Over 50 Billion! BASF Sells Off!

Recently, two pieces of news came from BASF:

On July 23, the latest ranking of the top 50 global chemical companies released by the authoritative industry journal C&EN showed that BASF has topped the list for six consecutive years.

Secondly, Bloomberg reported that, according to informed sources, the sale of BASF's coatings business has entered a new round of bidding. It is understood that BASF has completed the screening of potential buyers, and the valuation of this coatings business transaction may reach as high as 6 billion euros (approximately 50.5 billion yuan) or even higher.

Private equity firms Carlyle Group Inc., KPS Capital Partners, Lone Star Funds, and Platinum Equity, as well as AkzoNobel, the only bidder from the coatings industry, are all included.

May give rise to a super giant

It is worth mentioning that if AkzoNobel successfully completes the acquisition, the global coatings industry landscape will undergo a significant transformation. At that time, a European supergiant spanning decorative paints, high-performance coatings, and automotive coatings (OEM and refinish) will emerge.

BASF's coatings business covers multiple segments, with one key area being automotive coatings, including OEM coatings, refinish coatings, and decorative coatings. In 2023, revenue from automotive coatings accounted for approximately 65% of the company's total coatings business.

Currently, the material substitution trends in the automotive coatings field are mainly reflected in water-based coatings replacing solvent-based coatings, domestic coatings replacing imported coatings, the application of high-performance materials, and the impact of new energy vehicles on coating demand. These changes not only drive technological advancements in the coatings industry but also promote market diversification and intensify competition.

In terms of the paint supplier landscape, the global paint market concentration is gradually increasing, especially in the Chinese market. Early domestic development relied on cooperation with overseas companies to introduce automotive paint technology, but fully independent technology has never been achieved. Domestic original factory paint technology began to develop with Shenyang Paint Factory introducing technology from Kansai Paint of Japan, Changchun Paint Factory from Austrian companies Stölzle and Herberts, Beijing Hongshi Paint from AkzoNobel, and Shanghai Paint Factory and Wuhan Shuanghu Paint from BASF. The automotive paint market is almost entirely occupied by foreign paint companies, all of which are large overseas paint enterprises.

Over the past decade, the evolution of the landscape has shown that companies like Korea's KCC and the Sino-Japanese joint venture Xiangjiang Kansai have stood out. Meanwhile, with the rise of the new energy vehicle industry, the global automotive production focus has gradually shifted from overseas to domestic markets. Manufacturers closely tied to OEMs can more easily penetrate the supply chain due to locational advantages. In recent years, new energy vehicle models have emerged one after another, continuously being updated and iterated, gradually becoming more like consumer electronics. This increases the demand for customization and continuous iteration of upstream materials. For coatings, this requires upstream suppliers to have faster response times and R&D capabilities. Therefore, small specialized domestic enterprises are more likely to enter the market.

With the development of new energy, many automobile manufacturers and large high-end equipment manufacturing companies have made commitments to users, ensuring that the body, equipment, and related parts can be used for more than 10 years. They have also set higher standards for the corrosion resistance, high gloss, and aging resistance of the coatings themselves.

In practical applications, polyester resin coatings have low adhesion and poor stability; acrylic resin has low hardness, weak adhesion, poor solvent resistance, and poor abrasion resistance; amino resins have high VOC content and long curing times; polyurethane coatings are limited by high costs and complex application processes; epoxy resin coatings have low VOC content and exhibit excellent corrosion resistance and strong adhesion.

BASF's Strategic Restructuring

In September 2023, after taking office, Dr. Kai Li released a new corporate strategy and restructured the business architecture of the company.

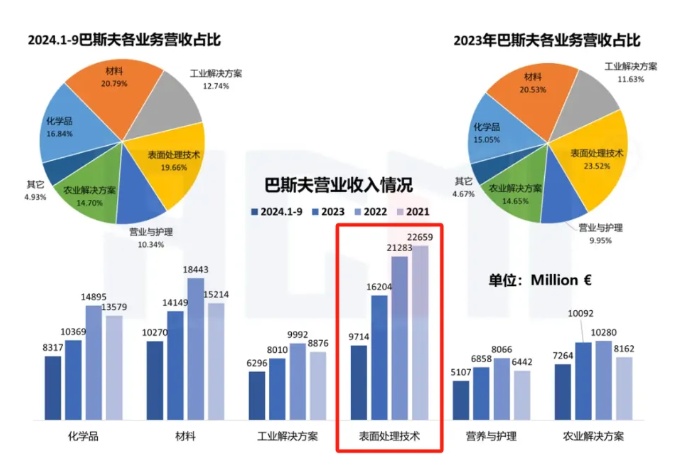

BASF's main business segments, originally divided into six major segments during the Ludwigshafen era—Materials, Chemicals, Surface Technologies, Industrial Solutions, Agricultural Solutions, Nutrition and Care—have been reclassified into "core" and "autonomous" businesses. Surface Technologies, which includes coatings, as well as Agricultural Solutions, among others, are considered autonomous businesses that may be spun off.

BASF's coatings business, as one of its independent operations, holds a leading position in the market and has previously generated substantial profits and dividend contributions.

