Shipping Companies Begin Raising Prices! Transpacific Freight Rates Surge Again?

This year, the traditional seasonal rhythm of the shipping market has been completely disrupted. Among them, the freight rates for the US route have continued to decline for two consecutive months, and the freight rates for the European route have also shown a weak trend recently. Currently, entering early September, the pressure of capacity supply in the market has eased compared to the end of August, and the downward trend of freight rates may see a temporary slowdown.

As the Golden Week in late September approaches, the market anticipates a surge in shipments, and the US route is expected to experience a short-term transportation peak as a result. However, it is still difficult to accurately predict how freight rates will change subsequently.

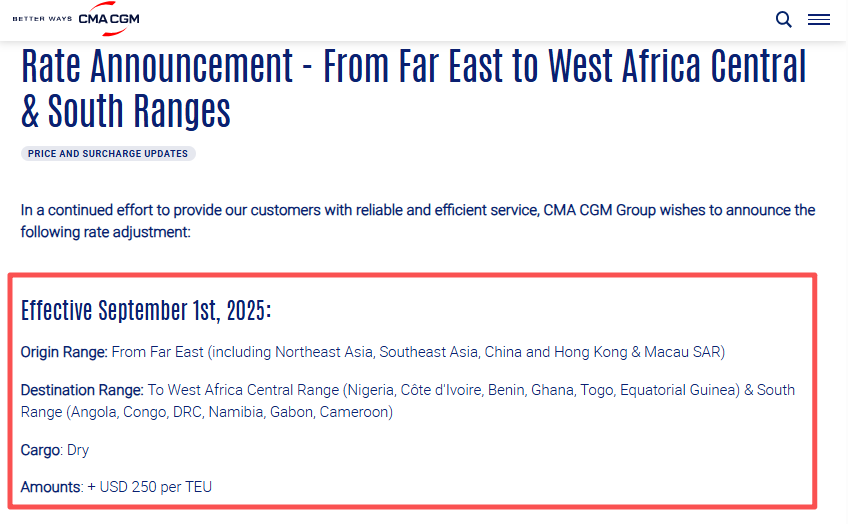

It is worth mentioning that recently some shipping companies have successively announced a new round of freight rate adjustment plans for September. Companies such as Maersk, CMA CGM, and Hapag-Lloyd will make adjustments to the rates on certain routes.

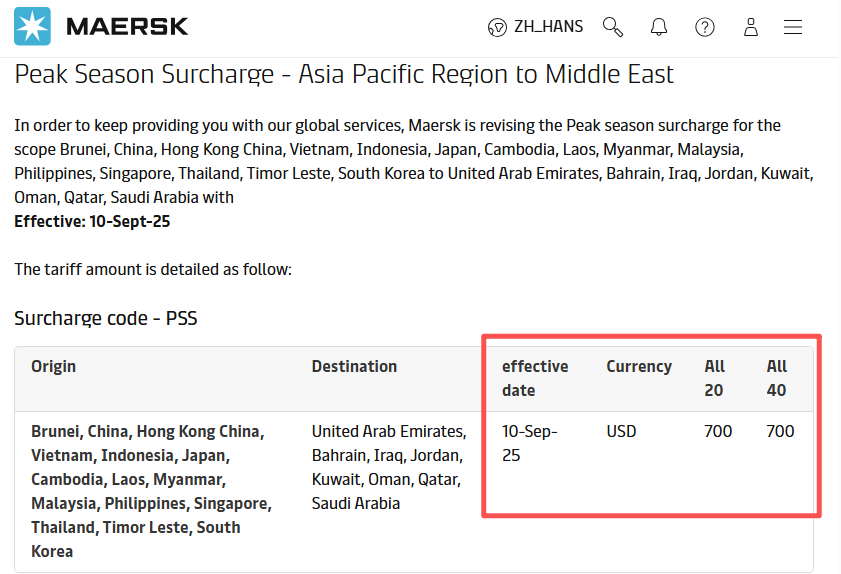

Maersk

Maersk is adjusting the scope of the Peak Season Surcharge (PSS), announcing the imposition of a PSS from the Asia-Pacific region to the Middle East. Starting from September 10, 2025, a surcharge of USD 700 per container will be levied on shipments from Brunei, China, Hong Kong (China), Vietnam, Indonesia, Japan, Cambodia, Laos, Myanmar, Malaysia, Philippines, Singapore, Thailand, Timor-Leste, and South Korea to the United Arab Emirates, Bahrain, Iraq, Jordan, Kuwait, Oman, Qatar, and Saudi Arabia.

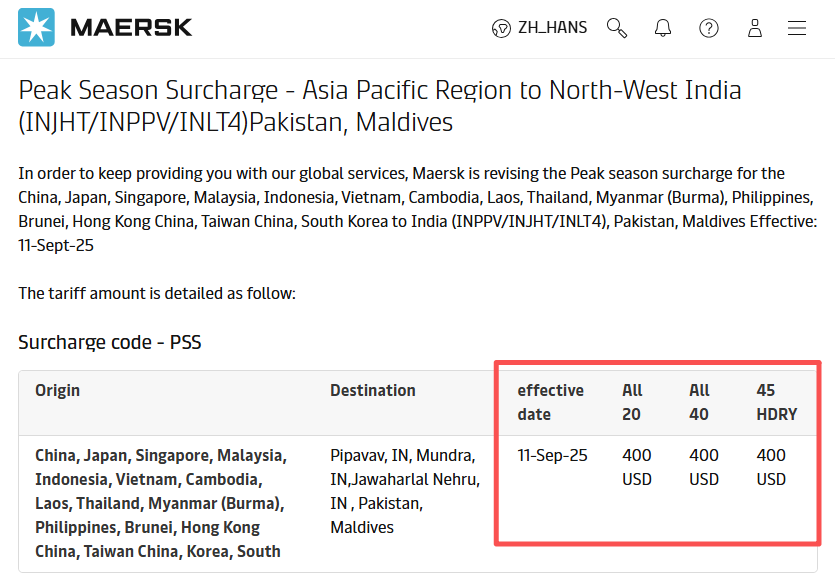

At the same time, Maersk is adjusting the Peak Season Surcharge (PSS) from China, Japan, Singapore, Malaysia, Indonesia, Vietnam, Cambodia, Laos, Thailand, Myanmar, the Philippines, Brunei, Hong Kong (China), Taiwan (China), and South Korea to India (INPPV/INJHT/INLT4), Pakistan, and the Maldives. The effective date is September 11, 2025; a Peak Season Surcharge of USD 400 per container will be applied.

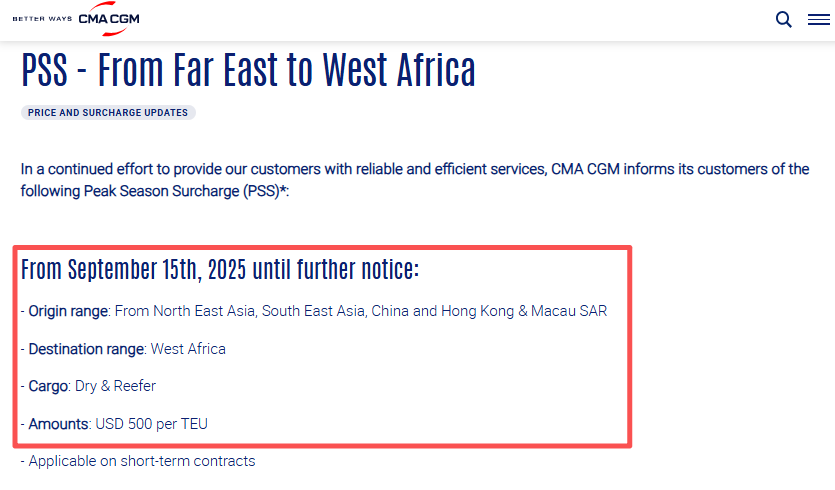

Effective date: From September 15, 2025, until further notice.

Port of departure: Northeast Asia, Southeast Asia, as well as China, Hong Kong Special Administrative Region of China, and Macao Special Administrative Region of China.

Port of destination: Ports in the West Africa region

Applicable goods: dry goods and refrigerated goods

The fee standard: 500 USD per standard container.

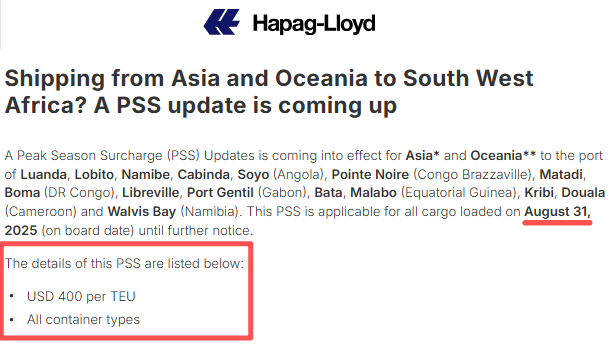

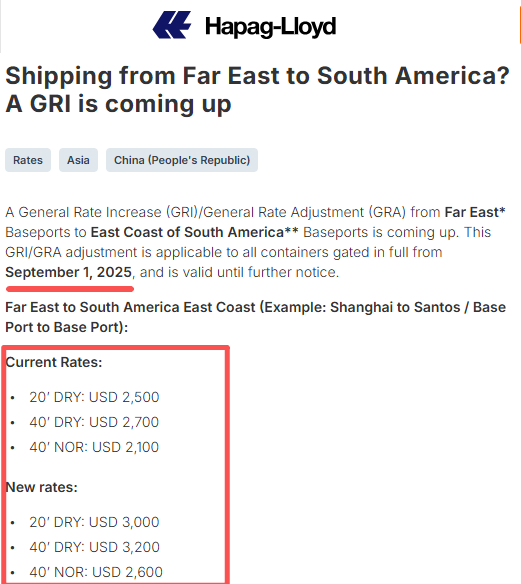

Hapag-Lloyd

Asia-Pacific and Oceania to West Africa

Asia-Pacific and Oceania to Central and West Africa

Far East to East Coast of South America route

U.S. routes may experience a short-term surge in transportation demand.

In the current global trade situation, container shipping on U.S. routes is expected to see a slight recovery in the coming months, potentially experiencing a brief "mini-boom." This is primarily driven by changes in the U.S.-China trade war and new port fee policies.

Recent changes in U.S. trade policy have impacted the global shipping market. Tariffs on China have been suspended until November 10th, maintaining a rate of 10%, while specific product tariffs still exist. There have also been adjustments to tariff policies for countries like Brazil. This uncertainty has made shippers hesitant in their transportation planning. However, with the Christmas shopping season approaching, shippers are under time pressure and are expected to increase shipping volumes in the coming weeks.

A similar situation occurred in May and June this year, where a suspension of tariffs led to a short-term surge in demand and a spike in freight rates. It is expected that the demand for the Pacific route will fluctuate again in August and September. However, shipping companies face challenges in adjusting capacity. For instance, although demand in the North American market is flat this week, liner companies have reduced capacity, resulting in a slight drop in freight rates.

Furthermore, the new port fees following the U.S. Section 301 investigation on Chinese vessels are expected to take effect in October, significantly impacting Chinese shipping companies. To reduce the financial burden, shipping companies may adjust their routes. For instance, COSCO Shipping and its subsidiary, Orient Overseas Container Line (OOCL), might reduce calls at U.S. ports, and OOCL has already announced that its new Pacific route will bypass ports such as Los Angeles.

In the coming months, the demand for U.S. airline transportation will face significant fluctuations. Under the dual impact of the trade war and new fee policies, shipping companies and cargo owners need to closely monitor changes to address market challenges.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track