On Another Battlefield, Domestic Brands Are Also Winning Victories

The penetration rate of new energy vehicles is soaring, attracting widespread attention in the industry. In stark contrast, the somewhat lackluster fuel vehicle market remains a battleground for fierce competition between domestic and joint venture brands.

According to data from the China Passenger Car Association, the cumulative retail sales of automobiles from January to August 2025 reached 14.741 million units, of which new energy vehicles accounted for 7.556 million units, an increase of 25.8%. The sales of fuel vehicles were 7.185 million units, basically on par with the sales of new energy vehicles.

In the vast Chinese automotive market, nearly half of consumers still choose fuel-powered vehicles. Consulting firm McKinsey predicts that by 2030, the market share of electric vehicles, hybrid vehicles, and fuel-powered vehicles in China's passenger car market will be approximately 40%, 30%, and 30%, respectively. Based on an estimated annual sales volume of 30 million passenger cars, this means that the market for fuel-powered vehicles will have a space of about 9 million units, which is almost twice the annual sales volume of India, the world's third-largest car market.

The fuel vehicle market has always been a stronghold for joint venture brands. In an era where the new energy vehicle industry is accelerating its competition, this has become their last line of defense in maintaining a foothold in the Chinese market. However, with the improvement of independent brands in technology, branding, and product strength, the offensive and defensive dynamics between joint ventures and independents in this market have become increasingly intense.

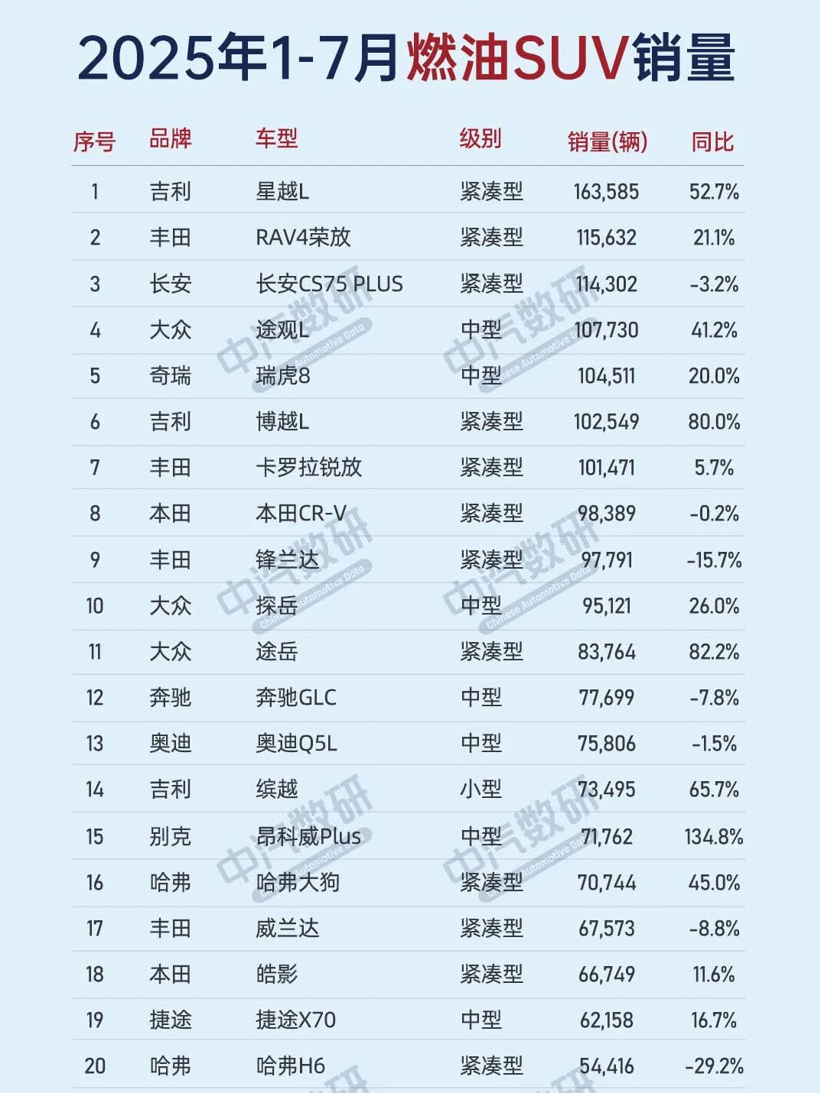

According to data from the China Automotive Research Institute, the Geely Xingyue L ranked first in fuel vehicle sales from January to July 2025, with sales of 163,600 units, a year-on-year increase of 52.7%. This compact SUV, priced around 150,000 yuan, outperformed classic joint venture models such as the Toyota RAV4 and Volkswagen Tiguan L, with sales even surpassing iconic sedans like the Nissan Sylphy, Volkswagen Lavida, and Sagitar. In addition, the sales of Geely Boyue L and Xingrui have also continued to grow in their respective market segments, achieving a lead over joint venture brands and becoming a focal point of market attention.

Independent brands such as Geely, Changan, and Chery are making efforts in both new energy and fuel vehicles to further capture the market share of joint venture brands.

Joint venture car companies cut prices to survive.

The fuel vehicle market has long been dominated by strong brands such as Toyota, Volkswagen, and Nissan.

In the 2024 sales rankings for fuel vehicles in the Chinese market, among the six models with sales exceeding 200,000 units, five are from joint venture brands. Apart from the Xuan Yi and the Su Teng, which saw a year-on-year decline in sales, the Su Teng, Passat, and Feng Lan Da all showed an upward trend.

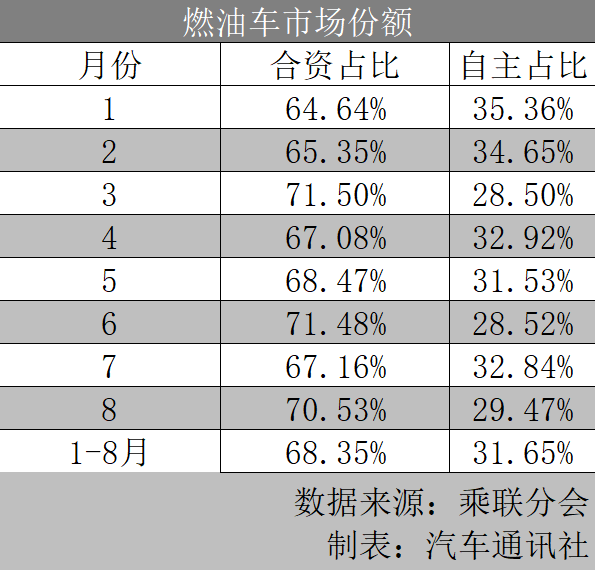

According to the sales data from the China Passenger Car Association compiled by the Auto Communication Agency, in the fuel vehicle market from January to August, joint venture brands consistently held nearly 70% of the market share compared to domestic brands.

However, at the same time, the top position in the fuel vehicle sales ranking from January to July has changed from the Xuan Yi to the Geely Xingyue L. In the top 15 fuel vehicle sales ranking for 2024, there are only three domestic brand models: Xingyue L, Chery Tiggo 8, and Changan CS75 PLUS. Meanwhile, in the cumulative sales ranking from January to July this year, Geely Boyue L and Xingrui have also made the list.

According to the latest statistics from August, the monthly sales of these 10 domestic brand models—Boyue L, Xingyue L, Tiggo 8, Haval Big Dog, Yidong, Arrizo 8, Changan CS75PLUS, Hongqi H5, Binyue, and Changan X5 PLUS—each exceeded 10,000 units, accounting for one-third of the top 30 fuel vehicle sales in August.

In terms of engine, transmission, and chassis tuning capabilities, joint venture brands have decades of technical research and data accumulation, making these advantages difficult to challenge in the short term. On the other hand, domestic brands are continuously improving in product design, configuration, and service. Joint venture car companies, in order to maintain their basic sales volume, must confront the ongoing shrinking of the fuel vehicle market and the fierce competition posed by domestic brands through cost-effectiveness and superior product strength.

In the current climate of intensified market competition, the premium once enjoyed by joint venture brands has been eroded. Joint venture brands can no longer rely solely on historical advantages to maintain their traditional positions and must lower prices to survive.

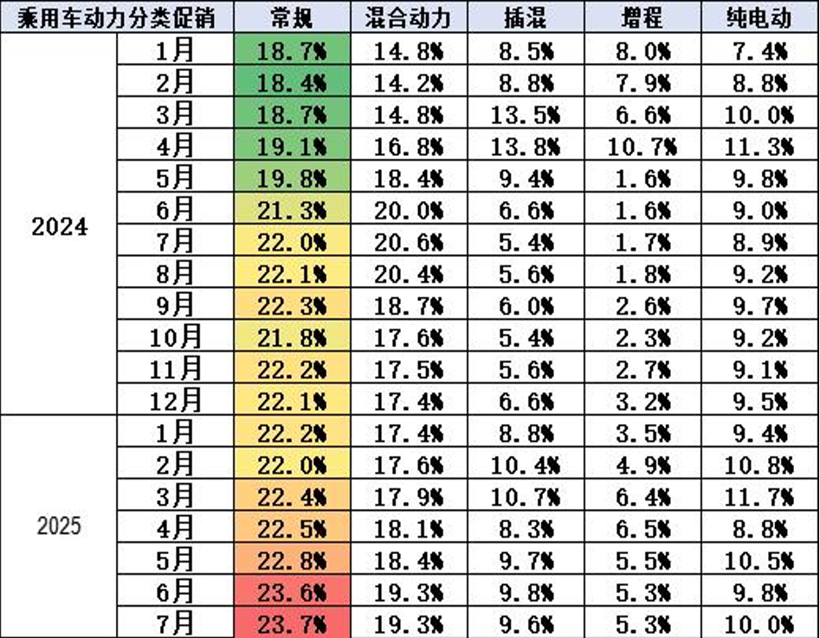

According to data from the China Passenger Car Association, 23 car models saw price reductions this August, which is lower than the same period last year. However, the promotional intensity for traditional fuel vehicles remained stable at 22.9%, higher than the level in the same period last year. Among the 23 models, there are 5 fuel vehicles, with an arithmetic average price reduction of 11,000 RMB, reaching a discount rate of 8.4%. Among these, the promotional efforts for mainstream joint venture fuel vehicles have gradually reached a high of 22%, higher than the 18.4% promotional intensity for independent fuel vehicles.

Before 2023, the promotional discounts for Japanese cars did not exceed 10%. However, starting from 2023, the promotional discounts have been increasing year by year, reaching 25.8% in August of this year. The promotional discounts for European cars are approaching 40%.

In September 2024, SAIC-GM took the lead in launching a "fixed price" strategy, offering the Envision PLUS at a limited-time "fixed price" of 169,900 yuan, which is 60,000 yuan lower than the official suggested retail price.

In August of this year, the starting price of the fuel vehicle sales champion model, Sylphy, was 79,900 yuan, but the terminal discount reached 54,000 yuan, with a reduction rate as high as 49%. In addition, the Buick Verano saw a price reduction of 47%, with the 1.5T entry-level model dropping to 68,900 yuan; the Accord and Lavida are also among the joint-venture brand models with significant price reductions.

The practice of exchanging price for market share has become the norm in the automotive market. Under the pricing offensive from joint venture car manufacturers, this year's market share growth for domestic brand fuel vehicles has not been significant.

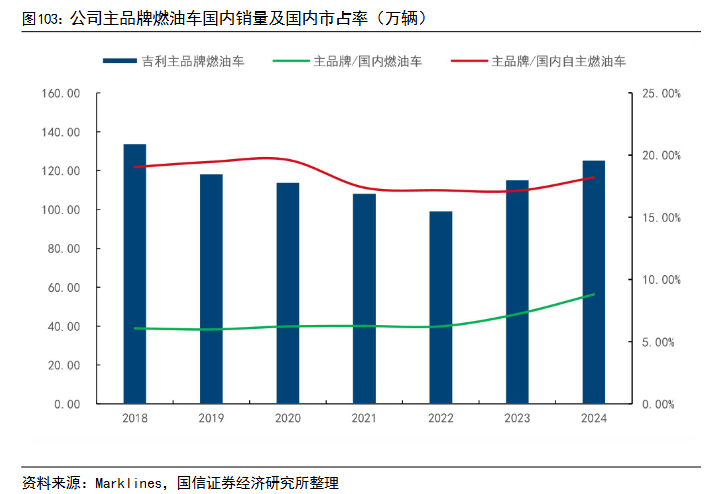

According to a report by Guosen Securities, the total sales of domestic fuel vehicles decreased from 22.04 million units in 2018 to 14.27 million units in 2024, but the scale of domestic brand fuel vehicles remained stable, from 7.03 million units in 2018 to 6.89 million units in 2024, with the market share significantly increasing by 6.21 percentage points from 42.20% in 2023 to 48.41% in 2024. Data from Northeast Securities shows that, under the wholesale criteria, the market share of domestic brands in fuel vehicles remained at 48% in the first half of this year.

Geely leads the fuel SUV market.

Despite the continuous decline in the pricing system of joint venture brands, the market performance of domestic brands remains resilient. Notably, brands like Geely, Changan, and Chery have shown strong performance in the fuel SUV market. In the sales rankings for fuel SUVs from January to July, the Xingyue L, Changan CS75 PLUS, Ruichu 8, and Boyue L made it into the top ten. Except for the Changan CS75 PLUS, the other three models saw year-on-year sales growth of 52.7%, 20%, and 80%, respectively. Particularly, the Xingyue L has accumulated sales of over 160,000 units, surpassing the second-place Toyota RAV4 by nearly 50,000 units.

Ultimately, product competitiveness is the decisive factor for sales growth. Domestic brands leverage their advantages in surpassing levels and cost performance to seize the market, especially as the effects of joint venture brands weaken. As domestic brands build their brand power in the new energy sector, they also enhance the competitiveness of their gasoline vehicles.

Taking Geely as an example, as a pioneer among private car companies and independent brands, Geely Auto not only occupies a leading position in the new energy market with its sub-brands Galaxy, Lynk & Co, and Zeekr, but also further solidifies its market share in the fuel vehicle sector through the upgraded models Starry Yue L and Boyue L.

Since its launch in July 2021, the Xingyue L has achieved sales of over 800,000 units in four years. After the release of the all-new model last October, its monthly sales nearly reached 30,000 units. Similarly, the newly launched Boyue L achieved sales of 24,000 units in August, surpassing the Tiguan L and RAV4.

The reason Geely has been able to create two legendary SUVs lies in the transfer of technology and high configuration at a low price. Both models are compact SUVs but have a noticeable advantage in space, especially the Xingyue L, which has a wheelbase of 2845mm, approaching the standard of mid-sized SUVs. Moreover, the configuration level of both models surpasses that of joint venture competitors in the same price range.

In terms of architecture, Geely's fuel vehicles are empowered by the CMA platform developed in collaboration with Volvo. In terms of intelligence, the Xingyue L and Boyue L offer more comprehensive smart driving and human interaction features, giving them a significant advantage over the Corolla Cross, Aion S, RAV4, and Vios.

A research report by Guoxin Securities shows that from 2018 to 2022, the market share of the Geely main brand in the fuel vehicle market remained stable at around 6%. By 2024, the market share of the Geely main brand in the fuel vehicle industry and among independent brand fuel vehicles will rise to 8.81% and 18.21%, respectively, with significant results.

It's hard to imagine that before the electric vehicle market took off in 2020, consumers generally assumed that domestic brands were a tier below. Ten years ago, being able to reach the level of joint venture models was something to boast about for domestic vehicles. In just five years, the narrative has shifted to domestic brands overwhelmingly surpassing joint venture automakers. Even in traditional strongholds of joint venture brands, the market landscape is quietly changing.

In detail, the fuel-powered SUV market in August continued to diverge, showing a concentration effect at the top. Among them, the Boyue L once again defended its title as the best-selling fuel-powered SUV, while in the joint venture brands, the Toyota RAV4 and Volkswagen Tiguan L were neck and neck in sales. The latter's ranking rose from fourth to second, while the former dropped to third, indicating intense competition. Models like Corolla Cross and Tiggo 8 maintained stable sales. The Haval Big Dog, after several months of declining sales, began to rebound, with monthly sales approaching 15,000 units, whereas the sales of Changan CS75 PLUS continued to decline.

Geely's success in the fuel vehicle market provides a reference for more independent brands to seize market share. Although sales of new energy vehicles are growing rapidly, fuel vehicles still account for the majority of market profits. For many brands, fuel vehicles constitute the majority of their sales share. By continuously refreshing products, upgrading configurations, and integrating smart technologies to enhance the product competitiveness of fuel vehicles, the transformation and upgrading of the fuel vehicle market may be accelerated.

Independent Brands: Will Not Abandon Fuel Vehicles

In the fuel vehicle market, independent models such as the Tiggo 8, Haval Big Dog, Yidong, and Arrizo 8 have long been prominent on the sales charts. Besides Geely, Chery, Great Wall, and Changan have also never abandoned the fuel vehicle market. The leaders of these brands have emphasized the importance of this market to them on various occasions.

At the Chang'an Technology Ecological Conference during the World Intelligent Expo in early September 2025, Yang Dayong, Executive Vice President of Chang'an Automobile, stated that 35% of users in the future market will still choose fuel vehicles, and it is not suitable for everyone to adapt to new energy vehicles.

Yang Dayong is responsible for the development of two key business areas: the Chang'an fuel vehicle Gravitational Series and the new energy brand Qiyuan. For the Gravitational Series, he insists on a strategy of continuous deep cultivation. The most popular fuel vehicle from Chang'an, the Yidong, is the core product of the Gravitational Series, which has sold over 1.9 million units globally since its launch 13 years ago. Recently, the Yidong welcomed its fourth generation, continuing to lead the market for fuel sedans among independent brands.

