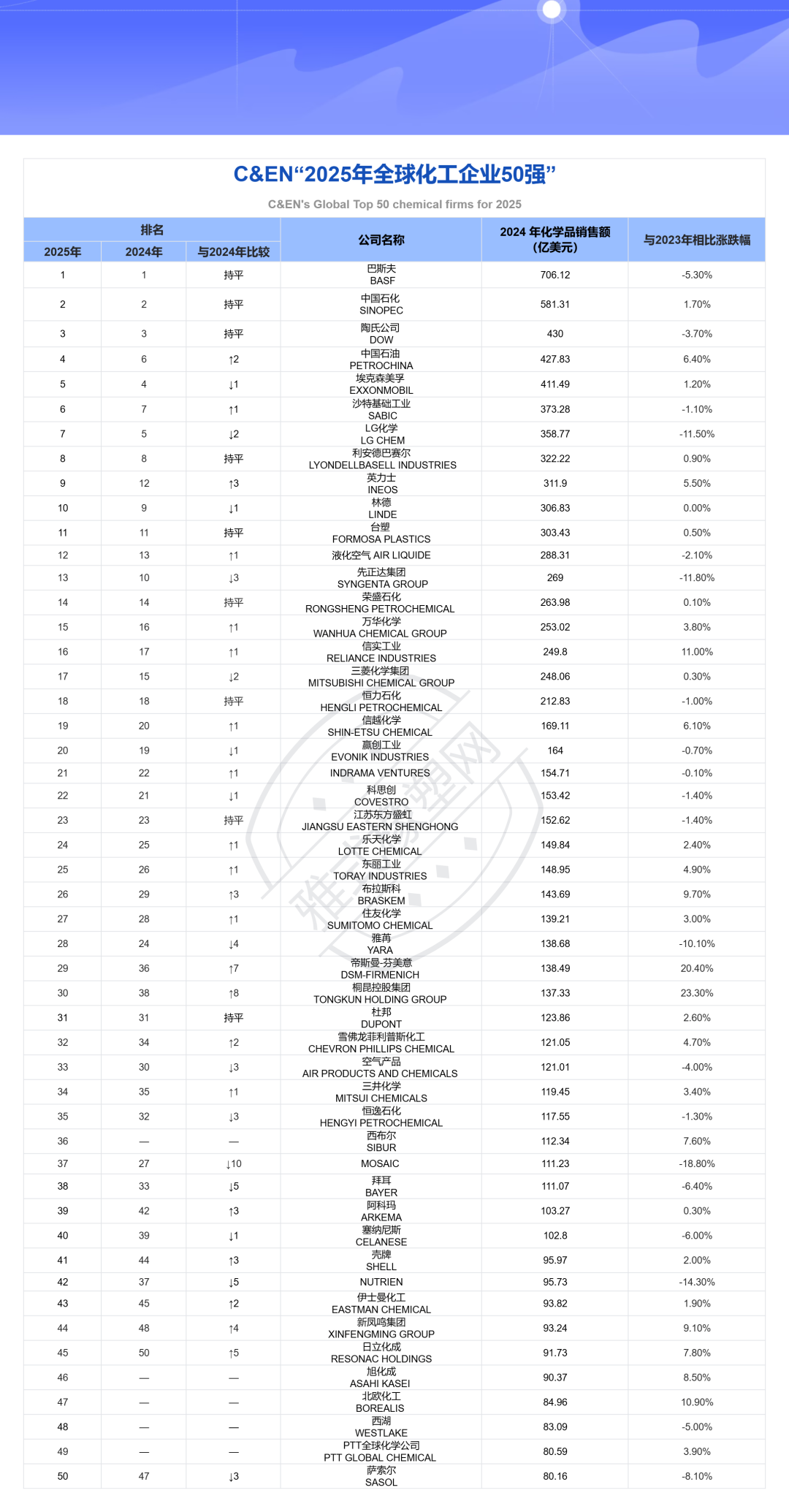

Sinopec Ranks Second, Wanhua Chemical Ranks Fifteenth

The threshold for this year's shortlist is $8 billion, which is nearly $4 billion lower than last year. Among the companies, China has 11, the United States has 10, Japan has 7, Germany has 4, the United Kingdom has 3, and South Korea has 2. The total sales of the 50 companies amount to $1.014 trillion, a year-on-year decrease of 0.07% from 2023. However, in 2023, there was a year-on-year decrease of 10.7% compared to 2022, which basically indicates that the chemical industry in 2024 has stabilized at the bottom.

For example, this July,Jiangsu Siborui Petrochemical Co., Ltd. under ShenghongThe pilot project for the development technology of 800 tons/year of polyolefin has been approved for record filing. The main product, dicyclopentadiene, is primarily used to produce the popular high-end chemicals COC/COP. This May,Jiangsu Shengbang New Materials Co., Ltd. Annual ProductionThe 5,000-ton para-aramid project was successfully commissioned in one go; in March this year, the announcement of the proposed approval status of the environmental impact assessment documents for Jiangsu Hongjing New Materials Co., Ltd.'s 100,000-ton/year high-end polyolefin monomer plant and supporting facilities project (second phase), to support the company.1010,000 tons of POE. In addition, the company also produces ultra-high molecular weight polyethylene (UHMWPE), PETG copolyester, CHDM polyester, acrylonitrile and its derivatives, recycled polyester fiber, lithium iron phosphate, etc.

Compared to the diversified product offerings of Dongfang Shenghong, Rongsheng Petrochemical must be described as having a chain-by-chain industrial layout, often involving investments of tens of billions, supported by Saudi Aramco, giving it a distinct presence.

For example, Rongsheng New Materials (Taizhou) is investing 148 billion yuan to build a project with an annual output of 10 million tons of high-end chemical new materials, covering eight major industrial chains including nylon 66, biodegradable plastics (PBAT/PBS), and specialty polyester. Another example is the Zhoushan Jintang New Materials Park, with a total investment of 76 billion yuan, covering EVA and POE.PTT、PBS、Polyether polyol plant, ABSPolycarbonate, PCTG, UHMWPEPP、Polyurethane elastomer.....

In contrast to Rongsheng Petrochemical's "financial strength," Wanhua Chemical is more adept at the "specialized, refined, and innovative" approach of making small, incremental advancements.

Accidentally, there are multiple flagship products, such as MDI, TDI, Nylon 12, PSU/PPSU, specialty isocyanates (HDI/IPDI), PC, bio-based TPU, cycloolefin polymers, citral and derivatives, specialty esters (HEMA/HPMA), POE...The company recently trended on social media due to TDI.

In addition, the company is recruiting talent globally to establish a presence in ten new material sectors, including packaging materials, PVC, ePTFE membrane materials, biomanufacturing membrane products, high-end optical films, polyolefin films, synthetic biology, electrolyzers and electrodes, anode and cathode products, and battery materials.

Compared to the aforementioned companies that like to chase market trends, Sinopec is clearly more focused on "filling gaps," doing what is needed, such as Zhenhai Refining & Chemical's "gold in plastics" polybutene-1, ultra-high melt index impact-resistant PP, special materials for battery separators, metallocene polyolefins, SSBR, bio-jet fuel, and so on.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track