September Home Appliance Production Slows, Air Conditioner Domestic and Foreign Sales Under Pressure

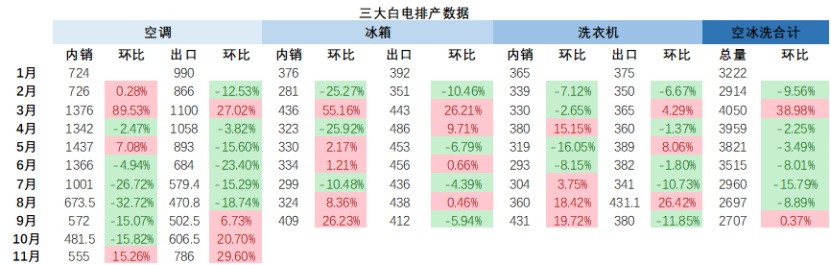

In 2025, the home appliance industry is approaching the critical "Golden September and Silver October" sales period, yet the latest production scheduling data reveals a chill in the air. According to the latest major white goods production scheduling report released by Industry Online, the total production schedule for air conditioners, refrigerators, and washing machines in September is 27.07 million units, a slight month-on-month increase of 0.37%, but a 7.2% decrease compared to the actual performance of the same period last year. This data reflects the complex situation currently faced by the home appliance market: weak domestic demand, pressure on exports, and high inventory levels, among other intertwined challenges.

Air Conditioners: Both Domestic and Foreign Sales Decline, Industry Enters Deep Adjustment Phase

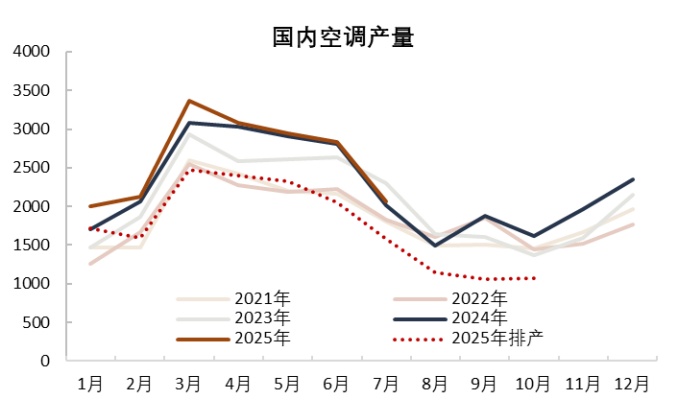

Air conditioners, as the main force in the white goods industry,The production schedule for September is particularly noteworthy. Data shows that in September, the production of household air conditioners reached 10.75 million units, a slight month-on-month increase of 0.94%, but a significant year-on-year decrease of 12.0%. By market segment, domestic sales production was 5.72 million units, down 15.07% month-on-month and 6.3% year-on-year; export production was 5.025 million units, up 6.73% month-on-month but with a sharp year-on-year decline of 16.6%.

What is even more concerning is that the downward trend in industry production scheduling continues.In October, domestic air conditioner production scheduling was 4.815 million units, a month-on-month decrease of 15.82% and a year-on-year decrease of 23.4%; in November, domestic production scheduling was 5.55 million units, a year-on-year decrease of 17.6%. This indicates that enterprises are extremely cautious about market prospects.

The continued decline in air conditioner production is due to multiple factors: many regions across the country have entered the rainy season, and frequent rainy weather has temporarily suppressed air conditioner installation and sales; the withdrawal of energy efficiency subsidy policies in some areas has weakened policy support; last year's national subsidy policy led to a high baseline, compounded by demand overdraft in the first half of the year, resulting in conservative production expectations from enterprises.

Exit direction,In September, although air conditioner export production scheduling increased by 6.73% month-on-month, it still saw a significant year-on-year decline of 16.6%. The high inventory pressure in overseas markets has not eased, and export tariffs remain high, further suppressing companies' willingness to schedule production. In specific markets, Europe showed growth benefiting from high temperatures, Oceania achieved some growth from a low base, but regions such as Asia and Latin America saw declines due to restrictions on transit trade.

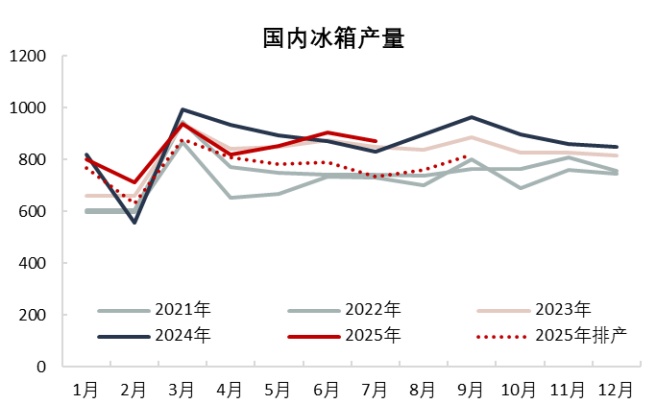

Refrigerators: Domestic sales production increased significantly month-on-month, while exports slightly declined.

Unlike the air conditioner market, the refrigerator market is showing a pattern of internal heat and external cold.In September, refrigerator production reached 8.21 million units, an increase of 7.74% month-on-month, but a decrease of 6.3% year-on-year.

In terms of domestic sales,In September, domestic production scheduling for refrigerators reached 4.09 million units, a significant month-on-month increase of 26.23%, with only a slight year-on-year decrease of 2.1%. This growth was mainly driven by the stimulus from the third round of national subsidies, resulting in a notable upward adjustment of domestic production plans since late August compared to previous expectations. However, in terms of enterprise structure, the increase in production scheduling was mainly concentrated among leading enterprises and small to medium-sized enterprises undertaking OEM orders. Currently, the refrigerator industry exhibits a clear product stratification: most large enterprises have brought the production of mid-to-high-end products back to their own factories, while some mid-to-low-end products are outsourced to OEM manufacturers.

Exit direction,In September, refrigerator export scheduling reached 4.12 million units, a month-on-month decrease of 5.94% and a slight year-on-year decline of 0.8%. It is worth noting that although tariffs on Chinese refrigerators imported into the U.S. remain high, the policy has been extended twice consecutively, providing a relatively stable time window for Chinese refrigerator exports to the United States. From the perspective of the U.S. market performance, the supply gap caused by the continuous decline in the number of refrigerators imported from China has yet to be effectively filled by other regions.

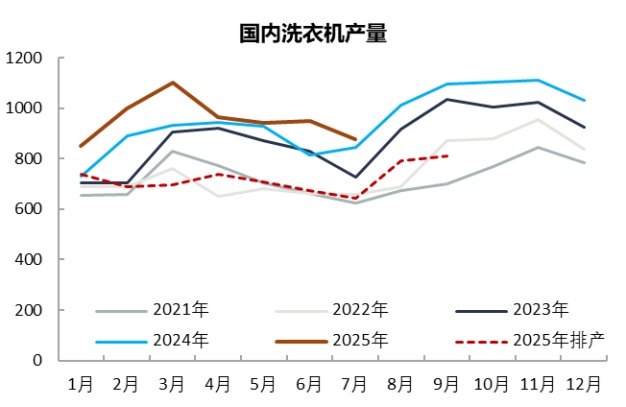

Washing Machines: Significant Domestic Sales Growth, Facing Pressure in Exports

The washing machine market is relatively stable.In September, washing machine production reached 8.11 million units, a month-on-month increase of 2.52%, but a slight year-on-year decline of 1.1%.

In terms of domestic sales,In September, the domestic production schedule for washing machines was 4.31 million units, a month-on-month increase of 19.72%, with only a slight year-on-year decrease of 1.2%. The autumn and winter seasons are relatively peak periods for laundry products, and the washing machine industry begins its year-end sprint preparation period in September. By 2025, the domestic sales market for washing machines will show several clear trends: companies' strategies will gradually shift from "low price for volume" to promoting high-end products; product advancement will move from single products to "scenario-based" solutions; personalized products will become more frequent, with continuous innovations such as AI integration and multi-drum zoning.

Exit direction,In September, the scheduled export volume of washing machines was 3.8 million units, down 11.85% month-on-month and slightly down 1.7% year-on-year. Since August, washing machine exports have faced a slowdown in growth rate and even declines. The pressure mainly comes from the high base effect in the second half of 2024, the impact of US tariffs on steel household appliances, as well as the increase in production capacity at overseas factories resulting from Chinese companies’ “going global” strategy, which has constrained domestic export growth.

Industry Outlook: Challenges and Opportunities Coexist

Overall,The September household appliance production data indicates that the industry is undergoing a period of deep adjustment. The total production volume of the three major categories—air conditioners, refrigerators, and washing machines—fell by 7.2% year-on-year, indicating overall market pressure. However, different subcategories and market performances vary, with the domestic market showing some resilience aided by policy support, while the export market generally faces pressure.

In the coming months, the home appliance industry will continue to face multiple challenges: high inventory pressure has not been fully alleviated, the impact of demand overdraft persists, the effects of policy dividends are weakening, and the export environment is complex and volatile. However, at the same time, some positive trends are emerging in the industry: product structure is continuously upgrading, innovative categories are constantly emerging, and corporate strategies are becoming more refined.

Author: Zhuansu Shijie Market Research ExpertZhao Hongyan

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories