September embodied intelligence: Billions in Financing Frequently Occur, Order Surge and "Bubble Theory" Coexist

In September, the investment boom in the field of embodied intelligence and robotics continued to rise.

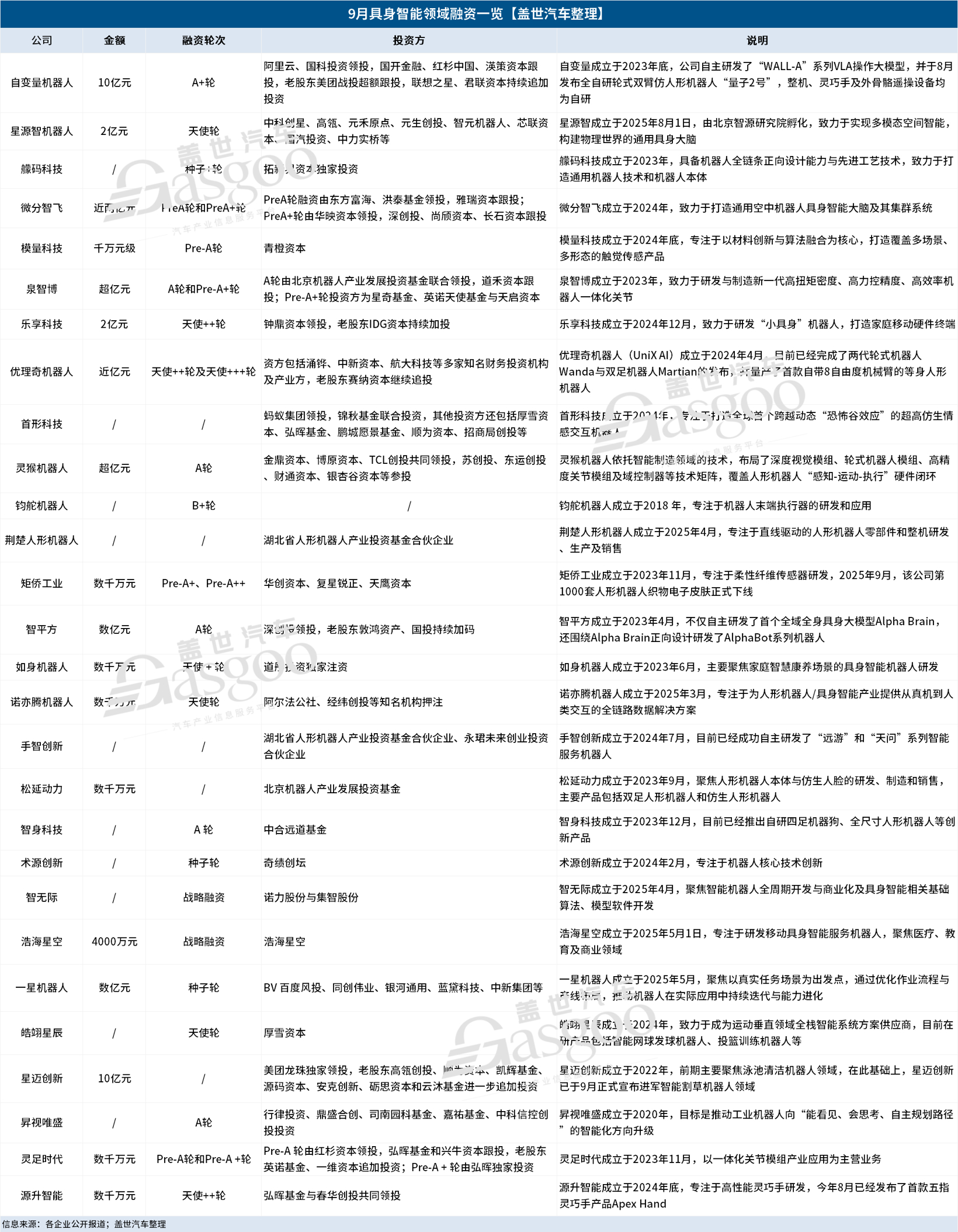

According to statistics from Gasgoo Auto, nearly 30 financing deals were publicly disclosed in the domestic embodied intelligence and robotics sector last month, with known financing amounts approaching 4 billion yuan. Subsequently, the financing in the embodied intelligence track showed several significant features, including leading companies continuously receiving multiple rounds of additional investments, emerging companies flooding into the market, and financing flourishing across various sub-tracks.

Under the deep integration of capital and industry, the embodied intelligence sector is accelerating its transition from the "technology exploration phase" to a new stage of commercial sprint.

Capital PursuitBillion-level financing frequently appears.

In September, the embodied intelligence sector continued to experience a capital frenzy, with multiple financing deals worth billions landing consecutively. This not only demonstrates capital's strong commitment to leading companies in the industry but also reflects the market's strong expectations for the sector's development prospects.

Among them,Independent Variable RobotEmerging with a standout 1 billion yuan Series A+ financing, becoming a focal point in the industry.

This round of financing is led by Alibaba Cloud and Guoke Investment, with additional investments from CDB Capital, Sequoia China, INCE Capital, and Meituan Strategic Investment. Lenovo Star and Legend Capital also continued to increase their investments. Notably, this investment is Alibaba Cloud's first in the field of embodied intelligence, which fully highlights its high recognition of Zibianliang's overall competitiveness.

Founded at the end of 2023, the company Variable focuses on achieving general embodied intelligence through end-to-end unified large models. Currently, the company has independently developed the end-to-end general embodied large model WALL-A and completed independent research and development in key areas such as whole robot systems, high-degree-of-freedom dexterous hands, and exoskeleton remote control data acquisition equipment.

Image Source: Independent Variable Robot

Thanks to its full-stack technology layout, in August this year, Zhibian launched the fully self-developed wheeled dual-arm humanoid robot "Quantum 2". This robot features a humanoid height of 172 cm with a foldable waist design, offering up to 62 degrees of freedom throughout its body, fully meeting the needs for precise operations in complex scenarios such as service, home, and industrial settings.

Currently, Zibianliang's robotic products have partnered with leading service and industrial enterprises in the industry, achieving implementation in multiple scenarios. Thus, it is not difficult to speculate that, in addition to solid technical capabilities, outstanding scenario adaptability and commercialization achievements are also the core factors that continue to attract leading capital investments to Zibianliang.

Since its establishment at the end of 2023, ZiBianLiang has disclosed a total of 8 rounds of financing. In addition to securing 1 billion yuan in its A+ round of financing, its Pre-A++, Pre-A+++, and A rounds have also reached scales of several hundred million yuan, indicating significant capital interest.

Another financing deal worth 1 billion yuan comes fromStar-Micronics InnovationExclusively led by Meituan Longzhu.

Image Source: StarMaker Innovation

Xingmai Innovation primarily focuses on intelligent swimming pool scenarios. Its main products include the AquaSense2 series pool cleaning robots and the iSkimUltra surface cleaning robots. According to official statistics, Xingmai Innovation has entered 38 countries worldwide and is present in over 2,000 offline stores.

In this context, the successful implementation of this financing outcome can be seen as a strong validation of StarMai's innovative business model's sustainability. It also indicates that embodied intelligence has significant market value and broad development prospects in specific vertical scenarios, such as home companionship and smart elderly care.

Square of Wisdom One-star robotIn the latest round of financing, both performed impressively, successfully raising hundreds of millions in funding. Among them, Zhipingfang completed seven rounds of billion-level financing in just six months by the latest round, showcasing formidable strength.

Founded in April 2023, Zhipingfang has, over the past two years, not only independently developed the first comprehensive embodied large model, AlphaBrain, but also designed and developed the AlphaBot series of robots based on AlphaBrain. Consequently, it has provided robotic products and solutions to leading customers in various fields, achieving initial technology implementation and transformation.

From this, it can be seen that Zhipingfang and the independent variable's strategy are somewhat similar, both choosing a bidirectional collaborative layout of embodied large models and robot bodies. By deeply integrating hardware development and model algorithms, they build a complete integrated technology system of both software and hardware.

This phenomenon of strategic convergence essentially reflects the rational evaluation logic of the capital market regarding the competitive barriers and commercial monetization potential of embodied intelligence technology: In the current technological competition landscape, companies that possess independent core hardware research and development capabilities, have advantages in large model algorithm innovation, and can precisely define application scenarios are often more favored by capital.

It is worth noting that this bidirectional collaborative development path has been validated not only in the domestic embodied intelligence sector but also highly recognized in overseas markets. Leading companies in the field of humanoid robots abroadFigureAIIt is a typical example among them.

Image Source: X

In September this year, FigureAI completed a Series C financing round of up to $1 billion. This round was led by Parkway Venture Capital, with tech giants such as NVIDIA and Salesforce also participating. After the investment, FigureAI's valuation soared to $39 billion, making it the highest-valued humanoid robot company in the world.

