Revenue and Net Profit Both Fall! Half-Year Results of Rongsheng, Hengyi, and Hengli Released, Is the Private Refining Industry Facing a Cold Winter?

According to the reports released by the three major refining giants, their performance has been somewhat impacted by unfavorable factors such as a sluggish macroeconomic recovery and fluctuations in crude oil prices. However, a thorough review and analysis reveal that these industry leaders are continuously making efforts by enhancing their integrated industrial chain advantages, advancing technological upgrades, and investing in high-end chemical materials, actively seeking strong support points for the next round of breakthrough development.

Hengyi Petrochemical: Half-year revenue of 55.96 billion yuan, with a significant increase in R&D investment.

Hengyi Petrochemical is a representative enterprise in the petroleum and petrochemical industry. Its main businesses include petrochemical and chemical fiber production and sales, petrochemical finance, and petrochemical trading.

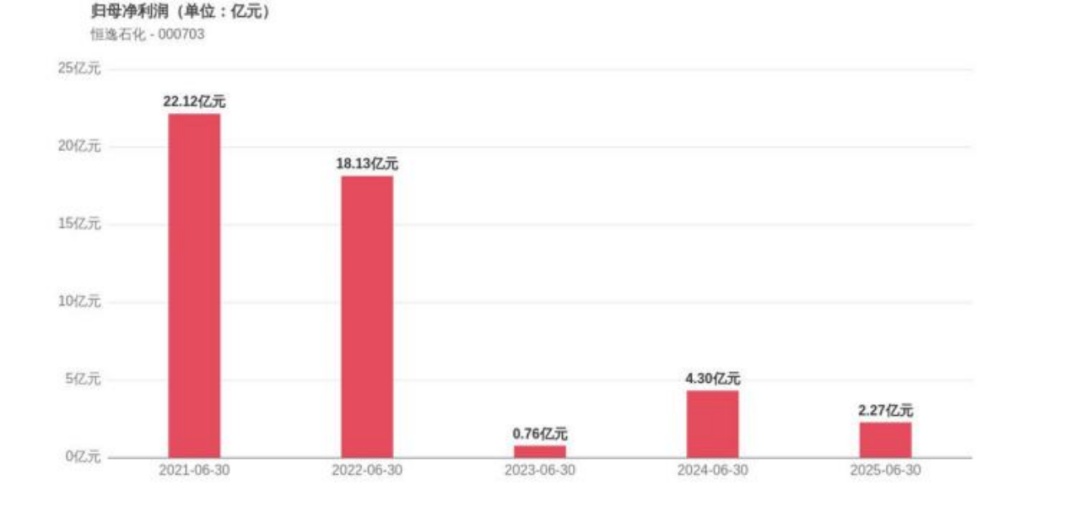

The performance report released by Hengyi Petrochemical shows thatIn the first half of 2025, Hengyi Petrochemical's operating revenue was 55.96 billion yuan, down 13.59% year-on-year, and net profit attributable to shareholders was 227 million yuan, down 47.32% year-on-year.

In the context of overall pressure on industry prosperity, Hengyi Petrochemical relies on the "one drop of oil, two strands of silk" strategy to continuously deepen its three core business segments: refining, PTA, and polyester fiber. It has established a full industry chain capacity layout with 8 million tons/year of refining, 21.5 million tons/year of PTA, and 13.25 million tons/year of polymerization, continuously strengthening its advantages in industrial integration.

In terms of key projects, the first phase of the Brunei refinery project overseas (with a capacity of 8 million tons per year) is operating smoothly. As the largest single investment project overseas by a domestic private enterprise, it has long-term growth potential due to the growth in demand in Southeast Asia and the tight supply-demand situation in the region.The 1.2 million-ton caprolactam-polyamide integration project in Guangxi is also about to be put into operation.The company will further extend its industry chain domestically, enhancing cost optimization and product synergy capabilities.

△Hengyi Petrochemical is mainly divided into core business segments such as the refining and chemical segment, PTA segment, and polyester segment. (Image source: Hengyi Petrochemical)

Research and product structure optimization are also key focus areas for the company. In the first half of 2025, Hengyi Petrochemical's R&D expenditure reached 460 million yuan, a year-on-year increase of 23.97%, with 300 invention patent applications submitted. The proportion of differentiated filament production rose to 27%, and the company accelerated the development of biodegradable fibers and high value-added products, promoting the chemical fiber industry towards green and low-carbon development.

It is worth mentioning that in the "Top 50 Global Chemical Companies of 2025" list published by Chemical & Engineering News (C&EN), Hengyi Petrochemical ranked 35th, rising 5 places compared to the previous year, demonstrating its growing influence in the global chemical industry chain.

Hengli Petrochemical: Revenue of 103.887 billion in the first half of the year, with prices of full-chain products under pressure.

Hengli Petrochemical's semi-annual report for 2025 shows,In the first half of the year, the company's operating income was 103.887 billion yuan, down 7.69% year-on-year. The net profit attributable to shareholders was 3.05 billion yuan, a year-on-year decrease of 24.08%, with basic earnings per share of 0.43 yuan. The net profit attributable to shareholders after excluding non-recurring items was 2.296 billion yuan, down 35.16% year-on-year.

During the reporting period, Hengli Petrochemical attributed the pressure on the prices of its main products to the weak macroeconomic conditions and the decline in industry prosperity, resulting in a decrease in both revenue and profit.The main operating data announcement shows that the prices of the company's three major products all declined in the first half of 2025. Among them, the refining and chemical products sold 9.396 million tons, achieving operating revenue of 47.71 billion yuan, with an average selling price of 5,077.67 yuan/ton, down 5.61% year-on-year; PTA sold 7.6037 million tons, achieving operating revenue of 32.311 billion yuan, with an average selling price of 4,249.42 yuan/ton, down 19.41% year-on-year; new material products sold 2.8742 million tons, achieving operating revenue of 19.991 billion yuan, with an average selling price of 8,103.95 yuan/ton, down 14.17% year-on-year.

In recent years, Hengli Petrochemical has been firmly advancing its strategies of high-end, integrated, and green development. By leveraging the path of "transforming basic chemical products into high-end new materials," the company deeply integrates the advantages of integrated refining and chemical operations with the development of high value-added downstream products, making every effort to accelerate the process of independent innovation.

Kanghui New Materials Technology Co., Ltd. (referred to as "Kanghui New Materials"), a subsidiary of Hengli Petrochemical, is expected to complete the full commissioning and start production of its functional film and lithium battery separator projects at the Nantong base by August 2025. The project was launched in 2022, and the construction of the plant buildings is basically completed, with some production lines already installed, commissioned, and put into operation. Upon reaching full production capacity, it is expected to achieve an annual output of 500,000 tons of functional polyester film and 1.5 billion square meters of lithium battery separators.

Hengli Petrochemical has completed a large-scale project, the Hengli New Materials Science and Technology Innovation Park Phase I, in the Changxing Island Industrial Park in Dalian, with a total investment of over 50 billion yuan. The innovation park can convert basic chemical products into high-end chemicals and new material products, accelerating the domestic replacement of imports.

The first phase of the project has been fully completed and put into operation, focusing on the following three main sectors:

-

2.6 million tons/year functional polyester project

Construct 3 production lines with an annual capacity of 600,000 tons, 2 production lines with an annual capacity of 300,000 tons, and 2 production lines with an annual capacity of 100,000 tons for polyester, mainly producing high-end products such as industrial filament-grade polyester chips, film-grade polyester chips, photovoltaic material polyester chips, and film-grade masterbatch polyester chips. The project leverages the advantages of PTA and ethylene glycol raw materials at the Changxing Island base to directly convert them into differentiated materials, providing support for downstream high-end applications such as MLCC release base films, optical films, and photovoltaic films. -

1.6 Million Tons/Year High-Performance Resin and New Materials Project

Focusing on the extension of the C2 value chain and the improvement of coal chemical production capacity, covering fine chemical products such as Bisphenol A, Polycarbonate, electronic-grade DMC, Isopropanol, Ethanolamine, Ethylenediamine, and Polyoxymethylene. These products can replace imports, fill the domestic gap in high-end materials, and enhance the company's competitiveness in the electronics, automotive, and medical fields. -

60,000 tons/year BDO (Phase I) Project

BDO (1,4-Butanediol) is a key raw material for biodegradable materials such as PBS and for solvents in lithium battery electrolytes. Upon completion of the first phase of the project, it will provide important support for the new energy materials industry chain at the Changxing Island base.

At the same time, Hengli Petrochemical has made optimizing its management structure a core focus, driving improvements in operational efficiency and cost reduction.Hengli Petrochemical recently announced that its wholly-owned subsidiary, Hengli Refining & Chemical, will merge Hengli Chemical through absorption.After the merger is completed, Hengli Refining & Chemical will continue to operate, while Hengli Chemical will be deregistered. Its assets, creditor’s rights and debts will be assumed by Hengli Refining & Chemical. The purpose is to optimize the management structure, improve operational efficiency, reduce management costs, and leverage the synergetic benefits of resource integration.

Hengli Refining & Chemical plans to merge Hengli Chemical by absorption. (Image source: Hengli Petrochemical)

Rongsheng Petrochemical: Revenue reached 148.63 billion yuan in the first half of the year! The 76 billion yuan Jintang project is accelerating construction.

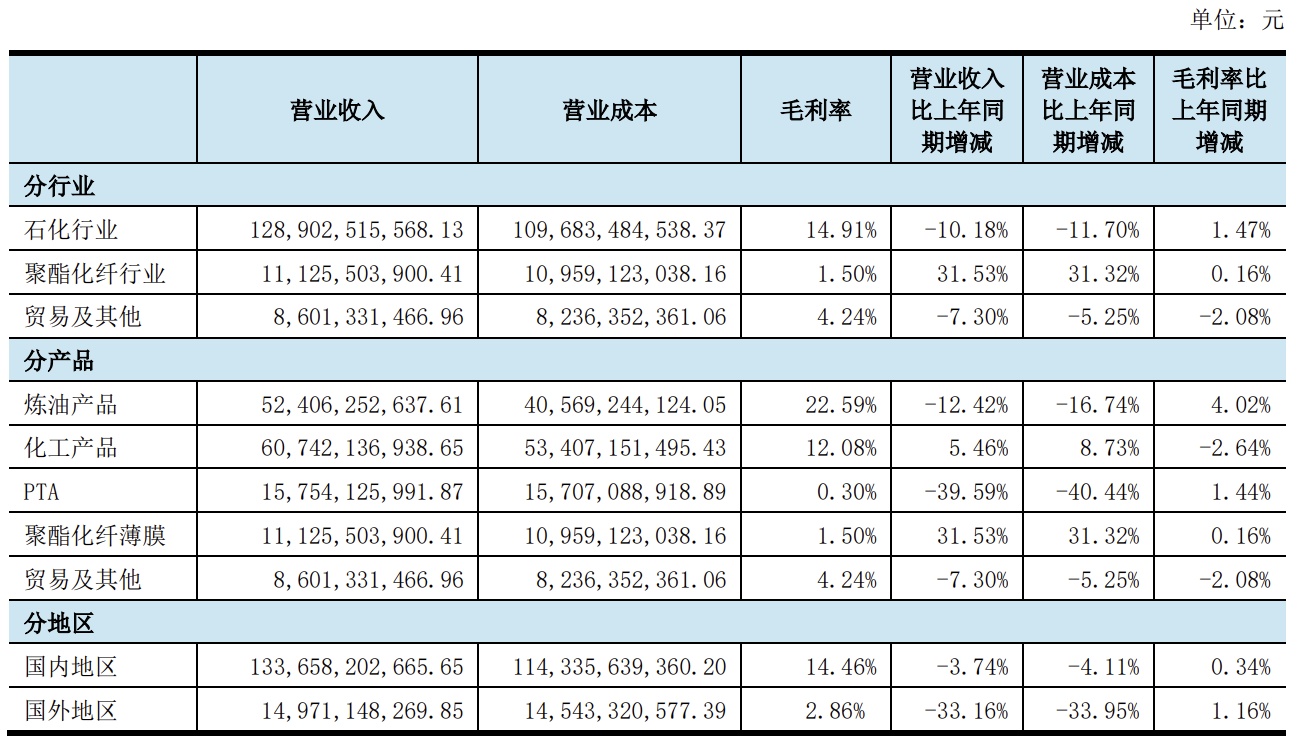

Rongsheng Petrochemical is an important producer of polyester, new energy materials, engineering plastics, and high value-added polyolefins in China and Asia. The company primarily operates the Zhejiang Petrochemical Refining and Chemical Integration Project, which has the capacity to process 40 million tons of crude oil, 8.8 million tons of paraxylene (PX), and 4.2 million tons of ethylene annually, with a globally leading integration rate in refining and chemical operations.

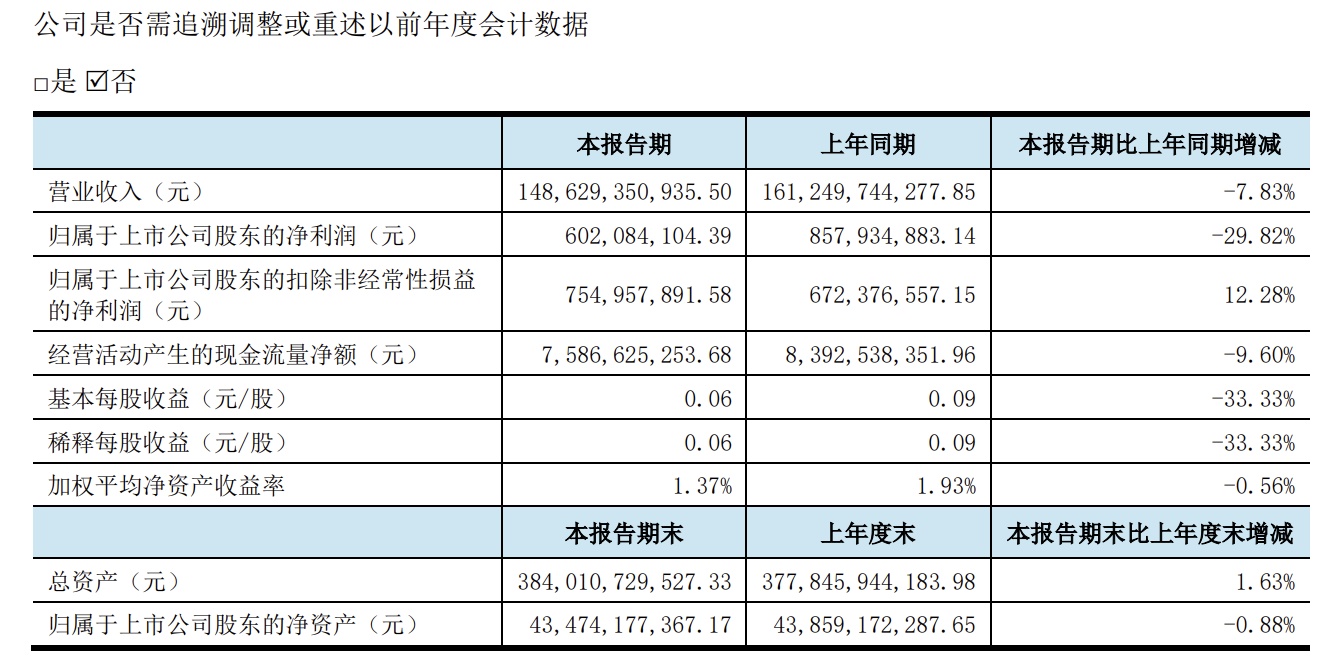

The financial data of Rongsheng Petrochemical for the first half of 2025 reflects the structural challenges faced by the traditional refining industry.Operating revenue was 148.63 billion yuan, a year-on-year decrease of 7.83%; net profit attributable to shareholders was 602 million yuan, a significant year-on-year decline of 29.82%, with a net profit margin of only 0.41%.This is reflected in the context of a downward shift in international oil prices and a trend toward a more balanced supply and demand for crude oil, revealing that a profit model relying solely on refining and chemical operations can no longer sustain high growth.

It is worth noting that Rongsheng Petrochemical's high value-added product segment performed well, offsetting some downward pressure: Revenue from chemical products (accounting for 40.87% of total revenue) increased by 5.46% year-on-year to 607.421 billion yuan. Polyester chemical fiber films (accounting for 7.48% of total revenue), benefited from a differentiated product layout, saw a year-on-year revenue surge of 31.53% to 111.255 billion yuan, reflecting the gradual effectiveness of the company's "reduce oil, increase chemicals" strategy.

Although data from the National Bureau of Statistics shows that the processing volume of crude oil in industries above designated size reached 361.61 million tons from January to June 2025, a year-on-year increase of 1.6%, the overall profitability of the industry has not improved accordingly. This indicates that the refining industry has entered a mature stage, and companies must seek new growth points through extending the industrial chain and upgrading their product structures. Among them,The total investment in the Rongsheng Petrochemical Jintang New Materials Project has increased from the initial 67 billion yuan to 76 billion yuan.This demonstrates the company’s firm commitment to the new materials sector. The core highlight of this project lies in its production capacity layout for high-end chemical materials, especially the construction of a 200,000-ton-per-year POE (polyolefin elastomer) facility.

In the first half of 2025, despite the impact of industry cycles and financial market fluctuations, which put short-term pressure on revenue and net profit attributable to the parent company, Rongsheng Petrochemical demonstrated resilience in its main business with the growth of net profit excluding non-recurring items and the outstanding performance of high value-added products. Leveraging the core advantages of Zhejiang Petrochemical's integrated refining and chemical operations, strategic collaboration with Saudi Aramco, and forward-looking layout in the new materials sector, the company's long-term growth logic is clear. In the future, as new materials projects come on stream, international expansion is implemented, and the green and digital transformation progresses, Rongsheng Petrochemical is expected to further consolidate its position as a global chemical leader, achieving dual improvements in scale and quality, and creating sustained returns for shareholders.

In the context of a sluggish recovery in overall demand in the petrochemical industry, private refining and chemical enterprises are under short-term performance pressure. They are navigating through the industry's downturn by deepening the integration of their industrial chains, intensifying research and innovation in high-end materials, and exploring overseas markets as tools to transcend the industry's downcycle.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track