"staying alive" shouldn't be honda's goal in china

Compared to Toyota and Nissan, which actively sought breakthroughs for survival throughout last year, Honda, also a Japanese company, faced a situation in China that everyone could see.

During this period, despite being backed by Honda's latest electrification strategy, Dongfeng Honda S7 and GAC Honda P7 entered the market with a relatively positive attitude one after another. However, considering their subsequent market performance and Honda's adjustments for the Chinese market, it seems that everything has fallen short of expectations for Honda.

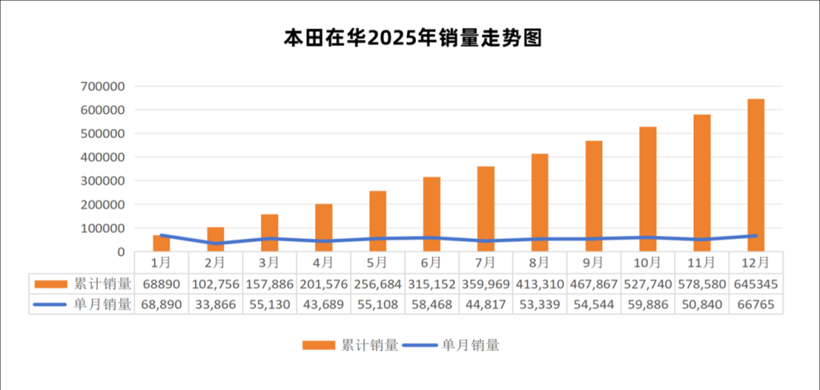

Throughout the year, Honda's terminal sales in China were only 645,345 units. Compared to the 852,269 units in 2024, the year-on-year decline of nearly 25% is quite glaring. In various market segments, aside from the Accord and CR-V, Honda's other IPs have uniformly lost their former glory.

Against the backdrop of Toyota, Nissan, and even GM, Ford, and Mazda all struggling to find paths to survival, does this kind of Honda really reflect what we want to see? This question has become a test of the times for everyone.

After several rounds of industry shake-ups, many foreign brands have successively withdrawn from China due to outdated concepts or impure motives, and a large number of new power companies have died off. This is not something anyone should regret.

For Honda, a sizable yet dynamically branded automaker that often acts as a trendsetter in the automotive industry, "silence" is hardly an appropriate response to the dramatic changes sweeping through the Chinese market. How could the once-unrivaled Honda be hindered by the industry's transformation?

In 2025, Honda will be in its 17th year of painstakingly cultivating the Chinese auto market, with a history of numerous glories adding vibrant colors to Honda's story in China.

Entering the new year, starting with the uproar caused by the limited release of the Fit, regardless of how the road ahead should be corrected, we always hope that Honda will resolutely reorganize its thoughts. Even if they don't compete for steamed buns, they must compete for pride, and continue to write new chapters for the industry picture book they have left in China over the past 20 years.

01Torn and anxious go hand in hand.

The outside world is well aware of the current predicament of joint ventures. The power unleashed by the booming new energy vehicle industry has caught everyone off guard. Not just Toyota and Volkswagen, but also luxury brands including BBA are increasingly feeling the chill in the Chinese market.

Last year, everyone came up with new solutions, determined to reclaim the market, which is true. However, a year has passed, and it seems that the momentum for joint ventures to recover is only being painstakingly maintained by a few companies such as GAC Toyota and Dongfeng Nissan.

It's not just Honda; even Beijing Hyundai, despite its efforts and the launch of products like the EO, has received a lukewarm market response. Seeing this, we increasingly conclude that not only have joint venture brands lost their brand moat in the Chinese market, but it has also become particularly important for them to actively learn from Chinese companies in this new round of offense and defense transition.

Of course, in an era where even Toyota and Volkswagen have to observe the moves of Chinese automakers before making decisions, if you ask whether the remaining joint venture brands still have a chance to turn things around, it's indeed a difficult question to answer.