In terms of technological research and development, FigureAI has independently developed the end-to-end model Helix for humanoid robots. This model allows robots to directly convert the rich semantic knowledge captured in visual language models into actions. Additionally, FigureAI has successively launched several generations of humanoid robot products, including Figure01, Figure02, and Figure03.

Overall, in September, the track was still dominated by ontology manufacturers, with humanoid robot companies continuing to lead the race. It is worth noting that, in order to better overcome performance bottlenecks and cost barriers, many ontology companies have started full-stack technology layouts, extending their research and development efforts into key areas such as software algorithms, joint modules, and dexterous hand systems.

In addition, the enthusiasm in niche sectors remains unabated. Frontier technological fields such as large models, dexterous hands, integrated joints, and electronic skin are also strategic high grounds for capital investment. Over a dozen companies, including Xingyuan Intelligence, Modulus Technology, Quanzhibo, Junduo Robotics, and Lingzu Era, completed a new round of financing in September, with capital precisely positioning itself around key nodes of the industry chain.

Amid Capital Frenzy: Bubble Concerns and Value Reversion

In the current intertwining tide of capital and the haze of commercialization, the embodied intelligence sector is experiencing a dual variation of fervor and prudence.

In the primary market, hot money flows in continuously, and emerging enterprises spring up like mushrooms after the rain. However, beneath this wave of enthusiasm, undercurrents have long been surging—the "bottleneck" predicament of core technologies and the deadlock in validating business models are like a Damocles sword hanging over the industry. They both contain the potential to disrupt the future and imply the risk of a bubble bursting.

In terms of the financing landscape for the embodied intelligence sector in September, although it remains lively, more than 90% of funded companies are still at the Series A or angel round stage, with only a few exceptions like Junduorobot, highlighting the early development stage characteristics of the industry.

Several companies established this year, such as Xingyuan Zhi, Jingchu Humanoid Robot, Yixing Robot, and Zhiwuji, quickly gained the favor of investors shortly after their founding. This phenomenon not only reflects the long-term value judgment of investors on the embodied intelligence sector but also highlights the industry's real need for financial support from investors in its process of technological development and commercialization exploration.

In the capital narrative frenzy of embodied intelligence, the rational alarm has already sounded.

Recently, renowned robotics expert, iRobot co-founder, and MIT professor Rodney Brooks warned investors who are pouring billions of dollars into humanoid robot startups: you are wasting your money.

Image Source: Tesla Official Website

Rodney Brooks pointed out that today's billions of dollars of investment are actually funding expensive training experiments that can never be scaled up for mass production. He specifically questioned companies like Tesla and FigureAI, arguing that their attempts to make robots imitate human actions through video demonstrations belong to "pure fantasy thinking," because the complex structure and tactile sensors of human hands cannot be replicated by robots, and safety issues have not been resolved.

He even compared it to "a race where the finish line keeps moving further back, just like the overpromises of autonomous driving back in the day."

Reflecting on the development trajectory of the autonomous driving industry, its early stages bear a striking resemblance to the current embodied intelligence track. Between 2015 and 2020, autonomous driving was the shining star in the eyes of capital, with countless startups easily securing valuations of hundreds of millions or even billions of dollars based on a technical demo or a grand blueprint.

The logic of the capital market back then is exactly the same as today: target a trillion-dollar market capable of disrupting human society and decisively invest in its nascent stage.

However, the "long tail effect" of technology, which refers to how to handle numerous rare but crucial extreme cases, has become a significant gap between ideal and reality. From L2 to L4, each level of advancement sees an exponential increase in technical difficulty, leading to the repeated postponement of the timeline for full commercialization of autonomous driving. Consequently, the fervor of capital has gradually cooled from its boiling point.

To some extent, embodied intelligence, especially humanoid robots, is on a very similar path to autonomous driving.

Rodney Brooks's view is not an isolated case.

In the domestic venture capital circle, as early as the first half of this year, Zhu Xiaohu, managing partner of GSR Ventures, publicly stated that he had exited multiple embodied intelligence projects and bluntly pointed out that there were signs of overheating in the industry. He believes that the commercial path for embodied intelligence is still unclear, especially in the field of humanoid robots, which will inevitably go through a bubble period before returning to rationality. Zhu Xiaohu likens this process to a "DeepSeek moment," meaning that the market needs to go through a period of frenzy and settling down to find true commercial value.

