Starting from intermediates! how ocean biotech bets 193 million on its own peek path?

Recently, Dayang Biotech announced an investment of 193 million yuan to construct a project with an annual production capacity of 2,000 tons of PEEK and key intermediates. This move seems to be a conventional step following the domestic "PEEK craze," but it actually holds a hidden strategy—while the majority of companies focus on the resin capacity race, Dayang Biotech has chosen a different path: the company's project simultaneously lays out PEEK and core intermediates, aiming to leverage the entire PEEK industry chain.

Image of PEEK granules (Source: Victrex)

1. PEEKWhy does it spark a chase fever?

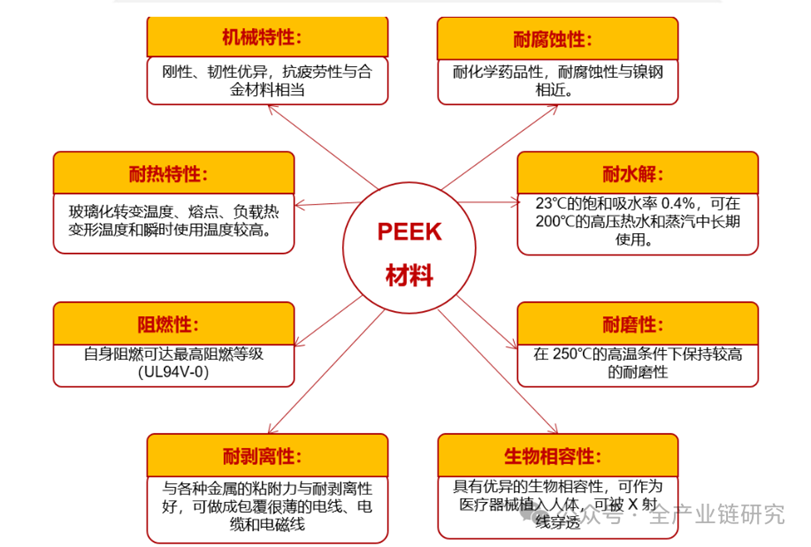

To understand the significance of Ocean's biological layout, it is first necessary to recognize the unique value of PEEK (polyether ether ketone) as a material.

As the "performance king" in the special engineering plastics family, PEEK's outstanding characteristics can almost meet all stringent requirements for material performance: long-term usage temperature can reach 260℃, tensile strength exceeds 100MPa, flame retardant rating reaches UL94 V-0, and it also possesses corrosion resistance, wear resistance, and self-lubricating properties. Moreover, its density is only 1.3g/cm³, perfectly aligning with the "lightweight" trend.

This unique combination of performance makes PEEK an indispensable strategic material for high-end manufacturing. In the aerospace sector, PEEK can replace metal components to reduce weight by 70%, significantly enhancing fuel efficiency; in the medical field, its biocompatibility makes it an ideal choice for orthopedic implants; in the new energy vehicle sector, PEEK components can meet the stringent insulation requirements of high-voltage electrical systems; and in the currently popular humanoid robot field, PEEK is the preferred material for core components such as joints and gears. Market data also reveals the enormous potential of PEEK. According to forecasts by Zhongshang Industrial Research Institute, Emergen Research, and Sullivan, the global PEEK market size is expected to reach 6.1 billion yuan in 2024 and 8.54 billion yuan in 2027, with a CAGR of 11.87%. The growth rate of the Chinese market is even more remarkable, with a size of 1.92 billion yuan in 2024, projected to increase to 2.8 billion yuan in 2027, and a CAGR exceeding 13%. This rapid growth is driven by the urgent demand for high-performance materials in emerging industries such as new energy vehicles, robotics, and the low-altitude economy.

Image source: Full Industry Chain Research

II. The Trump Card of Ocean Biotech: Fluorochemical Genes and Intermediate Breakthrough

Dayocean Bio's decision to enter the PEEK field at this time is not merely following market trends, but rather a precise alignment of its own resource endowment and industry opportunities.

