“Prince Ning” Lithium Mine Shutdown Shockwave: A New Signal Against Overcompetition?

Since the complete shutdown of CATL's Jianxiawo mining area in Yichun, Jiangxi on August 10, 15 days have passed. During these 15 days, the "butterfly effect" triggered by this lithium mine shutdown has been spreading throughout the entire industry chain.

As a core raw material for lithium battery cathode materials, lithium carbonate is widely used in several key fields such as new energy vehicles, energy storage systems, and consumer electronics. Its price fluctuations have always affected the entire industry chain. Now, under the structural adjustments driven by the “anti-involution” policies in the lithium mining industry, an industry reshuffle triggered by changes in the supply side of lithium carbonate is quietly underway.

The futures market, driven by emotions?

On August 11, CATL responded to investors on the interactive platform, stating that after the mining license for its Yichun project expired on August 9, the company has indeed suspended mining operations. The company is currently applying for the renewal of the mining license in accordance with relevant regulations and will resume production as soon as approval is obtained. This matter will have little impact on the company’s overall operations.

Image source: CATL

Although CATL stated that the suspension of lithium mining in Yichun would not have a significant impact on the company's overall operations, the news still triggered a strong reaction in the market. At the close on August 11, lithium mining concept stocks such as Shengxin Lithium Energy, Jiangte Electric, Tianqi Lithium, and Ganfeng Lithium hit the daily limit, while other related stocks also surged sharply.

As the "sentiment barometer" and "trend alarm" of the spot market, lithium carbonate futures were launched on July 21, 2023, at the Guangzhou Futures Exchange, starting their journey in the capital market with a benchmark price of 246,000 yuan per ton. However, this also marked the beginning of a prolonged decline in lithium carbonate futures prices.

By the end of 2024, lithium carbonate futures prices had fallen to 77,100 yuan per ton, plummeting nearly 70% from their level on the first day of listing. Entering 2025, the market is searching for a new equilibrium amid intense volatility, with market sentiment and fundamentals intertwined as prices saw a pullback in July followed by a strong rebound in August.

It is worth noting that the market-wide price surge on August 11th undoubtedly signals that, after more than two years of stagnation, lithium carbonate has entered a new stage in its market cycle.

However, when bullish funds loudly proclaimed a "lithium supply cut," the collective euphoria of lithium stocks lasted only 72 hours. On August 12th, bearish funds made a strong entry, with prices opening high and closing low. After surging to 88,800 yuan during the day, they suddenly plummeted, dropping to 84,800 yuan by the end of the trading session.

A short-selling investor personally experienced a “life-or-death speed”: He opened a short position on August 8, encountered a limit-up board and failed to cover on August 11, and was forcibly liquidated on August 12. His account went from an initial capital of 16 million yuan to a negative balance of 4.64 million yuan, ending up owing a huge amount to the futures company.

The Jianxiawo mining area of CATL in Ningde is currently the largest lithium mica mine in Yichun City, with an annual capacity equivalent to about 20% of the national lithium mica production capacity in terms of lithium carbonate equivalent. Therefore, the operational dynamics of this mining area have always been closely watched by the market. According to reports, CATL has internally notified that the lithium mining operations in this mining area will be suspended for at least three months. This news has further intensified market expectations of tightening lithium resource supply.

However, the short-lived market sentiment will eventually burst the bubble. On August 20th, a "mass exodus" occurred in the lithium carbonate futures market. The main contract LC2511 opened with a sharp drop of 8%, firmly hitting the limit down at 80,980 yuan/ton, with the price per ton evaporating by over 7,000 yuan in one day.

The reason lies in a resumption announcement issued the previous day by Yichun Yinli, a subsidiary of Jiangte Motor. On August 19, Jiangte Motor announced that its wholly-owned subsidiary, Yichun Yinli, had previously suspended production for equipment maintenance. Recently, the company received notification from Yichun Yinli that Yichun Yinli would officially resume work and production soon.

Therefore, it can be said that behind the rises and falls in the lithium carbonate futures market, real industry supply and demand have begun to take a back seat, while short-term sentiment is impacting the market.

Will there be a shortage in the supply of lithium carbonate?

In fact, the shutdown of CATL's Yichun lithium mine is closely related to the significant adjustments in China's mineral resource management policies.

On July 1 this year, the newly revised Mineral Resources Law was officially implemented, listing lithium for the first time as an independent mineral for separate management. This marks a further elevation of lithium resources' strategic status and also means that mining and approval requirements will become more stringent.

On July 7th, the Yichun City Natural Resources Bureau issued a "Notice on the Preparation of Resource Verification Reports," clearly stating that there were cases of overstepping authority in the approval process during the transfer, alteration, or renewal registration of mining rights for eight lithium resources, including Jianxiawo. It requires all relevant mines to complete the mineral type change and resource verification report by September 30th. This policy change directly affected the normal production of the mines and the process of renewing their permits.

According to relevant data, from a production capacity perspective, the smelting plant supporting the Jianxiawo mining area has a monthly output of about 10,000 tons of lithium carbonate, accounting for 12.5% of the domestic total production. If the mining area stops production for three months, it is expected that lithium carbonate supply in August will decrease by approximately 4,000 tons, causing the monthly supply-demand balance to shift from surplus to shortage, with an inventory drawdown of about 3,000 tons, and the market gap will gradually emerge.

Image source: CATL (Contemporary Amperex Technology Co., Limited)

In addition to the short-term supply contraction, other lithium mines in Yichun are also facing regulatory compliance pressures. Currently, there are seven other mines in the region (six of which are in production) that need to complete mineral type changes and compliance reviews by September 30.

This means that if the production suspension scope is further expanded, the affected monthly production capacity is expected to reach 14,000 to 16,000 tons, accounting for approximately 13% of the total monthly domestic supply.

Under the newly revised regulations, the approval process for lithium mine permits has become significantly more complex. Not only must all lithium mines be reclassified, but resource taxes must be paid retroactively according to regulations. The approval stages have increased, and the timeline has been extended. Therefore, although it is expected that the verification reports of reserves in the Jiangxi region will be submitted by the end of September, there remains considerable uncertainty regarding the overall approval time, making it difficult to accurately predict when production will resume.

In addition, lithium extraction from lithium mica itself faces practical challenges such as high costs and significant environmental pressure. Due to its complex lithium extraction process and low recovery rate, the production cost per ton of lithium carbonate is significantly higher than that of salt lakes and hard rock lithium mines, making it nearly unprofitable at the current lithium price level.

In September last year, the Jianxiawo mining area proactively suspended production due to low lithium prices and only resumed operations in February this year. In addition, producing one ton of lithium carbonate generates about 50 tons of waste residue, and the enormous cost of solid waste disposal further undermines its economic viability. Under multiple pressures, the sustainability of lithium extraction capacity from mica is questionable, with industry insiders frankly admitting that "shutdown is only a matter of time."

According to the forecast by Minsheng Securities Research Institute, the total global demand for lithium mines in 2025 will be 1.551 million tons of LCE (lithium carbonate equivalent), with a total supply of 1.743 million tons of LCE, overall remaining in a slight surplus state.

However, domestic supply mainly relies on lithium extraction from lithium mica in Jiangxi and lithium extraction from salt lakes in Qinghai, with the supply from both regions expected to be 164,000 tons LCE and 170,000 tons LCE respectively by 2025. If the mica mines in Jiangxi undergo large-scale rectification and suspension of production due to mining license compliance issues, or if the salt lakes in Qinghai fail to ramp up as expected due to development progress and technical limitations, the domestic lithium supply will still face structural tightness.

It is worth noting that the import market for lithium carbonate has also failed to provide effective supplementation. In July, Chile exported only 13,600 tons of lithium carbonate to China, which, although a 33% increase month-on-month, still represents a 13.5% decrease year-on-year. The increase in overseas supply is limited, making it difficult to alleviate the potential supply gap domestically.

Resist involution and start extending towards the middle and lower reaches.

Since the National Development and Reform Commission explicitly called for rectifying “involuted” competition on May 20, the lithium battery and new energy vehicle industry chains have gradually returned to a rational development path under continued policy guidance and active industry response.

The intensity of terminal promotions in the automobile market has weakened, the pricing system is becoming more stable, and the market is showing signs of steady improvement. This change not only reflects the timeliness and effectiveness of policy regulation, but also indicates that the industry's competitive logic is shifting from "trading price for volume" to "winning by quality."

Long before CATL's Jianxiawo lithium mine ceased production, signals of "anti-involution" had already been frequently emitted within the industry.

On July 3rd, the Ministry of Industry and Information Technology convened a meeting with 14 lithium battery companies including CATL and BYD, as well as industry associations, explicitly requiring the "legal and compliant governance of low-price disorderly competition." It also released industry regulations, incorporating "sales not below cost price" into compliance red lines to regulate the development of the lithium battery industry and maintain the price order of the lithium carbonate market.

Under the guidance of the Ministry of Industry and Information Technology, 33 leading enterprises have signed the "Industry Self-discipline Convention," committing to phased production reduction and control starting from July to promote the restoration of market supply and demand balance and alleviate the issue of overcapacity in lithium carbonate production.

On August 7, Duan Debing, Vice President and Secretary-General of the China Nonferrous Metals Industry Association, made it clear at a meeting of the Lithium Industry Branch held in Yichun: "We must soberly recognize the long-term harm caused to the industry by 'involution'-style competition, and resolutely respond to the central government's decisions and arrangements on comprehensively rectifying vicious competition."

This statement represents the mainstream voice of the industry and further promotes the formation of a self-discipline consensus among enterprises in all segments of the lithium battery industry chain.

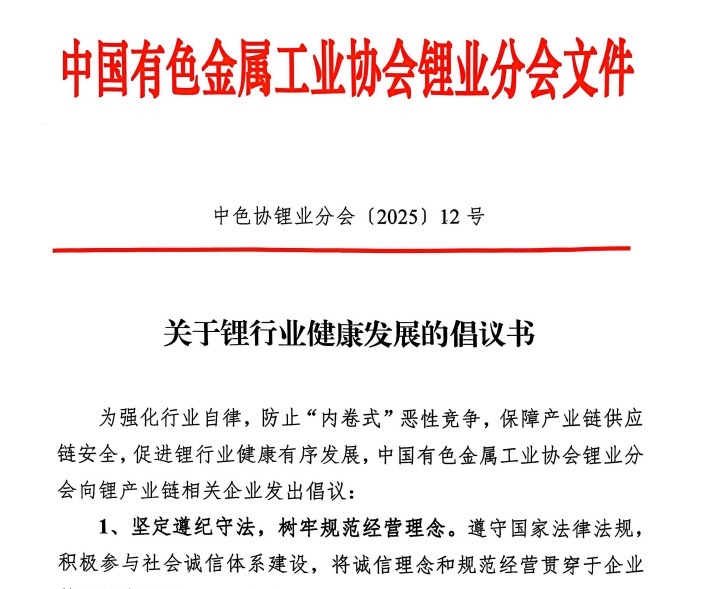

The recent production halt by CATL has triggered market concerns over high-cost excess capacity and further prompted the Lithium Branch of the China Nonferrous Metals Industry Association to issue an initiative calling for the resistance of vicious competition and the maintenance of market order.

According to the "Initiative for the Healthy Development of the Lithium Industry" issued on August 12, in order to strengthen industry self-discipline, prevent "involution-style" vicious competition, ensure the security of the industrial chain and supply chain, and promote the healthy and orderly development of the lithium industry, the Lithium Branch of the China Nonferrous Metals Industry Association has put forward six proposals to enterprises related to the lithium industry chain. These include enhancing upstream and downstream coordination to safeguard industry security, actively assessing market development trends, and reasonably planning new production capacities.

Image source: CATL

Industry insiders believe that CATL, as the industry leader, actively responding to policy adjustments, its production halt is seen as a landmark event for industry capacity reduction and anti-overcompetition, which helps guide resources toward compliant enterprises.

At the policy level, the Chinese government places great emphasis on the healthy and sustainable development of the lithium battery industry, repeatedly stressing the need to curb low-level repetitive construction and vicious price competition. It aims to guide enterprises to shift their focus towards technological innovation, product quality, and brand value enhancement. Under this guidance, the entire industry chain is undergoing a structural transformation from disorderly expansion to orderly competition.

It is worth noting that the "anti-involution" campaign is not limited to the lithium mining sector but continues to extend downstream. As one of the four core materials of lithium-ion batteries, separators have recently shown collective efforts to regulate market behavior.

From diaphragm companies seeking price stabilization, to lithium miners proactively limiting production to support prices, and then to coordinated statements from the government and industry organizations, a comprehensive "anti-involution" movement covering the entire lithium battery upstream and midstream to downstream sectors is evolving—from isolated points to a broader scope, from partial to systemic—driving the entire supply chain into a healthy resonance.

What is the future of lithium carbonate?

Industry insiders indicate that the key to "de-involution" in lithium carbonate lies in resolving overcapacity.

Industry chain analysts have stated that it is generally believed within the industry that the transaction price of lithium carbonate at around 90,000 yuan per ton will face significant resistance. Based on the current production costs of mainstream lithium mines globally, if the price reaches 90,000 yuan per ton, the vast majority of projects can achieve profitability, which will stimulate supply release, making it unlikely for the market to experience severe shortages. Therefore, a more likely scenario is that the price of lithium carbonate will fluctuate within a range above 80,000 yuan per ton.

At this level, upstream companies can achieve reasonable profits, while midstream and downstream material manufacturers and battery companies have a certain cost-bearing capacity. The entire industry chain is expected to enter a relatively balanced state.

Furthermore, the robust growth in end-user demand has also provided significant support for the stabilization of lithium prices.

Thanks to a series of government policies implemented since 2025 to promote automobile consumption—including the continuation of trade-in subsidies and purchase tax incentives for new energy vehicles—the overall automobile market has performed strongly, achieving double-digit growth.

According to the latest data released by the China Association of Automobile Manufacturers, from January to July this year, China's automobile production and sales reached 18.235 million and 18.269 million units respectively, representing year-on-year increases of 12.7% and 12%. Among them, the production and sales of new energy vehicles reached 8.232 million and 8.22 million units respectively, with year-on-year growth of 39.2% and 38.5%. The sales of new energy vehicles accounted for 45% of the total new car sales.

A relevant official from the China Association of Automobile Manufacturers stated that recently, the national level has issued the third batch of ultra-long-term special government bonds to support funds for the replacement of old consumer goods with new ones. The fourth batch is scheduled to be issued in October as planned. This will help stabilize consumer confidence, continuously boost automobile consumption, and maintain stable industry operations in the second half of the year.

Therefore, driven by both supply contraction and improving demand, the short-term outlook for the lithium carbonate market remains positive. In the medium to long term, however, the industry's sustained and healthy development will still depend on technological advancements, efficient resource integration, and coordination across the industry chain, in order to avoid falling back into vicious price competition.

In the future, as the global energy transition continues to advance, there will still be broad market demand for new energy vehicles and new types of energy storage. As a key raw material, the value of lithium carbonate is expected to gradually stabilize at a central level amid the dynamic balance of supply and demand.

Multiple brokerage research reports indicate that "anti-involution" is expected to become a key driver for profitability recovery and competitive landscape optimization in the lithium battery and other new energy industries.

By 2026, with the continuous release of demand from new energy vehicles and energy storage, the compound annual growth rate of lithium battery demand is expected to remain around 16%-21%. On the supply side, after adjustments and market exits, the approximately three-year oversupply cycle is likely to come to an end. The industry will enter a new development stage based on competition driven by real value. The competition in the next phase will belong to those enterprises that adhere to long-termism, focus on technological innovation, and possess truly core competitiveness.

Overall, the shutdown of the Jianxiawo mining area is not merely an isolated incident; it reflects the profound adjustments in the lithium industry amid multiple challenges such as policy transformation, cost pressures, and environmental constraints. Against the backdrop of continuous expansion in the lithium battery industry, unstable resource supply may become the norm. Enterprises along the industry chain need to further diversify their resource channels and strengthen resource reserves to cope with potential supply risks. This industry reshuffling, driven by a “reverse involution,” is reshaping the value logic of the midstream and downstream sectors of the lithium battery industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics