Shutdown vs. Under Construction! Can China's Polyolefins Replicate the "South Korea Model"?

Introduction: Reviewing the period from the 1990s to the early 2000s, Korean chemical companies (such as LG Chem and Lotte Chemical) achieved counter-cyclical expansion during the Asian Financial Crisis (1997) and the global chemical industry downturn (early 2000s) through low-cost asset acquisitions, technology introduction, and government support. After the 2008 financial crisis, with the recovery of global chemical demand, Korea quickly filled the market gap by leveraging its pre-established capacity and low-cost advantages.

The current polyolefin industry is exhibiting a new pattern of "contraction in Europe and the US, expansion in China," which bears certain similarities to the strategic opportunity period once experienced by South Korea. Some say, "The South Koreans expanded during the downturn, and when the economy recovered, they captured the entire market."Is the assertion reasonable? How will the future of China's polyolefin industry evolve? We shall wait and see.

Over the past 18 months, European chemical giants have successively announced permanent or temporary shutdowns of polyolefin units — Shell has decided to close its 750,000 tons/year polypropylene unit in Moerdijk, the Netherlands, by the end of 2025; Covestro has permanently shut down its 500,000 tons/year high-density polyethylene (HDPE) unit in Brunsbüttel, Germany...

At almost the same time, Sinopec, Zhejiang Petrochemical, Shenghong Refining & Chemical, Wanhua Chemical, and the Zhongsha Gulei joint venture project are constructing or commissioning downstream polyolefin capacities totaling over 8 million tons per year of ethylene and propylene. According to relevant institutions, from 2024 to 2027, China is expected to account for more than 60% of the global incremental polyolefin capacity during the same period.

A large amount of new production capacity is concentrated in general-purpose materials (such as raffia, injection molding, film materials, etc.), leading to extremely fierce market competition for these mid- to low-end products. As a result, capacity utilization rates have declined and corporate profit margins have been severely squeezed. Reports from institutions such as SCI99 (Sublime China Information) clearly indicate that mid- to low-end grades of PP and PE have entered a period of overcapacity.

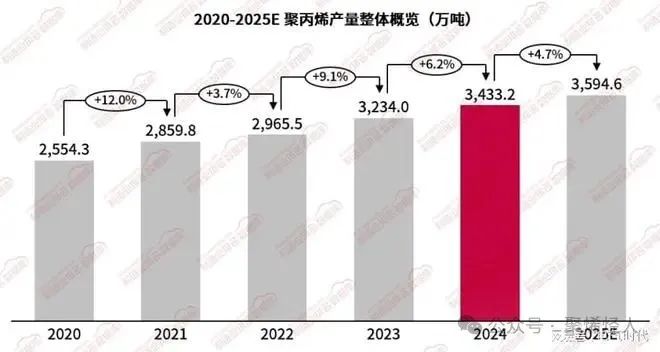

Gewu Zhisheng data shows that in 2024, polypropylene (PP) production reached 34.332 million tons, but the actual effective demand was only 32 million tons, resulting in a surplus of over 2 million tons. Inventory turnover days reached as high as 60 days, and the gross profit margin declined by 3 percentage points. In 2024, the ethylene capacity utilization rate was below 70%, significantly lower than the healthy international capacity utilization rate of 85% to 90%.

From the perspective of market demand, China's polyolefin industry exhibits typical characteristics of "excess total capacity and structural imbalance." Although the industry's comprehensive capacity is expected to reach a new high by 2025, data from the first four months still show a net import gap of several million tons. The core issue lies in the insufficient supply capacity of high-end products. Specialty materials such as metallocene polyethylene/polypropylene, high-carbon α-olefins, photovoltaic-grade POE, and ultra-high molecular weight polyethylene involve technological barriers encompassing catalyst design, polymerization process control, and modification processing across the entire industry chain. These directly restrict the development of strategic sectors including new energy (photovoltaic EVA films, lithium battery diaphragms), automotive lightweighting, biomedical materials, and 5G electronic chemicals.