The struggles and passivity of Korean and French brands have essentially set the final tone for the future of all joint venture car companies. With such clear examples before them, it's hard to believe Honda would ignore them, no matter how confident they are. However, as 2025 draws to a close with yet another year of strong performance from Chinese automakers, the window of opportunity for Honda to turn things around is indeed narrowing.

Looking back at Honda's actions over the past year, the news of Honda's layoffs and plant closures in China has been constant since the launch of the P7/S7. This means that even if Honda's headquarters can cover up some flaws in the automotive sector with the booming two-wheeled vehicle business, the changes happening in the automotive market still have a huge impact in the eyes of Honda's joint ventures.

Furthermore, Dongfeng Honda Engine Co., Ltd. was officially transferred to GAC Honda at the end of last year. It can be said that there were very few good news stories coming from Honda in China last year, leading to widespread concern about Honda's development in the Chinese market.

With 3.85 million new cars sold worldwide throughout the year, Honda's volume surpasses that of Ford and Nissan, ranking it 8th globally. From the perspective of car sales alone, who can say that Honda's ability to generate revenue has declined?

Therefore, when facing Chinese users, Honda often goes its own way, and it doesn't seem to have many problems. Compared to its peers, Honda's thinking throughout 2025 is still the same as before: emphasizing driving pleasure above all else is Honda's spiritual value as a joint venture brand. But as the saying goes, with sales declining year after year and its business scope in China continuously shrinking, Honda's willfulness is certainly unsustainable.

This year, the massive changes in the Chinese auto market have presented all joint ventures with a new requirement: to decouple their global strategies from China. After years of being "brainwashed" by new energy vehicle companies, Chinese consumers now see the so-called historical accumulation and experience as development constraints. Even if Honda is inclined to maintain its own style, reality no longer allows it to be so stubborn.

On January 13th, Honda officially announced that it will adopt a newly designed "H" mark as the new symbol of Honda's automobile business, representing Honda's automotive products and related business activities worldwide.

Honda stated that the design of the new "H" logo is intended to reflect the company's firm commitment to the transformation era. According to the plan, the new logo will first be applied to the next-generation pure electric vehicles and next-generation hybrid vehicles, and is planned to be fully adopted for new models launched from 2027 onwards.

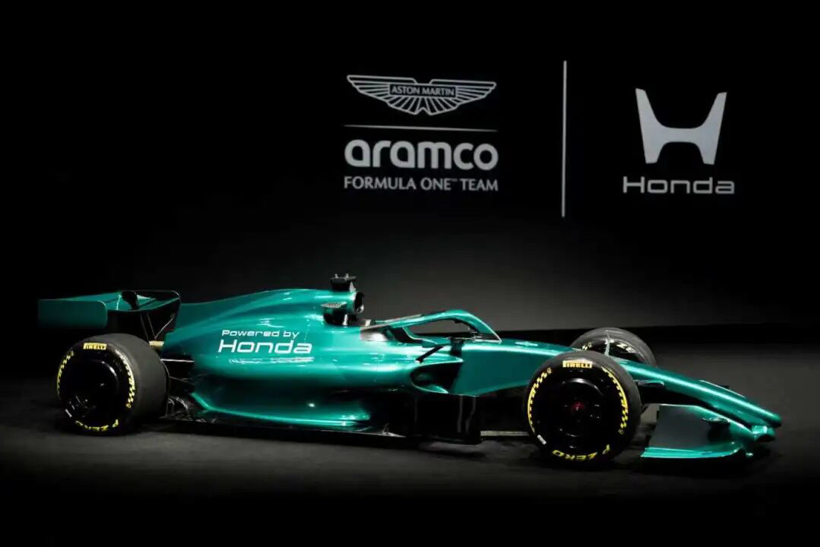

Just one week later, on January 20th, Honda officially unveiled its new generation RA626H power unit for the 2026 FIA Formula One World Championship in Tokyo. The new generation power unit will help Aston Martin compete in the 2026 F1 season.