In 2023, BASF ranked fifth globally in market share among paint suppliers with nearly 4.4 billion euros in business revenue, rising from seventh place worldwide in 2022. However, from the perspective of EBITDA of the business segment to which this business belongs—the Surface Treatment Technologies segment—the entire division, including coatings, has been experiencing a continuous decline in recent years. EBITDA is the primary metric for measuring shareholder returns.

Focusing back on core investments that create value for the company, BASF's major investment projects are globally distributed as follows: Chemicals (Nanjing/Zhanjiang in China, Antwerp in Belgium, Ludwigshafen in Germany, Kuantan in Malaysia), Materials (Zhanjiang in China, France, Geismar in the United States), Industrial Solutions (Huizhou/Zhanjiang/Jiaxing in China), Surface Technologies (Finland, Germany), Nutrition & Health (Jiashan/Zhanjiang in China, Antwerp in Belgium), and Agricultural Solutions (United States, Germany).

Considering the impact of industry competition, business dividend potential, a sluggish economic environment, high costs in key regions, and increasingly stringent environmental regulations, the coatings business will require higher sustainable investment. Under these circumstances, if BASF decides to divest the coatings segment to allocate more resources towards supporting customers' green transformation and other core strategic objectives, it would be a reasonable strategic choice based on current market and industry development trends.

Sell while buying

Since 2024, BASF has gradually divested its non-core businesses. However, this large multinational chemical giant continues to increase its investment in China. If we discuss the key business areas that BASF has identified to seize development opportunities in China, they can be roughly divided into three main fields: polyurethanes, new energy, and green transformation.

In terms of the polyurethane business, in 2003, BASF, in collaboration with Huntsman, Shanghai Huayi, and Gaoqiao Petrochemical, established Shanghai Lianheng Isocyanate Co., Ltd. in Shanghai. This company is jointly controlled by the two foreign parties. The joint venture initially constructed a 240,000 tons/year crude MDI project. Due to the expansion of downstream demand, BASF has invested in China four times from 2009 to 2025 to expand the related production capacity.

In 2009, BASF Polyurethanes (Chongqing) Co., Ltd. was established and a 400,000 tons/year MDI project was constructed, which began production in 2015. In 2018, the production capacity of crude MDI at BASF's joint venture Shanghai site was increased to 350,000 tons/year (now split: breaking news! separation!). In 2024, the MDI production capacity at BASF (Chongqing) will be increased to 530,000 tons/year. In 2025, Shanghai BASF Polyurethanes plans to expand its crude MDI production capacity to 401,760 tons/year.

In terms of new energy business, BASF's battery materials operations in China are primarily located in Shanghai, Changsha in Hunan, Lugu, Ningxiang, and Shizuishan in Ningxia. As of the end of 2022, BASF's cathode material production capacity has increased to 160,000 tons per year.

In the field of new materials, BASF has launched new materials suitable for high-standard, high-power charging systems in the past two years, including TPU, PA, PPA, and PBT. These materials will be used in various components of new energy charging piles, including electronic parts, charging guns, circuit breakers, switches, safety components, cables, and cooling systems. In addition, BASF is also focusing on a series of high-performance materials suitable for new energy vehicles, such as fully aromatic polyethersulfone, polysulfone, polyphenylsulfone, and high-protection polyurea products.

In terms of green transition: In fact, judging from the shutdowns and layoffs at BASF's European sites in the past two years, the current macroeconomic changes combined with geopolitical conflicts have had a substantial and significant impact on the company. This has further led to a sharp decline in BASF's earnings before interest, taxes, depreciation, and amortization (EBITDA).

In contrast, although the competition in the Chinese market is becoming increasingly intense, the external conditions in energy, infrastructure, logistics, and policies can provide a significant structural advantage for domestic and international chemical giants such as BASF and Wanhua. Especially in the context of rising green trade barriers, achieving carbon reduction at a lower cost could actually lead to higher investment returns.

According to brokerage firm estimates, taking BASF's largest domestic investment project, the integrated base in Zhanjiang, as an example, if BASF implements emission reduction measures in three areas—electricity, steam cracking energy consumption, and synthesis gas production—the project's CO2 emissions can be reduced by approximately 3.24 million tons. Based on the 2023 EU carbon allowance average price of 83 euros per ton, the carbon allowance value corresponding to the 3.24 million tons of carbon emissions reaches about 2.1 billion RMB.

Additionally, it is worth mentioning that according to Lin Hanping, President of BASF's Asia Mega Projects, the core units of BASF's Zhanjiang Verbund site will also begin operation by the end of this year.

In the face of continuous fluctuations in the global economy and niche markets, BASF's response strategy goes beyond macro-level strategic adjustments. As a leading company in the global chemical industry, BASF is actively optimizing its product lines and reallocating resources to adapt to the latest market changes.

BASF has seized opportunities in the Chinese market by implementing phased investment layouts, green decarbonization strategies, and structural adjustments, demonstrating strong resilience. These measures have provided the company with a solid foundation and new growth opportunities during economic downturns. These strategies not only help BASF respond to market fluctuations in the short term but also lay a solid foundation for the company's long-term sustainable development.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track