Oil Prices Surge Strongly for Four Consecutive Days! Plastic Futures Rise in Sync, PE Spot Short-Term Fluctuates Strongly

I. Overnight Crude Oil Market Dynamics

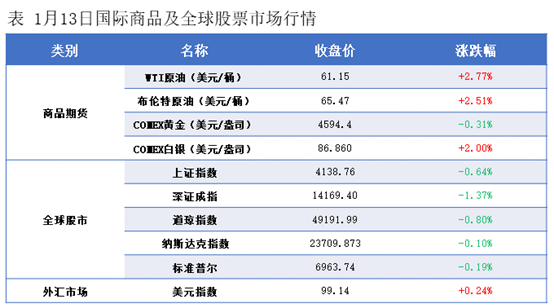

The instability of the situation in Iran has not been completely eliminated, potential supply risks persist, and international oil prices are rising. NYMEXCrude oil futuresFebruary contract at 61.15, up by $1.65/barrel, month-on-month +2.77%; ICE Brent crude futures March contract at 65.47, up by $1.60/barrel, month-on-month +2.51%. China's INE crude oil futures 2603 contract increased by 2.6 to 439.4 yuan/barrel, with the night session rising by 12.2 to 451.6 yuan/barrel.

Market Forecast

On Tuesday, the oil market continued to surge, despite U.S. President Trump stating, "I hope to see oil prices at $53 per barrel. We will make oil prices go further down." Oil prices slightly retreated following his remarks but ultimately still surged. WTI crude oil broke through $60, followed by Brent crude breaking through $65, with market attention focused on developments in Iran. The United States has requested American citizens to evacuate from Iran, and France has withdrawn non-essential staff from its embassy. Trump stated that all meetings with Iranian officials have been canceled. The suggestion for Americans to leave Iran now is a good idea, raising market concerns about the risk of U.S.-Israel military action against Iran escalating. Earlier, Trump imposed a 25% tariff on countries doing business with Iran via social media. The continued pressure from the U.S. on Iran has continually stirred market sentiment, leading to four consecutive days of increases. Brent crude oil's largest gain has exceeded $5, reaching the highest level since November.

Geopolitical risk premium is more directly reflected in global benchmarks associated with political risk (Brent), while the physical market in the Middle East shows weak discounts. The premium of Brent crude over Dubai crude has risen to its highest level since July of last year, indicating that geopolitical factors are significantly contributing to the risk premium in oil prices. The monthly spread of Brent crude has also rebounded significantly in recent times.

The EIA released its first Short-Term Energy Outlook for the new year, which did not adjust the forecast for oversupply despite recent geopolitical factors. However, it slightly revised up its oil price forecast, predicting that WTI crude oil prices will be $52.21 per barrel in 2026, up from the previous forecast of $51.42 per barrel, and $50.36 per barrel in 2027. The judgment is that oil prices will continue to fall because global oil production exceeds global oil demand, leading to rising oil inventories. Global inventories will continue to increase until 2027, although the growth rate will slow down. After reaching an annual record of 13.6 million barrels per day in 2025, it is expected that in a low oil price scenario, the slowdown in drilling activity will exceed the increase in drilling productivity, leading to a reduction in crude oil production. U.S. crude oil production is predicted to decline during the forecast period, with a decrease of less than 1% in 2026 and 2% in 2027. In the early morning, API released data for the week ending January 9, showing a crude oil inventory increase of 5.278 million barrels, far exceeding the expected decrease of 238,000 barrels; additionally, gasoline and diesel inventories also increased significantly by over 10 million barrels. This is clearly a bearish weekly report. However, despite the obvious oversupply in supply and demand data, oil prices have maintained a strong position due to geopolitical risks keeping market sentiment high. Geopolitical factors are keeping oil prices strong while also accumulating downward pressure like a dammed lake. Oil prices have now rebounded to a very critical strong resistance level and show a clear need for technical overbought correction. In the short term, the final extent of the oil price surge will depend on the development of the Iranian situation, and we need to wait for the outcome to be settled. The market still has significant uncertainty and high volatility. It is not advisable to chase the rise at this position; it is better to prepare for selling on highs. At this stage, the primary focus should be on risk control, followed by seizing opportunities, and attention should be paid to timing.

Section II: Macroeconomic Trends

1、The CPI growth in the United States remained stable in December, while the core CPI was slightly below expectations.Trump praises inflation data, saying Powell should significantly cut interest rates. The Federal Reserve spokesperson: December CPI is unlikely to change the current wait-and-see attitude.

The Chicago Mercantile Exchange plans to launch 100-ounce silver futures contracts on February 9.

The Venezuelan state oil company plans to restart oil wells to restore crude oil production capacity.

