Production is still rising! prices continue to fall! when will polyester filament hit the bottom?

This week, the downward trend of polyester filament has not stopped, continuing to drop by 50-100 yuan/ton compared to last week. When will such continuous decline come to an end?

The thunder is loud, but the rain is light in the reduced harvest.

Recently, with the continuous decline in polyester prices, news of reduced production for polyester filament has been rampant. Reports indicate that two factories in Wuxi have shut down for maintenance, with one having a capacity of 240,000 tons and the other 400,000 tons. Two leading enterprises in Tongxiang have a combined maintenance of 1.645 million tons of capacity (1.495 million tons + 150,000 tons). A large factory in Xiaoshan has a 150,000-ton unit undergoing maintenance, while an 80,000-ton unit in a factory in Shaoxing has stopped production. The Ningbo region has seen particularly concentrated reductions, involving multiple companies, including a complete shutdown of a 250,000-ton unit, maintenance of 144,000 tons and 120,000 tons units, and a complete closure of another 120,000-ton capacity. The northern and Shandong regions have also been affected, with a factory in Liaoning having a 200,000-ton unit undergoing maintenance, and a small enterprise in Weifang, Shandong, halting a capacity of 35,000 tons. If we add up all these capacities, the total amount involved reaches as high as 3.384 million tons, which is quite substantial.

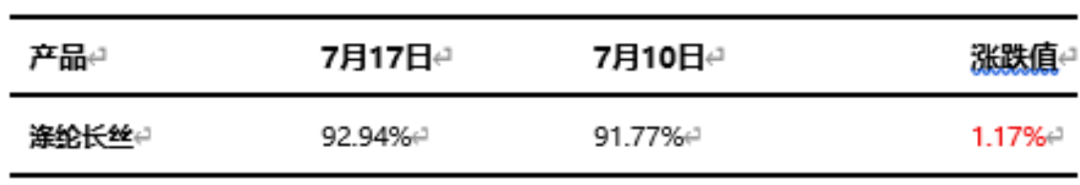

According to data statistics from Longzhong Information, in the recent week, the production of polyester filament reached 759,200 tons, an increase of 9,600 tons compared to the previous week, with a growth rate of 1.28%. The capacity utilization rate was 92.94%, an increase of 1.17 percentage points from the previous week. The production of polyester filament not only did not decrease but instead increased.

From the current situation, this round of production cuts indeed seems to be all noise and no substance, and it has largely contributed to the downward trend in polyester filament prices.

No promotions, no selling silk.

Although the reduction in polyester filament production is insufficient and the output has increased instead of decreased, the final result is a continuous increase in inventory. With prices continuing to decline and a significant halt in production on the weaving side during the off-season, the downstream market is currently showing a clear wait-and-see attitude, with only essential purchases being made.

Since late June, the production and sales of polyester filament have been mediocre. Last week, the weekly average production and sales rate of polyester filament was 37%. During the week, the overall production and sales rate of manufacturing enterprises was around 30-40%. Only on July 10 did the production and sales rate see a partial rebound, reaching around 200% on that day, with the average production and sales rate of sample enterprises exceeding 50%. This week, the weekly average production and sales of polyester filament has not shown significant improvement, remaining at only 38%, with production and sales under pressure. The inventory of manufacturing enterprises continues to grow. As of July 17, the inventory of polyester POY factories rose to 25.4 days, the inventory of polyester FDY factories increased to 25.6 days, and the inventory of polyester DTY rose to 30.7 days.

Once the inventory comes under pressure, polyester factories begin to promote discounts, leading to a continuous decline in the price of polyester filament.

Polyester chips have started to reduce production.

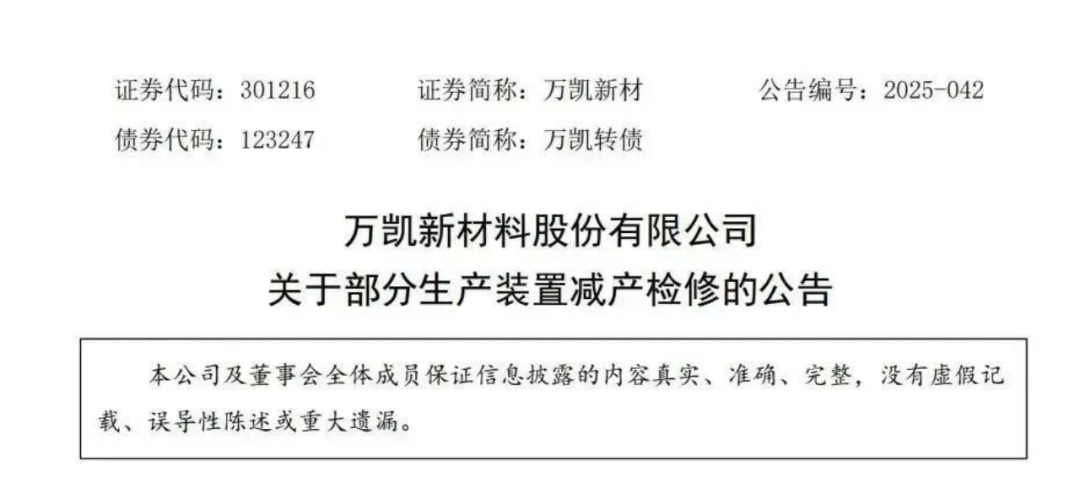

Although the reduction in polyester filament production is currently not as strong as expected, the reduction in another important area of polyester, polyester chips, is being carried out vigorously. On the evening of July 3, Wankai New Materials announced that, based on the overall industry situation and the company's production and operational needs, it plans to gradually adjust its PET production schedule starting from recent days, and will organize equipment maintenance during the reduction period. This production cut and maintenance will involve a PET capacity of 600,000 tons, accounting for 20% of the company's total capacity.

According to statistics, between June and July, several leading companies have joined the production reduction campaign: China Resources Chemical has started to reduce production by 20% at its three factories since June 22, involving a capacity of 660,000 tons of polyester bottle flakes; Sanfangxiang has cumulatively stopped 1 million tons of capacity since the end of May, with no confirmed restart date; Yisheng plans to implement production cuts starting July 1, with a shutdown of 750,000 tons at its Hainan base and 350,000 tons at its Daqing base. This concentrated production reduction involves a total capacity of 3.36 million tons, accounting for 16.3% of domestic total capacity. As the plan progresses, the domestic polyester bottle flakes operating rate is expected to drop to around 75%.

With the increased reduction in polyester chip production, the prices of polyester chips have begun to stabilize recently amid a decline in upstream raw materials, and profits have started to rebound.

Perhaps it will be only when the major factories in the filament sector truly reach a consensus on production cuts, like in the slicing industry, that the price of polyester filament can return to stability.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track