Shanying International has just divested, and Nordic Paper has achieved a record high in revenue, with net profit nearing historical peaks!

Recently, Norveg Paper officially published its annual report for 2024. The report shows that in 2024, the Norveg Paper Group's sales increased by 4% compared to 2023, reaching SEK 4.668 billion (approximately RMB 335 million), marking a historical high. The group's profit before interest, taxes, depreciation, and amortization increased by 4% year-on-year to SEK 806 million (approximately RMB 57.7 million), reaching the second-highest level ever, with a profit before interest, taxes, depreciation, and amortization rate of 17.3%. The growth in profit before interest, taxes, depreciation, and amortization was mainly due to increased sales volume and optimization of product structure.

The group achieved a net profit of 465 million Swedish kronor (approximately 332 million yuan), with a net profit margin close to 10%. In comparison, Shanying International expects its net profit attributable to shareholders of the listed company for the year 2024 to be between -350 million and -390 million yuan, indicating a loss compared to the same period last year. Additionally, the expected net profit attributable to shareholders of the listed company for 2024, after deducting non-recurring gains and losses, is estimated to be between -650 million and -750 million yuan.

As of now, Nordic Paper has a total of 698 employees across 5 factories, equipped with 9 paper machines. The company serves 730 clients, operating in 81 countries and regions worldwide. In terms of business divisions, the牛皮 Paper division comprises two paper factories: Bekkhamar Paper Mill (with 2 paper machines) and Amotfors Paper Mill (with 2 paper machines). The main revenue source for this division is bagboard paper, accounting for a share of up to 53%. The next largest segments are MG paper and other special papers, with shares of 23% and 24% respectively.

In 2024, the net sales of this business decreased by 2% year-on-year to 2.277 billion Swedish Krona (approximately 1.63 billion RMB), accounting for 48% of the group's net sales. The main reason for this decline was the decrease in product selling prices. Earnings before interest, taxes, depreciation, and amortization (EBITDA) fell by 34% year-on-year to 392 million Swedish Krona. The decline in EBITDA was also primarily due to falling product prices. The EBITDA margin decreased to 17.2%. Operating profit was 331 million Swedish Krona, with an operating profit margin of 14.5%. The majority of the sales revenue in the kraft paper division comes from the European market.

The business department of the natural paper business has set up three paper mills, each equipped with two paper machines, one at the Glaceau paper mill, one at the Quebec paper mill, and two at the Savelle paper mill. The main source of income for this business is the baking paper, with a share of 77%. The second source is the baking paper cup, with a share of 16%.

The net sales of the natural greaseproof paper business department reached 2.448 billion Swedish Krona (approximately 1.752 billion RMB), with a year-on-year growth of 12%, accounting for 52% of the group's net sales. The increase in sales volume and product mix optimization contributed to a 14% growth. Earnings before interest, taxes, depreciation, and amortization (EBITDA) grew by 58% year-on-year, reaching 446 million Swedish Krona. The EBITDA margin improved to 18.2%. Operating profit increased to 366 million Swedish Krona, and the operating profit margin also rose to 14.9%. The majority of sales revenue from the natural greaseproof products department comes from the European market, but North America is also an important market.

Overall, Nordic Paper demonstrated strong operational resilience in 2024. Despite facing challenges such as rising raw material costs, the company achieved double-digit growth in both sales and profits by optimizing its product mix, controlling energy and transportation costs, and strategically investing to improve production efficiency. Its premium market positioning, sustainable production capabilities, and global footprint, particularly the strong performance of its natural greaseproof paper business, laid the foundation for long-term competitiveness. In contrast, Shanying International found itself mired in losses in 2024, presenting a stark contrast to Nordic Paper's impressive performance.

In 2017, Eagle International acquired 100% of Norske Skog's shares for 2.4 billion Swedish kronor, formally entering the high-tech special paper market with high barriers to entry and stronger profitability. Through the establishment of SUTRIV Holding AB in Sweden, Eagle International indirectly holds 100% of Norske Skog's shares. This move is seen as an important step in the company's internationalization strategy.

According to the annual reports of ShanYing International for 2017-2019: In 2017, ShanYing International's net profit was 20.14 billion yuan, while Nordisk Papir's net profit was only 3.168 million yuan; in 2018, ShanYing International's net profit increased to 32.04 billion yuan, with Nordisk Papir's net profit rising to 1.75 billion yuan, accounting for 5.46% of ShanYing International's net profit; in 2019, ShanYing International's net profit was 13.62 billion yuan, with Nordisk Papir's net profit rising again to 2.05 billion yuan, accounting for 14.75% of ShanYing International's net profit.

In October 2020, Nordic paper company became the first Scandinavian company to list on the Nasdaq OMX Stockholm. Following its listing, the company's holding in SUTRIV Holding AB decreased to 48.16%. As a result, Nordic paper company no longer is part of SUTRIV Holding AB's financial report.

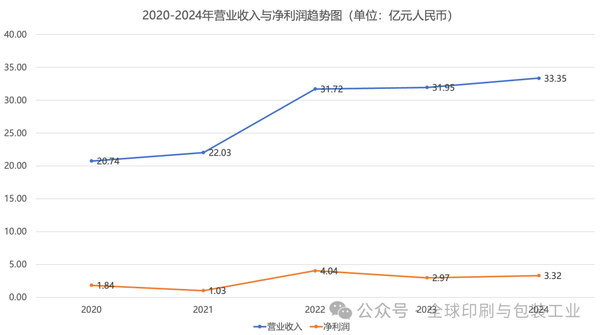

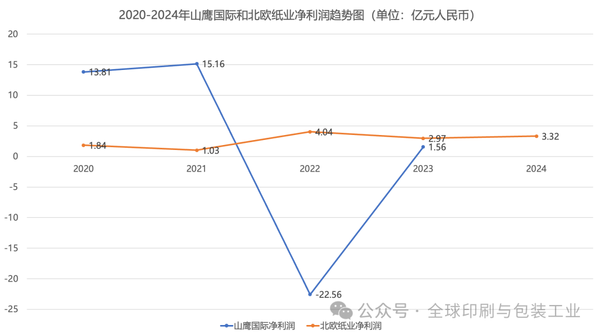

From the annual reports of Shanying International and Nordic Paper from 2020 to 2023, we can see the above chart. Except for the years 2020-2021, Nordic Paper's revenue and net profit have been significantly lower than that of Shanying International; however, since 2022, Shanying International's net profit has not been able to compare with Nordic Paper. In 2022, when Nordic Paper reached its peak net profit, Shanying International suffered a loss of 2.256 billion yuan. In 2024, when Nordic Paper's net profit reached its second-highest in history, Shanying International again faced severe losses.

In October 2024, following the announcement by global investment firm SVP that its newly established company, Coniferous BidCo, would launch a full takeover bid for Nordic Paper, a Swedish manufacturer of kraft paper and greaseproof paper, the largest shareholder of Nordic Paper, China-based Yangtze River Paper Industry, made an irrevocable commitment to accept SVP's offer. At that time, Yangtze River Paper Industry held 48.16% of Nordic Paper's shares (amounting to approximately 1.1 billion RMB), which was also the upper limit for shares set by SVP for this acquisition. On December 3, 2024, the European Commission approved the acquisition case, making SVP the majority shareholder of Nordic Paper.

By previously transferring the stake in Nordisk Paper, Shan Ying International may have temporarily alleviated its financial pressures, but it has given up a profitable, technologically advanced and high-end market core asset. With Nordisk Paper's ability to contribute over 30 million yuan in net profit in 2024, this starkly contrasts with Shan Ying's massive losses, highlighting the further weakening of its profit landscape after divesting its core assets. Meanwhile, Nordisk Paper strengthens its advantages in its niche area through continuous technological investment, whereas Shan Ying International, after divesting Nordisk, urgently needs to clarify new growth areas. Its current loss situation may compel a business structure optimization, but it may face transitional pains in the short term.

The losses of Shanying International and the growth trajectory of Nordic Paper essentially reflect two distinct paths for the transformation of traditional paper manufacturing companies: the former is hampered by cyclical fluctuations in the domestic industry and low value-added competition, while the latter achieves breakthroughs through technical barriers, global expansion, and high-end products. For Shanying International, the sale of the Nordic Paper equity, though a desperate measure for survival, also signifies the abandonment of a long-term value growth engine. In the future, the company needs to focus on cost reduction and efficiency improvement, optimize its product structure, and explore circular economy or emerging sectors.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track