We know very well that Honda is still that young man who loved chasing the wind. Watching the world change rapidly, only the passion for speed and machinery has never been extinguished.

It's true that in the new year, Honda is sticking to its own technological path in specific areas, such as top-tier racing like F1, or in the field of hydrogen fuel cell development. That's fine. But on the other hand, it should also leverage unprecedented collaboration in China to vindicate itself, proving that it's not just content to drift along aimlessly in the Chinese market.

02The darkness before dawn

Entering the new year, what kind of face will Honda use to compete in the Chinese market? With a lackluster performance last year as a backdrop, the outside world has been waiting for Honda to provide a detailed and penetrating response.

Previously, when Honda ambitiously showcased its entire portfolio for the 2025 Tokyo Mobility Show, regarding the planning for subsequent products, Honda stated that it would first start production of the 0 Series SUV in the US in the first half of 2026, followed by mass production of the 0 Series sedan in the second half of the year.

Meanwhile, at the 2026 International Consumer Electronics Show (CES), Sony Honda Mobility (SHM), a joint venture between Sony and Honda, brought the pre-production version of the AFEELA 1 all-electric mid-size sedan and the new AFEELA Prototype all-electric SUV concept car to the public eye. It seems that Honda has not chosen to remain idle in terms of forward-looking industry development, but is still actively involved in the research and development of new technologies.

However, when we refocus our attention on Honda's plans in China, the information released by the two joint ventures is quite limited.

Regarding investment in electrification, Honda has provided almost no concrete details. This inevitably leads one to wonder, is Honda really indifferent to this?

At the Dongfeng Honda annual business conference the other day, Masayuki Igarashi, Managing Executive Officer of Honda Motor Co., Ltd., Chief Officer of China Regional Operations, and Vice Chairman of Dongfeng Honda, pointed out a direction: "In the future, we will shorten the development cycle, strengthen the level of intelligence by strengthening cooperation with local partners, and enhance price competitiveness through thorough cost optimization."

Combined with Honda's previous painful decision to halt the production project of the "Ye" GT, perhaps Honda secretly has a new plan to address the highly competitive Chinese auto market. Boldly speculating, learning from the examples of the P7/S7, and relying on the new energy technologies of Dongfeng or GAC, Honda may have abandoned its stubbornness and is seriously building a Chinese version of new energy vehicles.

Of course, any company with a modicum of vigilance about reality, no matter how many holes it sees in its own transformation path, will have no choice but to bow to Chinese users.

Unsurprisingly, Honda's next generation of electrified products in China won't debut until 2027. Before that, Honda can only rely on minor updates to existing models like the CR-V to help. This means 2026 will likely be a product gap year for Honda. Against this backdrop, Honda needs to maximize its efforts to maintain the brand's vitality.

"Strengthening the foundation" is Honda's ideal interim goal. Therefore, before the next generation of products are launched, events such as the limited release of the new Fit unexpectedly triggering positive feedback in the terminal market are likely to be just a flash in the pan marketing event.

In contrast, from a top-down perspective, Honda needs to consider whether its "headquarters-led" model can be changed in the face of its China business division, and whether its China team can truly be given greater decision-making power.

Faced with the terminal, how should Honda systematically repair and stabilize its dealer network, enhance channel confidence and the terminal service experience, thereby preventing the vicious cycle of dealer network shrinkage, and maintain channel health in the context of thin new car profits?

Ultimately, there's a possibility for Honda to stabilize its position in 2026, but achieving significant growth or a comeback will be extremely difficult. It's more likely a challenging "fight for survival" than an easy "turnaround." Backed by its global operations, "surviving in China" isn't difficult, but the challenge lies in whether Honda has the determination to shed its burdens and truly understand the evolution of the Chinese auto market, especially as rivals like Toyota and Nissan gradually find ways to respond to the crisis.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

New 3D Printing Extrusion System Arrives, May Replace Traditional Extruders, Already Producing Car Bumpers