Smart Cockpit IPO Battle: Burning Money, Game of Strategy, and Survival Breakthrough

As leading autonomous driving companies vie to enter the capital market, the IPO process of the smart cockpit industry will also accelerate sharply in 2025.

Recently, Zebra Zhixing, a subsidiary of Alibaba Group, submitted an application for a main board listing to the Hong Kong Stock Exchange, officially initiating its independent capitalization process. Zebra Zhixing is the fifth core supplier of smart cockpits to seek an IPO this year. Prior to this, several companies, including Siwei Zhilian, Meijia Technology, Botai Telematics, and Zejing Electronics, have also submitted prospectuses to the Hong Kong Stock Exchange, intending to go public on the Hong Kong stock market.

This IPO race among smart cockpit unicorns is not only a contest of overall competitive strength but also a test of capital endurance. As competition in the smart vehicle market continues to intensify—with automakers increasing their in-house development and tech giants entering the field—the survival space for third-party smart cockpit suppliers is being relentlessly squeezed. Under mounting pressure, going public and securing financing has become the key to survival for players in this sector.

Why is the IPO surge happening all at once?

The rush of smart cockpit companies to pursue IPOs is the inevitable result of the combined effects of market maturity, technological iteration, and capital cycle dynamics.

As the penetration rate of smart cockpits continues to rise and R&D "burn rates" enter deeper waters while the capital window remains open, going public has become a strategic necessity for companies.

According to the latest statistics from Gasgoo Auto Research Institute, in the first half of this year, the number of intelligent cockpit installations in China's passenger car market reached 7.957 million units, corresponding to a penetration rate of 75.1%. This means that for every 10 passenger cars sold domestically, 7 are equipped with intelligent cockpits. Especially in the mid-to-high-end vehicle market, the penetration rate of intelligent cockpits has remained at a high level, and even in the market for vehicles priced below 100,000 yuan, the penetration rate has exceeded 50%.

From the perspective of core configurations, functions such as the central control screen, voice interaction, and vehicle networking have all achieved penetration rates exceeding 80% in the first half of the year, gradually becoming standard features. Among them, the penetration rate of the central control screen is close to 95% and is expected to continue rising. It is worth noting that about five years ago, many of these features were exclusive to luxury cars, but now they have become commonplace even in 100,000 yuan-level family cars.

As the penetration rate of intelligent cockpits in the terminal market continues to rise, players in the sector have also followed differentiated growth paths based on their respective strategic choices and advantages.

Image Source: Gasgoo Auto

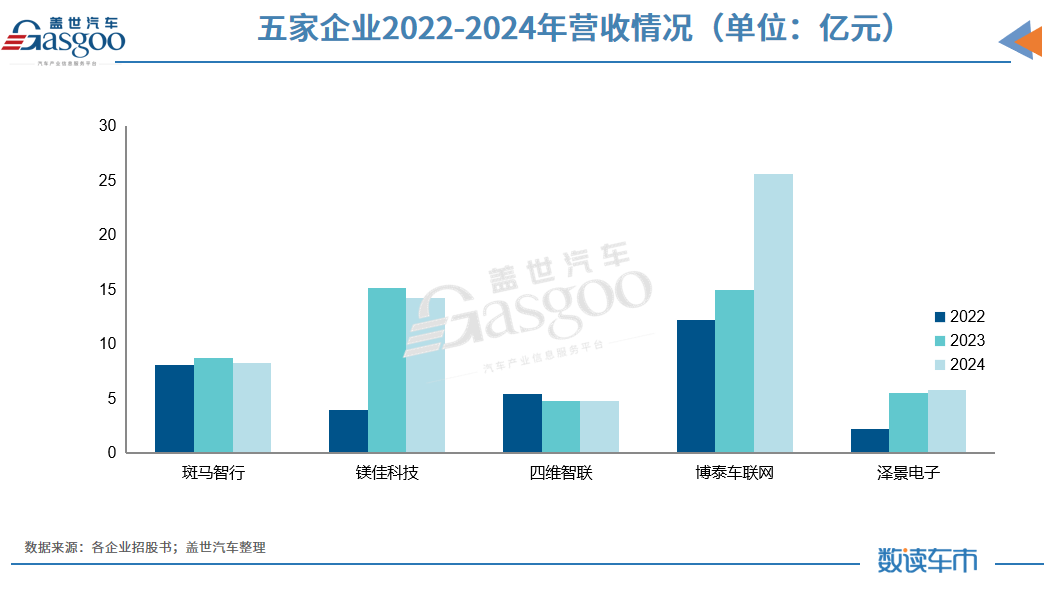

Zebra Zhixing's intelligent cockpit solution, which is centered on software, achieved seamless integration of software, AI, and in-car services. In 2022, it was installed in 835,000 units in the end market, and this number is expected to further increase to 2.334 million units by 2024, with a compound annual growth rate of 67.2%. Its revenue has also consistently remained above 800 million yuan.

Meijia Technology primarily focuses on AI-driven intelligent cockpit and domain controller solutions. Relying on a modular software platform and a diversified customer strategy, it has become one of the leading players in China's intelligent cockpit and domain controller market within just a few years.According to analysis data from Gasgoo Automotive Research Institute, in the domestic passenger car intelligent cockpit domain controller market, 2024 will...Meijia Technology Installed Capacity 502,503 sets, 7.5%Market share ranks 5th among the Top 10 suppliers, with the top 4 positions held respectively by Desay SV, Pegatron/Quanta.ECARX Connected Vehicles Worldwide.In the first half of this year, Meijia Technology continued to hold a 6.1% market share with shipments of 248,973 units.

With the rapid increase in shipments, Meijia Technology's revenue has also grown significantly, quickly jumping from 388 million yuan in 2022 to 1.513 billion yuan in 2023, and continuing to maintain a revenue scale of 1.42 billion yuan in 2024.

Image source: Gasgoo Auto

Botai Telematics, leveraging high shipment volumes of intelligent cockpit hardware solutions such as display screen controllers, connected devices, and domain controllers, saw its revenue rapidly soar from 1.218 billion yuan in 2022 to 2.557 billion yuan in 2024, with a three-year compound annual growth rate of 42.4%. Among these, the domain controller products achieved revenues of 674 million yuan, 785 million yuan, and 1.959 billion yuan respectively during the period, making them the core growth engine.

Zeijing Electronics mainly focuses on the HUD segment. From 2022 to 2024, the sales volume of HUD solutions surged from 175,700 units to 624,600 units, driving total revenue to rapidly grow from 214 million yuan to 578 million yuan.

However, the rapid expansion in sales volume and revenue scale is accompanied by intense market competition, tremendous R&D pressure brought by technological iteration, and the ongoing challenge of sustained losses.

Image source: Gasgoo Auto

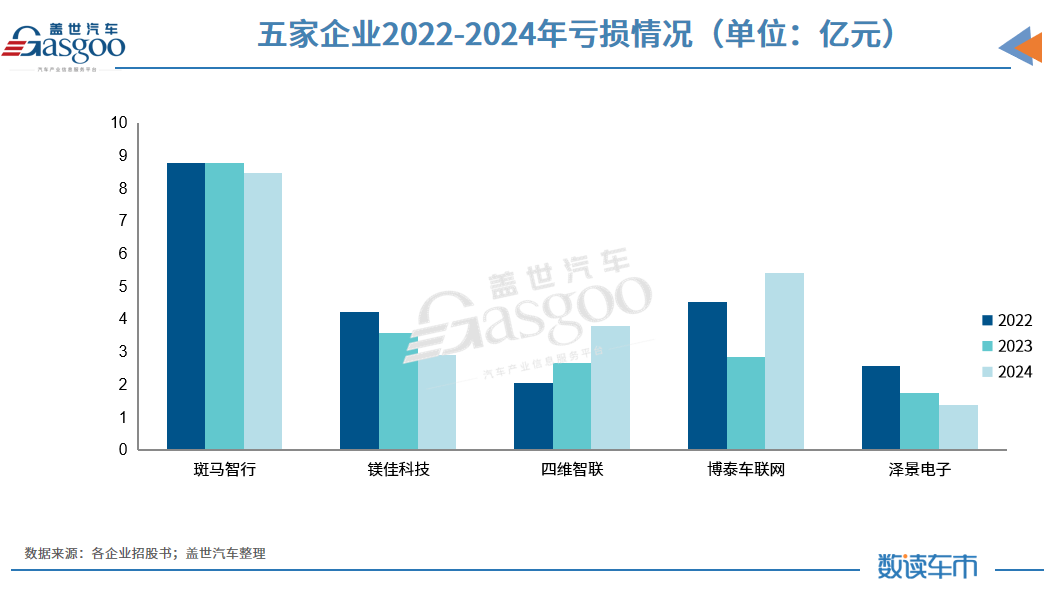

According to prospectuses disclosed by various companies, Zebra Zhixing accumulated a loss of 2.6 billion yuan from 2022 to 2024, with annual R&D investment exceeding 1 billion yuan. In the first quarter of 2025 alone, it recorded a single-quarter loss of 1.582 billion yuan, making it a case of “the more they sell, the more they lose.” Magia Technology accumulated losses of 1.072 billion yuan over three years, with total R&D expenditure exceeding 900 million yuan. Siwei Zhilian also did not escape this fate, with net losses expanding from 204 million yuan in 2022 to 378 million yuan in 2024. Even Pateo, the fastest-growing in revenue, accumulated losses of 1.277 billion yuan over three years, with R&D spending totaling 719 million yuan during the same period.

The paradox of "the more you lose, the more you invest" is essentially the result of the resonance between the "involution" of the smart cockpit industry and the pressure of technological iteration. As market competition intensifies, players are forced to continuously invest funds into core technologies to maintain their market share and fortify their technological moat. However, the intensity of such investment far exceeds the revenue capacity of many enterprises. For instance, Zebra Zhixing's R&D expenses accounted for more than 100% of its revenue from 2022 to 2024, reaching 144.7% in the first quarter of 2025. Such cases are not uncommon in the upstream and downstream of the supply chain.

The increasingly intense price wars are further squeezing profit margins, forcing companies to both "burn money" on R&D and deal with cost-cutting pressures. To capture market share, they sometimes have to "exchange price for volume." Under such multiple pressures, the need for external financing becomes urgent. For some players, an IPO is no longer a "choice" but a "survival imperative."

In the prospectusThe "truth"

The prospectus of smart cockpit companies is like a multifaceted prism, reflecting the bright prospects of a high-growth track while also exposing the deep-seated concerns of industry development. The collision of capital stories and real-world challenges forms the complex backdrop of this IPO feast.

From a positive perspective, after several years of intense competition, some companies in the smart cockpit sector have already established certain competitive barriers. As one of the few third-party suppliers in China fully capable of independently developing automotive operating systems, Banma Zhixing has formed an integrated capability of "system-level OS + AI engine + ecosystem services," and has secured a certain market share in the smart cockpit software market.

It is worth mentioning that the new category of "Internet cars" was first proposed by Zebra Intelligence in 2016.

SIVIEW has independently developed a full-stack software platform, including AI assistants, navigation maps, the Welink3 intelligent interaction system, and other software solutions, as well as standard domain controllers, advanced domain controllers, and other hardware terminals. As of June 2025, SIVIEW has delivered over 15.9 million sets of intelligent cockpit software solutions and more than 1.55 million sets of integrated software and hardware solutions, serving nearly 20% of approximately 250 domestic automakers.

Ze Jing Electronics has established a firm foothold in the HUD field by forming stable partnerships with leading new forces such as NIO and Li Auto, achieving substantial growth in both shipment volume and revenue.According to analysis data from Gasgoo Auto Research Institute, in 2024, Zejing Electronics ranked second in the domestic passenger car market for HUD shipments, with 517,699 units, second only to Huayang Multimedia, accounting for approximately 15.3% of the market share. In the first half of this year, Zejing Electronics continued to hold a market share of 12.5% with shipments of 218,430 units, ranking third among the Top 10. The top two were Huayang Multimedia and Denso.

Image source: Gasgoo

However, turning to the other side of the prospectus, issues such as continued losses, declining gross margins, and customer dependence are equally glaring.

Especially in terms of performance, the industry as a whole has generally fallen into the predicament of "increasing revenue without increasing profit." According to the current trend, companies may continue to incur net losses in the short term. This ongoing "bleeding" state has undoubtedly raised concerns in the market: against the backdrop of ever-increasing R&D investment, when will companies reach a turning point toward profitability?

Customer concentration risk is also prominent, having already become a "Sword of Damocles" hanging over industry players. For Banma Zhixing, the proportion of revenue from its top five customers consistently exceeded 88% from 2022 to 2024 and in Q1 2025, with its largest customer, SAIC Motor, continuously contributing nearly half of its revenue. For NavInfo, the revenue proportion from its top five customers has long exceeded 85%, and the proportion from its largest customer was 62.6%, 46.5%, and 47.8% in the past three years, respectively. For Meijia Technology, the revenue proportion from its top five customers was 92.8%, 91.2%, and 84.7% from 2022 to 2024, with the proportion from its largest customer exceeding 50% in both 2022 and 2023.

The "major client dependency syndrome" exposes the vulnerable position of third-party suppliers within the industry chain. Once orders from core clients fluctuate, the company's performance will face significant impacts. Zebra Intelligent Driving clearly pointed out that its reliance on a few key clients exposes it to higher risks related to these clients' procurement decisions, vehicle project planning, and product roadmap adjustments. If any of these major clients reduce purchases, delay mass production plans, shift to in-house development, or terminate cooperation, its business could be severely adversely affected.

In addition to reliance on major clients, related party transactions leading to independence disputes are also obstacles for some companies in expanding their commercialization processes. For instance, Zebra Zhixing, from 2022 to 2024 and the first quarter of 2025, has consistently had over 50% of its total procurement amount coming from its largest supplier, Alibaba, which also holds a 44.72% stake in Zebra Zhixing. Meanwhile, SAIC, as its largest client, holds a 34.34% stake. This dual binding of "supplier + shareholder" and "client + shareholder" makes it difficult for the market not to question its ability to operate independently, thereby limiting Zebra Zhixing's ability to expand its third-party clientele.

The challenges of technological route transformation cannot be ignored. Currently, the cross-domain integration of intelligent driving and smart cockpits has become a new industry trend. Cockpits no longer just control entertainment and navigation; they also need to interact with autonomous driving systems. However, many smart cockpit companies have mainly focused on cockpits in the past and have relatively insufficient technical reserves in intelligent driving. If they cannot quickly address these shortcomings, they will face significant competitive pressure.

Amid multiple difficulties, some companies have already shown red flags in their financials. According to the information disclosed in the prospectus, as of the end of March 2025, Zebra Intelligence had only 320 million yuan in cash and cash equivalents, while its annual R&D and operating expenses approached 1 billion yuan. Without timely financing through an IPO to replenish funds, it is feared that the company may not survive for a year.

The end is far from here; going public is just a ticket to enter.

For startups, an IPO is not the end but the starting point of more intense competition. Companies that successfully go public have the opportunity to leverage capital to achieve greater scale in commercialization. However, those that miss the chance for capitalization or perform poorly after listing may still be eliminated in the fierce market competition. Under such pressure, breaking the deadlock is crucial.

Currently, the path to breakthrough for everyone is quite clear: exchanging capital for technology and using technology to seek market opportunities. For example, Banma Zhixing plans to use the funds raised from its IPO to further strengthen its technological leadership in the Chinese smart cockpit solutions market. Meanwhile, NavInfo is focusing its research and development efforts on developing and optimizing high-computing-power smart cockpit software and integrated software-hardware solutions.

Image source: MagneTech

Megjia Technology also plans to further invest the funds raised from its IPO into research and development, including expanding and optimizing AI algorithms for in-vehicle scenarios, proprietary software toolkits, strengthening modular software architecture, and expanding its “Smart Cockpit + X” product matrix. The so-called “Smart Cockpit + X” refers to a high-performance smart cockpit as the core, seamlessly integrating a range of intelligent function modules tailored for intelligent connected vehicles, including AI voice assistant, DMS/OMS, ADAS, Internet of Vehicles, etc., continuously expanding the application boundaries of the smart cockpit.

Market expansion, especially the development of international business to further increase market influence and share, is another path to breakthrough.

Zebra Smart Mobility is accelerating the expansion of customers outside the SAIC system to broaden overall market coverage and is closely cooperating with international joint ventures such as Nissan, which are committed to deepening their presence in the Chinese market. Together, they are jointly developing intelligent cockpit solutions tailored to local needs. At the same time, by supporting Chinese brands going overseas and directly entering new overseas markets, Zebra Smart Mobility is expanding its global business layout. It is reported that Zebra Smart Mobility currently supports the overseas expansion of all models under the IM brand, including its deployment in the Thai market.

Four-dimensional Zhilian is leveraging cost-effective products and collaborating with domestic automakers to explore international markets. It is reported that a certain new energy vehicle model, sold in Europe by a major Chinese automaker, is equipped with its standard domain controller.

Magnesium Jia Technology is also committed to replicating its successful experience in the Chinese market in its collaborations with international OEMs. It is expected that by the end of 2025, products equipped with the company's technology will expand to more than 40 countries and regions. Prior to this, Magnesium Jia Technology had already established partnerships with several automakers from East Asia and the United States.

Notably, in order to prioritize the development of more sophisticated and software-centric solutions based on long-term strategic considerations, Magjia Technology proactively severed its business relationship with its largest early customer at the beginning of 2024. Previously, Magjia Technology primarily supplied this company with basic domain controllers rather than integrated intelligent domain controllers. Although this caused the company’s revenue to decline from 1.513 billion yuan in 2023 to 1.42 billion yuan in 2024, its gross profit margin increased from 12.1% in 2023 to 21.8% in 2024.

From this perspective, the IPO frenzy of the smart cockpit is not merely a simple capital carnival but a signal that the industry is moving from the "first half" to the "second half." If the first half was about "who can create a smart cockpit," then the second half is about "who can create a better smart cockpit." This not only refers to the current concept of smart cockpits but also includes the next generation of "AI-defined cockpits," with a healthier and more sustainable business model.

The IPO provides companies in the sector with an opportunity for "infusion," but whether they can survive and thrive depends on subsequent technological iterations and strategic planning. For the entire industry, this shake-up is not a bad thing—eliminating outdated production capacity will allow resources to concentrate on leading enterprises, accelerating the implementation of "cabin-driving integration" and "AI large models on vehicles," ultimately enabling consumers to enjoy a smarter travel experience.

Just like the development of smartphones back in the day—from feature phones to smartphones, from standardized hardware to software ecosystems—the industry always undergoes upgrades driven by capital. Smart cockpits are now at this critical juncture, and the IPO is merely the beginning of this upgrade.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track