Over 50% of Car Dealers Posted Losses in First Half of Year, Only 30% Met Sales Targets

New car sales continue to face pressure, and the proportion of loss-making automobile dealers has expanded. Recently, the China Automobile Dealers Association released a report on the survival status of automobile dealers nationwide for the first half of 2025, which shows that in the first half of the year, the proportion of loss-making dealers rose to 52.6%, the proportion breaking even was 17.5%, and the proportion making a profit was 29.9%.

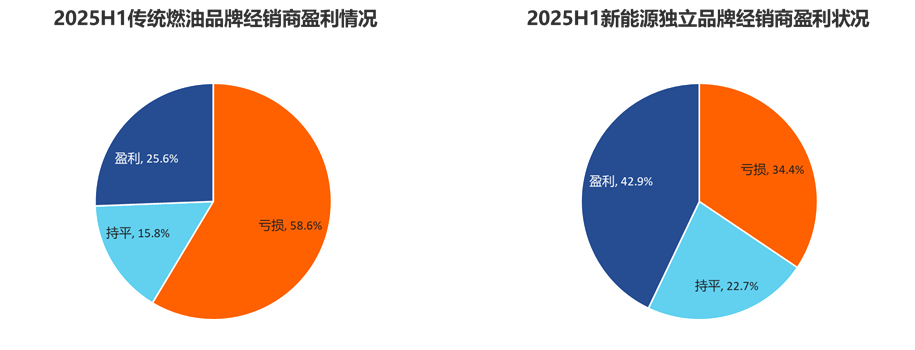

Dealers of independent new energy vehicle (NEV) brands are performing better than those of traditional fuel vehicle brands. The profit and loss situation for independent NEV brand dealers is as follows: 42.9% are profitable, 22.7% are breaking even, and 34.4% are operating at a loss. In contrast, for traditional fuel vehicle brand dealers, 25.6% are profitable, 15.8% are breaking even, and 58.6% are operating at a loss.

Image source: China Automobile Dealers Association

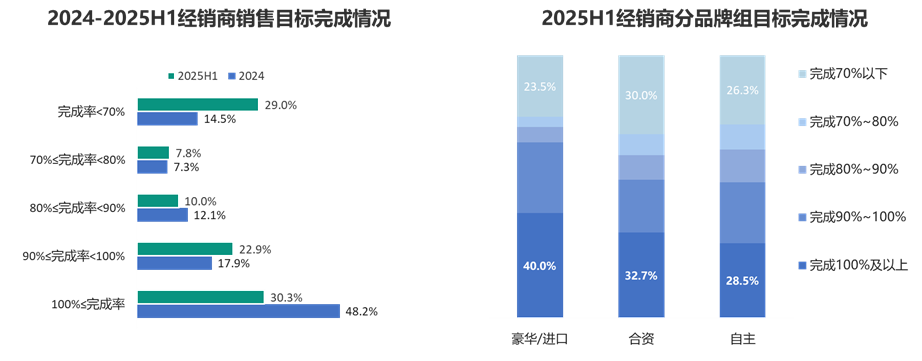

Image source: China Automobile Dealers AssociationThe survey also showed that in the first half of the year, only 30.3% of dealers achieved their sales targets. Dealers with a target completion rate below 70% accounted for 29.0%, while those with a target completion rate above 70% but below 100% accounted for 40.7%.

Image source: China Automobile Dealers Association

Image source: China Automobile Dealers AssociationFrom the perspective of brand groups, luxury brands have a slightly better target completion rate compared to joint venture brands and independent brands. Among joint venture brands, the proportion of dealers who completed 70% or less of their targets is higher than that of luxury/import brands and independent brands.

The survey shows that in the first half of the year, 74.4% of car dealers experienced varying degrees of price inversion, and 43.6% of car dealers had a price inversion of more than 15%.

The China Automobile Dealers Association analyzed that severe price inversion has eroded dealers’ cash flow, resulting in widespread reports of financial pressure among dealers. In particular, dealers of traditional fuel vehicle brands are suffering significant losses in their new car business due to price inversion. Independent new energy vehicle brand dealers mainly face pressures such as low after-sales output value and long investment payback periods.

Looking ahead to 2025, dealers' overall outlook is for slight growth or stability, but their expectations for growth are lower than those at the end of last year. Approximately 49% of dealers believe that annual sales will increase, while the proportion of dealers expecting a decline has slightly risen compared to 2024.

The nationwide survey on the survival status of car dealers was officially launched in July 2025. After more than a month of collecting questionnaires, the survey covered 4S stores under large and medium-sized car dealer groups, as well as small groups and single stores, with a total of 936 valid questionnaires recovered.

The survey results show that the overall satisfaction score of car dealers is 64.7 points, which has significantly decreased compared to the end of 2024. The core issues are the increasing price inversion and intensified financial pressures, among other compounded operational pressures. Additionally, dealers reported that the rewards from manufacturers for achieving basic targets have shrunk, leading to a severe imbalance between effort and reward. Therefore, dealers' satisfaction with the manufacturers has significantly declined.

In early July this year, the four major associations of the Yangtze River Delta jointly issued a "Letter Requesting Automakers to Improve the Operating Difficulties of Automobile Dealers in the Yangtze River Delta Region," which mentioned that automobile dealerships in the Yangtze River Delta are generally facing severe challenges such as high inventory levels, disorderly market competition, and an increased risk of corporate capital chain rupture.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track