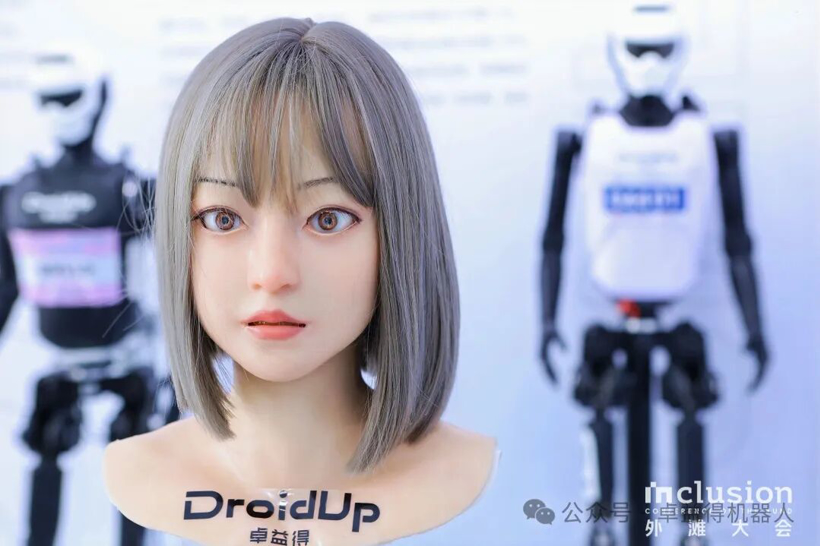

Li Qingdu, founder and CEO of Zhuoyide Robotics, also believes that in the process of humanoid robots racing towards a trillion-level market scale, there will be a "bubble." "Because more and more people are entering this field, and their skills may vary. Some people may be average and lack so-called innovative capabilities, but of course, there are also many professionals and highly capable robotics entrepreneurs."

Image Source: Joydeed Robotics

In the early stages of the autonomous driving industry, a large number of companies emerged in this field. However, as technological bottlenecks and commercialization pressures became apparent, the market underwent several rounds of reshuffling. A batch of companies with overinflated valuations, singular technological paths, or insufficient commercialization capabilities either had to shut down or were acquired at low prices after their valuations shrank. The industry gradually transitioned from fervor to rationality.

However, from a valuation perspective, Li Qing believes that humanoid robots have not yet reached the "bubble" stage.

Liu Tianjie, a director at Huaying Capital, previously stated that he does not believe there is a bubble in embodied intelligence at present. "Companies in the industry are indeed not cheap right now, but we are ultimately targeting a trillion-dollar market. In the early stages of a trillion-dollar market, the emergence of companies worth tens of billions is a very normal thing."

However, he also pointed out that as the hype decreases, companies in this sector may not be able to secure funding for a period of time in the future.

Zheng Yong, head of technology mergers and acquisitions at China Renaissance, pointed out from historical patterns that there will be a short-term bubble in the robotics industry, similar to the mobile internet of the past. Many companies will be overvalued, but ultimately real giants will emerge from the bubble. "A good company is not necessarily the first one to start, but it will definitely be among the first batch," noted China Renaissance.

It is evident that the bubble risk in the embodied intelligence field is unavoidable and has become a common consensus. A deeper analysis reveals that the contradiction between capital frenzy and technological bottlenecks, the ambiguity of commercialization paths, and the varying quality of participants all contribute to the uncertainty in the industry.

However, from a long-term perspective, the technological value and market potential of embodied intelligence have not been negated. As demonstrated by the development trajectories of autonomous driving and mobile internet, a bubble period is often a necessary stage for an industry to mature. Ultimately, what determines a company's success or failure is not the scale of financing or market popularity, but its ability to implement the technology and the efficiency of its commercialization.

Only after the bubble has receded will the true value leaders emerge.

Large orders frequently appear, taking big strides towards commercial breakthroughs.

Under the continued impetus of capital boom, the embodied intelligence industry is advancing towards mass production at an unexpectedly rapid pace.

In September, with the continued rise in financing activity in the field of embodied intelligence, multiple companies announced the signing of large orders ranging from tens of millions to billions of yuan. This accelerates the transition from laboratory demonstrations to real-world deployments, responding to market expectations and doubts with concrete actions.

Image Source: UBTECH

September 29,UBTECHTianqi Co., Ltd. announced a purchase of WalkerS series industrial humanoid robots worth a total of 30 million yuan, with delivery to be completed by December 31, 2025. This is the second major order secured by UBTECH in September. Earlier, at the beginning of the month, UBTECH also obtained a 250 million yuan contract for embodied intelligent humanoid robot products and solutions from a well-known domestic enterprise.

