Solid-State Battery Material "New Force" Rises: Hefei Yinshi New Material Secures 100-Million-Yuan-Level Financing, Sulfide Electrolyte Mass Production "Accelerates"

In early 2026, the solid-state battery sector received another boost. On January 24, Hefei Innostar New Material Technology Co., Ltd. (hereinafter referred to as "Innostar New Material") announced the completion of a tens of millions of yuan angel round of financing, led by Ruicheng Fund under Chery Group, followed by Vertex Ventures under Temasek and Anhui Guokong Investment, with Xiaomi Group's strategic investment department making an additional investment. This funding will be used to expand a new production line with an annual output of 300-500 tons of sulfide solid-state electrolytes and accelerate technology research and development, paving the way for the commercialization of all-solid-state batteries.

The investor lineup for this round of funding is quite "luxurious."

1. Industrial Capital: The entry of Chery Ruicheng Fund directly bridges the "last mile" between materials and automotive companies. As a representative of domestic new energy vehicle enterprises, Chery's participation signifies that Innostar Materials' electrolyte materials have entered the field of view of OEMs, and may be prioritized for application in Chery's models in the future.

2. International capital: The inclusion of Temasek's Pavilion Capital brings a global perspective to the project. Pavilion Capital has previously invested in several new energy technology companies in their early stages, and their endorsement may assist Inxense Material in expanding into overseas markets.

3. Tech Giant: The follow-on investment from Xiaomi’s Strategic Investment Department highlights its long-term layout in the solid-state battery sector. Xiaomi EV has explicitly identified solid-state batteries as a next-generation technical direction, and this investment may serve as a precursor to future supply chain integration.

Industry insiders analyze that capital collectively flowing into the materials sector reflects that the industrialization of solid-state batteries has moved from the "technology verification" stage to the "supply chain breakthrough" stage. As the core material of all-solid-state batteries, the performance of electrolytes directly determines the energy density, safety, and cost of batteries, making them a "key target" for capital competition.

"Disruptor" in Technology: The "Stabilization" and "Compatibility" Techniques of Sulfide Electrolytes

Founded in 2024, Yinshi New Materials may be a newcomer to the industry, but by leveraging the technical expertise of top-tier research teams from the Yanshan University National Key Laboratory, the University of Science and Technology of China (USTC), and the Chinese Academy of Sciences (CAS), it has immediately set its sights on the most challenging frontier: sulfide electrolytes.

The Achilles' heel of sulfide electrolytes:

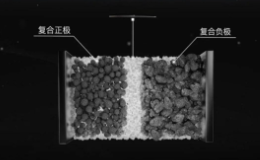

Traditional sulfide electrolytes have long been confined to the laboratory due to issues such as poor air stability (generating highly toxic H₂S upon contact with water), short circuits caused by lithium dendrite growth, and high assembly pressure requirements. In-Situ Materials' R&D team, through material modification techniques, has successfully extended the air exposure time of the electrolyte from "minutes" to "hours", significantly reducing the difficulty of manufacturing processes. Simultaneously, by designing nanoscale structures to suppress lithium dendrite growth, the thermal runaway temperature of the battery cell has been increased by over 20%, bringing its safety level close to that of liquid batteries.

Ramping up production with "acceleration":

Currently, Phase I production line of Innostar New Materials has a production capacity of 30 tons of sulfide solid-state electrolyte per year, with products covering various particle size specifications and electrolyte membranes, and samples have been sent to several leading battery companies for testing. According to the plan, Phase II production line, which will be launched in the second half of 2026, will increase the capacity to 300-500 tons/year, meeting the material needs of hundred-megawatt-scale battery projects.

"Future 'Three-Step' Plan: From Materials to Batteries, Targeting Next-Generation Technologies"

Inse Materials' ambitions extend far beyond electrolytes. The company's founder revealed that future research and development will focus on three major directions:

1. Deepen sulfide technology: optimize low-pressure adaptability, reduce battery assembly process difficulty, and promote the transformation of solid-state batteries from "laboratory samples" to "automotive-grade products."

2. Expand Anode Compatibility: Upgrade the matching degree of silicon-carbon anode materials to adapt to high-energy-density battery systems, helping electric vehicles achieve a range of over 1000 kilometers.

3. Layout of Frontier Fields: Explore lithium-rich manganese-based cathodes, lithium metal anodes, and anode-free systems to build up "ammunition" for solid-state battery technology iterations beyond 2030.

Solid-state battery "materials war" ignites: Can the Chinese contingent lead the world?

In the beginning of 2026, the solid-state battery sector is experiencing a wave of financing. From material breakthroughs by Yinshi New Materials, to equipment innovation by Gaoneng Shuzhao, and cross-industry entry by Jingke Energy, China's industrial chain is impacting the global market with a "full-chain effort."

Challenges remain.

Cost Challenge: The current cost of sulfide electrolytes is 5-10 times higher than that of liquid electrolytes, requiring cost reduction through scaled-up production.

Ecological synergy: Materials, battery cells, and automakers need to form a "research and development - validation - mass production" closed loop to avoid "single-point breakthroughs" becoming "technology silos."

Opportunities abound.

It is predicted that the global solid-state battery market will exceed $150 billion by 2030, with materials accounting for over 40%. Leveraging a complete industrial chain and policy support, China is expected to dominate key areas such as sulfide electrolytes and silicon-based anodes.

Conclusion:

The commercialization of solid-state batteries is a game of "technological patience" versus "capital ambition." Inherent Materials' financing is not only a recognition of material innovation by capital, but also an epitome of the Chinese industrial chain moving towards "high-precision and cutting-edge." When more companies like "Inherent Materials" emerge, the "ultimate form" of solid-state batteries may no longer be distant—at that time, electric vehicles will bid farewell to "range anxiety," energy storage will usher in a "safety revolution," and China may stand at the forefront of this transformation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories