Recycled plastics weekly report | tianfulong listed; shandong zhengkai's chemical method polyester fiber annual capacity exceeds 12,800 tons...

Domestic Hotspots

Shandong Zhengkai: Chemical recycling and utilization project for polyester fibers, with an annual production capacity of over 12,800 tons.

2. Recycled Polyester Staple Fiber Giant: Tianfulong Goes Public with a Market Value of 28 Billion!

3. From Waste to "New Material": Defulun's Eco-Friendly Fiber Technology Unlocks a New Solution for Textile Sustainability

4. ZDHC "Recycled Polyester Guidelines" Pilot Results Released, Zhejiang Jiaren Sets a Benchmark in Sustainability Practices

Uniqlo launches a new clothing workshop to practice sustainable fashion with "Clothing Rebirth".

International Hotspot

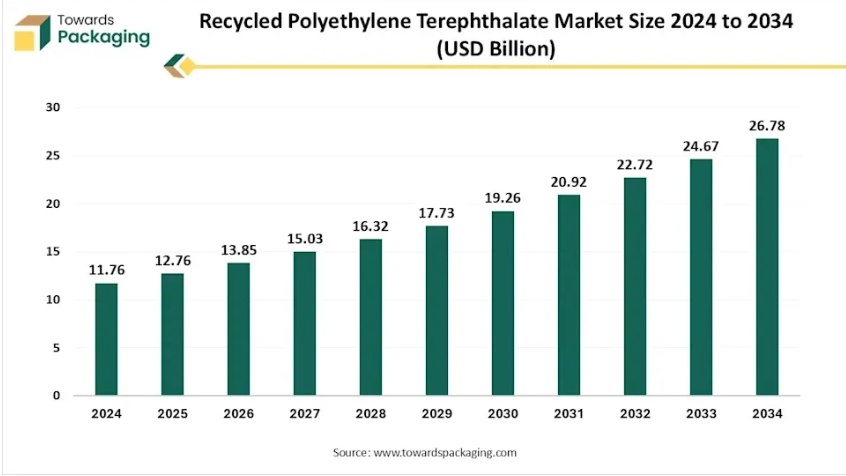

The global rPET market is expected to exceed $26.78 billion by 2034 according to the latest report from Precedence Research.

BASF collaborates with a recycling plastic company to promote food-grade recycled rPET in Vietnam.

8. SK Chemicals' profits soar by 98.5%! Depolymerization technology empowers, turning chemical recycling into a "gold mine."

Coca-Cola Germany introduces Krones equipment twice to upgrade the recycled PET bottle production line.

10. Indorama: The Journey of Recycling 150 Billion Plastic Bottles

11. New Dynamics in India's Food-grade PET Recycling Industry: Mandatory Recycled Content Faces Risk of "Regressing"

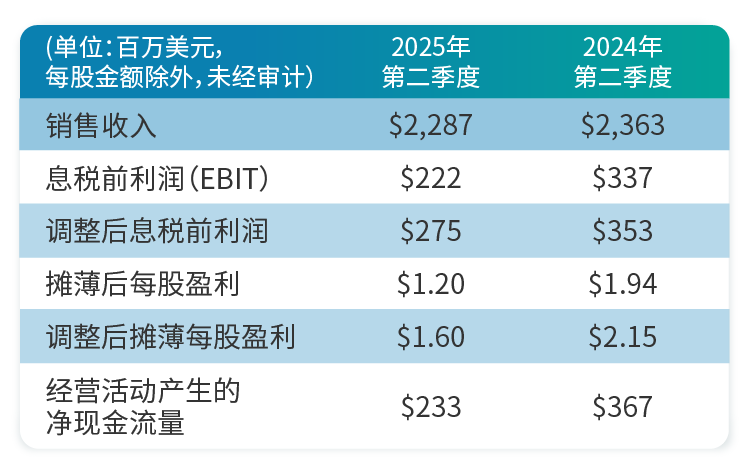

Eastman released its second-quarter financial report, with the methanolysis PET facility setting a new record, reaching 2.5 times the target capacity!

13. Soluble paper labels to address EPR regulatory challenges, or become a new opportunity for PET circular economy.

14. Physical recycling is difficult to cure the root problem; what makes chemical recycling capable of turning PET waste into high-value raw materials? Under the strong push of policies, a trillion-yuan market is about to explode.

From 70% Loss to 99% Purity: The Closed-Loop Industrial Pathway for PET Tray-to-Tray.

Domestic Hotspots

1. Shandong Zhengkai: Chemical method polyester fiber recycling project, with an annual production capacity of over 12,800 tons.

The chemical recycling project for polyester fiber regeneration is the support for Zhengkai New Material Co., Ltd. to achieve "turning waste into gold." The project is equipped with 50,000 spindles of high-performance ring spinning and 24 advanced vortex spinning production equipment, forming a strong production capacity foundation. Its product line is rich and diverse, covering colored spun virgin and recycled series, cellulose series colored spun yarn, and more, widely used in clothing, home textiles, industrial textiles, and other fields. The project's annual production capacity exceeds 12,800 tons, with the expected annual output value of each production line exceeding 10 million RMB.

2. Recycled Polyester Staple Fiber Giant: Tianfulong Goes Public with a Market Value of 28 Billion!

3. From Waste to "New Material": DeFuren's Eco-Friendly Fiber Black Technology Unlocks New Answers for Textile Sustainability

4. The pilot results of the ZDHC "Recycled Polyester Guidelines" have been released, with Zhejiang Jiaran setting a benchmark for sustainability.

The global leading organization for chemical management in the textile industry, ZDHC (Zero Discharge of Hazardous Chemicals), has officially released the "Recycled Polyester Guidelines V1.0 Pilot Edition" and completed its first global practical verification. In 2025, ZDHC, in collaboration with five representative enterprises from China and India (covering chemical and mechanical recycling processes), will launch the world's first pilot study. This study will focus on evaluating key aspects such as raw material traceability, chemical management, and waste monitoring. Zhejiang Jiaren New Materials, as a pioneering enterprise in the field of chemical recycled polyester, is participating in this study, providing crucial practical data and process details for the optimization of the guidelines.

Pilot results show that Jiaren New Materials has met or exceeded 80% of the baseline requirements in core metrics such as chemical management and emission control.

Uniqlo launches a new clothing workshop, practicing sustainable fashion with "Heartfelt Clothing Rebirth" initiative.

Recently, UNIQLO's global flagship store on Shanghai's Huaihai Middle Road officially launched the newly upgraded RE.UNIQLO STUDIO, introducing the UPCYCLING "Heartfelt Clothing Remake" project and hand-stitched embroidery services.

On the product side, UNIQLO is continuously increasing the proportion of recycled materials used. According to the sustainability vision previously outlined, Fast Retailing, UNIQLO's parent company, aims to replace 50% of all clothing materials with eco-friendly recycled materials by 2030. Starting in 2023, some of UNIQLO's fleece materials are already made from 100% recycled materials. On the service side, the RE.UNIQLO STUDIO is becoming a new initiative, with the project now present in 63 UNIQLO stores across 22 countries and regions globally. It is revitalizing the life of flawed new garments through craftsmanship, allowing consumers to participate in this "recreation" model in a simple and enjoyable way.

International Hotspots

The global rPET market is expected to surpass $26.78 billion by 2034, according to the latest report by Precedence Research.

BASF collaborates with a circular plastics company to promote food-grade recycled rPET in Vietnam.

SK Chemicals' profits soar by 98.5%! Depolymerization technology empowers, turning chemical recycling into a "gold mine".

Coca-Cola Germany introduces Krones equipment twice to upgrade the recycled PET bottle production line.

PET bottle recycling production line

Filling 1-liter recycled PET bottle with soft drink

- Production capacity: 36,000 bottles per hour

- Scope of supply:

Updating and upgrading part of the production line equipment, including: Contipac depalletizer, Linajet crate washer, Rotomat bottle cap separator, various empty and full bottle inspection systems, Smartpac packer, and two Modulpal Pro 2A palletizing/depalletizing machines.

Processing equipment: Contiflow mixer and VarioClean CIP equipment

Indorama: The Journey of Recycling 150 Billion Plastic Bottles

Indorama has more than 20 recycling facilities in 11 countries worldwide, some of which are partnerships. These plants can recycle or reprocess 789 bottles per second, converting waste PET into high-quality recycled PET (rPET) resin and other circular materials. These are widely used across various industries, helping the company and its clients achieve their sustainability goals.

11. New Developments in India's Food-Grade PET Recycling Industry: Mandatory Recycled Content Faces Risk of "Setback"

Eastman released its second-quarter financial report, with the methanol-recycled PET facility setting a new record, achieving 2.5 times the target capacity!

Soluble paper labels could address EPR regulatory challenges and become a new opportunity for PET circular economy.

14. Physical recycling is hard to cure the root cause, why can chemical recycling transform PET waste into high-value raw materials? The trillion-yuan market is set to explode under policy pressure.

The major economies such as the European Union, China, and the United States have enacted legislation mandating the use of a certain proportion of recycled materials in plastic products. Major brands are also continuously innovating and strategically positioning themselves in the application of rPET, publicly setting ambitious recycling goals, including material substitution rates, closed-loop recycling timelines, and carbon reduction commitments.

15. From 70% Loss to 99% Purity: The Closed-Loop Industrial Pathway of PET Tray-to-Tray Recycling

Tray-to-tray (TtT) recycling is becoming an important pathway for driving the circularity of plastic packaging, especially for food-grade applications. Unlike bottle-to-bottle recycling, the PET tray stream has long been underestimated and underutilized.

Approximately 1 million tons of PET trays are placed on the EU market each year, but about 70% are lost, with only approximately 300,000 tons being collected for recycling, resulting in a significant circularity gap and environmental burden.

In the past, the recycled content in trays mostly came from bottle-grade recycled materials, raising concerns about the "diversion of bottle-grade closed-loop material sources."

Policy changes are underway. The EU Single-Use Plastics Directive (SUPD) and the Packaging and Packaging Waste Regulation (PPWR) have increased the recycled content ratio of beverage bottles and gradually extended the targets to "non-bottle" packaging, compelling the tray system to seek dedicated rPET material sources, thus providing momentum for the TtT model. (Information date: August 6, 2025)

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track