With the latest order, it has been reported that the UBTECH Walker series humanoid robots have cumulatively received contracts worth nearly 430 million yuan, including orders of nearly 50 million yuan delivered in the first half of the year. Additionally, since its release in March this year, the company's full-sized scientific research and educational humanoid robot, Tiangong Walker, has received orders for over a hundred units and is currently in the process of batch delivery.

September 14th,Zongqing RobotSigned a strategic cooperation agreement with Duolun Technology and reached a framework procurement cooperation intention: In the next three years, based on project progress and market demand, it is expected to purchase no less than 2,000 embodied intelligent humanoid robots for deployment in key field scenarios.

September 11th,Square of WisdomA strategic cooperation has been reached with HKC's wholly-owned subsidiary, Shenzhen Huizhi IoT. Over the next three years, more than 1,000 embodied intelligent robots will be deployed at HKC's global production bases, covering the entire process of warehousing logistics, material handling, component assembly, and quality testing. The estimated order value of this cooperation is expected to be close to 500 million RMB.

Prior to this, Zhifang has successively established strategic partnerships with enterprises such as Geely's Crystal Micro, Huaxi Bio, Dongfeng Liuzhou Motor, and Vietnam's Geleximco. They have taken the lead in deploying their Aibao intelligent robots in various fields, including automobile manufacturing, biotechnology, and public services.

Image source: Stardust Intelligence

September 2nd,Stardust IntelligenceAnnouncing a strategic partnership with Xian Gong Intelligence for humanoid robots, aiming to collaboratively deploy over a thousand AI robots in industrial, manufacturing, warehousing, and logistics scenarios on a large scale and in phases over the next two years.

While domestic market demand continues to surge, positive signals are also coming from overseas markets.

October 9th,FigureAIFigure03 has been released as a major update. Designed as a dedicated hardware support system specifically for Helix, Figure03 comprehensively upgrades previous issues such as perception latency, insufficient motion accuracy, and data loop breakage. According to official disclosures, leveraging the BotQ manufacturing plant built specifically for Figure03, the product aims to achieve a production target of 100,000 units within four years.

This series of intensive order announcements and cooperation signings signifies that the embodied intelligence industry is making great strides from the technology research and development stage to the commercial application stage.

Based on the characteristics of the orders, the purchasing entities are primarily traditional manufacturing enterprises. The application scenarios are concentrated in labor-intensive areas with a high degree of standardization in operational processes, such as logistics handling, production manufacturing, and quality inspection. The order amounts range from tens of millions to hundreds of millions of yuan, with delivery times generally set within 1-3 years. These features indicate that the market demand for embodied intelligence has shifted from early-stage technology validation and conceptual exploration to a new phase of addressing actual business pain points and creating real commercial value.

However, the challenges faced by the industry should not be underestimated.

In the case of the humanoid robot sector, it has become the focus of the capital market due to its tremendous development potential. However, Rodney Brooks believes that successful humanoid robots in the future will actually be equipped with wheels, multiple arms, and specialized robotic sensors, meaning that they will not resemble humans in form and appearance.

Rodney Brooks' perspective not only breaks the industry's common "humanoid obsession" but also reveals a core fact: in the commercialization process of embodied intelligence, functional practicality is the core element driving market value, and an excessive pursuit of bionic form may instead become a shackle to a company's development.

Moreover, from a business logic perspective, while the frequent occurrence of large orders in embodied intelligence certainly injects a "booster" into the industry, the real "touchstone" for testing the industry's true quality will be whether these orders can be delivered on time, whether their performance meets expectations, and whether the return on investment is reasonable.

This means that, in addition to addressing technical challenges, companies in the field need to demonstrate comprehensive competitive strength in areas such as cost control, building supply chain resilience, and establishing a full lifecycle service system.

Throughout the history of the technology industry, almost all disruptive technologies undergo a long uphill journey of "conceptual emergence - implementation pains - scale breakthrough." From this perspective, the current embodied intelligence industry is at a critical turning point just before dawn: the dense announcements of orders are like the rumblings of spring thunder, indicating that the "rainy season" of large-scale application may be imminent.

In such an industry window, rational examination and constructive criticism are more important than capital enthusiasm and order frenzy. True commercial success has never been about how much money was raised or how many letters of intent were signed, but rather whether the product can continuously create value in practical application scenarios and build a virtuous ecological cycle of "technology development - scenario application - commercial monetization."

Only technologies and products that withstand the test of real-world applications can truly drive the industry towards a mature future. After all, in the long cycle of commercial development, all short-term market noise will eventually give way to long-term value accumulation and continuous innovation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track