The inevitable extension of technological accumulationThe core of Dayang Bio's confidence lies in its foundation. The company traces its origins back to the establishment of Jiande County Dayang Chemical Plant in 1976. Over nearly fifty years of development, the company has accumulated profound technology in the field of fluorochemistry. The most critical intermediate in PEEK production—4,4'-Difluorobenzophenone (DFBP)—is a fluorinated compound, providing Dayang Bio with a natural technical entry point. The core of DFBP synthesis lies in the control of the fluorination reaction, and Dayang Bio's technical reserves in the field of fluorinated fine chemicals can be transferred to this process.

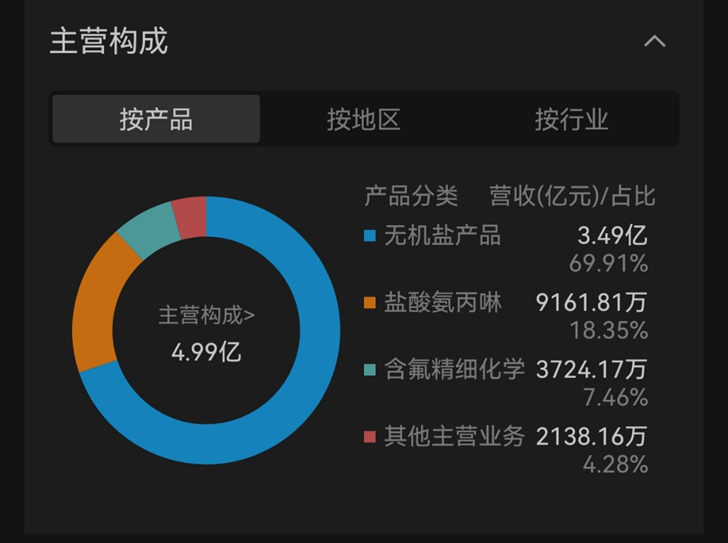

Main Composition of Ocean Biology (Source: Wind)

Strategic Considerations for Supply Chain SecurityAt present, more than 80% of the domestic demand for PEEK relies on imports, and the situation is even more severe as DFBP, the core raw material for PEEK (accounting for 50%-60% of the production cost), has long been controlled by overseas companies, often leading to supply difficulties characterized by "high prices and scarcity." Dayang Biotech is simultaneously focusing on the production of DFBP and PEEK, targeting the weakest link in the industry chain, demonstrating a strategic intention to solve the "bottleneck" issue.

The intrinsic demand for transformation and upgradingThe decision is also driven by this. The traditional business of Ocean Biotech focuses on inorganic salts, with a "one body, two wings" industrial structure of developing veterinary drugs and fluorine-containing fine chemicals. PEEK, known as "plastic gold," has a price range of 300,000 to 1 million yuan per ton, making it a typical high value-added product. It is worth noting that the price fluctuation of DFBP has a significant impact on the production cost of PEEK. According to data from Gongyan Industry Research Institute, the unit price of DFBP is expected to be 121,300 yuan per ton in 2026. Based on a consumption of 0.7 tons, the DFBP cost per ton of PEEK is about 85,000 yuan. Producing DFBP in-house can save 20,000 to 30,000 yuan per ton compared to purchasing externally, with considerable marginal benefit in large-scale production. Therefore, entering the PEEK sector can help the company optimize its product structure, enhance profitability, and achieve a strategic transformation from basic chemicals to the new materials field.

3. Competitive Landscape: The Siege of International Giants and the Differentiated Paths of Domestic Players

Ocean Biotech's entry into the PEEK sector is showing a competitive landscape dominated by international giants and rapidly pursued by domestic companies.

Top international tierPowerful and well-established. United KingdomWiggersAs the global absolute leader, with a production capacity of 7,150 tons per year, it dominates the high-end markets of medical grade and aerospace grade, with a market share of approximately 50%. Its technical barriers lie not only in the polymerization process but also in application development capabilities—Victrex has accumulated over 40 years of PEEK application data, enabling it to offer customers comprehensive solutions from material selection to part design.

BelgiumSyensqo(Capacity 2500 tons/year) and Germany With a production capacity of 1,800 tons per year, these companies establish advantages in the semiconductor, automotive, and industrial equipment sectors. Leveraging their first-mover advantages and technological accumulation, they have long maintained control over pricing power in the high-end market.Domestic enterprisesStriving to catch up.

