Range Extenders: Breaking Free from the Technology “Contempt”?

From "technical disdain" to "full bloom," in just about five years, range-extended technology quickly completed its market turnaround.

The domestic range extender market is gradually taking shape in terms of competitive landscape.

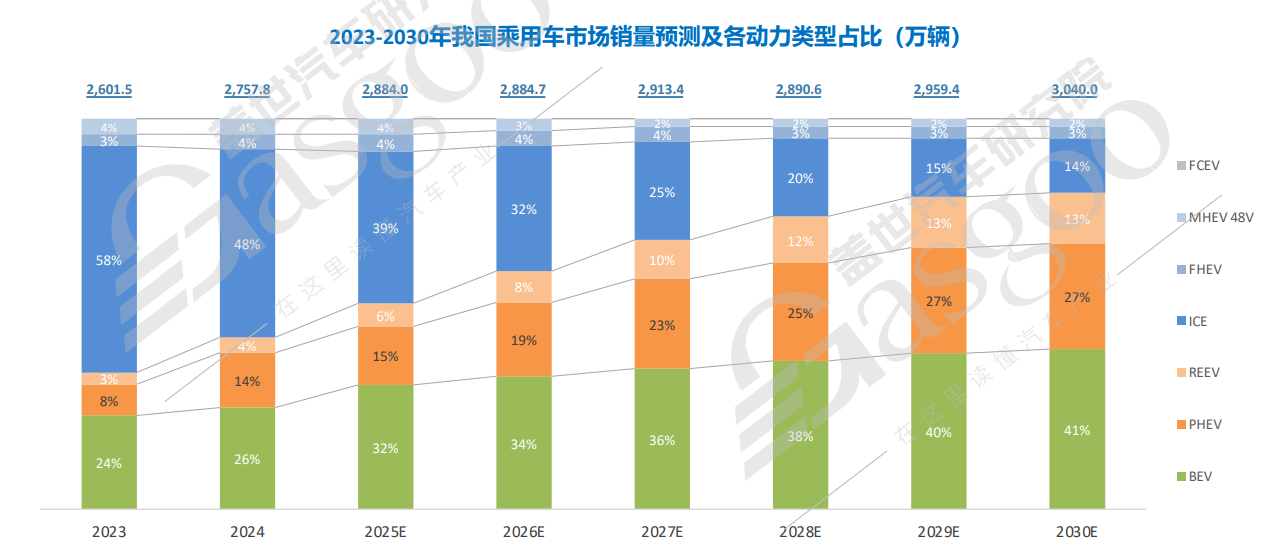

According to data compiled by Gaishi Automobile Research Institute, the market share of domestic range-extended hybrid vehicles has increased from 3% in 2023 to 4% in 2024. It is expected to reach 6% in 2025 and will continue to maintain a high growth trend in the coming years. By 2030, the penetration rate of the range-extended market is expected to exceed 13%.

In addition, it is worth mentioning that both plug-in hybrid and range-extended hybrid vehicles have maintained rapid market expansion in recent years, while also showing a clear downward trend in prices. According to analysis by Gasgoo Auto Research Institute, plug-in hybrid models are currently mainly distributed in the sub-200,000 RMB market, with the 100,000-150,000 RMB segment being the primary market. Range-extended hybrids, on the other hand, are mainly distributed in the above-200,000 RMB market, with the 200,000-300,000 RMB segment as the main market. In the future, as the electrification process continues to advance in China, the market penetration rates of both plug-in hybrids and range-extended hybrids will keep rising. By 2030, their combined penetration rate is expected to exceed 40%, with the total market size reaching over 12 million vehicles, making them the absolute mainstream of the passenger vehicle market.

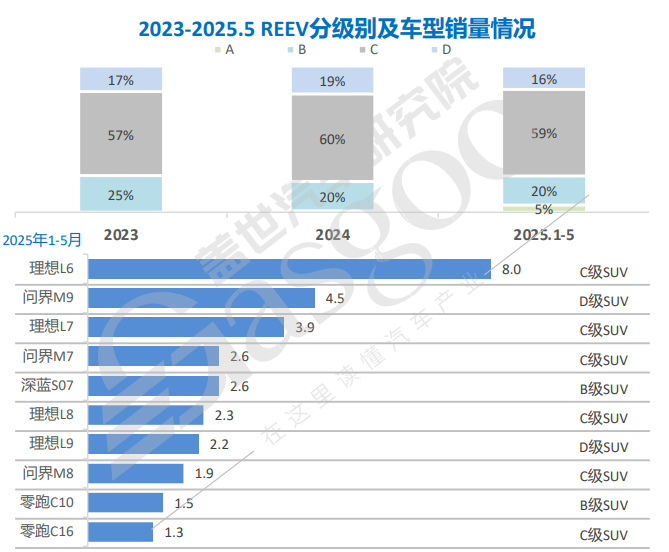

If plug-in hybrids and range-extended vehicles are further subdivided and statistically analyzed, it can be found that currently in the domestic market, plug-in hybrid models are mainly distributed in the A-segment and B-segment markets, with traditional domestic brands led by BYD being the main market players. Range-extended vehicles are primarily distributed in the C-segment market, while the B-segment and D-segment markets are also accelerating penetration. Among these, the market shares of both new forces and traditional domestic brands remain relatively stable. Brands such as Li Auto, AITO, Deep Blue, Leapmotor, and Avita rank among the top sellers in the range-extended vehicle market.

Overall, the current domestic range-extended vehicle market is still characterized by highly concentrated competition, with Li Auto and AITO emerging as the industry's two dominant players. Li Auto has achieved explosive growth in its L series models by precisely targeting family scenarios and alleviating range anxiety. Leveraging Huawei's intelligent technology, AITO has also secured a strong foothold in the high-end range-extended market. In addition, brands like Changan Deepal and Leapmotor are gradually establishing a “high-low product mix” market layout by filling in the 100,000 to 250,000 RMB price segment, further accelerating the scaled growth of the range-extended vehicle market.

Besides the established players, a new wave of range-extended players has also started to emerge recently.

Joint ventures that once regarded range extender technology as a "backward solution" are experiencing a shift in attitude from "doubt" to "embrace." SAIC Volkswagen plans to launch two range extender models by 2026; Dongfeng Nissan intends to introduce five new energy vehicles within two years, covering the range extender technology route; Jiangling Ford has announced a new energy version of the Lie Ma model, which is applying for both range extender and pure electric powertrain versions; Buick, under SAIC General Motors, recently launched the flagship model Zhijing L7, equipped with a range extender system composed of a 1.5T engine. In addition, Beijing Hyundai, Changan Mazda, and others have also revealed their range extender product schedules, while BMW has previously been reported to have plans to "restart range extender" development.

According to incomplete statistics, as of now, more than 15 range-extended models from joint venture brands have already been officially released or are in reserve. It is clear that joint venture brands, which have already fallen significantly behind in the transition to new energy, are now attempting to replicate the path to success once taken by domestic new energy brands—using range-extended systems to achieve a comeback as latecomers.

Of course, it’s not just the joint venture brands that want to do this; recently, there have also been quite a few emerging domestic brands eager to make a push in the range-extended vehicle market.

Zhiji has just released its range-extended hybrid system called the "Hengxing Super Range Extension," aiming to compete in the range-extended market with large batteries and long range. The first range-extended model, the new generation Zhiji LS6, has officially started pre-sales on August 15th. GAC is also making significant moves in the range-extended field. On August 12th, GAC Group announced that it will officially release its all-new range-extended technology, "Xingyuan Range Extension," on August 19th, aiming to address the long-standing issue of power deficiency in range-extended electric vehicles.

The Deep Logic Behind Automakers' Collective Shift Toward Extended-Range Technology

Both domestic and joint venture companies are gearing up to enter the range-extended (EREV) vehicle sector in a concentrated manner. This raises a question: why is everyone choosing to adjust their technical strategies at this particular time?

Technological adaptation and market breakthrough are the two explicit driving forces.

Firstly, the structure of the range extender system is simplified, reducing the research and development threshold, making the technical route easier to control. Traditional joint venture brands can leverage their existing engine technology accumulation, which can effectively reduce the R&D costs of range extenders. Independent brands with comprehensive technical reserves in the new energy sector can also improve the electric drive efficiency of the range extender system through the adoption of a high-voltage platform across the entire domain.

Secondly, the overall range advantage of the range extender system, given the current battery technology and energy replenishment convenience, still offers a relatively strong solution to address range and charging anxiety.

Furthermore, the precise matching of scenario-based needs is also a key reason. Many Chinese families actually have daily usage scenarios of "one car for multiple purposes." The model of using electricity in the city and fuel for long-distance travel in range-extended vehicles can better address the user pain points in this regard compared to other new energy routes, and better balance daily economic efficiency with intercity convenience.

In addition, it is very important to note that from a market perspective, the failure of traditional paths is also forcing companies to make strategic adjustments. The fuel vehicle market is rapidly shrinking, and as the transition to pure electric vehicles has already allowed other brands to seize market advantages, many latecomers are facing tremendous pressure in their market expansion efforts. From this perspective, range-extended vehicles, as a "dual-fuel" compromise solution, can both accommodate the transition of fuel vehicle users to new energy and avoid the fierce competition in the pure electric market. More crucially, this technical route does not pose a high technological barrier, giving "latecomers" significant opportunities to make their mark.

The policy also has favorable aspects. Under the current policy expectations of "equal rights for oil and electricity," range-extended vehicles enjoy the benefits of new energy vehicle licenses while avoiding the stringent requirements of the dual credit policy for pure electric models. The continuous decline in the cost of power batteries is also a crucial factor for many brands transitioning to the range-extended track. Stimulated by technological innovation, the cost of power batteries has significantly decreased, fundamentally determining that within a certain price range, range-extended vehicles can meet the demand for long pure electric range by equipping a large battery. For example, the IM Motors previously released its Star Range Super System, which features a 66kWh battery pack (larger than those in many pure electric models) and supports a pure electric range of 450 kilometers. Under the current industry expectation that the price of range-extended versions is significantly lower than that of pure electric models, the ability to equip such a large battery pack clearly hinges on the continuous decline in battery costs.

Gasgoo Auto Research Institute believes that with the continuous improvement of hybrid battery technology and consumers’ growing demand for driving range, a number of high-capacity models with battery capacities above 50 kWh are emerging, which will drive the average battery capacity per vehicle to show an increasing trend year by year.

Furthermore, the trend of internal combustion engines is moving towards high efficiency and low energy consumption. According to an analysis by Gasgoo Auto Research Institute, the current fuel consumption of PHEV models in depleting mode has entered the 3L/100km range and is moving towards the 2L/100km range. The oil-electric conversion efficiency of range extenders has surpassed 3.6kWh/L and is expected to reach a target of 3.8+kWh/L in the future. The 800V platform and ultra-fast charging batteries will also accelerate their adoption in plug-in hybrid and range-extended models. The 800V high-voltage platform and ultra-fast charging batteries are the main solutions to address the energy replenishment challenges of new energy vehicles. With the decreasing cost of 800V technology and the development of higher charging rates for hybrid batteries, models with 800V systems and plug-in hybrids equipped with batteries capable of 3C or higher charging rates have already been launched. It is expected that these new technologies will continue to penetrate the market. Moreover, an increasing number of automakers are also researching more diverse fuel technology hybrid solutions in parallel. Green fuels such as hydrogen and methanol offer advantages like zero emissions and easy accessibility. Automakers are actively exploring hybrid systems based on fuel technology, which will provide new directions for the future development of range-extended hybrid technology.

The Breakthrough Battle of the Latecomers

The range extender system has become a key battleground in the domestic market. Looking ahead, how will new independent and joint venture players build their own market moats?

For independent brands, intelligence and cost control are significant advantages, while joint venture brands focus on traditional technical accumulation and the strength of a global system.

Independent brands have built strong competitive barriers in the extended-range field through years of market cultivation, particularly possessing indisputable industrial advantages in intelligent experience. For newly entering independent brands, they also have their own unique advantages in areas such as electrification and intelligence.

Taking IM Motors as an example, its newly released hybrid system boasts numerous impressive performance parameters: a combined range of 1,500 kilometers, a 66 kWh large battery delivering a pure electric experience, exceptional energy efficiency and cost-effectiveness, groundbreaking ERNC noise reduction, and winter scenario solutions. All these specifications currently place it at the forefront of the industry and directly address the actual pain points of today’s new energy vehicle users. In addition, IM Motors’ holistic digital chassis technology enables real-time dynamic chassis tuning through vehicle-cloud collaboration. Combined with intelligent driving assistance systems, this greatly enhances driving safety and comfort, together building IM Motors’ unique intelligent ecosystem for both the interior and exterior of the vehicle.

With the strong support of the SAIC system, from the development of core components (battery, high-efficiency engine), large-scale validation (10 million kilometers of road testing + AI), production manufacturing, to supply chain cost control, IM Motors’ range extender indeed has many advantages of its own. However, as a newcomer in the pure electric market that has not yet fully proven itself in the range extender segment, IM Motors will inevitably face obvious challenges. In terms of market recognition and brand trust, as a “new player” in the range extender field, IM Motors needs to invest more resources in educating the market and proving that its technology’s reliability, durability, and actual experience can meet the level of its claims, truly possessing the capability to compete head-to-head with leading players in niche markets such as Li Auto and AITO.

Joint venture brands entering the extended-range field have a core advantage in their profound accumulation of engine development. Companies like Volkswagen and Toyota have cultivated the traditional internal combustion engine sector for decades, possessing mature technologies for optimizing thermal efficiency. When applied to extended-range systems, these technologies enable more efficient power generation, creating low-fuel-consumption and long-life extended-range power units, effectively reducing usage and maintenance costs. Under a global procurement system, joint venture brands also have stronger capabilities to integrate resources. Core components such as motors and batteries can be sourced through global supply chains, and the cost control potential under economies of scale is relatively significant.

Intelligent features and product iteration are weaknesses for joint venture brands. In terms of in-car intelligent systems, most joint venture brands rely on third-party systems and commonly face problems such as rudimentary voice interaction functions and slow OTA updates. These issues make it difficult to meet the needs of Chinese users, who have been deeply “nurtured” by smart electric vehicles and now expect high-frequency interactions and real-time updates in smart cockpits. Regarding the speed of product updates, many joint venture brands are also under significant pressure. For domestic brands, the development cycle from project initiation to market launch is now typically measured in months, whereas joint venture brands, constrained by global R&D processes and decision-making mechanisms, have much longer development cycles. If joint venture brands pursue extended-range vehicles but, in a rapidly changing market, once again miss the opportunity to respond promptly to market demand and changes in consumer preferences, the consequences could be disastrous.

Moreover, it must be said that the niche market has actually upgraded from a "blue ocean" to a "red ocean" competition. With the rapid expansion of the extended-range vehicle market, the price war has already begun to show signs, and the foreseeable future suggests an intensifying trend. In the current domestic extended-range market, the market structure is becoming increasingly clear. Below 200,000 RMB is where brands like Leapmotor and Changan Deep Blue dominate; the 200,000-300,000 RMB range is the main stage for entry-level models from brands like Li Auto and AITO to compete; and above 300,000 RMB, Li Auto and AITO's high-end brands take the lead. In the future, as more players enter the market, competition within these price ranges in the extended-range track is bound to intensify. Leapmotor and Changan Deep Blue will attract budget-conscious consumers with high-value products, focusing on cost control and basic configuration optimization. In the 200,000-300,000 RMB range, brands like Li Auto and AITO will leverage their brand influence, technological prowess, and rich configurations to capture market share. Many joint venture extended-range products are also expected to tap into this niche market by capitalizing on brand advantages. In the luxury market above 300,000 RMB, brand premium, high-end configurations, and intelligent experiences become the core of competition. Beyond leading brands like Li Auto and AITO, many traditional luxury brands are also expected to continue to make efforts.

In such intense market competition, small and medium-sized players will face tremendous pressure to survive, and some brands lacking core competitiveness may soon be eliminated from the market.

New players need to identify more specific use cases, such as focusing on range-extended models for specialized scenarios like off-road or commercial use, driving the evolution of range-extended vehicles from a "single category" to "full-scenario coverage."

Summary:The "Prisoner's Dilemma" in the Range-Extended Vehicle Track and the Path to Break the Deadlock

Despite the general consensus in the industry that pure electric vehicles are the ultimate direction of development, before the large-scale application of solid-state batteries, range-extended vehicles are expected to maintain a golden development period in the coming years due to their "anxiety-free experience + cost advantages." They will become an indispensable component of the new energy vehicle market in the short to medium term, meeting consumer travel needs in different scenarios and jointly forming a diversified new energy vehicle market landscape with pure electric vehicles and plug-in hybrid models.

There is no doubt that the current booming development of the range-extended vehicle market is an inevitable choice after weighing technology and market considerations by car manufacturers. Domestic brands, leveraging their first-mover advantage and smart positioning, have already secured a favorable position in the market. However, they must be wary of the risk of "involution" and avoid falling into mere configuration stacking. They should continue to focus on core technologies such as battery safety and energy management to enhance the comprehensive competitiveness of their products. Although joint venture brands have technological accumulation and the advantage of a global system, they need to lower their stance, accelerate intelligent transformation, and deeply understand Chinese users' demand for contextual experiences, responding to market changes with more agile product iteration speed.

Looking ahead, as range extender technology evolves from a "compromise choice" that addresses range anxiety to a "value choice" integrating efficiency, intelligence, and comfort, this technology revolution driven by market demand will undoubtedly reshape the competitive landscape of the global automotive industry even more profoundly.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track