas such as downstream CPP, daily injection molding, transparent, and modified PP have seen slight growth, the recovery in demand is weaker than the growth rate of supply, and the supply-demand contradiction remains prominent.

Cost: There is room for flexibility on the cost side.

There is an expectation of relaxation in costs continuing, OPEC+ maintains production increase operations, and there is an expectation of relaxation in international oil prices. Propane downstream demand follows slowly, with weak support from the cost side.

Conclusion (Short-term)The next period is expected to see polypropylene primarily experiencing bearish fluctuations, as supply increments are anticipated to far exceed the pace of demand recovery. Key points of focus: 1. The supply side increment is becoming apparent, with the expansion of CNOOC Daxie Petrochemical's second-phase 450,000 tons/year facility expected in mid-September, and reduced maintenance losses, leading to a gradual increase in supply. 2. Demand is slowly picking up. Mainstream downstream orders are recovering slowly, with some local downstream orders slightly increasing, which is insufficient to support a substantial market reversal. 3. The expectation of cost loosening continues, with OPEC+ maintaining production increase operations and international oil prices showing signs of loosening; the downstream demand for propane is slow to follow up, resulting in weak cost-side support.

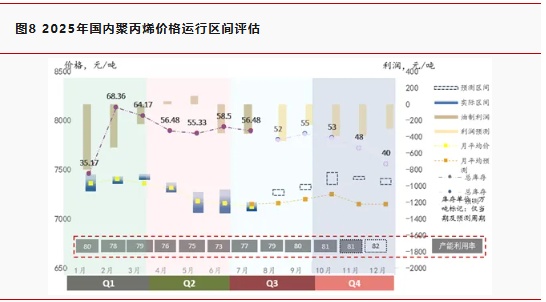

Conclusion (Medium to Long Term):On the macro side, the policies from the Central Political Bureau's work meeting to stabilize the economy and the expectation of RMB depreciation benefiting exports will be key drivers guiding the market. In the critical period of supply and demand variables, intensive maintenance and new capacity expansion are in a balancing act, with demand alternating between peak and off-peak periods, presenting opportunities for weak improvement in demand variables. However, due to global trade barriers and tariff impacts, the demand side valuation is weaker than the same period last year. The cost side has limited support, with the expectation of OPEC+ production increase plans affecting international oil prices, leading to anticipated easing on the oil-based cost side. The fundamental supply and demand situation of the polypropylene industry is difficult to reverse, and external policy becomes an important breakthrough point for breaking the market deadlock. Under external and internal challenges, it is expected that the market will continue its stalemate tug-of-war, with intermittent opportunities for policy-driven price increases. The raffia grade will be tested at 7000-7250 RMB/ton. Key factors to focus on include changes in foreign trade export orders, cost side changes, and the release of new capacity.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track