PEEK Sector "Crowded"! Giants Cross Over to Challenge Global Leadership

In recent years, against the backdrop of "using plastic instead of steel" and "lightweighting," polyether ether ketone (PEEK) material, recognized globally as one of the best-performing thermoplastic engineering plastics, has been widely used in fields such as transportation, aerospace, electronic information, energy and industry, and medical health.

Amid the robotics boom, PEEK material has also emerged in this field, and companies in the related industry chain are very active in the capital market, with the popularity of the PEEK material industry remaining high.

From the perspective of the industry landscape, the current global PEEK production manufacturers show a pattern of "one strong leader and multiple strong players." UK-based Victrex is the largest PEEK producer in the world, with a capacity of 8,650 tons per year; Belgium's Syensqo (established as a spin-off from Solvay at the end of 2023) has a current PEEK capacity of 2,500 tons per year; and Germany's Evonik ranks third, with a PEEK capacity of 1,800 tons per year.

The main domestic production companies include Zhongyan Co., Ltd. (1000 tons/year), Water Co., Ltd. (900 tons/year), Shandong Junhao (1500 tons/year), Zhejiang Pengfulong (700 tons/year), Changchun Jida Special Plastic (500 tons/year), and Shandong Haoran Special Plastic (300 tons/year).

Zhongyan Co., Ltd.

Zhongyan Co., Ltd. primarily produces resin-based PEEK, forming an existing product system of "two major categories, three major grades, and seven major series" with a total of 89 specifications and grades. Additionally, it also includes a small number of PEEK products.

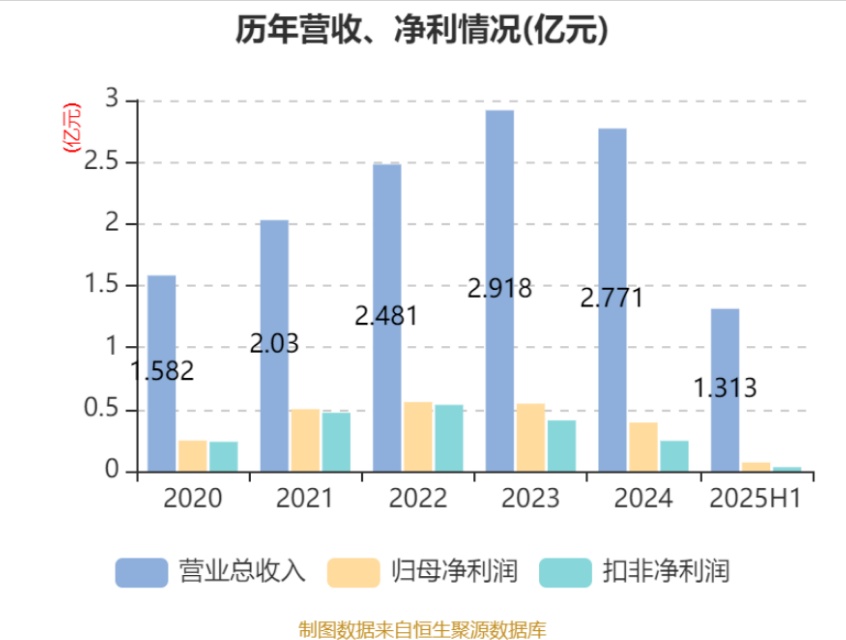

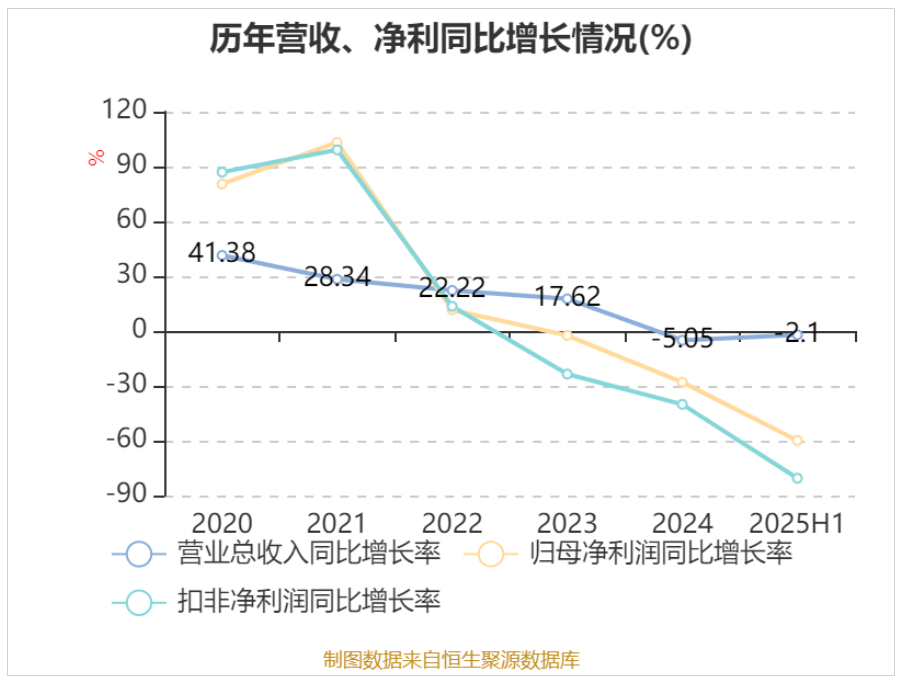

In the first half of 2025, the company achieved a total operating revenue of 131 million yuan, a year-on-year decrease of 2.10%; the net profit attributable to shareholders was 7.0269 million yuan, a year-on-year decrease of 59.89%.

Although net profit decreased in the first half of 2025, the decline in raw material prices resulted in a comprehensive gross margin of 44.42%, higher than last year's 40.16%.

Research and development (R&D) investment increased by 38.09% compared to the same period last year, mainly due to increased consumption of R&D materials, an increase in the number of employed R&D personnel, and higher salaries paid to R&D staff. In the first half of the year, R&D expenses amounted to 18.8764 million yuan, accounting for 14.38% of operating revenue; after deducting the amortization expenses of intangible assets formed by capitalization, the current R&D investment was 17.6404 million yuan, accounting for 13.44% of operating revenue.

The company is currently focusing on the research of medical-grade PEEK and has subsequently developed ZR3G and ZR7G pure resin granule products with different flow grades, as well as ZR7R rod products and ZR7PL sheet products. Its medical-grade PEEK products have completed the primary document filing with the National Medical Products Administration. Kangtuo Medical, Dabo Medical, and Maipu Medical have successively used the company's medical-grade polyether ether ketone raw materials to obtain registration certificates (or raw material changes). In addition, the company is also developing anti-static PEEK and high-temperature resistant insulating PEEK materials.

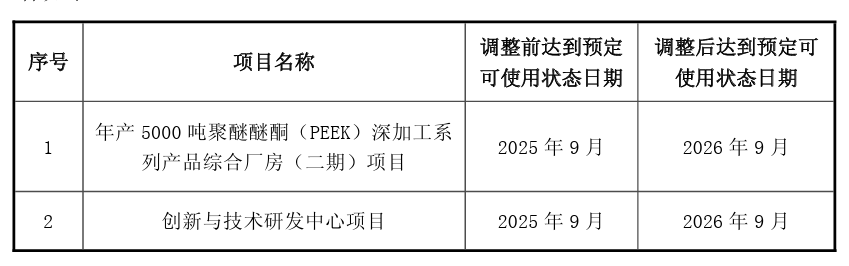

On August 27, Zhongyan Co., Ltd. announced the decision to postpone the completion date of its initial public offering fundraising projects, specifically the "Annual Production of 5,000 Tons of Polyether Ether Ketone (PEEK) Deep Processing Series Products Comprehensive Plant (Phase II) Project" and the "Innovation and Technology Research and Development Center Project" from September 2025 to September 2026. As of the announcement date, the infrastructure construction of the "Annual Production of 5,000 Tons of Polyether Ether Ketone (PEEK) Deep Processing Series Products Comprehensive Plant (Phase II)" has been smoothly implemented, and the main building has passed acceptance inspection. The main reason for the delay is the need to make dynamic adjustments and reasonable decisions based on changes in the market environment and policies during the project implementation process, in order to effectively control costs, reduce risks, and enhance asset liquidity.

At the same time, the implementation method of the "Shanghai Carbon Fiber Polyether Ether Ketone Composite Material Research and Development Center Project" has been changed from the original plan of providing loans to Zhongyan Shanghai through the company to increasing capital to Zhongyan Shanghai.

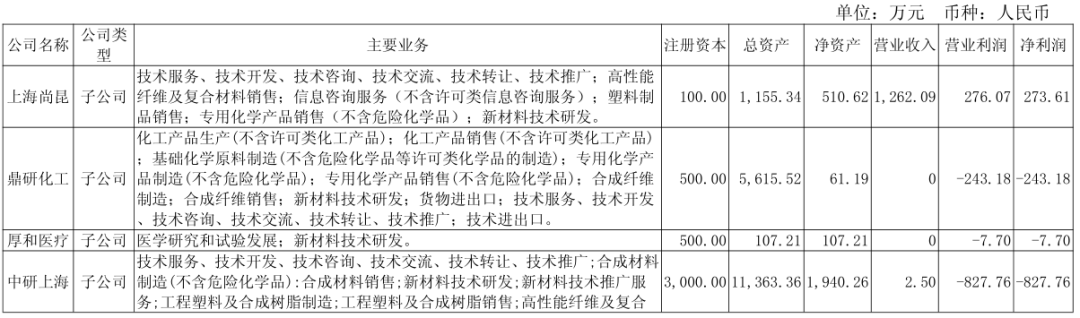

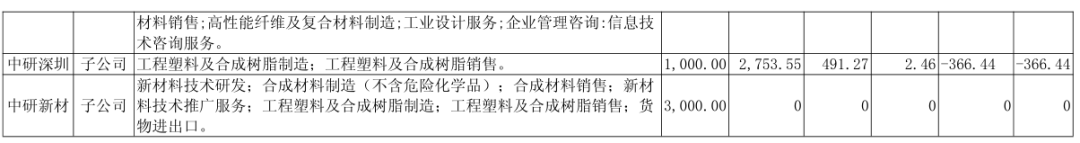

In addition, Zhongyan Co., Ltd. currently has subsidiaries (including joint ventures) such as Shanghai Shangkun, Dingyan Chemical, Houhe Medical, Zhongyan Shanghai, Zhongyan Shenzhen, and Zhongyan New Materials. On January 16 of this year, it established a secondary subsidiary, Zhongyan Composite Materials (Shanghai) Aerospace Technology Development Co., Ltd., mainly for the research and development of new material technologies. It is worth mentioning that Zhongyan Co., Ltd. has decided to increase its investment in Dingyan Chemical by 45 million yuan using its own funds; to increase its investment in Shanghai Zhongyan by 70 million yuan (raising 43.204 million yuan + using 26.796 million yuan of its own funds); and to increase its investment in Zhongyan Shenzhen by 20 million yuan using its own funds.

Watts Co., Ltd.

Watts Holdings has currently achieved a full value chain layout for core materials such as LCP, PPA, PEEK, PPS, PTFE, and polyarylether sulfone.

In the first half of 2025, the total operating revenue was 906 million yuan, a year-on-year increase of 12.29%. The net profit attributable to shareholders was 18.408 million yuan, a year-on-year increase of 23.94%. Among them, revenue from specialty polymer materials reached 443 million yuan, accounting for nearly 50% of total revenue, with significant growth in the shipment of core products such as LCP, PPA, PPS, and PEEK. In terms of research and development investment, Watte Co., Ltd. reported R&D expenses of 55.9804 million yuan in the first half of the year, a year-on-year increase of 17.29%, accounting for 6.18% of revenue.

In terms of capacity construction, the Chongqing base's 20,000-ton LCP resin project (Phase I and II) and the 1,000-ton PAEK resin project (Phase I, including PEEK and PEKK) were put into production in May. Once completed, the annual production capacity of LCP will reach 25,000 tons, which is expected to become the largest capacity supplier in the world. Currently, the company's subsidiary, Zhejiang Kesai, has achieved production and processing capabilities for PEEK profiles at the hundred-ton level and is gradually supplying PEEK profiles to customers in fields such as precision electronics, electronic information, industrial machinery, and bearings. The company is also utilizing PEEK materials in high-end applications in semiconductor component solutions, fluorine materials, and seals through acquisitions. For example, it has completed the full acquisition of Shanghai Waterhua Semiconductor Technology Co., Ltd. and is proposing to acquire 100% of the equity of Walka Sealing Products (Shanghai) Co., Ltd. held by Walka Corporation for 25.716 million yuan (including tax).

In addition, Wote Co., Ltd. has achieved batch shipments of its thermosetting carbon fiber composite material production line, which is applied in fields such as drones and robots. The series of bio-based high-temperature nylon, bio-based transparent nylon, bio-based long-chain nylon, and bio-based nylon elastomers have achieved mass production.

Junhua Co., Ltd.

On August 21, Jiangsu Junhua High Performance Specialty Engineering Plastics Co., Ltd. (hereinafter referred to as "Junhua Co., Ltd.") obtained the registration for IPO counseling, planning to go public on the A-shares market. Junhua Co., Ltd. was established in 2007, with a registered capital of 51 million yuan, and its legal representative is Li Jun. It is a comprehensive full-industry chain specialized company capable of PEEK resin raw material polymerization, PEEK sheet, rod, and tube extrusion, as well as PEEK precision parts manufacturing. Additionally, it also deals with raw materials and rods of polyimide and PPSU.

It is reported that Junhua Co., Ltd.'s new factory project is expected to officially start operations in February next year. The total investment for the project is 300 million yuan, and once completed, it will have an annual production capacity of 1,000 tons of PEEK and 100 tons of PI materials and related products.

Currently, Junhua Co., Ltd. has 40 specialized production lines for high-performance special engineering plastic profiles for continuous extrusion, and has subsidiaries such as Shandong Junhao and Changzhou Junhua Medical. Shandong Junhao adopts patented technology from Jilin University and focuses on the research, development, production, and sales of high-performance polymers such as PEEK (Polyether Ether Ketone) and PEK (Polyether Ketone). It is constructing two production facilities in the Jining New Material Industrial Park with an annual capacity of 2,500 tons of PEEK resin, 600 tons of modified PI resin particles, and 100 tons of medical-grade PEEK. On September 19, the main structure of the three-phase project of Shandong Junhao—a stereoscopic workshop—was successfully topped off. This project includes production capacities for PEK resin (200 tons), PEEK particles (1,100 tons), PEEK modified particles (300 tons), PEEK fine powder (100 tons), PI particles (100 tons), and high-purity sodium carbonate (1,500 tons). The project is expected to begin trial production in the first quarter of 2026.

Zhejiang Pengfulong

Zhejiang Pengfulong Technology Co., Ltd. (Pengfulong Technology) has three major business segments: specialty engineering plastics, specialty coatings, and biomaterials. Its holding subsidiary, Zhejiang Pengfulong New Materials Co., Ltd., was established on December 2, 2010. The leading products include PEEK, polyethersulfone (PES), and other specialty polymer materials. As of 2024, Zhejiang Pengfulong New Materials Co., Ltd. holds 45 authorized patents, including core technologies such as the preparation of polyetherketone resin products and thermochromic ceramic coatings.

The human implant materials produced by Zhejiang Zhongju Biotechnology Co., Ltd., a subsidiary of Pengfulong Technology Holdings, using PEEK, have passed more than 10 biocompatibility tests, ranging from fracture fixation nails to cranial repair plates. Additionally, the newly expanded factory, with a total investment of 150 million yuan, has been put into operation.

Changchun Jida Special Plastic

Changchun Jida Special Plastic Engineering Research Co., Ltd. (JUSEP) was established in 2002, with a registered capital of 15 million yuan. It is a company engaged in the research and development, production, sales, and secondary processing of polyaryletherketone (PAEK) and polyarylether sulfone (PAES).

JUSEP has a clean workshop of 2000 square meters and an industrial workshop of 3000 square meters, with an annual production capacity of 500 tons of polyether ether ketone (PEEK), 500 tons of polyether ether ketone ketone (PEEKK), 500 tons of polyether ketone (PEK), and 100 tons of polyether sulfone (PES) resins and their modified materials. JUSEP offers a wide range of products, including high heat-resistant specialty engineering plastics, specialty engineering plastic-based reinforced materials and alloys, specialty engineering plastic-specific grade resins, profiles, and injection molded products, totaling more than 80 grades across five major series. It is one of the enterprises with the most complete variety of specialty engineering plastics globally. JUSEP's products are widely used in aerospace, automotive, petrochemical, electronics, and medical fields.

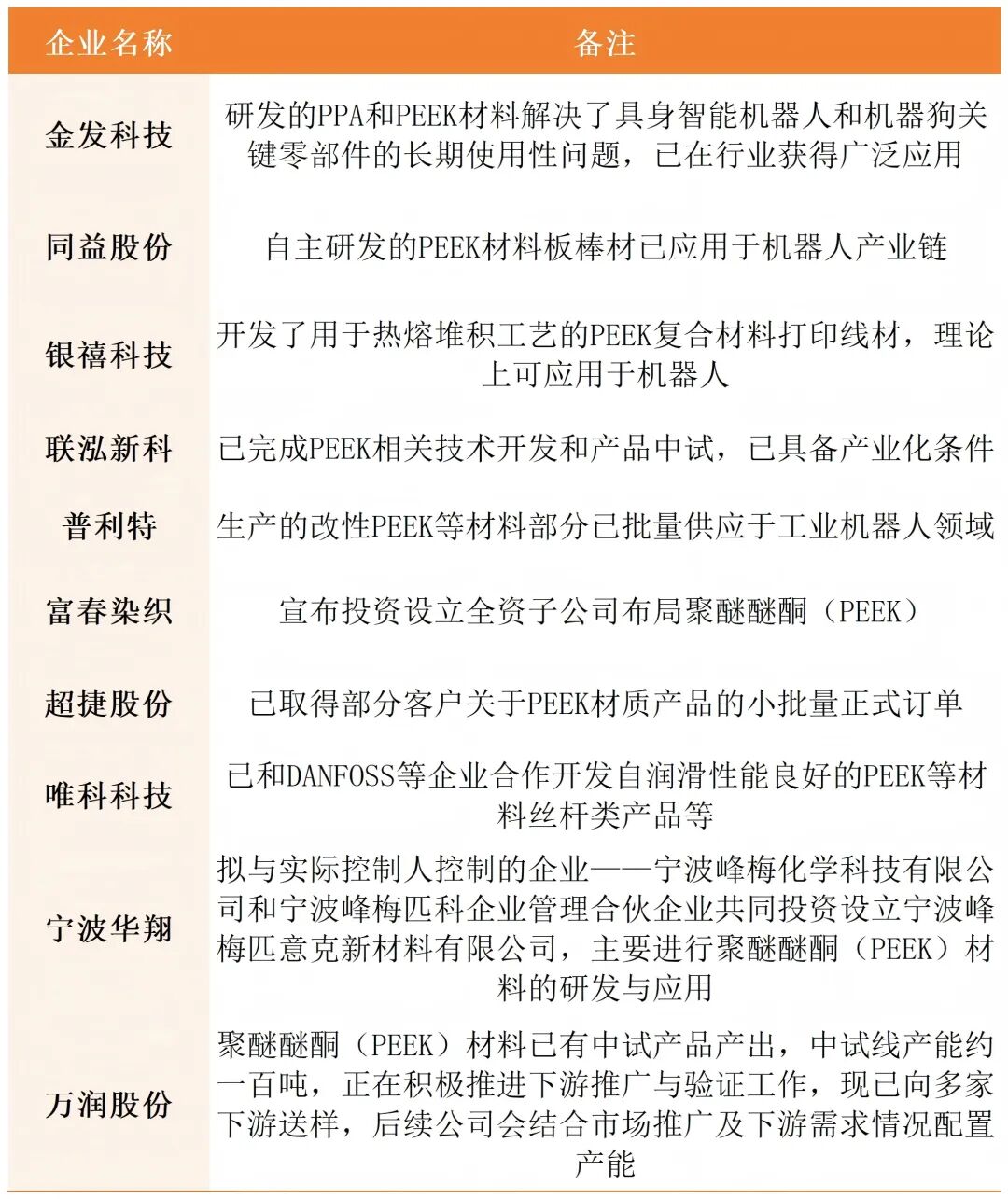

Many companies have made progress.

In addition, besides the aforementioned companies, PEEK, as a popular material, is indeed in high demand, and recently several companies have made progress.

Ningbo Huaxiang, in partnership with Fengmei Chemical and Ningbo Fengmei PICO Enterprise Management Partnership, has established a joint venture called Ningbo Fengmei PEEK New Material Co., Ltd. This venture plans an annual production capacity of 12,000 tons of PEEK material, to be implemented in four phases, with the first phase capacity being 4,000 tons, expected to commence production in the second half of next year. This production capacity plan is the largest known globally, aiming to become the world's leader! It is reported that Ningbo Huaxiang is one of the world's top 500 auto parts companies, a leading listed company in the domestic automotive interior industry, and a giant in the domestic auto parts sector.

Guoen Co., Ltd. has announced the completion of the development of PEEK material production technology and core processes. It plans to establish a vertically integrated platform covering the entire PEEK industrial chain from polymerization to compounding to finished products through its wholly-owned subsidiary Zhejiang Guoen Chemical Co., Ltd. The company is set to build a styrene engineering materials polymerization pilot platform and a 300,000-ton/year organic polymer modification and composite materials project. This project has obtained project registration issued by the Economic Development Bureau of the Zhoushan High-Tech Industrial Park Management Committee. It is reported that the total investment in the project is 960 million yuan, with plans to build two PEEK polymerization production lines, one set of styrene engineering materials polymerization pilot platform equipment, and 36 modified and composite material production lines.

Overall, the trend towards lightweight humanoid robots has provided PEEK material manufacturers with an opportunity to expand their market size. They are expanding production in hopes of gaining a competitive edge. Relevant agencies predict that the global PEEK market size will approach 7 billion yuan by 2025 and exceed 13.1 billion yuan by 2031; the Chinese market size is expected to reach 2.18 billion yuan by 2025 and 5 billion yuan by 2031. However, most application scenarios belong to high-end fields (such as aerospace, medical devices, new energy, semiconductors, etc.). In addition, the entire industry chain of PEEK from raw materials to synthesis to modification to application has high technical barriers, and there is a significant gap compared to foreign giants. Moreover, the research and development cycle is very long, and the investment is high, so entrants need to consider comprehensively.

References: Websites of major companies such as Zhongyan Co., Ltd., Water Co., Ltd., Junhua Co., Ltd., and Chemical New Materials.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track