Chery Automobile's Executive Vice President and General Manager of Chery Brand Domestic Business Division, Li Xueyong, once stated: "By 2030, there will still be 30% of the market that will be fuel vehicles, because China's vast territory means that electric and hybrid vehicles cannot solve all application scenarios." He indicated that Chery and Jetour will continue to uphold fuel vehicles and focus on the development of hybrids as a core aspect of their new energy strategy.

Observing the sales and profit share of these independent brands reveals that fuel vehicles always take the lion's share. In 2024, fuel vehicle sales accounted for 73.9% of Great Wall's total sales. Chery, known for its exports, saw over 80% of its export sales in the past year come from fuel vehicles, reaching 915,000 units.

Relying on continued growth in overseas markets, Chery has become one of the few domestic car companies whose fuel vehicle sales are still increasing. The revenue from this segment also accounts for the majority of Chery's total income, with the revenue proportion exceeding 70% over the past three years. Similarly relying on the high profits from the fuel vehicle business, Great Wall, despite a shrinking market share, accounted for one-quarter of the Chinese automotive market profits in 2024, with a gross profit margin of 19.51%, ranking among the top car companies.

It can be said that the fuel vehicle business is equally crucial for domestic brands that excel in the new energy sector. Brands like Geely, Great Wall, Changan, and Chery have never slowed down their investment in the fuel vehicle field. While they have taken a lead in the new energy sector, they are also directly facing challenges in the engine race.

In March of last year, Changan Automobile launched the 500Bar ultra-high pressure direct injection new Blue Whale engine, which was fully equipped on the Gravity series products in April this year. While most traditional fuel vehicles are still using engines with a injection pressure of 350Bar, Changan has demonstrated its leading engine technology strength above international standards. This technology provides a more powerful and energy-efficient driving experience, allowing a distance of 1000 kilometers on a single tank of fuel.

Great Wall announced its "Pan Internal Combustion Engine Strategy" at this year's Shanghai Auto Show. Under this strategy, Great Wall has developed the Hi4 new energy four-wheel drive hybrid system and launched its self-developed 4.0T V8 engine, demonstrating its ultimate pursuit in the field of engines.

The Chery Arrizo 8 PRO 2.0T version, launched in March, is equipped with the Kunpeng Power 2.0TGDI engine. This engine boasts a maximum power of 187kW and a peak torque of 390N·m, earning the title of one of China's top ten engines. The Arrizo 8 PRO 2.0T version is also paired with one of the world's top ten transmissions, the 7DCT wet dual-clutch transmission, with a thermal efficiency of up to 98%, greatly enhancing the driving experience and fuel economy for consumers.

Faced with the reality that the sales structure and profit structure are skewed towards the fuel vehicle segment, domestic brands have not stopped their pursuit of better engine technology. Developing cleaner, more efficient, and energy-saving engines while also delivering power has always been a major trend in the automotive market.

Furthermore, by relying on the intelligent advantages accumulated during the electrification transition, independent brands are striving to consolidate their market share in the fuel vehicle sector. For example, when the Arrizo 8 PRO was launched, it emphasized its label as a "benchmark for intelligent fuel vehicles," clearly stating the intention to "forcibly reclaim the territory of fuel vehicles with performance, intelligence, and safety."

Chery's smart strategy and "Falcon Intelligent Driving," released in March, are not only applied to new energy vehicles but also equipped in gasoline vehicles to promote "fuel-electric parity." Changan Automobile has proposed the "Fuel-Electric Same Intelligence" strategy, applying the "Beidou Tian Shu" intelligent achievements (such as AI large model voice and advanced parking) to gasoline vehicles to consolidate its user base.

The Automotive News Agency believes that domestic brands are gradually but persistently penetrating the fuel vehicle market through technological improvements. Their efforts in this market will not cease; they are leveraging the integration of new energy technologies and employing strategies such as technology decentralization and experience enhancement to increase product premium capabilities and capture a larger market share.

As the penetration rate of new energy vehicles continues to rise, the market share of fuel vehicles will further shrink in the future. For both domestic and joint venture brands, fuel vehicles are the foundation of their development. Domestic brands are continuously enhancing their product strength and cost-effectiveness, while joint venture brands are attempting to stabilize their position through deep localization and optimized pricing systems, relying on brand accumulation and systemic strength. This indicates that an increasingly complex competition will continue to unfold in this market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track