Oil Long-Short Game Intensifies: Supply and Demand Tug-of-War in a Volatile Market

In mid-August, WTI crude oil and Brent crude oil temporarily stabilized at $63.96 per barrel and $66.63 per barrel, respectively, having retreated over 10% from their annual highs. The current trend in oil prices is being hit by the dual pressures of expanding supply and concerns over demand. Coupled with geopolitical uncertainties, the risk of market volatility has significantly increased.

1. Supply Side: Coexistence of Increased Production and Geopolitical Risks

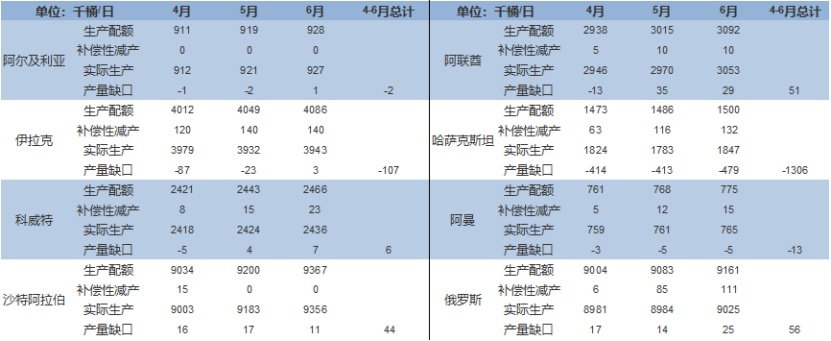

OPEC+'s shift in production policy has become a key factor in suppressing oil prices. The decision reached at the beginning of August to increase production by 548,000 barrels per day in September marks the full exit from the organization's 2.2 million barrels per day reduction agreement.(The image below)。The cumulative increase in production from April to August has reached 1.919 million barrels per day, equivalent to 2% of global daily demand. More noteworthy is that another voluntary production cut agreement of 1.66 million barrels per day will be reassessed by the end of December, and the pressure on the supply side may continue to intensify.

In terms of geopolitics,The August 15th US-Russia summit has become the focus of the market. If an agreement is reached to lift sanctions on Russian oil, it could release about 2 million barrels per day of potential supply. However, Iran's tough stance on the "US corridor" in the Caucasus, as well as Ukraine's attacks on Russian refineries, continue to create supply disruptions. The US's pressure policies on oil-producing countries are also showing effects, with the discount on Russian Urals crude oil widening to $5 per barrel, and Indian state-owned refineries considering suspending imports of Russian oil. Chinese major refineries have begun negotiating purchases of Urals crude, which may reshape global trade flows.

2. Demand Side: End of Peak Season and Macroeconomic Pressures

Current oil consumption showsThe characteristic of "strong reality, weak expectation." The U.S. refinery operating rate is as high as 96.9%, but historical patterns indicate that it will peak and decline after late August. High-frequency data shows that gasoline demand decreased by 2.7% month-on-month, while distillate demand increased by 1.9%, reflecting that the driving force of the summer travel peak season is weakening.

Macro-level pressure is emerging. United StatesNonfarm payrolls increased by only 152,000 in July, and CME interest rate futures show that the market is pricing in a 90.7% probability of a rate cut in September. While easing expectations provide short-term support for risk assets, an economic slowdown will ultimately suppress demand. Risks remain in the trade sector, as Trump’s threat of a 35% tariff on EU automobiles could impact global trade volumes.

Institutional forecasts show significant divergence.OPEC raised its 2026 demand forecast by 100,000 barrels per day, while the EIA raised its 2025/26 supply forecasts by 800,000 and 700,000 barrels per day, respectively, and lowered its 2026 Brent average price forecast to $51.43 per barrel.

3. Price Path Projection: Short-term Fluctuations and Long-term Variables

Changes in futures market positions confirm the waning bullish sentiment.The non-commercial net long positions in WTI have decreased by 22.57% compared to the July average, while the net long positions in Brent funds have decreased by 19,559 contracts week-on-week. Technically, the range of $62.5-$65.5 per barrel constitutes the short-term fluctuation zone for WTI, with an options barrier support at the $60 level, and a large number of producer hedging sell orders concentrated in the $68-$70 area.

The market focus for the next two weeks is clearly directed toward three catalysts.

The outcome of the US-Russia talks(August 15): If a ceasefire framework is reached, oil prices may test the psychological level of $60; if negotiations break down, geopolitical premiums could drive a rebound above $68.

EIA Inventory Evolution: Current U.S. commercial inventories are at a five-year average low, but the latest API data shows an unexpected crude oil build of 1.519 million barrels. If the build trend continues into the peak season, it will strengthen the bearish outlook.

Federal Reserve Policy Signals:The CPI data for July has alleviated inflation concerns, but if the Jackson Hole meeting in August sends hawkish signals, it may suppress oil prices through the dollar channel.

In the medium to long term, three major variables will determine the trajectory of oil prices.

Supply side:The direction of adjustments to voluntary production cuts at the OPEC+ December meeting, as well as the actual enforcement strength of US sanctions on Russian oil.

Demand Side: Heating demand performance in the Northern Hemisphere winter and changes in operating rates of Chinese refineries.

Policy aspect: Adjustments in energy policy before and after the U.S. elections, particularly the potential easing of sanctions on Iran and Venezuela.

Author: Expert in Market Research from Specialty Plastics VisionZhao Hongyan

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track