In terms of industrial upgrading, leading enterprises are seizing high-value positions through differentiated layouts. Shenghong Petrochemical leverages its integrated refining and chemical advantages to build the world's largest high-end EVA production base; Wanhua Chemical has successfully put into operation a 200,000-ton/year POE unit, precisely addressing the localization challenges of photovoltaic encapsulation materials; Baofeng Energy focuses on the coal-to-olefins route, with a key breakthrough in the preparation technology of high-value-added polyethylene specialty materials. Notably, the gross profit margin of these high-end products can reach 20%-30%, significantly higher than the 5%-8% of traditional general-purpose materials, fully validating the value leap brought by technological upgrading.

Cost advantages and policy guidance jointly drive light hydrocarbon cracking (such as ethane cracking and propane dehydrogenation, PDH) to become the mainstream for new capacity additions. Its costs are generally lower than those of traditional oil-based or coal-based routes, with a significant increase in its share of new capacity in 2025. At the same time, light hydrocarbon-based olefin production has lower carbon emissions, aligning with the "dual carbon" goals, making it a key focus for future development.

Enterprises strengthen their competitiveness through vertical integration and flexible production.

Large-scale integrated refining and petrochemical enterprises or those with raw material advantages (such as stable coal/light hydrocarbon resources): integrate the industrial chain to reduce production costs, maintain resilience in the general feedstock market, and support the development of high value-added products.

New capacity configuration: predominantly utilizing LDPE/EVA flexible units to enable flexible product switching and effectively avoid homogenization risks.

Characteristics and Responses of Various Technical Routes:

Coal-to-olefins: In coal-rich areas such as Xinjiang and Inner Mongolia, the cost is 2000-3000 yuan/ton lower than the naphtha route. Thanks to large-scale operations and leading consumption control, Baofeng Energy remains profitable even during the industry's loss period in 2024.

PDH route: In 2024, the average loss reached 882 yuan per ton. Companies are gradually improving profitability by optimizing processes (such as Jinneng Chemical’s application of Spherizone technology) to increase the proportion of high-end products.

Ethane cracking: Benefiting from the ethane price advantage in North America, the cost in 2024 is 3,010 RMB/ton lower than the naphtha route, maintaining strong competitiveness.

It is worth noting that the polyolefins mentioned aboveNew Capacity AdditionSome of the capacity is actually a replacement and upgrade after eliminating outdated production. For example, Wanhua Chemical has transformed its million-ton ethylene unit to diversify raw materials, shifting from propane to ethane. The ethane-to-ethylene process has higher yield, lower material and energy consumption, and can flexibly adjust raw materials according to market changes, significantly enhancing the overall efficiency and risk resistance of its ethylene industry chain.

The polyolefin industry is currently undergoing a three-dimensional upgrade characterized by "clustered layout, capital-driven, and global expansion." In terms of industry chain integration, leading companies such as Rongsheng Group and Sinopec are deepening vertical extension through new or expanded projects, building a complete industry cluster from raw material supply to end applications, thus forming significant scale effects and synergistic advantages.

Capital operations have become a key driver of industrial expansion. As a strategic sector within the chemical industry, the polyolefin industry has attracted a large influx of capital. Enterprises obtain expansion funds through diverse financing channels such as IPOs and bond issuance, providing solid support for capacity building and technological upgrading. This deep integration of capital and industry is accelerating the transformation of the sector from scale-based competition to quality-based competition.

In terms of export market expansion, Chinese enterprises are enhancing their international competitiveness through a dual-driven approach of "technology empowerment + regional penetration." Taking Jinneng Chemical as an example, it has adopted Spheripol and Spherizone dual-process technologies to develop products that meet high-end demands such as automotive lightweighting and new energy battery packaging. In the first two months of 2025, its polypropylene export volume exceeded 40,000 tons, with an annual forecast of 200,000 tons, mainly sold to emerging markets in Southeast Asia and Africa. According to data from the Source One industrial chain, from January to March 2025, China's exports of polyethylene and polypropylene to Vietnam reached a record high of $118 million, confirming the strong overseas demand for high-end products.

In addition, changes in the international market landscape are creating new opportunities for Chinese enterprises. The energy crisis in Europe has led to the shutdown of 2.86 million tons of olefin production capacity, resulting in a significant market gap. Leveraging their cost advantages and technological breakthroughs, Chinese companies are accelerating efforts to fill this void and are securing a more favorable position in global operations. This strategic synergy of “deep domestic cluster development + international market expansion” is reshaping the competitive landscape of the global polyolefin industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track