Ruifeng Advanced Materials Sees Modest Revenue Growth in First Half, PBAT Modified Products Achieve Bulk Sales

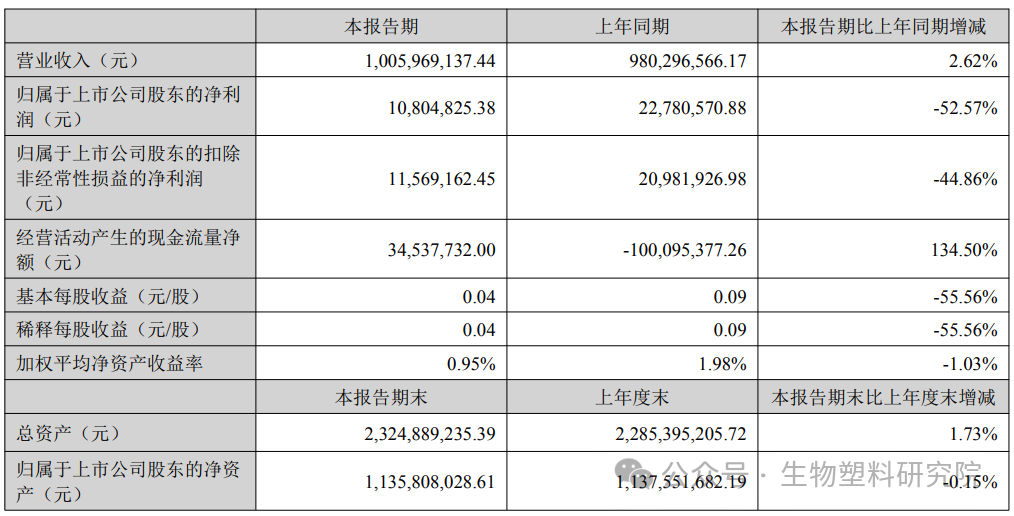

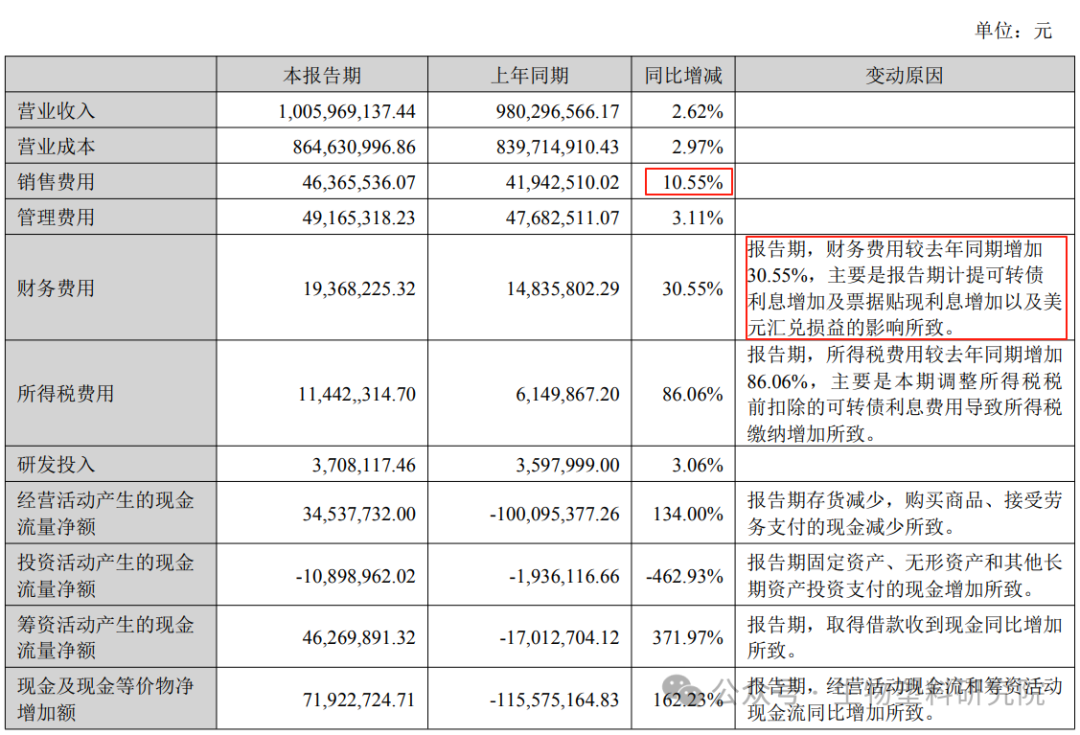

Ruifeng Advanced Materials(300243) Announcement: In the first half of the year, the company achieved an operating revenue of 1.01 billion yuan, an increase of 2.6% year-on-year; net profit attributable to shareholders was 10.8 million yuan, a decrease of 52.6% year-on-year; net profit attributable to shareholders excluding non-recurring gains and losses was 11.57 million yuan, a decrease of 44.9% year-on-year. Despite the decline in performance, the company is steadily progressing in its traditional business while actively exploring new business areas, laying the groundwork for future development.

Traditional business is steadily progressing, and the growth rate of engineering plastic additives is impressive.

As a company specializing in the production and sales of plastic additives and engineering plastic additives, Ruifeng Advanced Materials currently has a comprehensive production capacity of nearly 200,000 tons. During the reporting period, the company adhered to its traditional PVC additives business while leveraging technological innovation to successfully develop toughening modifiers for PC/ABS alloy materials and high rubber powder for ABS, gradually expanding its market share.

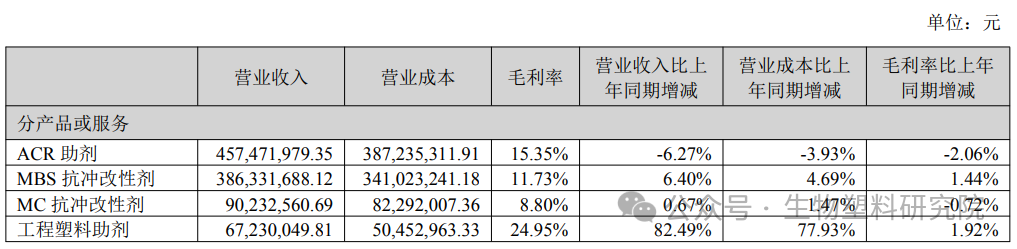

Benefiting from the growth in the overall sales of its main products, the company achieved a year-on-year increase in sales revenue. Among them, the performance of engineering plastic additives was particularly outstanding, with sales revenue of 67.23 million yuan in the first half of the year, a significant increase of 82.49% compared to the same period last year, becoming an important force driving revenue growth. However, due to increased expenses and expenditures, the company's performance declined in the current period.

Degradable materials continue to advance, but market promotion still faces pressure.

In the field of biodegradable materials, the company’s layout continues to advance, currently possessing a production capacity of 60,000 tons of PBAT. In the first half of 2025, the company utilized self-produced PBAT products for modification and has achieved mass sales of modified PBAT products.

However, as an emerging industry in China, biodegradable materials are still in the early stages of development. Market promotion faces certain pressures due to factors such as underperformance in policy implementation, an incomplete supporting system across the upstream and downstream industry chains, and higher prices of downstream products compared to traditional non-degradable products. The downstream demand for PBAT products is also greatly affected by raw material prices and the implementation of relevant policies in the biodegradable materials market.

The diversified new business layout holds promising potential for future growth.

It is worth noting that Ruifeng High Materials is actively carrying out the research, development, and investment of multiple new products to seek new growth drivers for the company's future development.

Specialty Polyester Materials Business: The company's 60,000-ton PBAT production facility can accommodate the production of specialty polyesters such as PETG/PCTG, and the related products have successfully passed pilot tests. The company is currently undergoing technical transformation of this facility to enable it to meet the industrial production of PETG/PCTG products simultaneously, with the transformation work expected to be completed by September 2025, aiming for operation in October. PETG/PCTG products are mainly used in fields such as personal care packaging, home appliances, sheet film products, medical devices, and 3D printing.

Synthetic Biomaterials Business: The wholly-owned subsidiary Ruifeng Bio has completed pilot production of one-step polylactic acid, succinic acid, and dextran products. Among them, the dextran product has already achieved small-batch sales. The company plans to further expand the market and increase production capacity when appropriate. This product is mainly used in the biopharmaceutical field.

Battery Binder Materials Business: The company has launched certain grades of SBR series and other series of anode binder products, which have been sampled and are undergoing testing with multiple lithium battery enterprises. Currently, performance improvement R&D is being carried out to benchmark against imported products. These products are mainly used in lithium-ion battery fields such as 3C, energy storage, and power batteries.

Black phosphorus product business: The holding subsidiary Ruifeng Yuanneng has completed the normal operation of a 100-kilogram scale black phosphorus pilot plant in 2024. Through continuous research and optimization, the reaction conditions have been lowered, efficiency and yield have been improved, and costs have been reduced. Currently, a ton-scale black phosphorus pilot production line is under construction, expected to be completed and put into operation by September. Subsequently, efforts will be actively made to connect with downstream applications and promote cooperation. As a two-dimensional semiconductor material, black phosphorus has broad potential applications in fields such as new energy battery anode materials, flame retardants, catalysts, electronics and semiconductors, and innovative pharmaceuticals.

Although these new businesses are currently in the early stages, they offer vast potential for the company's future growth. Overall, Ruifeng High Materials is seeking new breakthroughs through a diversification strategy while maintaining stability in its core operations, making its future development promising.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track