Subsidy Fully Withdrawn, National Day Car Market Panics?

Under the guidance of policies and after years of ups and downs, the new energy vehicle industry has ultimately become the greatest driving force for Chinese automobiles to move from the margins to the center stage. As we enter 2025, regardless of whether the price war sweeping through the entire automotive market has put immense pressure on every company involved, the trend indicates that fully betting on the new energy market is always the right move.

In addition, with the policies supporting the trade-in of new energy vehicles, the entire Chinese auto market is bustling with activity amidst the massive wave of new energy development.

"As of September 10, the number of vehicle trade-in applications this year has reached 8.3 million. On September 13, at the 2025 China Automotive Industry Development (TEDA) International Forum, the Ministry of Commerce announced this achievement and stated that it would further implement the decisions and deployments from higher authorities, vigorously boost consumption, comprehensively expand domestic demand, and promote the high-quality development of the automotive industry."

It is foreseeable that due to this series of relief measures, the Chinese car market will likely continue to show another period of booming activity.

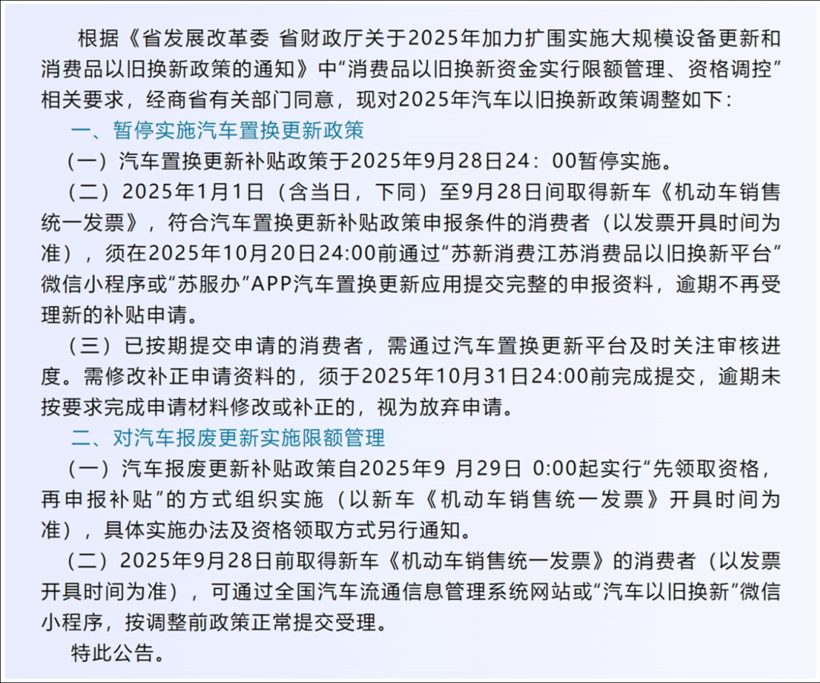

Interestingly, Jiangsu Province also recently issued a notice regarding the adjustment of the automobile trade-in policy for 2025, announcing that starting from September 28, 2025, at 24:00, the automobile replacement subsidy policy will be officially suspended across the province, and a quota management system will be implemented for vehicle scrapping and replacement.

The development of the car market seems to have encountered an uncertain direction once again. As the support from policies gradually withdraws, the Chinese automotive market begins to face the market's challenges independently. Can it still demonstrate an unstoppable growth in sales? Without policy incentives, can consumers maintain their enthusiasm for purchasing cars?

01The results are remarkable, but they will eventually come to an end.

Since the real estate bubble burst due to some unexpected events, everyone knows the significant role the automotive industry plays in the national economy. In the past, during the early stages of new energy development, the government promoted the industry's progress by subsidizing car companies. However, compared to this, when subsidies are directly given to consumers, the core objective has shifted from accelerating industrial advancement to promoting consumption.

In other words, as the new energy industry gradually becomes the cornerstone for the growth of China's automotive industry, car consumption naturally plays a crucial role.

In fact, driven by policies, in the first eight months of this year, China's automobile production and sales reached 21.051 million and 21.128 million units, respectively, with year-on-year growth rates of 12.7% and 12.6%. Among them, the cumulative production and sales of new energy vehicles reached 9.625 million and 9.62 million units, respectively, with year-on-year growth rates of 37.3% and 36.7%. New energy vehicle sales accounted for 45.5% of total new car sales.

Given such results, it cannot be said that the reason consumers choose to buy cars is 100% due to various subsidies, but it is clear that when buying a car becomes a non-essential matter, the sudden influx of subsidies must have played a crucial role.

Since the beginning of this year, we have all observed the sales situation in the automotive market. If we continue to follow the development model of the past when the car market was booming, it is not easy to stimulate the enthusiasm of potential users. Therefore, even without subsidies, the measures taken by car manufacturers are comprehensive.

For a whole year, we have been constantly talking about how certain car companies have released new cars that are so cheap and how their product capabilities are on a level that delivers a dimensionality reduction strike. Essentially, this is a variant of a price war.

When it comes to the increasingly intense price war in 2025, it seems on the surface to be a market contest initiated by a few car manufacturers. However, it now appears that the overall landscape of the consumer market has long been set.

Compared to the past, nowadays, for those who are considering buying a car, the primary criterion for choosing a vehicle is its low price. Regardless of the brand or category, cars on the market are simply divided into cheap and expensive. As this view continues to spread across the market, any new car launched now can only gain some exposure on social media platforms if its price is lower than similar products.

Given this situation, it's hard to say whether it aligns with the logic of evolution in the automotive industry. After all, with the current environment, it's impossible to return to the past era where car companies made easy profits and consumers bought cars without much thought.

But in the long run, can such a situation truly enable the positive circulation of the internal cycle of the Chinese automotive market?

Nowadays, just before the National Day holiday, car purchase subsidies, including those in developed coastal provinces, are continuously being tightened or even canceled, which indeed caught everyone off guard.

To put it bluntly, when the trade-in subsidy disappears, the cost of purchasing a car will directly increase for consumers. Previously, vehicles that met the policy requirements could enjoy a cash subsidy of up to 20,000 yuan, and with the suspension of this subsidy, this cost will need to be borne by consumers themselves, which will inevitably lead budget-sensitive consumers to postpone their car-buying plans. Given the current consumption environment, I believe that most people will be budget-sensitive.

The future of the Chinese car market remains uncertain, and no one can provide a definitive answer to this question. However, it is clear that no industry in history has grown strong by relying on external forces to stimulate consumer sentiment. Although car subsidies are beneficial, in the end, it is up to the car companies themselves to win over users.

02Policy exit, the auto market.

In fact, even before Jiangsu, many regions such as Hubei, Hunan, Anhui, and Guangzhou had successively suspended applications for automobile replacement subsidies. In some areas, the "unconditional application" was changed to a "coupon grabbing mode," and strict restrictions were placed on the registration locations for new cars. In fact, some places had already terminated their originally planned subsidy activities, which were supposed to last until the end of the year, as early as the second quarter due to rapid consumption of funds.

The threshold for car purchase subsidies has significantly increased, and the uncertainty of future policies has clearly been rising, indicating that the window for consumers to purchase cars with discounts is continuously narrowing. However, when Jiangsu made the same decisive move, one thing became even clearer: the withdrawal of policies will not only have an immediate impact on the market but also an unprecedented depth of influence.

Due to policy adjustments, car dealers will face more difficulties; with sales hindered, car manufacturers will be hesitant in advancing their subsequent products; suppliers bound to car manufacturers will find it increasingly uneasy under the premise of tight funds for the manufacturers.

Nowadays, this situation can make everyone in the industry on edge. If the policies for tax exemptions on new energy vehicle purchases are tightened in the future, to be honest, it’s hard to imagine how those companies that have long relied on external support will manage to get by.

Of course, just as the market landscape changed after the cancellation of national-level policies such as the "automobile going to the countryside" initiative and the halving of purchase taxes, the reduction or adjustment of subsidy policies is ultimately a crucial step in prompting the automotive industry to transition from being "policy-driven" to "market-driven" and "experience-driven."

If viewed positively, this move serves as a new starting point for compelling car manufacturers to build core competitiveness. After saying goodbye to subsidies, car manufacturers can no longer rely solely on price advantages and must refocus on the strength of their products.

On the other hand, this will accelerate the survival of the fittest in the industry. Leading car manufacturers, due to their advantages in technology, funding, and supply chains, are better able to adapt to an environment without subsidies. In contrast, companies that heavily rely on subsidies may face the risk of being eliminated from the market, which in turn will contribute to industry consolidation and healthy development.

Undeniably, the suspension of car replacement subsidies will cause short-term pain in the market, but in the long run, it is a necessary path for the industry's maturation. Currently, given that subsidies will continue to be disbursed in batches in the fourth quarter, it means that the policy is not exiting with a "one-size-fits-all" approach. Instead, it is entering a phase of optimization and adjustment with a greater focus on precision and efficiency, to prevent the recurrence of past issues such as subsidy exploitation and fraud, like the "zero-kilometer used cars" phenomenon.

As bystanders, we hope that the healthy development of the future automotive market will rely more on automakers' technological innovation, product experience enhancement, and a fair competitive environment in the market. As for consumers, when all the glitz fades away, purchasing decisions may need to consider the long-term value of products more comprehensively, rather than just the short-term price discounts and subsidies.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track