Pc industry strengthens across the board, rongsheng petrochemical becomes a key beneficiary of the boom

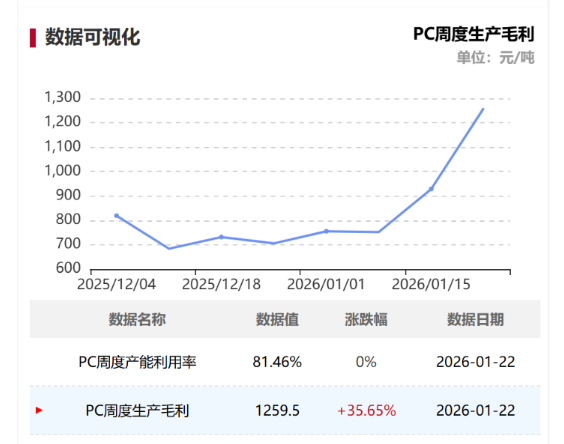

Since the beginning of 2026, the polycarbonate (PC) industry chain has shown comprehensive strength, ranging from upstream raw materials to core products. According to Longzhong Information, as of January 26, mainstream negotiations for low-end injection-molding grade materials in East China were referenced at 11,250–13,450 RMB/ton, while mid-to-high-end materials were negotiated at 14,700–15,250 RMB/ton; some price centers rose by 50–200 RMB/ton compared to last Friday. As of January 22, the weekly production gross profit for PC stood at 1,259.5 RMB/ton, representing a week-on-week surge of 35.65%.

Chart: Weekly Production Gross Profit Trend for PCs

This round of price increases is driven by the resonance of cost-side and supply-demand factors. Pure benzene and acetone led the surge in upstream raw materials, with phenol following suit to provide cost support. Coupled with tight PC supply and downstream rigid demand absorption, the price transmission path within the industrial chain is clear. Market sentiment has gradually shifted from cautious to optimistic after the holiday. This price hike, triggered by the resonance of costs and supply-demand, is reshaping the profit landscape across all segments of the industrial chain.

In the current PC industry price increase driven by both cost and supply-demand dynamics, Rongsheng Petrochemical has become a core beneficiary of the industry's upward prosperity due to its integrated, full-chain layout.

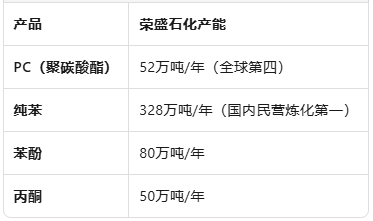

(Chart: Production Capacity of Rongsheng Petrochemical's PC Industry Chain)

PC prices are rising steadily against the backdrop of a tight supply-demand balance.

Looking ahead to 2026, the supply-demand imbalance in China's domestic PC industry is projected to ease significantly compared to 2025, with market prices and supply-demand dynamics exhibiting a much stronger correlation. From an industry cycle perspective, 2026 will see China's domestic PC industry enter a capacity expansion "vacuum," with no new capacity coming online throughout the year, resulting in a substantial slowdown in supply-side year-on-year growth. Meanwhile, natural growth in downstream consumption and exports is expected to continue, leading to a significant improvement in the industry's supply-demand imbalance.

Specifically, shutdowns and reduced operating rates of domestic PC production facilities throughout the year will lead to a temporary contraction in supply, directly supporting market prices. On the demand side, there is multi-dimensional growth. The rapid development of automotive lightweighting and the new energy vehicle industry will drive continuous increases in demand for PC/ABS alloys. Demand in electronics, electrical appliances, medical and other fields will expand steadily. Simultaneously, continued growth in the export market will be a significant supplement to PC demand growth. This tightening of supply and loosening of demand will significantly alleviate the pressure of supply-demand imbalance in the domestic PC market in 2026, and the dynamic supply-demand situation will have a significant impact on prices. Overall, PC market prices are expected to enter a steady upward channel in 2026.

Upstream raw materials surge collectively, with cost support solidifying the foundation for price hikes.

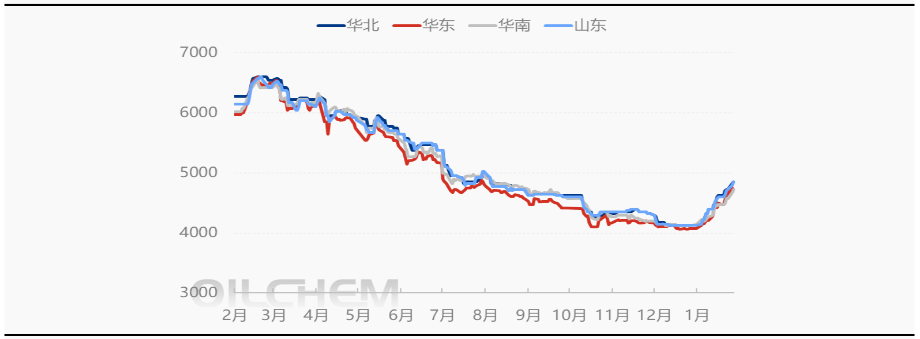

As the origin of the PC industry chain, the aromatics and phenol ketone sector has performed strongly since the beginning of the year, becoming the core driver of price increases across the entire industry chain. Among them, the price increase of benzene is particularly significant, climbing from around 5,400 yuan/ton in early January to around 6,000 yuan/ton in East China as of January 28, with a cumulative increase of about 600 yuan/ton, a rise of approximately 11.1%. This round of benzene price increases stems from a confluence of factors. On the one hand, the pace of commissioning of aromatics-related varieties has slowed down, intensifying supply-side disruptions. On the other hand, cost pass-through from crude oil price fluctuations, coupled with the recovery in demand from downstream industries such as phenol ketone and styrene, have jointly pushed up benzene market prices.

Chart: Domestic Acetone Market Price Trend (Unit: RMB/ton), Source: Longzhong Information

Driven by the rising price of pure benzene, the phenol-ketone industrial chain has also strengthened. The acetone market saw a strong rebound, with prices climbing from 4057 yuan/ton to 4750-4800 yuan/ton in just over 20 days after the New Year's Day holiday, an increase of 18.3%. Major factories had no significant inventory backlog, and they successively raised their ex-factory prices starting from January 5th, with cumulative increases of 650-800 yuan/ton. This, coupled with a "slight increase followed by a decrease" in port inventory, strengthened destocking expectations, reinforcing the anticipation of tight supply and further supporting price increases. Although the phenol market saw a relatively moderate increase, it maintained a steady upward trend, with market prices reaching 6186 yuan/ton by January 28th, an increase of 333 yuan/ton since the beginning of the year, or 5.69%. The rigid support from the cost side was particularly significant.

Integrated full industrial chain layout: Rongsheng Petrochemical benefits the most.

Relying on the scale advantage and supporting capabilities of its ZPC 40 million tons/year refining and chemical integration base, Rongsheng Petrochemical holds leading production capacity in all key links of the industrial chain. This enables it to resist the risk of upstream raw material price fluctuations and fully enjoy the dividend of terminal product price increases, comprehensively releasing its profit elasticity.

It is understood thatRongsheng Petrochemical's PC production capacity reaches 520,000 tons, ranking fourth globally. PC product production adopts the industry-leading melt transesterification process, using carbon dioxide as a raw material. The production process generates minimal waste discharge, and the byproduct phenol can be recycled and reused. Utilizing carbon dioxide aligns with the dual-carbon strategy, representing a green chemical production route. ,Having integrated raw material supply, the company has formed core competitiveness in scale, cost, and environmental protection.

In terms of product structure, Rongsheng Petrochemical's PC products cover multiple grades ranging from low-end injection molding materials to mid-to-high-end engineering plastic grades, which highly match the product categories currently experiencing price increases in the market. Specifically, its low-end materials cater to rigid-demand markets such as electronic and electrical appliance casings, while mid-to-high-end materials are adapted for high-growth sectors like automotive lightweighting and medical devices, precisely positioning the company in the track of downstream demand upgrading.

From the perspective of upstream raw materials, Rongsheng Petrochemical possesses the largest pure benzene production capacity among private refining and chemical enterprises in China. Its subsidiary, ZPC, holds an annual capacity of 2.8 million tons, while Zhongjin Petrochemical provides a supporting capacity of 480,000 tons per year, bringing the total annual capacity to 3.28 million tons.Amidst the recent surge in benzene prices, with monthly increases exceeding 11%, the company's self-supplied benzene resources not only fully meet the raw material needs of its own phenol-acetone plant, eliminating reliance on external procurement, but also generate additional revenue through the external sale of surplus capacity.

Meanwhile,Rongsheng Petrochemical also possesses a phenol production capacity of 800,000 tons/year and an acetone production capacity of 500,000 tons/year.With the price of acetone rising by 18.3% after New Year's Day and phenol steadily increasing, Rongsheng Petrochemical has achieved self-sufficiency in raw materials, significantly reducing the impact of cost fluctuations on production and forming a "benzene-phenol-ketone" cost closed-loop support.

Against the backdrop of a general price increase in the PC (polycarbonate) industry chain and elevated upstream raw material costs in 2026, Rongsheng Petrochemical is poised to benefit not only from revenue elasticity driven by rising product prices but also from its internal self-sufficiency in key raw materials such as phenol and acetone. This capability allows the company to effectively lock in costs and reduce reliance on external procurement, thereby significantly expanding its profit margins. Compared to peers dependent on external raw materials, its competitive advantage in profitability is expected to widen further.

It is evident that, by leveraging its integrated full-chain layout from pure benzene to PC, Rongsheng Petrochemical has achieved efficient synergy across all segments. In a market environment characterized by solid cost support and tight supply, the profitability of the company's PC business across all stages is expected to improve comprehensively. Consequently, the company stands out as a core beneficiary with high certainty in this round of price increases.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories