Polypropylene falls for 47 consecutive days with a 6% drop! can it turn the tide in the fourth quarter?

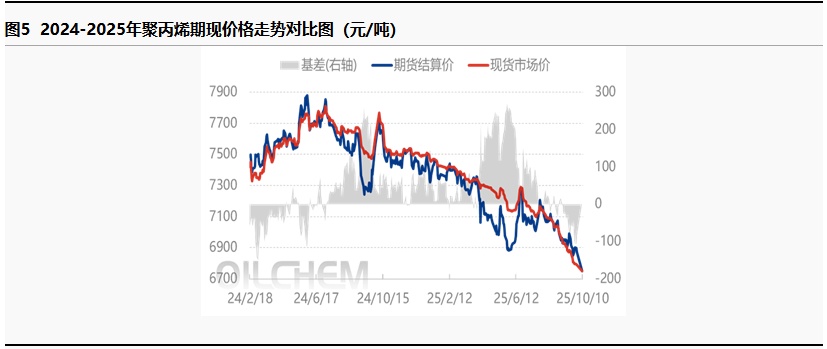

Introduction: According to tracking data from Longzhong Information, polypropylene entered a downward trend at the end of July, experiencing a decline for 47 consecutive working days, with a drop of 6%. During this period, polypropylene exhibited a pattern of strong futures and weak spot prices, with low market willingness to hold inventory and selling pressure causing the basis to weaken. How will the supply and demand dynamics for polypropylene perform in the future? Can the market turn around despite the headwinds?

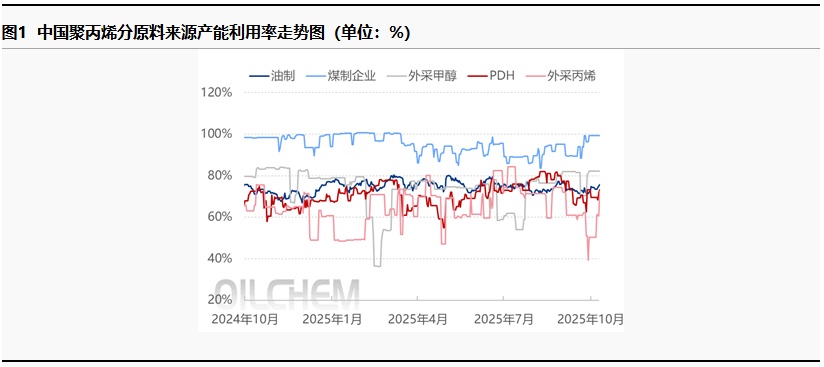

I. Positive support from the supply side is evident; pay attention to the operation of PDH units in the fourth quarter.

On October 10, 2025, the Ministry of Transport announced the collection of special port fees for American vessels. The announcement states that, starting from October 14, 2025, special port fees will be charged for vessels owned by enterprises, other organizations, and individuals from the United States; vessels operated by enterprises, other organizations, and individuals from the United States; vessels owned or operated by enterprises or organizations in which enterprises, other organizations, and individuals from the United States directly or indirectly hold 25% or more of the voting rights or board seats; vessels flying the American flag; and vessels built in the United States. The maritime management authorities at the port where the vessels are docked will be responsible for collecting these special port fees.

From the perspective of polypropylene, apart from coal-to-chemical companies that have self-sufficient raw materials, other types of enterprises are affected to varying degrees. Among them, PDH units, due to their high reliance on imports from the U.S., may be directly impacted by the implementation of this policy. According to Longzhong Information statistics, there are currently a total of 9.9 million tons/year of PDH-based PP production capacity in China, accounting for about 20% of the total polypropylene supply. Currently, PDH operating load remains stable at around 70%. After the policy is implemented, as PDH companies deplete their raw material inventory, there will be significant pressure for subsequent raw material replenishment, and the operating rate of PDH units is expected to decline to around 50%. The future stability of PDH units will become an important variable for the polypropylene supply side.

Under the stimulation of low prices, downstream buying of polypropylene is activated, and major downstream sectors have entered a profitable zone.

From the perspective of downstream performance, due to the continuous decline in polypropylene raw material prices in the earlier period, the market's willingness to hold inventory has remained low, and the raw material inventory days in downstream industries have dropped to the lowest point in three years. As of the latest statistics on October 9, the raw material inventory days in the polypropylene downstream industry are only 9.72 days, which is 15% lower year-on-year. In terms of average profit performance in downstream industries, as the product prices fluctuate less than the PP raw material side, the recent average profit in downstream industries has generally increased, with average profit per ton exceeding 500 yuan/ton. High profits are stimulating the operating enthusiasm of downstream sectors, and the demand for polypropylene downstream is expected to enter a positive feedback loop.

|

Figure 2: Raw Material Inventory Days in PP Downstream Industries (Unit: Days) |

Figure 3 Average Profit Statistics of PP Downstream (Unit: Yuan/Ton) |

|

|

|

|

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

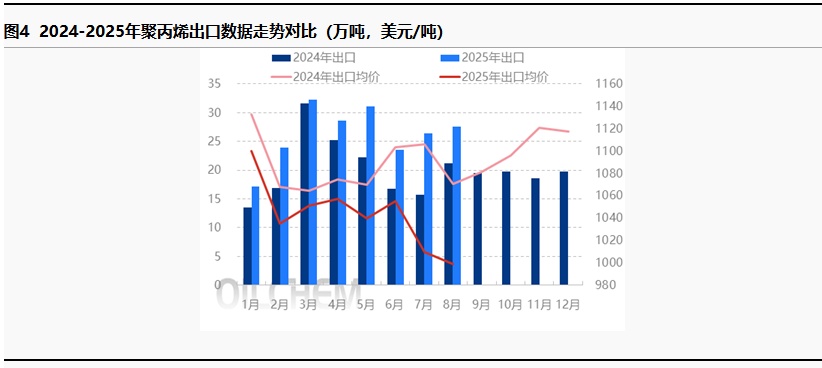

3. Export Promotion of Polypropylene Raw Material Consumption: The export growth expectation for the fourth quarter remains at 30%.

According to customs data, the cumulative export volume of polypropylene from January to August 2025 reached 2.1035 million tons, an increase of 29.03% year-on-year.Looking ahead, production enterprises have a good grasp of export rhythm for the year. As the fourth quarter approaches, the market is entering a closing phase, and some enterprises have set annual strategic goals to increase export volume by 100%. Therefore, in the fourth quarter, some enterprises are expected to continue offering discounts to maintain export growth, making exports an important means to expand domestic demand.

4. Improvement in the Fundamentals of Polypropylene: Strengthening of the Spot Basis

After the National Day holiday, propane costs collapsed, and the polypropylene market was hit again. However, under the stimulus of low prices, downstream buying interest increased, leading to a good trading atmosphere during the day. The market's fundamental situation improved, and the spot basis strengthened.

In summary, with the continuous decline in prices in the early stages, the supply-demand contradiction of polypropylene has been converted into price adjustments, which are gradually being digested. As we enter the fourth quarter, the supply-demand pattern of polypropylene is improving. On the supply side, there is only the expected release of a new capacity of 400,000 tons/year from Guangxi Petrochemical, marking the end of the high expansion cycle and entering a recovery phase. Particularly, the sudden introduction of the port fee policy raises questions about future supply stability, and there is a significant probability of a decline in the utilization rate of PDH capacity. On the demand side, low raw material inventory combined with high profits supports a recovery in demand, which is expected to enter a positive feedback loop. The trend of high growth in exports is maintained, and the annual export plan supports raw material consumption in the fourth quarter. It is anticipated that polypropylene will recover from the previous excessive decline and enter an upward range, with prices verifying transactions around 6,800-7,000 yuan/ton.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

![[隆众聚焦]:连跌 47 日跌幅 6%! 聚丙烯四季度能否逆风翻盘?](https://oss.plastmatch.com/zx/image/c94a67ba54c04eeda45a49fd3c8d6e63.png)

![[隆众聚焦]:连跌 47 日跌幅 6%! 聚丙烯四季度能否逆风翻盘?](https://oss.plastmatch.com/zx/image/030cb29e61834118890dc1293df86a7f.png)