Off-Season Not So Off! Double-Digit Growth in July Car Market, New Energy Vehicles "Racing" Overseas

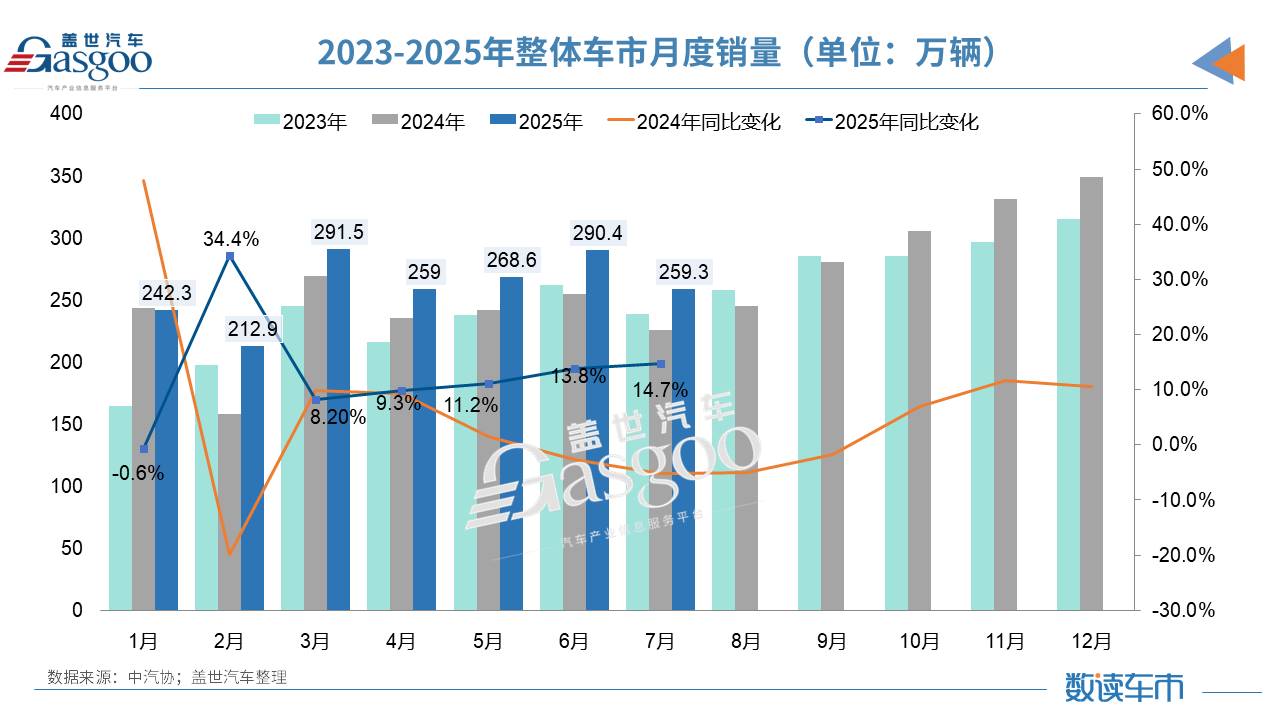

According to the latest statistics released by the China Association of Automobile Manufacturers, in July this year, China's automobile production and sales were 2.591 million and 2.593 million units respectively, representing a month-on-month decrease of 7.3% and 10.7%, and a year-on-year increase of 13.3% and 14.7%. From January to July, the cumulative production and sales reached 18.235 million and 18.269 million units, showing a year-on-year increase of 12.7% and 12%.

The association's analysis indicates that the car market entered a traditional off-season in July. Some manufacturers scheduled annual equipment maintenance, resulting in a slowdown in production and sales, showing a seasonal decline on a month-on-month basis. However, from the perspective of the industry market environment, the effect of the old-for-new policy continues to manifest, positive progress has been made in the comprehensive industry rectification work to reduce "involution," and companies are continuously launching new models, helping the car market to operate smoothly and achieve year-on-year growth. Among these, new energy vehicles continue to maintain rapid growth.

The new energy vehicle market continues to outperform the overall market, with production and sales growing by more than 26% year-on-year.

In July, the data shows that the production and sales of new energy vehicles in China reached 1.243 million and 1.262 million units, respectively, representing a month-on-month decrease of 2% and 5%, and a year-on-year increase of 26.3% and 27.4%. The sales of new energy vehicles accounted for 48.7% of the total new car sales. The month-on-month decline in the production and sales of new energy vehicles is mainly due to seasonal factors and adjustments in consumer car purchasing patterns. However, the year-on-year growth rate of over 26% is still higher than the overall level of the automotive industry.

The strong performance of the new energy vehicle market in July is inseparable from policy support. The driving effect of the national "Two New" policy subsidies is prominent, the market heat has continued to strengthen since the Spring Festival, and the subsidy effects of trade-in programs across various regions have exceeded expectations. Meanwhile, the Ministry of Industry and Information Technology, in collaboration with multiple departments, has deployed measures to further regulate the competitive order of the new energy vehicle industry, guiding the sector to shift from price wars to "value competition" focused on technological upgrades and service quality improvement, thereby stabilizing the market environment and enhancing consumer purchasing confidence.

In July, different car companies showed varied performances. BYD solidified its leading position in new energy vehicles among domestic brands with both pure electric and plug-in hybrid models, achieving passenger car sales of 341,030 units in July. Leapmotor set a new record for monthly deliveries with 50,129 units, marking a year-on-year growth of over 126%. XPeng Motors delivered a total of 36,717 new cars in July, representing a year-on-year increase of 229% and a month-on-month growth of 6%, setting a new record for monthly deliveries.

In terms of market segments, there is a significant structural differentiation among new energy vehicles with different technological routes. Among them, fuel cell vehicles have become a highlight this month, with month-on-month "production and sales showing varying degrees of growth," but year-on-year production and sales have declined significantly, reflecting the phase fluctuations in the competition of technological routes. Although pure electric and plug-in hybrid models have slightly decreased month-on-month, they have both achieved year-on-year growth, continuing the stability of mainstream technological paths.

From January to July, the cumulative production and sales of new energy vehicles reached 8.232 million and 8.22 million units, respectively, with year-on-year increases of 39.2% and 38.5%. The sales of new energy vehicles accounted for 45% of the total sales of new cars. Among the main types of new energy vehicles, compared to the same period last year, the production and sales of fuel cell vehicles have significantly declined, while the production and sales of the other two major types of new energy vehicles have shown varying degrees of growth.

With continuous technological advancements, improvements in battery range, faster charging speeds, and the popularization of intelligent driving technologies will further enhance consumers' acceptance of new energy vehicles. At the same time, under the global advocacy for green travel, the export of new energy vehicles is expected to maintain high growth and expand into broader international markets. However, market competition will become increasingly intense, requiring automakers to continuously improve product competitiveness, optimize product structure, and strengthen technological innovation and service quality in order to secure a favorable position in the market.

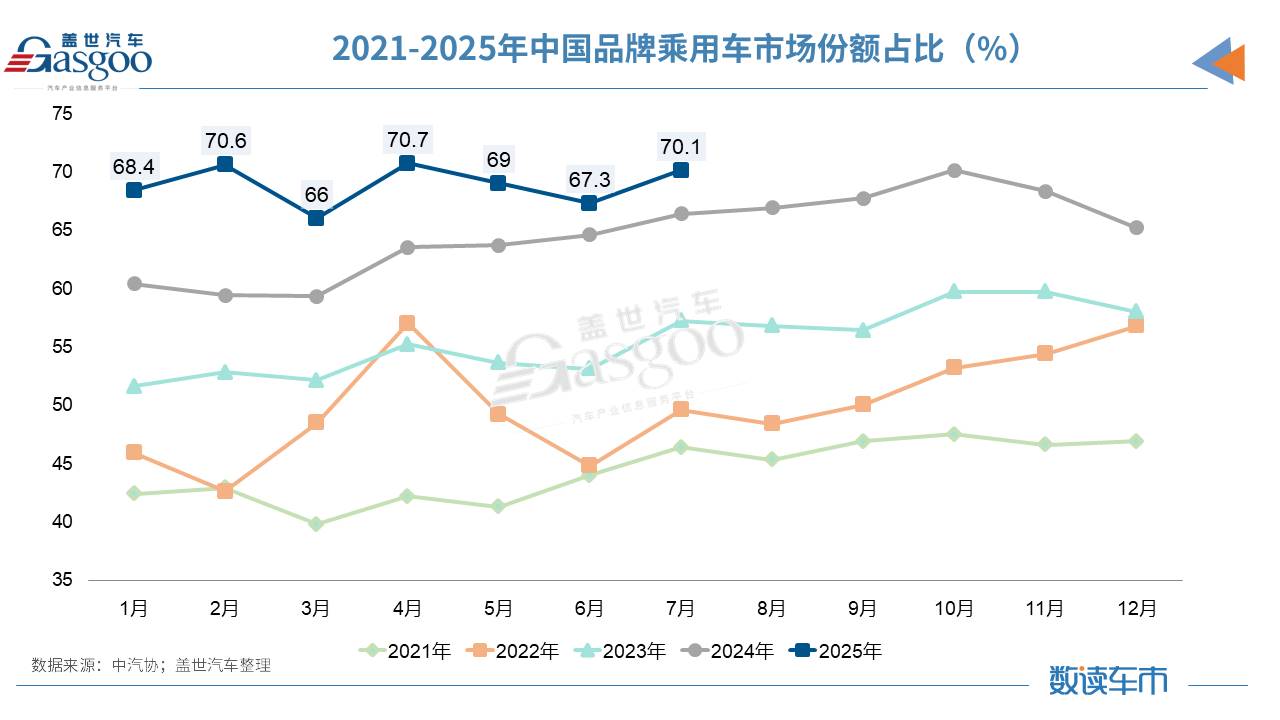

The market share of Chinese brand passenger cars exceeds 70%.Success, differentiation in the landscape of foreign brands

In July, under the dual impetus of the ongoing effectiveness of the vehicle trade-in policy and the intensive launch of new models by companies, the national passenger car market achieved stable operation, with sales showing a significant year-on-year growth trend.

The data shows that 2.287 million passenger cars were sold in the month, a month-on-month decrease of 9.8% and a year-on-year increase of 14.7%. It is noteworthy that although the sales of all four major types of passenger cars declined to varying degrees compared to the previous month, they all achieved varying degrees of growth compared to the same period last year, highlighting the overall resilience of the market.

From the longer period data from January to July, the passenger car market also performed remarkably, with cumulative sales of 15.841 million units, representing a year-on-year increase of 13.4%. Among these, the sales growth of crossover passenger cars was more significant, becoming one of the key drivers of market growth.

In the market competition landscape, Chinese brand passenger cars have performed exceptionally well. In July, Chinese brand passenger cars sold a total of 1.604 million units, a month-on-month decrease of 6% and a year-on-year increase of 21.3%, accounting for 70.1% of the total passenger car sales. The market share increased by 3.8 percentage points compared to the same period last year.

In terms of specific models, the market shares of Chinese brand sedans, SUVs, and MPVs in July reached 64.9%, 73.7%, and 68%, respectively. Compared to the previous month and the same period last year, the market shares of these three model categories all showed varying degrees of growth, demonstrating the comprehensive efforts of Chinese brands in various market segments.

From January to July, the leading advantage of Chinese brand passenger cars further expanded. A total of 10.873 million units were sold, marking a year-on-year increase of 24.4%, and accounting for 68.6% of the total passenger car sales. The market share saw a significant increase of 6.1 percentage points compared to the same period last year. In the sub-segment categories, the market shares of Chinese brand sedans, SUVs, and MPVs were 62.7%, 72.6%, and 68% respectively from January to July. All of these figures represent growth compared to the same period last year, continuously consolidating their dominant position in the major sub-markets.

In contrast to the strong performance of Chinese brands, foreign brands are experiencing a divergent pattern. In July, among major foreign brands, French brands saw double-digit growth in sales, while the other four major brands experienced varying degrees of decline. From a year-on-year perspective, German and French brand sales declined to varying extents, while the other three major brands experienced growth to varying degrees. Data from January to July shows that foreign brands as a whole are under pressure, with only Korean brand sales seeing a slight increase, while the other four major brands experienced varying degrees of decline.

In terms of the performance of leading companies in various market segments, the top ten sedan manufacturers sold a total of 4.557 million units from January to July, accounting for 68.7% of the total sedan sales. Among them, FAW-Volkswagen, Changan Automobile, SAIC Volkswagen, and Dongfeng Limited (headquarters) saw a year-on-year decline in sales, while other companies achieved growth. In the SUV market, the top ten SUV manufacturers sold a total of 5.599 million units, accounting for 67.2% of the total SUV sales. Tesla and GAC Toyota experienced a year-on-year decline in sales, while other companies showed a growth trend. In the MPV market, the top ten MPV manufacturers sold a total of 521,000 units, accounting for 77.9% of the total MPV sales, with only GAC Trumpchi and SAIC Maxus experiencing a year-on-year decline in sales, while other companies achieved growth.

Overall, from January to July, the passenger car market, under the dual influence of policy incentives and new product iterations, exhibited the distinct characteristics of Chinese brands continuing to lead and a divergence among leading companies in niche markets.

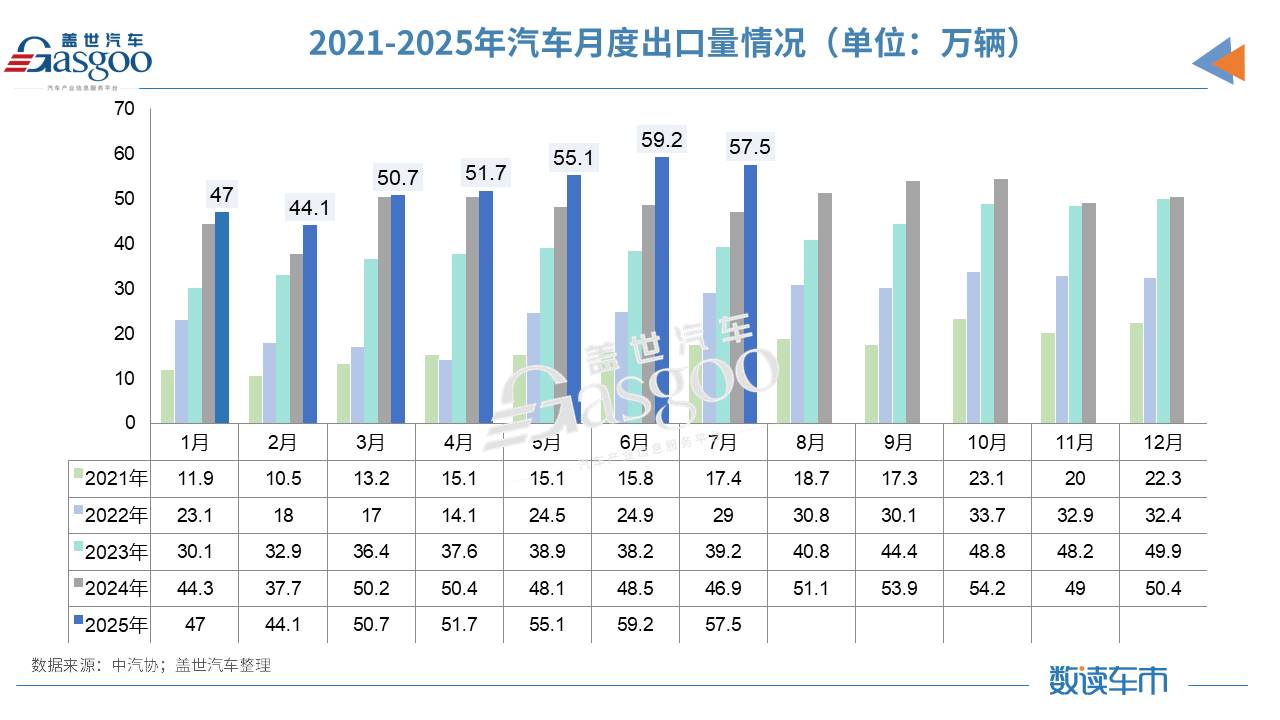

7The monthly exports increased by 22.6% year-on-year.New energy vehicles become the core growth engine.

In July 2025, China's automobile export market sustained its growth resilience amid structural adjustments. Although the overall export volume slightly declined month-on-month, it still maintained double-digit growth year-on-year.

In July, data shows that 575,000 vehicles were exported, a month-on-month decrease of 2.8%, but a year-on-year increase of 22.6%. From January to July, a total of 3.68 million vehicles were exported, marking a year-on-year growth of 12.8%, demonstrating the continuous competitiveness of China's automobile industry in the global market.

In terms of specific vehicle models, passenger cars remain the main force of exports, with 499,000 units exported in July, representing a slight month-on-month decrease of 0.5% and a year-on-year increase of 25.2%. From January to July, a total of 3.103 million units were exported, marking a year-on-year increase of 13.3%. This steady growth trend has provided strong support for overall exports.

In the commercial vehicle sector, there is a month-on-month pressure trend, with exports in July reaching 76,000 units, a decrease of 16% month-on-month, but still an 8% year-on-year increase. Among these, truck exports were 64,000 units, down 15.7% month-on-month, but up 5.3% year-on-year. Bus exports were 12,000 units, a 17.4% month-on-month decrease, but with a remarkable year-on-year growth rate of 26.1%, making it the highlight of the commercial vehicle segment. Cumulative data shows that from January to July, commercial vehicle exports totaled 577,000 units, a 10.2% year-on-year increase, with truck exports at 494,000 units, up 9.7% year-on-year, and bus exports at 83,000 units, up 12.9% year-on-year. The commercial vehicle market maintains its cumulative growth momentum amid structural differentiation.

In terms of energy types, the performance of traditional fuel vehicles and new energy vehicles shows a stark contrast. In July, traditional fuel vehicle exports were 350,000 units, a month-on-month decrease of 9.6% and a year-on-year decrease of 4.3%. From January to July, cumulative exports were 2.373 million units, a year-on-year decrease of 7%, with market share continuously being squeezed by new energy vehicles.

In stark contrast, the export of new energy vehicles continued its explosive growth, with 225,000 units exported in July, representing a month-on-month increase of 10% and a year-on-year surge of 1.2 times; the cumulative export for January to July was 1.308 million units, an increase of 84.6% year-on-year, becoming the core engine driving the growth of automobile exports.

In the internal segments of new energy vehicles, both pure electric and plug-in hybrid models continue to grow rapidly, with the growth of plug-in hybrid models being more prominent. In July, pure electric vehicle exports reached 141,000 units, a month-on-month increase of 8.3% and a year-on-year increase of 83.6%; plug-in hybrid vehicle exports reached 85,000 units, a month-on-month increase of 12.9% and a year-on-year increase of 2.2 times. Cumulatively, from January to July, pure electric vehicle exports totaled 833,000 units, a year-on-year increase of 50.2%; plug-in hybrid vehicle exports totaled 475,000 units, a year-on-year increase of 2.1 times. The plug-in hybrid models, with their enhanced product competitiveness, have become a significant source of growth in new energy exports.

At the corporate level, leading companies continue to drive export growth. Among the top ten vehicle exporters in July, Chery exported 119,000 units, a year-on-year increase of 31.9%, accounting for 20.7% of the total export volume, thereby firmly maintaining its leading position. BYD showed strong growth momentum, with exports reaching 81,000 units, a year-on-year increase of 1.6 times, marking the most significant growth rate among the top ten companies.

From the cumulative data, among the top ten vehicle exporting companies from January to July, Chery's export volume reached 667,000 units, a year-on-year increase of 7.3%, accounting for 18.1% of the total export volume; BYD's exports reached 553,000 units, a year-on-year increase of 130%, continuously expanding its market share at a high growth rate, further highlighting the competitive advantage of leading companies.

Overall, in July 2025, China's automobile export market maintained growth momentum driven by the strong performance of new energy vehicles. Despite some month-on-month fluctuations in certain segments, the rapid growth of new energy, especially plug-in hybrid models, along with the leading role of major companies, collectively propelled the steady increase in China's share of the global automobile export market, laying a solid foundation for achieving the annual export targets.

Summary:The Central Political Bureau meeting held on July 30 comprehensively deployed economic work for the second half of the year, clearly stating that macroeconomic policies should continue to exert force and be intensified when appropriate. This will effectively unleash the potential of domestic demand and continuously optimize market competition order. Recently, the national level has already issued the third batch of ultra-long-term special treasury bonds to support the funding for trade-in of consumer goods, with the fourth batch scheduled to be issued in October as planned. Local authorities will be urged to detail the fund usage plan to ensure the funds are used in an orderly and balanced manner until the end of the year. The clarity of national policies will help stabilize consumer confidence, continuously boost automobile consumption, and ensure the stable operation of the industry in the second half of the year.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track