Nylon modification additives: Development And Application Trends In 2026

Nylon, as a crucial engineering plastic, owes its performance enhancement to the continuous innovation of modification additives. From early tougheners and flame retardants to today's functional and environmentally friendly additives, its development history is closely linked to market demands and technological breakthroughs. In the future, additive R&D will focus more on efficiency, multifunctionality, and green sustainability, providing the core impetus for the expansion of nylon materials in high-performance fields.

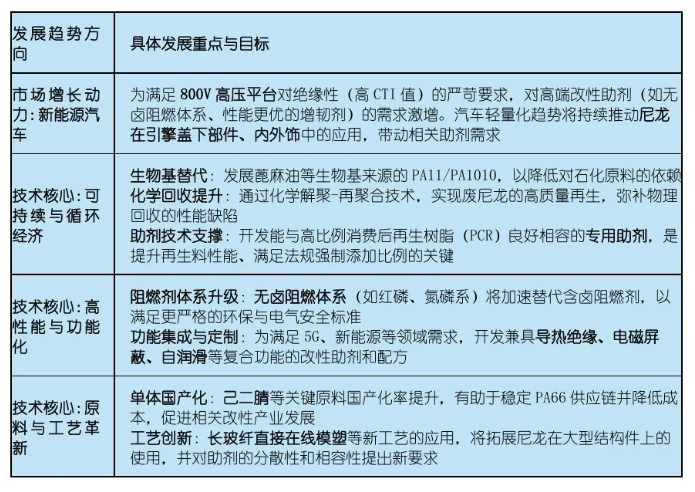

Development trends of nylon modification additives in 2026. Sustainability and Circular Economy, High Performance and Functionalization, Raw Material and Process Innovation These are three clear long-term development directions, and market demand and growth are primarily driven by downstream applications.

Main directions of future development and key market areas.

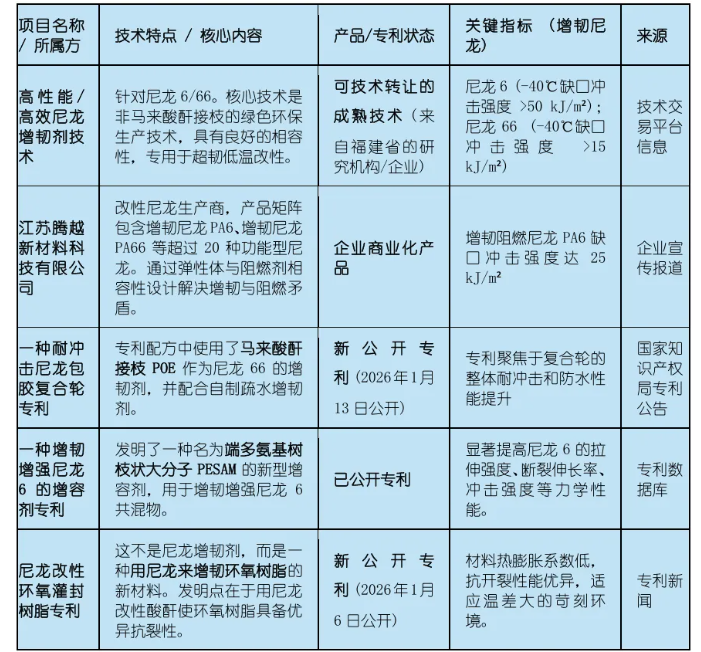

2026 Nylon Toughening Agent Technology and Market

Development Trends

1. Technological Innovation: R&D is shifting from traditional grafting methods to more environmentally friendly and high-performance novel compatibilizers (such as dendritic macromolecules), as well as developing toughened nylon that maintains performance at ultra-low temperatures (e.g., -40°C).

2. Market Applications: Toughened nylon is expected to have promising applications in new energy vehicles, rail transportation, and sports equipment.

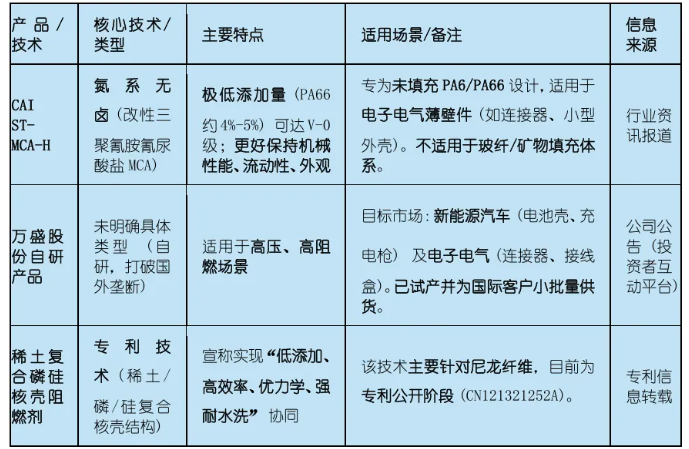

2026 Nylon Flame Retardant Market and Technology

Recently, several new nylon flame retardant products have been released, each representing different technical routes and application directions.

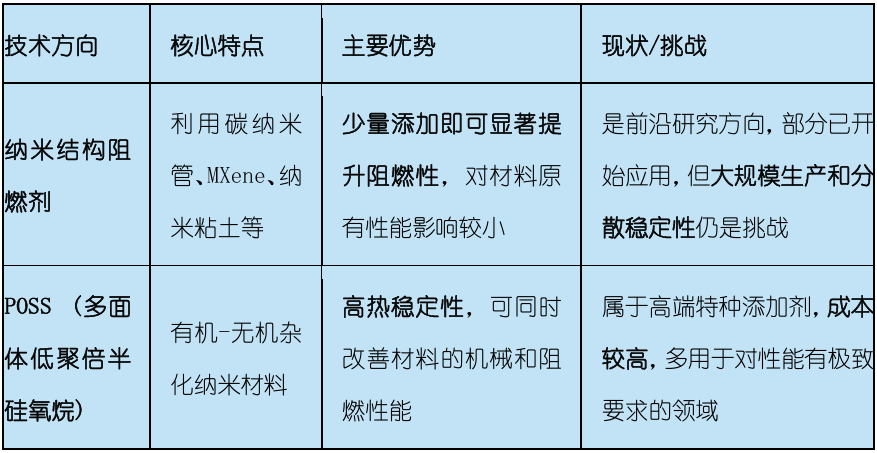

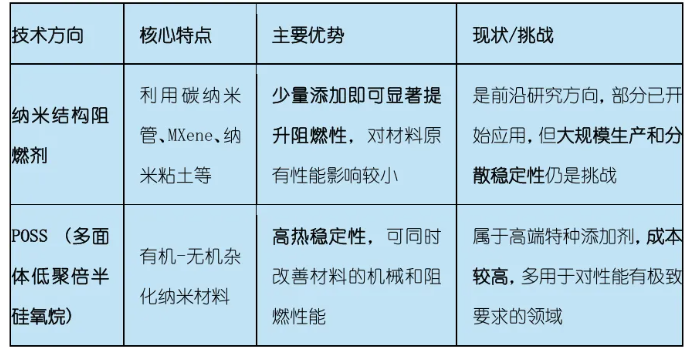

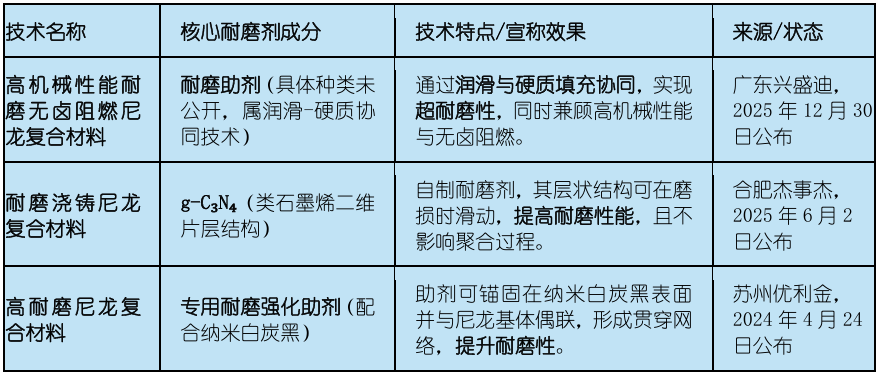

Table: Emerging Technology Research Trends

How to choose the right flame retardant

Faced with a diverse range of choices, you can follow a clear decision-making path.

Clearly define regulations and market requirements: The primary task is to identify the environmental regulations (e.g., halogen-free requirements) and safety standards (e.g., UL94 rating) applicable in your product's target sales market (e.g., EU, North America) and application area (e.g., automotive, electronics).

Define material system and core requirements.

Unfilled Nylon (PA6/PA66): High-efficiency MCA products like CAI ST-MCA-H can be emphasized for evaluation, aiming to reduce costs while ensuring performance.

Glass fiber/mineral filled nylon: MCA is usually not applicable. Phosphorus red-based (high efficiency but affects color) or phosphinate-based solutions specifically for filled systems should be considered.

Performance priorities: Clearly identify whether mechanical strength, electrical performance, appearance color, or extreme cost is the least negotiable performance aspect, as this directly determines the choice of technical approach.

Pilot testing is necessary to validate any theoretical match. This testing should verify the compatibility of the flame retardant with your specific nylon grade, processing techniques, and other additives (such as tougheners), ensuring that the final product meets comprehensive performance standards.

In early 2026, the development of the nylon flame retardant field is characterized by the following:

1. Product innovation concretization: New products will primarily iterate around the goals of "higher efficiency, lower additives, and superior comprehensive performance," rather than releasing broad annual specifications.

2. Technology route divergence: Mainstream technical solutions are completely different for unfilled and filled nylon, requiring initial distinction during selection.

3. Monitor domestic progress: Domestic companies, represented by WanSheng Co., Ltd., whose self-developed products have entered the international supply chain, are worth monitoring.

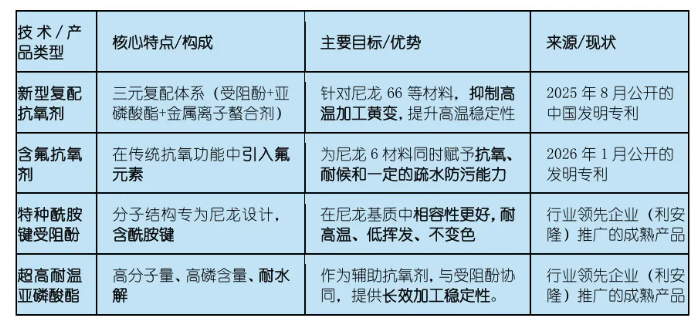

2026 Nylon Antioxidant Technology Trends and Selection

Based on currently available industry reports and patents, the situation of nylon antioxidants in 2026. High-efficiency compounding and functional complexation are clear technological trends.

Overall industry development trends

From a macroscopic perspective, the field of nylon antioxidants is developing along with the upgrading of downstream industries.

Demand-driven: Automotive lightweighting (especially the higher temperature operating conditions of new energy vehicles) and the heat dissipation challenges brought by the miniaturization of electronic products are driving the demand for more efficient and temperature-resistant antioxidants.

Technical direction: The industry as a whole is moving towards high efficiency, low addition levels, good compatibility, and low volatility. Meanwhile, providing "full-chain system solutions" targeting thermal aging and photo-aging is becoming a service model for leading companies.

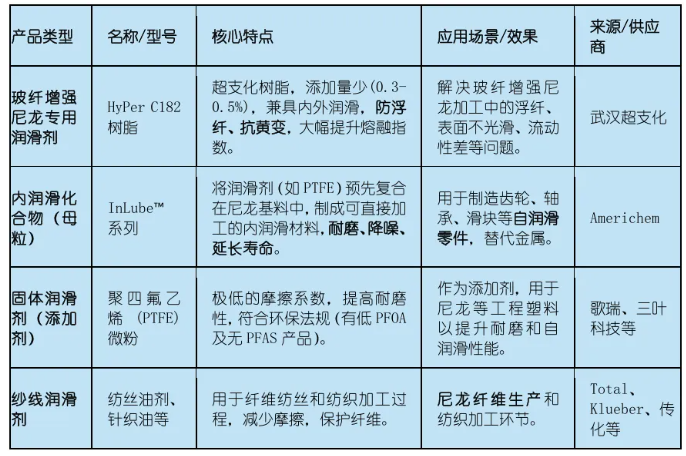

2026 Nylon Lubricant Technology Development and Application

Which option you choose mainly depends on your application scenario.

If you are a nylon product manufacturer experiencing issues like fiber bloom, rough surface, poor flow, or yellowing when processing glass fiber reinforced nylon, HyPer C182 and similar dedicated processing lubricants offer a direct and targeted solution.

If you are a component designer or manufacturer needing to produce nylon gears, bearings, and other moving parts with long-lasting self-lubricating properties, choosing an internal lubricating compound masterbatch like InLube™ is a more efficient and convenient option, offering a "ready-to-use" material solution.

If you are a modified plastics manufacturer developing a wear-resistant formulation for a specific customer, you might consider incorporating PTFE micropowder as a key additive for compounding.

Future Trends and Industry Insights

Here are two clear trends in the industry for your reference:

Long-lasting and intelligent: Future lubricated nylon materials are developing towards long-lasting lubrication and intelligent monitoring. For example, controlling grease release through nano-microencapsulation technology or embedding sensing materials to provide early warning of wear.

Environmental Protection and Regulations: Global regulations on PFAS (per- and polyfluoroalkyl substances) are becoming increasingly stringent. When selecting fluorinated lubricants (such as certain PTFE products), it is crucial to closely monitor their compliance with regulations like REACH limit requirements, or consider switching to PFAS-free alternative products.

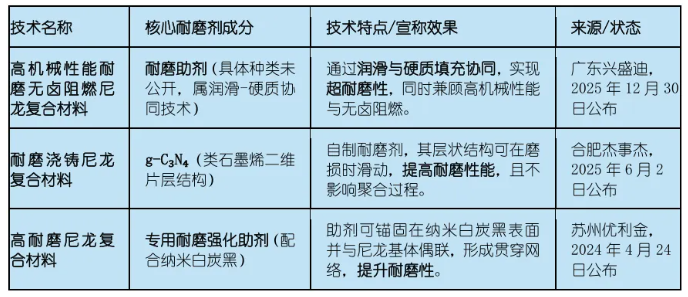

2026 Nylon Wear Resistance Agent Technology and Application

ATTENTION: The above information is all sourced from patent application documents published by the China National Intellectual Property Administration. Patented technologies are typically in the research and development or protection application stage and do not necessarily represent mature products already available for sale.

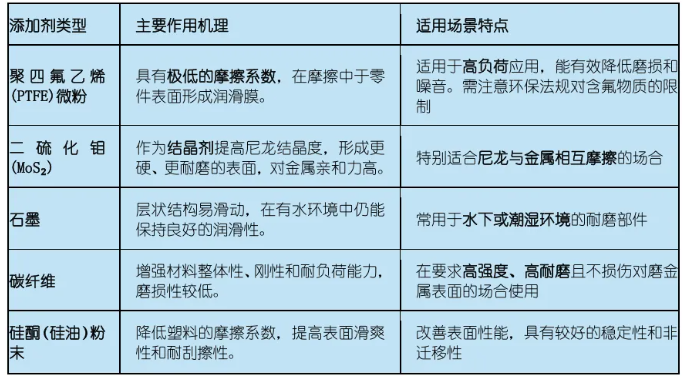

Current mainstream nylon wear-resistant agent types

Table: Widely Used and Technically Mature Abrasion-Resistant Additive Types

In recent years, the development of nylon modification additives has focused on improving the comprehensive performance of materials, expanding application fields, and actively embracing bio-based and sustainable development concepts.

High performance and multi-functionality is the core direction. Additives are developing from single-function to multi-functional integration to address challenges such as... Automotive, Electronics and Electrical To meet the increasingly complex material demands of downstream fields. For example, through Unique grafting technique , which can simultaneously improve the toughness and bonding strength of nylon. New composite additives, on the other hand, can simultaneously address multiple properties such as flame retardancy, yellowing resistance, and laser welding transmissivity.

Synthetic technology innovation ... become key to enhancing performance. Cutting-edge research advances by... Bio-based monomer copolymerization or post-polymerization modification techniques directly introduce functional groups into the nylon backbone. This approach imparts customized properties to the material, such as enhanced adhesion, elasticity, hydrophilicity, and recyclability, realizing a shift from "addition" to "structural design."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories