Recycled PET: Bottle Flakes Expected to Hold Steady Today

Focus areas

Crude oil futures rose to their highest level since last October, boosted by the situation in Iran, severe weather in the United States, and a weaker dollar.

Due to the cooling weather, the supply of PET bottle circulating goods is limited, and prices remain firm.

Core logic: Focus on weather and terminal load changes.

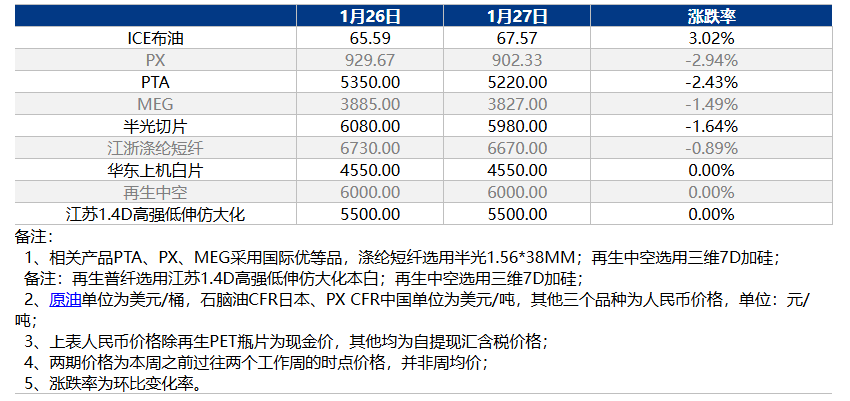

II. Price List

、 Market Outlook

Sharp fluctuations in crude oil and polyester raw materials, combined with a broad decline in virgin fiber and virgin polyester chips, have caused the price spread between virgin and recycled materials to narrow sharply, weighing on sentiment in the recycled market. Additionally, with declining terminal operating rates and insufficient support from essential orders, sales for recycled chemical fiber plants remain sluggish. Under cost-control pressures, manufacturers are increasingly inclined to push for lower raw material procurement prices. However, as it is currently the low season for bottle collection and many cleaning plants are entering Chinese New Year holiday mode, the supply of tradable goods in the market is limited. Amidst this tug-of-war between supply and demand, the recycled PET bottle flake market is expected to remain in a stalemate today.

Four 、 Data Calendar

|

Data |

Release date |

Previous period data |

This period's trend forecast |

|

Polyester chip production and sales ratio |

Weekday 16:00 |

40.42% |

↘ |

|

Capacity Utilization Rate of Recycled PET Flakes |

Thursday 16:00 |

42.5% |

↘ |

|

Recycled PET flake factory inventory |

Thursday 16:00 |

4.6 |

↘ |

|

Chemical fiber weaving operating rate |

Thursday 16:00 |

51.2% |

↘ |

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories