Supply delay vs. slow demand: Can the PP market break through the awkward situation?

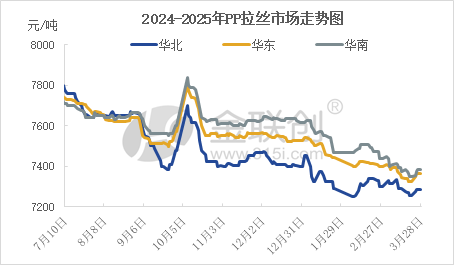

Recently, PP futures have stopped falling and turned positive, which has somewhat boosted market sentiment, leading traders to tentatively raise their prices slightly. On the supply side, the ramp-up of new production facilities has slowed down, and there are concentrated maintenance schedules for PP production units, primarily large petrochemical plants with longer maintenance periods, which alleviates supply pressure for the time being. On the demand side, although downstream operating rates are steadily increasing, the rising raw material prices have suppressed the purchasing enthusiasm of downstream factories, leading to transactions mainly at lower prices and limited demand support. As of today, the average weekly price for wire drawing in East China is 7365 yuan/ton, an increase of 40 yuan/ton compared to last Friday, reflecting a rise of 0.55%.

Supply: The operating rate of domestic polypropylene plants has slightly increased, currently at 78.03%, up 0.11 percentage points from last Thursday and up 3.09 percentage points year-on-year. The supply of new installations is slowing down; additionally, multiple polypropylene plants such as Pujie Energy Chemical, Zhongjing Petrochemical, and Beihai Refining are still undergoing shutdowns, which has eased the supply pressure temporarily.

Demand: Recently, downstream polypropylene product enterprises have been experiencing poor profit margins, with an overall operating rate between 46.00% and 56.51%. In terms of plastic weaving, the orders from the agriculture and construction industries provide good support for plastic weaving manufacturers, and the operating enthusiasm of enterprises is relatively decent. For plastic films, the market trading atmosphere is average, and there is still supply pressure in the industry. Most downstream factories mainly consume their previous raw material inventory, maintaining a selective low-demand replenishment.

Supply pause VS slow demand recovery, how will the future trend of the PP market develop? Can it alleviate the awkward situation and continue the upward trend? Next, let's analyze the fundamental situation one by one: First, the international crude oil prices are expected to fluctuate within a range next week, with general cost support. As the end of the month approaches, with the progress of the two oil assessments, it is expected that after the inventory depletion, there will be a slight increase. On the supply side, although some production lines at Donghua Energy Ningbo and Zhongjing are still shut down, the number of new maintenance facilities is relatively low, and facilities like Zhejiang Petrochemical are planned to restart, so a short-term supply increase is expected. However, from a regional perspective, in April, the Dalian Hengli 200,000-ton unit, Daqing Refining and Chemical 300,000-ton new unit, and Liaoyang Petrochemical 300,000-ton unit in Northeast China all have maintenance plans, with the longest maintenance duration being about one month. It is recommended that businesses closely monitor the market for thin-walled and some copolymer, pipe prices. On the demand side, the overall demand from downstream manufacturers has been generally weak recently, with poor orders for daily necessities and weak transactions in homopolymer injection. Although there has been a slight improvement in woven bag orders, the increase in demand is not significant. At the same time, in April, companies may enter a concentrated maintenance season, which still provides effective support for the market, and the supply-demand conflict is not significant in the short term.

Overall, although there are not significant contradictions in the fundamentals, there is still no strong and effective positive support in the market. Macroeconomic news is sparse, and market participants are cautious. It is expected that the PP market will mainly experience fluctuations and consolidation in the short term, with little upward momentum.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track