4. Fed's Musalem: There are not many reasons for further easing of policy in the short term; still believes that inflation risks will be more persistent than expected.

5、LME copper inventory fell by 22%, reaching a six-month low.

6. Iran Situation - ① The EU is discussing additional sanctions against Iran. ②Trump: All meetings with Iranian officials have been canceled, and the Iranian authorities will "pay a huge price."Vance is scheduled to meet with the national security team this morning to lead the formulation of a strategy towards Iran.

7、The United States has relaxed restrictions on the export of Nvidia H200 chips to China.

CCTV: China has applied for 203,000 satellite frequency orbit resources, which is related to our future.

The Ministry of Foreign Affairs responded to the United States imposing a 25% tariff on countries that have commercial dealings with Iran.

10、GFEX adjusts the trading fee standards and trading limits for lithium carbonate futures contracts.

11. Rongbai Technology: Signed a procurement cooperation agreement with CATL for lithium iron phosphate cathode materials worth 120 billion yuan.

The Ministry of Industry and Information Technology held the 18th manufacturing enterprise symposium, focusing on stabilizing effective investment in manufacturing and consciously resisting "involution."

The Ministry of Commerce: Continue to impose anti-dumping duties on imported solar-grade polysilicon originating from the United States and South Korea for a period of 5 years.

Three, early market dynamics of plastics.

Oil prices have strongly risen for four consecutive days! Overnight, most of the main domestic plastic futures contracts moved higher.

The plastic 2601 contract is priced at 6815 yuan/ton, an increase of 1.19% compared to the previous trading day.

The PP2601 contract is quoted at 6,576 yuan/ton, up 0.55% from the previous trading day.

PVC2601 contract reported at 4889 yuan/ton, down 0.02% from the previous trading day.

The styrene 2601 contract is quoted at 7,087 yuan/ton, an increase of 0.67% compared to the previous trading day.

Section 4: Market Forecast

PE: Domestic PE downstream product enterprises maintain stable production, but are currently in the traditional off-season for consumption. Core downstream orders for agricultural film, packaging film, etc., are insufficiently followed up, and enterprises mainly consume previous inventories, with a generally weak willingness to restock, maintaining only the pace of necessary procurement. Overseas, the slowed pace of global economic recovery suppresses external demand, coupled with the narrowing price advantage of some imported sources, leading to a reduction in domestic PE imports, which to some extent alleviates pressure on the domestic supply side. From the perspective of industry operation, cost support is the current market's core favorable factor, but the fundamental weakness in demand has not substantially improved. Traders adjust prices according to trends, but actual transactions are still mainly negotiated, with limited acceptance of high-priced sources. Overall, the short-term polyethylene market will show a volatile and slightly stronger trend. Market upward movement will be supported by both cost and futures market, but under the constraint of downstream off-season necessities, a unilateral trend is unlikely, and overall fluctuation amplitude is controllable. Attention should be paid to the sustainability of the cost side and marginal changes in downstream operations.

PP: From the perspective of industry supply and demand, although the pressure on the PP supply side has somewhat eased, downstream enterprises have basically wrapped up their orders for the year, with limited growth in new orders. Most are maintaining procurement based on actual demand, and the supply-demand fundamentals have not yet formed an effective boost. However, due to favorable cost factors and rising market speculation, bullish sentiment continues to rise. Coupled with signals from national business meetings about stabilizing the economy and promoting domestic demand, market expectations have further improved. Overall, the core contradiction in the current polypropylene market is the balance between cost support and weak demand. In the short term, it is expected to show a fluctuating but slightly strong trend, with market rises supported by costs and sentiment, but declines cushioned by weak demand. The overall volatility is limited, making a unilateral trend unlikely. Continuous attention is needed on the impact of geopolitical situations and the effectiveness of policy implementations on the market.

PVC: At the current factory price, most PVC plants are operating normally, and the supply of PVC remains abundant. In terms of downstream demand, as we enter mid-January, holidays are starting to occur, and demand is expected to become increasingly sluggish. From a supply-demand perspective, there is still pressure to digest social inventory, making it difficult to achieve effective de-stocking before the Spring Festival. This is also a challenge for intermediaries who face the need to sign contracts and quickly move goods, as well as whether to hedge. However, recently, both the futures and spot markets have shown increased volatility, and the traditionally slow season isn't as dull, adding uncertainty to future trends in both markets. On the international front, oil prices have risen for the third consecutive trading day, reaching a seven-week high, as the market worries that the suppression of anti-government protests could lead to a decline in Iran's oil exports. Overall, in the short term, PVC spot prices will continue to undergo frequent adjustments.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories