Polypropylene: Why the Peak Season Hasn't Arrived and When the Price Turning Point Will Come

As we enter 2025, the domestic PP market has been on a downward trend, and by August, the market did not experience the anticipated rebound, instead declining further. With the "Golden September" approaching, the question remains whether market demand will improve and when the market turning point will arrive.

The price continues to decline, reaching a new low for the year.

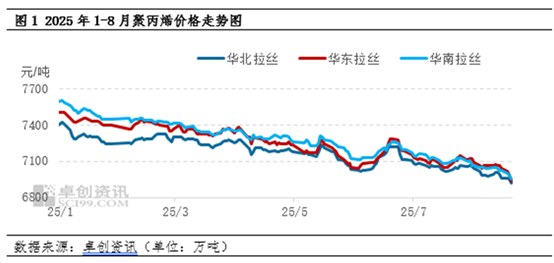

In 2025, the domestic PP market showed a one-sided trend, with the focus continuously shifting downward. Especially by August, the market still lacked support, and the focus dropped further. According to data from Zhuocang Information, taking East China PP raffia as an example, the average price in August was 7,035 yuan/ton, down 0.92% month-on-month, marking a new low for the year. Analysis indicates that although there was some macroeconomic news support released near the end of August, the supply and demand fundamentals remained weak. In particular, downstream new orders showed no improvement, coupled with slow destocking of finished product inventories, which hindered downstream purchasing enthusiasm. This increased the resistance to market rallies, causing the focus to decline once again.

Supply-side pressure intensifies again

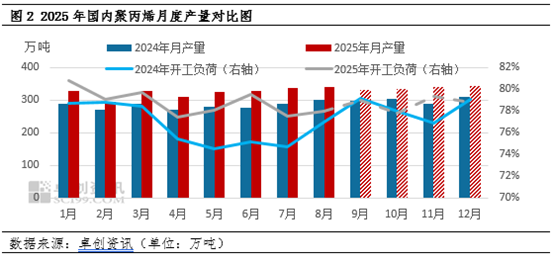

The supply side is expected to increase in the later period, adding upward pressure to the market. On one hand, new production capacity is about to be commissioned. According to data from SCI99, the 450,000-ton Line 2 of the second phase of Ningbo Daxie has already produced qualified products, while the 450,000-ton Line 1 of the same phase is planned to be launched in mid-September. In addition, the 400,000-ton Phase II unit of Guangxi Petrochemical is scheduled to release capacity in mid-October. The anticipated addition of new capacity is expected to have a strong impact on the market in the future.

In terms of equipment maintenance, PP maintenance was concentrated in the first half of the year, but currently, the intensity of maintenance on existing equipment has somewhat weakened, and there is a decreasing trend in the number of newly planned maintenance units. Especially after most companies complete their major maintenance plans in the first half of the year, they tend to operate steadily in the second half, and as the winter weather turns colder, maintenance units decrease even further. Therefore, the overall maintenance intensity of equipment is expected to weaken in the future. Overall, considering the impact of new capacity additions and the anticipated weakening of maintenance intensity, supply is expected to be relatively abundant, exerting downward pressure on prices.

Differences have emerged between domestic demand and external demand.

Domestic demand is expected to improve in the later period, providing support for market expectations in September and October. Holidays and the back-to-school season are anticipated to drive increased demand for PP daily necessities and packaging. Additionally, holiday promotions for home appliances will further boost PP demand. Moreover, due to the earlier impact of high temperatures, downstream operating rates declined; as the high-temperature weather gradually subsides, there is an expectation for increased downstream operations.

From the perspective of external demand, the expected improvement is likely to be limited. On one hand, overall overseas demand remains uncertain. On the other hand, due to fluctuations in Sino-US tariffs in the first half of the year, some domestic export-oriented enterprises have adjusted their export directions, resulting in a reduction in export volumes. In addition, the practice of "front-loading" exports has already consumed part of the demand in the first half of the year, so exports of finished products are expected to decline year-on-year. However, overall, domestic demand is expected to increase to some extent, providing strong support to the market.

Overall, the market is still expected to stop falling and rebound in September, with the market focus likely to rise. Although supply is expected to increase, domestic demand is anticipated to improve, which may strengthen the market’s fundamental support. At the same time, on the macro front, further announcements regarding the renovation of old domestic facilities may be released, and there is a strong expectation of a Federal Reserve rate cut in September. Both factors are likely to boost the PP market to some extent. However, considering the pressure from ample supply and the fact that consumer spending remains cautious, these may pose resistance to market growth. As a result, the market is expected to rise moderately.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track