Slumping Oil Market Will Spell Disaster for Small Banks in Oil and Gas Regions

In recent years, influenced by geopolitical conflicts, global tariff changes, and adjustments in energy policies, crude oil prices have experienced significant fluctuations. Although media attention often focuses on the impact of oil price volatility on production adjustments by major oil-producing countries and on macro aspects such as international geopolitics, the fluctuations in oil prices also have noticeable effects on many micro-level industries, such as small and medium-sized banks.

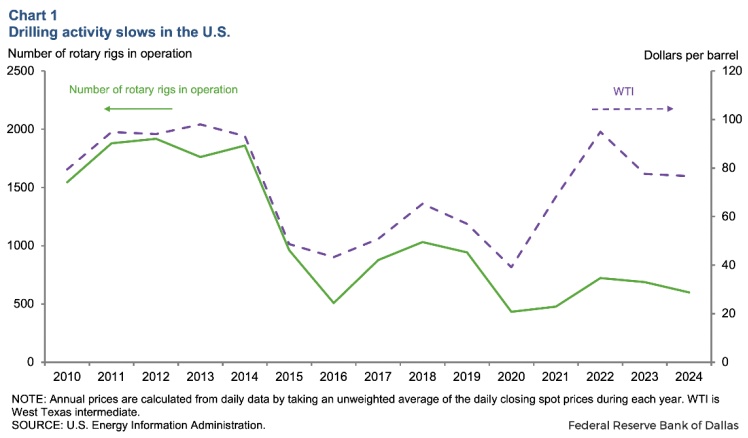

From 2014 to early 2016, innovations in drilling technology and a surge in oilfield activities brought about a booming era for shale gas and tight oil, known as the "shale oil revolution." However, the subsequent plunge in oil prices led to a significant reduction in the number of active drilling rigs.Sorry, but there is no image or content provided for me to translate. Please provide the text or image you want translated.The oil and gas production areas have been severely affected, leading to a deterioration of the local economic situation, which in turn has dealt a severe blow to the banks and financial institutions serving these areas.

Comparison of WTI Crude Oil Prices and Active Rig Count

The energy industry chain, in addition to the chemical-related industries we traditionally consider, also includes upstream extraction industry operations and oilfield services industry. These industries impact the local economy by creating a wide range of employment opportunities, including direct jobs in drilling and production, as well as indirect jobs in supporting industries such as transportation, equipment supply, and hospitality. These industries also contribute to local government revenue through taxes, royalties, and lease payments, which can be used for public services and infrastructure development.

Despite various benefits, the economic returns from oil and gas activities often fluctuate cyclically with oil prices. This volatility can lead to economic instability and trigger cycles of boom and bust in regions highly dependent on oil and gas extraction.

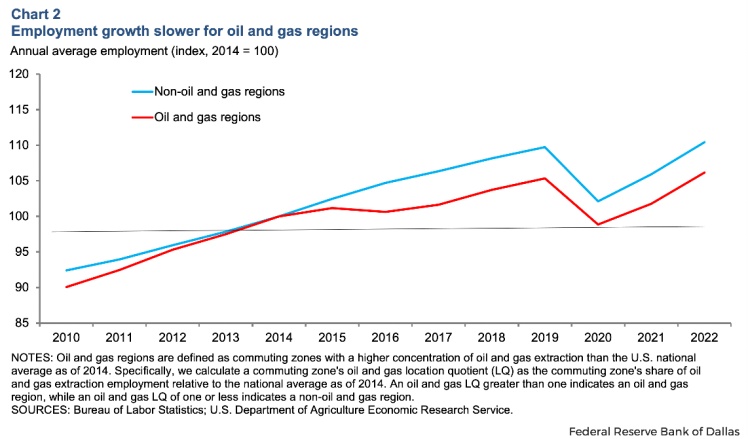

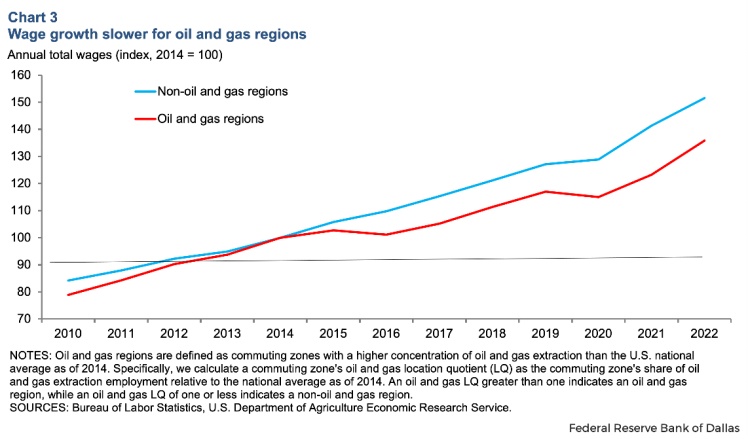

In the United States, for example, in the oil and gas producing regions, the extraction industry actually accounts for only a small portion of the local economy, with the average employment in this industry comprising less than a percentage of the total employment in these areas.Prior to 2014, total employment and private sector wage growth in these areas were stronger than in other regions, despite the relatively small proportion of direct employment, which was below 2.6% in even half of the oil and gas extraction sectors. However, after 2014, employment in these areas...(See below)and salary Growth has again shown a significant slowdown, leading to a noticeable widening of the gap with non-oil and gas regions.

Comparison of Employment in Oil and Gas Producing Areas vs Non-Oil and Gas Producing Areas

Figure: Wage Comparison Between Oil & Gas Producing Areas and Non-Oil & Gas Producing Areas

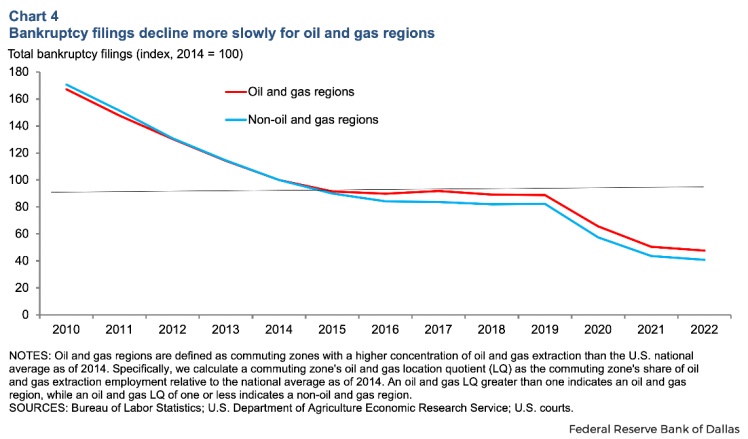

After 2016, prolonged low oil prices reduced the income of oil and gas producing regions and remained weak in the following decade.Sorry, but there is no image or content provided for translation. Please provide the text or image you would like to have translated.The main reason is that the number of consumer bankruptcies remains high.

Figure: Comparison of the number of bankruptcies between oil and gas production areas and non-oil and gas production areas

The economic slowdown in oil and gas producing regions has also affected small banks operating in those areas. These banks typically serve local residents and businesses, focusing on residential and commercial real estate loans. Therefore, these banks are more closely tied to the local economic conditions than large national banks.

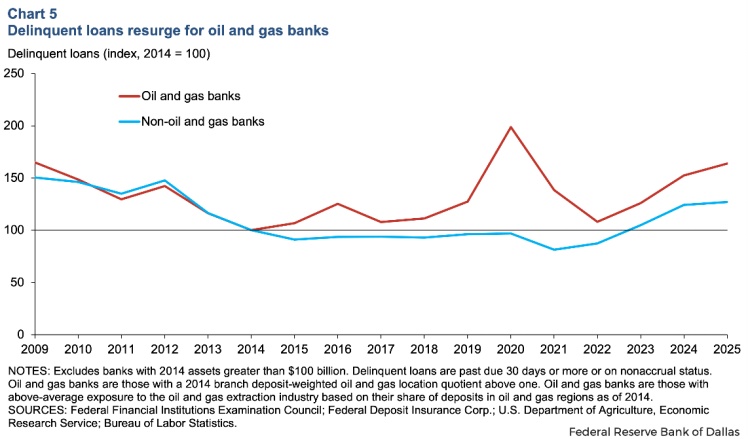

During periods of low oil prices, the overdue loan rate at banks in oil and gas producing regions has increased.The overdue rate of bank loans in non-oil and gas production areas has continued to decline steadily.。

Diagram: Comparison of Bank Loan Delinquency Rates between Oil and Gas Producing Areas and Non-Oil and Gas Producing Areas

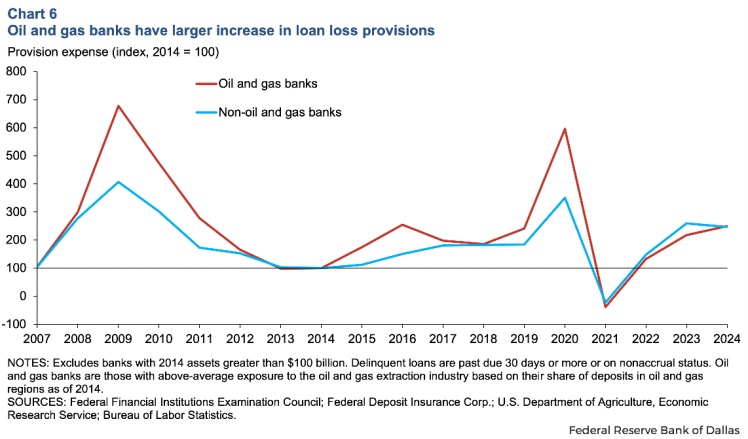

As loan quality deteriorates, these banks have also seen a significant increase in their loan loss provisions, partly due to the decline in the collateral value associated with oil and gas assets.========================================================================。

Figure: Comparison of Loan Loss Provision Expenses between Oil and Gas Producing Areas and Non-Oil and Gas Producing Areas

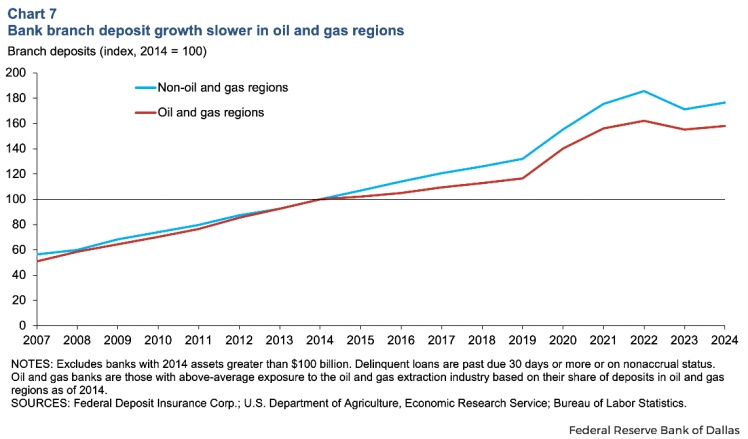

Moreover, during periods of low oil prices, deposits in bank branches in oil and gas producing regions increased.5%, much lower than the 14% increase in non-oil and gas producing areas.I'm sorry, but it seems there is no image provided in your message. If you can describe the content or provide the text you want translated, I would be happy to help with the translation.In addition to asset quality and funding pressures, the slowdown in the local economy also means that the demand for loans and other financial services from these banks is weakening.

Graph: Comparison of Deposit Growth between Oil and Gas Producing Areas and Non-Oil and Gas Producing Areas

The decline in oil prices from 2014 to 2016 did not lead to widespread bank failures, but it did put operational pressure on banks heavily reliant on oil and gas regions. The cyclical nature of the oil and gas industry means these banks are more vulnerable during economic downturns. In 2020, the sharp decline in oil prices due to the pandemic-induced drop in demand once again led to loan defaults and increased reserves for banks in oil and gas regions. Therefore, with the continued slowdown in oilfield activities by mid-2025, a new round of prolonged low oil prices may pose more severe challenges for small banks in these areas.

Author: Gao Xing, Senior Market Analyst

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track