[pp daily review] supply and demand variables pull market, pre-holiday stalemate continues

1. Today's Summary

At the beginning of the month, Sinopec East China reduced PP by 100 yuan. Zhong'an T is set at 6,650 yuan/ton, Zhenlian T is set at 6,950 yuan/ton, M17 is set at 6,800 yuan/ton, Shang F800EPS is set at 8,200 yuan/ton, GM1600E is set at 7,900 yuan/ton.

At the beginning of the month, Sinopec Central China's PP price adjustments: Zhongyuan raffia decreased by 200 yuan/ton, thin-walled Luoyang decreased by 50 yuan/ton, Changling decreased by 70 yuan/ton, transparent decreased by 100-150 yuan/ton, copolymerized Sino-Korean low melt increased by 30 yuan/ton, high melt increased by 50 yuan/ton.

Today, the domestic polypropylene shutdown impact decreased by 1.34% compared to last week, reaching 18.31%. Hengli Petrochemical's STPP unit, with a capacity of 200,000 tons per year, and Huizhou Litong's unit, with a capacity of 150,000 tons per year, have started operations, with an expected daily output increase of 1,050 tons. The daily production proportion of raffia increased by 2.97% compared to last week, reaching 30.94%. This is mainly due to Beihai Refining's 200,000 tons per year, Gulei Petrochemical's 350,000 tons per year, and Jineng Chemical's 900,000 tons per year units switching to raffia production, with an expected increase in raffia output of 4,350 tons per day.

③、(20250919-0925) The supply-demand balance in this period remains tightly balanced. , The supply-demand gap has narrowed somewhat, continuing to support market sentiment. The supply-demand balance gap for the next period is expected to narrow due to increased supply, which is anticipated to weaken the support for prices.

2. Spot Overview

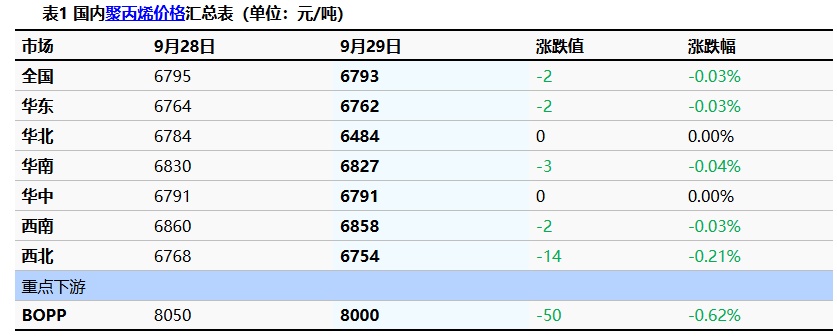

As a benchmark for the East China region, today's polypropylene filament closed at 6,762 yuan/ton, down 2 yuan/ton from yesterday. The national average price of filament decreased by 2 yuan/ton from yesterday, down 0.03% from last week, in line with the morning forecast.

Futures opened lower and fluctuated today. In the morning, market quotations remained stable with some areas seeing a decrease of 10-20 yuan/ton. At the end of the month, the industry's destocking process accelerated, with downstream pre-holiday restocking mainly on a demand basis. Market transactions have entered a slower pace. The supply and demand fundamentals are in a state of stalemate and contention. The market is expected to experience narrow fluctuations in the near term. As of midday, the mainstream price for East China raffia is between 6,750-6,850 yuan/ton.

|

Figure 1 Domestic Polypropylene Price Trend (Unit: Yuan/Ton) |

Figure 2 Domestic Polypropylene Prices Chart by Region (Unit: RMB/ton) |

![[PP日评]:供需变量牵引市场 节前僵持局势延续(20250929)](https://oss.plastmatch.com/zx/image/a0d79d4123fd4c23b997cc943f4425f5.png) |

![[PP日评]:供需变量牵引市场 节前僵持局势延续(20250929)](https://oss.plastmatch.com/zx/image/b014824709164d05a2a738e11e53da4c.png) |

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

3. Futures-Spot Basis

From the perspective of basis, the polypropylene basis in East China today is -136 yuan/ton, a decrease of 4 yuan/ton compared to yesterday; the basis in North China is -115 yuan/ton, a decrease of 9 yuan/ton compared to yesterday.

|

Figure 3 Basis Trend in North China (Unit: Yuan/Ton) |

Figure 4 Basis Trend in East China (Unit: yuan/ton) |

![[PP日评]:供需变量牵引市场 节前僵持局势延续(20250929)](https://oss.plastmatch.com/zx/image/d21dc94cbf784d03aa7a5f4823b4ba23.png) |

![[PP日评]:供需变量牵引市场 节前僵持局势延续(20250929)](https://oss.plastmatch.com/zx/image/649a6d8ecbbb443bb59e457d9161e0ef.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

4. Production Dynamics

The capacity utilization rate of polypropylene increased from 75.93% yesterday to 77.34%, up by 1.41% from the previous day. Hengli Petrochemical's STPP unit with a capacity of 200,000 tons per year and Huizhou Lituo's unit with a capacity of 150,000 tons per year have started operations, with an expected daily output increase of 1,050 tons.

|

Figure 5 Domestic Polypropylene Capacity Utilization Trend Chart |

Figure 6 Domestic Polypropylene Profit Price Trend Chart (Unit: Yuan/Ton) |

![[PP日评]:供需变量牵引市场 节前僵持局势延续(20250929)](https://oss.plastmatch.com/zx/image/f7b45c32e54444868f4bd72941476597.png) |

![[PP日评]:供需变量牵引市场 节前僵持局势延续(20250929)](https://oss.plastmatch.com/zx/image/69d070de41b94f65bb7ed2a203dde690.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

5. Market Sentiment

With the National Day holiday approaching, downstream buyers are mostly purchasing on demand, while upstream producers are pre-selling resources in advance to mitigate the risk of holiday inventory. Intermediaries are mainly maintaining low inventory to promote transactions.

6. Price Forecast

The National Day holiday impacts have accelerated the pre-holiday destocking process in the industry chain. Due to the prominent long-term oversupply contradiction in polypropylene, upstream production enterprises are conducting maintenance and reducing load to avoid market risks. On the demand side, there is weak pre-holiday restocking intention, with post-holiday on-demand procurement mode, leading to a weak and fluctuating market situation. Recently, there are limited variables on the supply and demand side, and it is expected that the short-term market will weakly fluctuate around 6750-6850 yuan/ton.

7. Related Product Information

Table 2 Summary of Prices for Polypropylene-Related Products (Unit: Yuan/Ton)

|

Market |

9 28th of the month |

9 Month 29th |

Change in value |

Change in rate |

|

Shandong Propylene |

6450 |

6435 |

-15 |

-0.23% |

|

Shandong Methanol |

2380 |

2380 |

0 |

0.00% |

|

Linyi PP powder |

6760 |

6700 |

-60 |

-0.89% |

Data Source: Longzhong Information

8. Data Calendar

Table 3 Overview of Domestic Polypropylene Data (Unit: 10,000 tons)

|

Data Project |

Publication Date |

Previous Data |

Current trend forecast |

Unit |

|

Total PP Inventory |

Wednesday 4:30 PM |

77.39 |

↓ |

10,000 tons |

|

PP production enterprise capacity utilization rate |

Thursday 4:30 PM |

75.52% |

↑ |

% |

|

PP weekly maintenance impact== |

Thursday 4:30 PM |

18.363 |

↓ |

10,000 tons |

|

Total Production of Domestic PP Enterprises |

Thursday 4:30 PM |

77.34 |

↑ |

Ten thousand tons |

|

Oil-based PP enterprise profit |

Thursday 4:30 PM |

-644.59 |

↓ |

CNY/ton |

|

Coal-to-PP Enterprise Profit |

Thursday 4:30 PM |

312.53 |

↓ |

CNY/ton |

|

PDH-based PP enterprise profit |

Thursday 4:30 PM |

-816.71 |

↑ |

CNY/ton |

|

PP import profit |

Thursday 4:30 PM |

-569.93 |

↓ |

CNY/ton |

|

PP export profit |

Thursday 4:30 PM |

-10.05 |

↓ |

USD/ton |

|

1. Consider a significant fluctuation as an increase or decrease exceeding 3%, highlighting the data dimension of such changes. 2. ↗↘ are considered as narrow fluctuations, highlighting data with a price change within 0-3%. |

||||

Data Source: Longzhong Information

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics