Range-Extended Vehicles, Hard to Sell

"Whoever wants to use this outdated technology can go ahead."

Around five years ago, range extenders were subjectively labeled by some in the industry. However, as time has passed, especially with leading players like Li Auto and AITO actively promoting and capitalizing on it, range extenders have gradually become an undeniable force in the Chinese automotive market.

Last year, terminal sales surged even more, and an increasing number of OEMs enthusiastically embraced this technological route one after another.

Based on this context, a "bold theory" was proposed: in the near future, within the new energy sector alone, it is very likely that a tripartite situation of pure electric, plug-in hybrid, and range extender will emerge.

However, as we stride into the new year, we find that the plot has not developed in the direction we anticipated.

I originally thought that with the power of the "fuel tank," extended-range vehicles would shine thoroughly, but the reality is quite the opposite. Take the recently concluded July as an example: even in the so-called "off-season," new energy vehicles still delivered a relatively impressive performance, with retail penetration reaching 54%, setting a historic record.

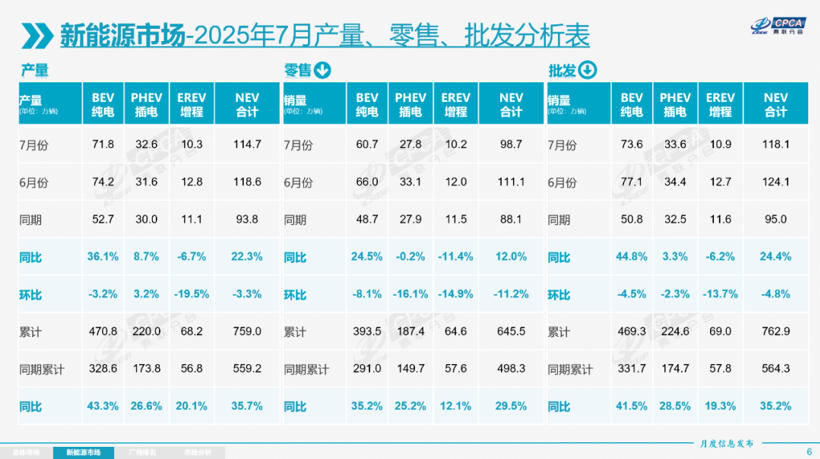

For further breakdown, the sales of pure electric vehicles reached 607,000 units, a year-on-year increase of 24.5%; plug-in hybrids achieved sales of 278,000 units, with a slight year-on-year decrease of 0.1%; in contrast, range-extended vehicles recorded sales of only 102,000 units, a year-on-year decline of 10.4%. From January to July, the cumulative retail sales of range-extended vehicles showed a year-on-year growth of 12.1%, which is significantly lower than the 35.2% for pure electric vehicles and 25.2% for plug-in hybrids.

Anyway, there is a faint sense of fatigue revealed. Naturally, many readers will be curious about what exactly happened that led the main subject of today’s article to fall into a growth bottleneck.

Regarding the answer, it can only be said to be multidimensional.

01Some trends are irreversible.

In fact, the reason why range extenders are difficult to sell is easy to understand.

First of all, the explosive growth of pure electric vehicles has greatly squeezed the living space of the main subject of today's article, especially in the mainstream mass market. The balance of supply and demand between automakers and consumers has gradually shifted crazily in favor of the former.

At the same time, more and more early range extender users are entering the car replacement cycle, and a significant portion of them are starting to opt for pure electric vehicles. Although it's a bit disheartening, this has indeed been the industry trend observed over the past several months.

There have already been no fewer than three or four such cases just around me.

Looking deeper, the extended-range models in this sub-segment are mostly limited by overall costs, resulting in relatively short pure electric driving ranges. This inevitably increases the frequency at which owners need to recharge, significantly diminishing the user experience. In terms of overall fuel consumption when the battery is depleted, they also fall short compared to plug-in hybrid competitors in the same class, leaving them awkwardly stuck in the middle.

More often, it seems to serve the function of supplementing the product lineup.

For example, Leapmotor, a typical representative among new car-making forces, currently has several popular SUVs whose sales composition is basically pure electric as the main focus, with range-extended versions as auxiliary, which is exactly contrary to traditional external perceptions. Moreover, new models like the B10 and BO1, priced as low as around 100,000 yuan, have not even launched range-extended versions.

Whether admitted or not, being in the mainstream mass market where the "cake" is most tempting, the protagonist of today's article finds it much more challenging than imagined to grab a share from the pure electric and plug-in hybrid sectors.

What about the mid-to-high-end market?

Undeniably, in recent years, thanks to the fierce competition between Li Auto and AITO, these two "big bosses" have jointly created a very prosperous scene, with both volume and price soaring, making many manufacturers envious.

Subsequently, many brands began investing significant human, material, and financial resources into the range extender sector. However, this year, what was once a "blue ocean" has quickly become overcrowded.

The intensity of the fierce battle increased day by day.

Take Li Auto as an example, after experiencing the period from January to July, one can clearly feel the immense pressure faced by this new electric vehicle manufacturer. The delivery volume in July plummeted year-on-year, dropping from 50,000 units last year to 30,000 units, which is a very dangerous signal.

As for AITO, it also experienced fluctuations in the first half of the year. Fortunately, with the successive launches and outstanding performance of the M9 and M8, the downward trend was reversed. With the arrival of the M7, it is bound to regain its vitality.

However, with Huawei's endorsement, it ultimately belongs to the minority.

Overall, the intense competition in the mid-to-high-end range-extended segment has left everyone exhausted. What is even more severe is that the growth rate of the corresponding "cake" is far slower than the increase in the number of competitors. Roughly counting, this year alone there are no fewer than 15 range-extended large six-seat SUVs, yet the overall market size has not changed significantly.

Additionally, from the current economic environment perspective, potential customers' enthusiasm for purchasing "luxury cars" continues to weaken. According to data released by the China Passenger Car Association, luxury car retail sales in July were only 170,000 units, a year-on-year drop of 20%.

Essentially, the alarm for danger has already been sounded.

Reflecting on the protagonist of today's article, poor sales will definitely not be a short-term phenomenon but will persist for a long time. In this process, only leading players with brand halos, such as Li Auto and AITO, are destined to be able to share the market with ease. Most of the resource-strapped chasers who blindly bet on this track are highly likely to end up as mere cannon fodder.

In short, whether in the mainstream mass market or the mid-to-high-end market, "range extenders are indeed appealing, but not easy to obtain."

02Range extension becomes a high-end configuration.

As stated at the beginning of the article, if the current trend continues, it is almost impossible for pure electric, plug-in hybrid, and range-extended vehicles to each dominate their own territory.

As an observer, and referencing industry trends, I am increasingly convinced that: "With the passage of time and technological advancement, the mainstream mass market will see pure electric vehicles take the lead, with plug-in hybrids serving as a supplement and range-extended vehicles becoming negligible. In the mid-to-high-end market, however, range-extended vehicles will remain a force to be reckoned with. Meanwhile, with the support of a mature charging infrastructure, the market share of pure electric vehicles will gradually expand, while plug-in hybrids will instead become a minority."

In other words, the true opportunity point for range extenders is clear at a glance.

Recently, judging from the new product launch strategies of several major releases, "ultra-fast charging + large battery + long battery life" has gradually become the mainstream trend in the industry.

For example, the "traffic star" in the ultra-luxury market, the Zunjie S800, has a power battery capacity of 63 kWh and a pure electric range of over 330 kilometers.

For example, IM Motors, which recently held a launch event for its "Star" range extender technology, showcased its collaboration with CATL on a 66 kWh battery and an 800V ultra-fast charging high-voltage platform, delivering over 450 kilometers of pure electric range.

For example, XPeng, which made a high-profile announcement last year about entering the range-extended vehicle market, has finally unveiled the long-awaited range-extended version of the X9 in the latest MIIT catalog. Reportedly, its pure electric range will also reach 450 kilometers.

"We are now seeing a trend where range-extended vehicles are being equipped with increasingly larger batteries. The purpose is to further reduce the frequency of using the range extender, isn't it? Originally, it could be used five or six times a year, but now it might only be used once or twice a year. Carrying hundreds of kilograms of stuff every day when driving doesn't seem very cost-effective. Using a human as an example, it seems very unreasonable to carry such heavy luggage every day."

It is quite interesting that in an interview after the launch of the Letao L90, Li Bin shared his views. Implicitly, it was much like: "The range-extending batteries are getting bigger and bigger, so why not just buy a pure electric vehicle?"

The reasoning is not wrong, and in fact, I have communicated with quite a few owners of range-extended vehicles.

First, why do people buy extended-range vehicles? The unanimous answer is that they are afraid of range anxiety. Second, why do most people use pure electric mode in most driving conditions after buying an extended-range vehicle? The common response is that charging is much cheaper than refueling. Furthermore, what are the pain points? Short pure electric range and slow charging speed are the most frequently mentioned issues.

The large battery and ultra-fast charging on extended-range vehicles are clearly the ultimate results of automakers continuously iterating and evolving in response to urgent demands—"Regardless of whether it's reasonable or not, if people want it, just give it to them."

Based on this background, looking back at Li Bin's statement, "From NIO's perspective, the starting point is good, but never try to educate users. For many extended-range vehicle owners, even if the range extender is only activated once or twice a year, having it there always reassures them more than thousands of battery swap stations."

The vast Chinese automotive market has led to a situation where one technical route cannot dominate entirely.

From my personal perspective, I would like to say: "In the past, range extenders had an absolute advantage over pure electric vehicles—a lower overall manufacturing cost. However, now, with the significant drop in raw material costs for batteries, this advantage has almost been gradually erased."

On the other hand, this year's range-extended models equipped with "ultra-fast charging + large battery + long range" even have costs that exceed some pure electric models of the same class. After relentless promotion, this power system has been transformed into a "premium configuration" in the minds of many people.

To put it more plainly, for a new energy vehicle trying to enter the mid-to-high-end market—whether it’s an SUV or a sedan—once it has this kind of support, the cost of explaining it to end customers will be much lower than that of competing pure electric models in the same class. Furthermore, from a business perspective, the company will be able to achieve higher premiums and profit margins.

This also explains the fundamental reason why Li Auto and Wenjie are so enviable: "Range extenders are not outdated technology; they are essentially profit cows."

For most brands, whether joint ventures or independent, wanting to sell so-called "expensive cars" in the future, embracing the main subject of today's article is still an unavoidable destiny.

Range extenders are hard to sell, but they remain appealing, especially when transformed into "high-end configurations." The intricacies, strategies, and rules within have once again been adjusted and reshaped.

To gain a firm foothold in the mid-to-high-end market, "ultra-fast charging + large battery + long battery life" is the shortcut. Of course, in addition to the technology itself, aspects such as brand image, marketing strategies, and product pricing must not have significant shortcomings. Think about it, give it some thought.

From the sales structure between January and July this year, range-extended vehicles accounted for less than 10% of the entire new energy vehicle market, remaining a niche choice for a small group of people.

But there are always cannon fodder who overestimate themselves, like moths to a flame...

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track