Zhongyan Co., Ltd.(1,000 tons/year) is currently the largest PEEK producer in China, specializing in integrated polymerization and modification.Walt Co., Ltd.(900 tons/year) Relying on a strong modification platform, providing one-stop solutions.Shandong JunhaoThe third-phase project (1500 tons/year) is progressing, showing strong development momentum. In addition,Zhejiang Pengfulong(700 tons/year),Changchun Jida Special Plastics(500 tons/year)Shandong Haoran Special PlasticsGradually, it is securing a place in the market with a capacity of 300 tons per year.

Apart from these players, 2025PEEK of the yearThe track is still crowded with new entrants, such as:

Automotive Parts GiantNingbo HuaxiangPlanned the world's largest 12,000-ton PEEK capacity, aiming to achieve a "materials + manufacturing" closed loop; leading enterprise in modified plastics.Golden Hair TechnologyPlan a production capacity of 5,000 tons per year, etc.

It is worth noting that the biggest difference between Dayang Biotech and the aforementioned companies lies in its choice of path by entering through intermediates. Currently, there are very few domestic companies that can self-supply DFBP, and Dayang Biotech is expected to establish a first-mover advantage in this niche field.

Four, The Test of Life and Death: Four Stages from the Laboratory to the Market

However, no matter how beautiful the blueprint is, the path ahead for Ocean Biotech is far from smooth. From laboratory flasks to ten-thousand-ton reactors, this road to industrialization is fraught with challenges, testing the determination and resilience of this traditional chemical company at every step.

The challenge of technological maturity comes first.The performance of a few grams of sample synthesized in the laboratory is outstanding, but it is a completely different concept from the stable output of qualified products on a ten-thousand-ton production line. The polymerization of PEEK is akin to a precise art, with almost stringent control over temperature, pressure, and reaction time. A slight deviation in molecular weight distribution or an increase in end-group content can significantly deviate the material's performance from the stringent standards required for aerospace or human implants. Although Ocean Biotechnology is backed by research capabilities from Dalian University of Technology and others, the leap from small-scale experiments and pilot tests to large-scale production still requires verification with time and substantial investment in roaring factories.

The bigger challenge lies in opening the door to the market.In the high-end PEEK sector, new faces are not welcome. Downstream automotive giants and medical device manufacturers are extremely conservative in their choice of material suppliers. Suppliers' products not only need to meet performance standards but also maintain "absolute consistency" across batches, whether it be one, ten, or a hundred. The lengthy certification period can range from one to two years to as long as three to five years, during which there is significant investment with little return. As a newcomer in the industry, Dayang Biotech needs to prove to its customers not only that "I can do it," but also "I can consistently do it well."

The pressure of real money follows like a shadow.An investment of 193 million yuan is by no means a small amount for Dayang Bio. Although the company claims that funds have been arranged, in the current environment, capital expenditure of this scale will undoubtedly strain the company's cash flow. From construction, commissioning to reaching production capacity, and then generating positive cash flow, a considerable period is required. Every step forward is accompanied by significant financial consumption.

And all these challenges ultimately boil down to " Challenges.The PEEK industry requires versatile talents who are proficient in polymer synthesis, process engineering, and application development. Such talents are scarce in China and are highly sought after by industry giants and prominent startups. The challenge for Dayang Bio is akin to overcoming technical hurdles, as it strives to attract and retain top-notch technical experts and market pioneers, and build a strong core team capable of tackling tough challenges.

Therefore, Doyo Chemical's PEEK journey seems more like a risky gamble. Although it holds a strong fluorochemical card, whether it can win in the brutal game of industrialization, marketization, capitalization, and talent competition still requires time to tell.

Dayang Biotech's entry into the PEEK industry is a rational choice based on its own advantages and a strategic move towards the future. From a broader perspective, Dayang Biotech's exploration provides important insights for the development of China's new materials industry: latecomer companies do not need to blindly follow the footsteps of technology leaders; instead, they should leverage their own endowments to find the most suitable entry points and value creation segments in the industrial chain.

Edited by: Lily

Sources: Global Polyurethane Network, Huizheng Information, Liansu Network, Polymer Technology, Gongyan Industry Research Institute (Gongyan Network), official websites and public information of various companies.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories