[PP Weekly Review] Market Consolidates in a Narrow Range This Week, Likely to Slightly Weaken Next Week

1Market Review: The domestic PP market saw narrow-range adjustments, with price levels stabilizing compared to the previous period.

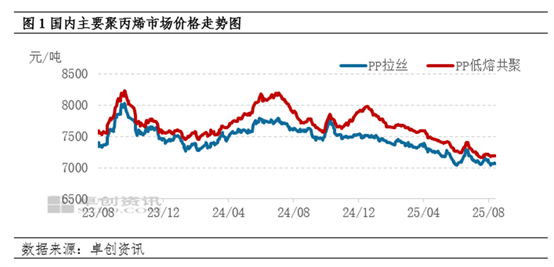

This week, the domestic PP market showed narrow fluctuations, with prices stabilizing on a weekly basis.As of this Thursday, the average weekly price of East China wire drawing is 7,068 yuan/ton, an increase of 3 yuan/ton from the previous week, with a growth rate of 0.04%. The regional price difference for wire drawing continues to widen. In terms of product types, the price difference between wire drawing and low melt copolymer has not changed significantly from the previous period.

This week, the PP USD market remained generally stable with minor fluctuations, while trading activities in the market faced pressure.In the import market, the PP futures shifted to a warmer tone during the week and then primarily consolidated, while the fluctuating crude oil prices provided limited support to the PP cost side. Overseas suppliers offered few quotations to China, and the price difference between domestic and international markets remained inverted, resulting in limited market changes. Most traders tended to stabilize and follow market trends. The downstream sector has not completely emerged from the off-season, with limited new orders from downstream factories and an average pace of finished product inventory reduction, leading to insufficient market confidence. There was moderate low-price purchasing primarily to meet production just-in-time needs. In the domestic market, the mainstream offers for August-September shipments of raffia ranged from $840 to $870 per ton, while the mainstream offers for homopolymer injection molding were also in the $840 to $870 per ton range. For copolymer transparent grades, the mainstream price range for August-September shipments was between $890 and $910 per ton. In the export market, this week, China's FOB offer intentions for homopolymer raffia ranged from $855 to $885 per ton. With abundant supply at the front end of the market, the sales pressure in the export market increased, leading some export enterprises to slightly lower their quotations for large-volume orders, while overall quotations tended to stabilize. The overseas market demand was weak, and the impact of U.S. tariff policies on Southeast Asian countries, among others, led to a decline in buying interest in the market, resulting in a lackluster performance in the export market during the week.

2Driving factors: Limited guidance from fundamentals, market trades in a narrow range.

Crude oil prices fluctuated continuously during the week, resulting in limited support for PP from the cost side. This week, the intensity of plant maintenance increased and some units reduced operating rates, slightly easing market supply pressure. However, upstream petrochemical enterprises still need to destock in the short term, so supply-side support for the PP market remains limited. On the demand side, downstream factories showed little improvement in new order follow-ups, insisting on low-priced, just-in-time procurement; short-term demand is difficult to release, which weighs on the PP market. Overall, both fundamentals and cost support for the PP market are limited. In addition, intraday fluctuations in PP futures have failed to boost market participants’ trading confidence. The market lacks clear guidance, with PP spot prices mainly experiencing narrow-range consolidation.

3Outlook for the future market: Fundamentals remain weak, and the market may continue to fluctuate within a weak and narrow range.

The PP market is expected to be weak and narrow next week.Taking East China as an example, the expected price range for raffia grade PP next week is between 6980-7150 yuan/ton, with an average price expected at 7050 yuan/ton. The low melt copolymer grade PP is expected to run between 7100-7250 yuan/ton, with an average price of 7160 yuan/ton. On the cost side, crude oil is expected to fluctuate widely, providing little guidance for PP costs. On the supply side, the impact of new production capacity is hitting the market, while plant maintenance is expected to weaken, leading to increased supply. On the demand side, downstream operations remain at low levels in the short term, and procurement of goods is cautious, indicating weak demand. Overall, market support from supply and demand fundamentals is weak, and there is no clear guidance from the cost side. Based on this, the PP market is expected to undergo slight downward adjustments next week.

Supply: With the commissioning of new production capacity and a decrease in maintenance of existing units, supply is expected to increase.Next week, regarding new production capacity, Ningbo Daxie Phase II Line One plans to release products next week, impacting the market. In terms of facility maintenance, both new maintenance and restart of facilities will coexist next week. Overall, the intensity of facility maintenance is expected to weaken, with an estimated loss of 153,700 tons next week, a decrease of 4.77% compared to this week. Supply is expected to increase slightly next week. Recently, the inventory reduction pace of major production enterprises is average, with future supply pressures and demand expected to be weak, making it difficult for the supply-demand fundamentals to improve. The resistance to inventory reduction for enterprises is increasing, and inventory is expected to increase slightly. Regarding traders' inventory, traders are selling according to the market in the short term, as confidence in future operations remains insufficient, maintaining a low inventory level as the main strategy. For port inventory, domestic prices are hovering at low levels in the short term, and the spread between domestic and international markets continues. The sentiment for foreign merchant offers has not changed significantly. In terms of exports, ocean freight and overseas demand have not changed much, and the export volume remains relatively stable. PP port inventory is expected to change little next week, remaining around 30,000 to 34,000.

The follow-up on new orders downstream is limited, procurement enthusiasm is insufficient, and demand remains relatively weak.Although high-temperature weather has decreased recently, new orders from downstream have not improved, and operating levels remain low with cautious procurement of goods. Additionally, due to the impact of the military parade, downstream operations in parts of North China are expected to decline next week. Overall demand remains weak, providing little support for the PP market.

Cost: Looking ahead to next week, oil prices are expected to fluctuate within a wide range. The average price of WTI crude oil is projected to be $62 per barrel, with a fluctuation range between $60 and $65 per barrel.Trump has declared that if Putin does not stop the conflict, he will face "serious consequences." If a "Trump-Putin summit" goes smoothly, a trilateral meeting between the US, Russia, and Ukraine will be held. Trump's remarks exert further pressure on a certain European country, so whether negotiations can proceed smoothly will depend more on this European country, which will amplify market uncertainty and oil price volatility. If the negotiations go smoothly, crude oil prices are likely to run weak; otherwise, there will be a sharp rebound, correcting the recent optimistic expectations of a possible agreement, and thus oil prices will fluctuate widely. In terms of risks, the first is the accumulation of US oil inventories; the second is Saudi Arabia's suspension of production increases. Crude oil is expected to fluctuate within a wide range, providing limited guidance for the cost side of PP.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track