Revenue decreased, but net profit increased. How did this company achieve that?

According to statistics from the China Petroleum and Chemical Industry Federation, the chemical sector is expected to achieve operating revenue of 9.76 trillion yuan in 2024, a year-on-year increase of 4.6%, while profits are projected to be 454.44 billion yuan, a year-on-year decrease of 6.4%. The reality facing most chemical enterprises in 2024 is that they are experiencing revenue growth without profit growth; however, Wanhua Chemical has delivered an exceptional performance.

Recently, Wanhui High-tech released its annual report for 2024.Achieved operating revenue of 8.03 billion yuan, a year-on-year decrease of 2.82%.Attributable to shareholders of the listed companyNet profit of 370 million yuan, a year-on-year increase of 8.20%.The net profit attributable to the parent company after deducting non-recurring gains and losses is 323 million yuan, a year-on-year increase of 27.27%.Export revenue reached 242 million USD, a year-on-year increase of 9.01%.。

It can be seen that while Wanwei High-Tech's revenue has decreased, it has still achieved an increase in net profit. Compared to many chemical companies, this performance is truly surprising. Next, let's analyze Wanwei High-Tech's core business and market competitiveness to uncover the growth logic behind it.

I. Understanding Anhui Wuwei High Technology

Anhui Wanwei High New Material Co., Ltd. is one of the subsidiaries under Anhui Wanwei Group. Anhui Wanwei Group has six subsidiaries, and Anhui Wanwei High New Material Co., Ltd., as the core subsidiary of the group, was listed on the Shanghai Stock Exchange in May 1997 (stock name: Wanwei High New, stock code: "600063").

Wanhui Group is an important chemical, chemical fiber, building materials, and new materials manufacturing enterprise in Anhui Province.Total assets exceed 10 billion yuan, annual sales revenue is 10.206 billion yuan, and export earnings exceed 300 million US dollars.The company's main business is the research, production, and sales of polyvinyl alcohol (PVA) and its derivatives.

The group has an annual production capacity of 350,000 tons of polyvinyl alcohol (PVA), 600,000 tons of VAC, 120,000 tons of methyl acetate, 500,000 tons of calcium carbide, 40,000 tons of high-strength high-modulus PVA fibers, 60,000 tons of polyester chips, 140,000 tons of VAE, 40,000 tons of redispersible powder, 40,000 tons of PVB resin, 40,000 tons of PVB film, 12 million square meters of PVA optical films, 7 million square meters of polarizers, and 4 million tons of cement clinker. Among these, PVA and high-strength high-modulus PVA fibers have ranked first in production and sales in the national industry for many years; PVB resin and films are among the top in the country, and PVA optical films are a domestic innovation.

Wanhui Group's main business is the research and development, production, and sales of polyvinyl alcohol (PVA) and its derivatives. This business has been operated by its subsidiary Anhui Wanhui High-tech Materials Co., Ltd. (hereinafter referred to as Wanhui High-tech). Currently, Wanhui High-tech is one of the largest producers of PVA series products in China and a leading enterprise in the domestic PVA film sector.

China is the largest producer of PVA.

Polyvinyl alcohol (PVA) is a water-soluble polymer made from the polymerization and hydrolysis of vinyl acetate (VAc). It has good chemical stability and exhibits excellent insulation, film-forming, gas barrier, water solubility, adhesion, interfacial chemistry, solvent resistance, and thermal stability. PVA is mainly used in adhesives, emulsifiers, and dispersants.

Currently, the global production of polyvinyl alcohol (PVA) is mainly concentrated in a few countries and regions, including China, Japan, and the United States.The total production capacity is approximately 1.85 million tons.Representative PVA companies mainly include Kuraray Co., Ltd. from Japan, Sekisui Chemical Co., Ltd. from Japan, Nippon Synthetic Chemical Industry Co., Ltd. from Japan, Anhui Wanwei High-Tech Materials Co., Ltd., China Petroleum & Chemical Corporation, Chang Chun Group from Taiwan, Inner Mongolia Shuangxin Environmental Protection Materials Co., Ltd., and Ningxia Dadi Recycling Development Co., Ltd.

Since the Beijing Oriental Petrochemical Co., Ltd. (formerly Beijing Organic Chemical Plant) introduced technology from Japan to build China's first PVA production facility using the calcium carbide acetylene method (which was changed to the petroleum ethylene method in 1995), the production scale of China's PVA industry has been continuously expanding, making the country a major PVA producer in the world. At the same time, with the continuous rise in downstream demand, domestic consumption of PVA has also increased correspondingly.

During the "13th Five-Year Plan" period, under the guidance of industrial structure adjustment, the domestic PVA industry began to reduce capacity. A number of companies, including Jiangxi Jiangwei High-Tech Co., Ltd., Hunan Xiangwei Co., Ltd., Fujian Textile Chemical Fiber Group Co., Ltd., Yunnan Yunwei Co., Ltd., Beijing Oriental Petrochemical Co., Ltd. organic chemical plant, Guizhou Crystal Organic Chemical Group Co., Ltd., and Lanzhou New West Vinylon Co., Ltd., have closed or permanently ceased production, totaling over 300,000 tons of capacity, completing the first round of reshuffling.

In the first half of 2024, the total production capacity of PVA in mainland China is 1.096 million tons, with major producers including Anhui Wanwei Hi-tech and Sichuan Vinylon Works. Anhui Wanwei Hi-tech is one of the largest and most technologically advanced producers of PVA series products in the country.

3. PVA Supply and Demand Situation and Demand Structure Analysis

The demand for polyvinyl alcohol is mainly concentrated in Northeast Asia, North America, and Western Europe, with these three regions accounting for approximately 85% of global consumption. China is the largest consumer market for polyvinyl alcohol in the world, with a consumption volume accounting for about 50% of the global total. In recent years, while the total consumption of polyvinyl alcohol in China has remained stable, the consumption structure has been continuously optimized, with an increasing proportion of high value-added demand from downstream industries.

According to data from Guanyan Tianxia, the production of polyvinyl alcohol (PVA) in China in 2022 was approximately 802,000 tons, with an apparent consumption of 639,600 tons, indicating that domestic production capacity has met domestic demand. The aforementioned also mentions that during the "13th Five-Year Plan" period, under the guidance of industrial structure adjustment, the domestic PVA industry began to reduce production capacity, further confirming this viewpoint.

In the domestic consumption structure of polyvinyl alcohol, the proportion of polymer additives is 38%, fabric pastes account for 20%, adhesives make up 12%, and vinylon fibers represent 11%. Other applications are mainly concentrated in areas such as papermaking, building coatings, PVB, and dispersants. In recent years, the demand for high-value-added emerging fields such as PVB and PVA water-soluble films has been steadily increasing. However, compared to the global market, the proportion of high-end demand for PVB and PVA films in China's polyvinyl alcohol consumption structure is still relatively low, indicating significant market potential for growth in related fields.

In 2024, PVA export volume reaches a historic high.

In the absence of significant growth in the domestic PVA market, one reason why Wanwei High-tech was able to deliver such an outstanding performance is the explosion of the overseas market.

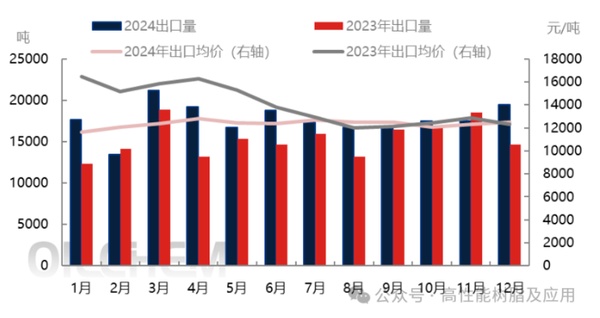

In 2024, China's export volume of polyvinyl alcohol (PVA) reached 212,000 tons, a year-on-year increase of 15.2%, marking the highest level in history. Based on the price advantage of domestic PVA, the supply side has abundant export orders for some key production facilities, maintaining a high export volume.

China's PVA prices are the lowest in the world, providing a significant export advantage. Domestic downstream users maintain a steady demand for procurement. However, due to insufficient domestic demand, PVA production enterprises are actively engaged in export operations.

From the perspective of export destinations, India, Malaysia, and South Korea rank as the top three. The main export direction is focused on near-sea transportation to surrounding regions. In 2024, with overseas energy costs remaining high, the demand for domestic PVA in Europe is stable, and China's exports to Europe and the United States have shown a significant increase compared to the same period last year.

End of text

Currently, Anhui Wuwei High-tech is actively laying out its strategy for the high-end PVA market. The company’s high-strength, high-modulus polyvinyl alcohol (PVA) fiber products have the highest output in the country, accounting for over 60% of the national total, with an international market share of approximately 35%. The company has independently developed "optical-grade super mirror, large-size casting roller research and application technology," which has significantly reduced the construction costs of production lines for optical films made from PVA used in polarizers, thereby greatly lowering the raw material costs for the domestic display industry and breaking the foreign monopoly on high-end PVA optical films.

Wanhua Chemical has managed to break through during a challenging period for the industry, with its success attributed to precise strategic planning and differentiated competition strategies. In response to the challenges of balancing supply and demand in the domestic PVA market, the company has achieved breakthroughs by optimizing its product structure and focusing on high value-added sectors: on one hand, relying on technological accumulation to penetrate high-end markets such as optical films to fill the gaps with domestically produced alternatives; on the other hand, fully leveraging China's global price advantage in PVA to deepen its overseas market layout. Looking ahead, as new demands arise in fields such as new energy and environmentally friendly materials, Wanhua Chemical continues to intensify its R&D in special PVA and coordination of production capacity, which is expected to solidify its leading position in the global industrial restructuring and provide a model for the transformation and upgrading of Chinese chemical enterprises.

Source: Wanwei High-tech Official Website, Guanyan Tianxia, High-performance Resins and Applications, Puhua Youce

Editor: Shi Shenbing

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track