Northeast Asia Polyolefins Start Production, Impacting South Korea Petrochemical Industry

In August 2025, there were two most sensational pieces of news. One was that several large polyolefin plants in Northeast Asia were put into operation, with capacities generally in the range of 300,000 to 400,000 tons per year. As a result, domestic polyolefin prices have continued to remain sluggish. The other was that South Korea's petrochemical industry suffered massive losses, and it is expected to withdraw 3.8 million tons per year of capacity. In the past two weeks, many self-media outlets have published numerous related reports. "Dadi" believes it is necessary to analyze future changes in polyolefin capacity and profit margins from a fundamental perspective.

Period

All things are cyclical. From the current situation, the economy is at a bottom phase, and it may take 2-3 years, that is, until 2027 or 2028, to reach a temporary bottom.

Looking back, economic growth has slowed year by year since 2022. Analyzing from several dimensions: according to the Kondratiev cycle (a 50-60 year cycle), economic recovery is expected around 2030; according to the Kuznets cycle (a 15-25 year cycle), recovery may come around 2035; and according to the Juglar cycle (a 7-10 year cycle), economic recovery could occur around 2028.

Analyzing from several dimensions, the current economy is either at the bottom or in the process of bottoming out. The fastest economic recovery could take around 3 years; a slow recovery might take about 10 years.

In terms of economic growth, the expected global growth rates (the data may not be completely accurate, and statistical calibers may differ—figures are for reference only) are: 3.2% in 2022, 3.0% in 2023, 3.2% in 2024, 3.0% in 2025, and 3.1% in 2026. Generally, the global growth rate should be 3.8%.

We can conclude that it will take 3 to 6 years for the economy to possibly recover.

Generally speaking, the demand for polyolefins is closely related to the macroeconomic environment. Polyolefin demand will only increase after the economic growth rate rises (according to empirical data, polyolefin demand growth rate = GDP growth rate * coefficient + structural growth factors). So, the future demand expectations are certainly weakening. What about the capacity situation?

2. Northeast Asia Production Capacity

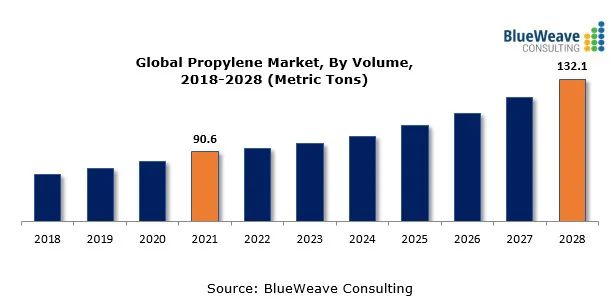

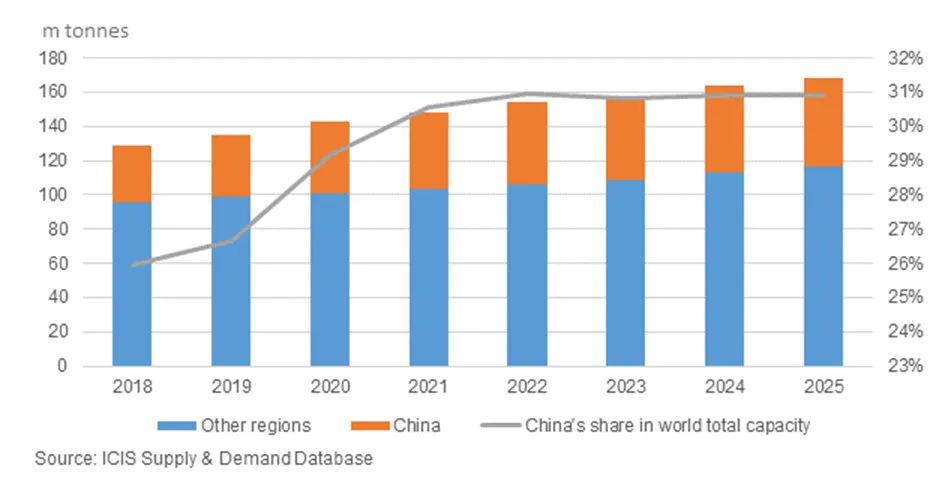

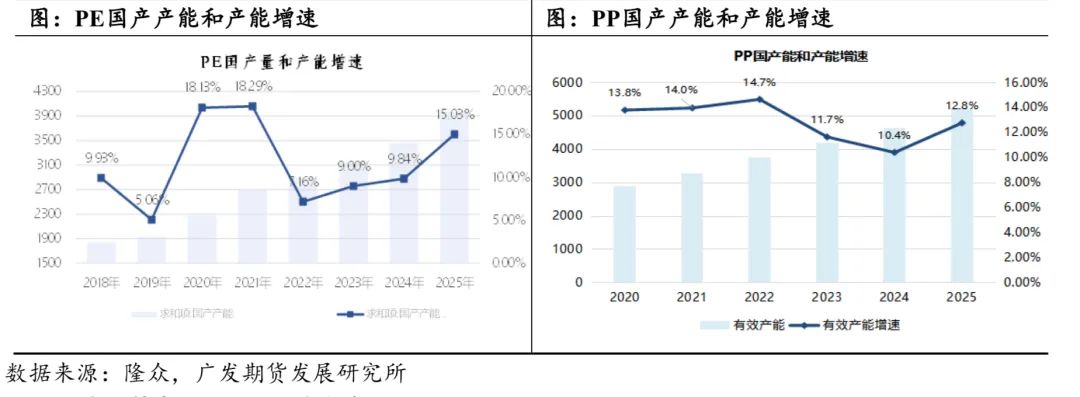

Northeast Asia is releasing capacity rapidly. For polyethylene, an additional 3.15 million tons is expected to be added in the second half of 2025, and polyethylene production capacity is expected to exceed 40 million tons in 2025. The average annual growth rate of polyethylene over the past five years has reached double digits.

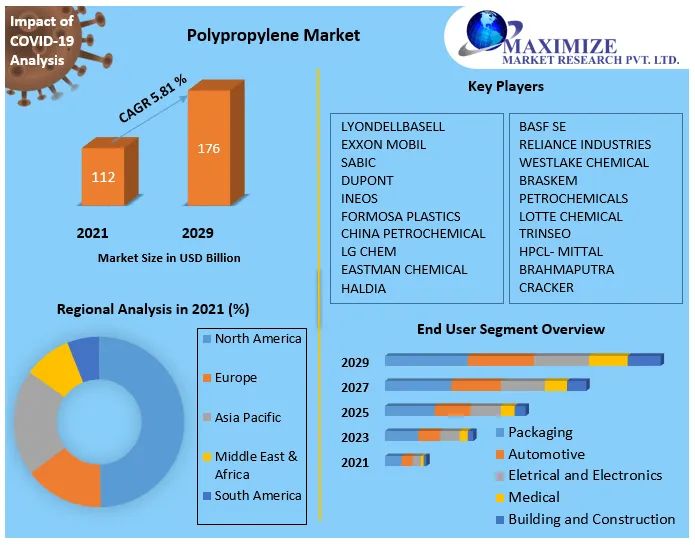

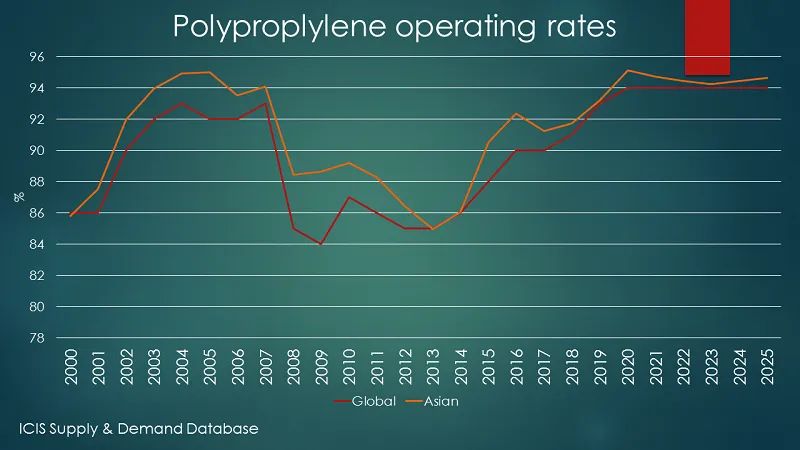

Polypropylene: In the second half of 2025, approximately 3 million tons of new production capacity will be added, bringing the total polypropylene production capacity close to 50 million tons in 2025. The average growth rate of polypropylene over the past five years has also reached double digits.

The demand for general-purpose materials is sluggish, and the only thing to look forward to is the specialized materials.

Polyolefins are like this, and so is refining capacity. In 2025, Yulong Petrochemical's 10 million tons/year and Daxie Petrochemical's additional 6 million tons/year capacity will be gradually released, bringing Northeast Asia's refining capacity to nearly 9.60 million tons/year. Among them, Daxie Petrochemical's olefin production reaches 1.8 million tons/year, with its core being the largest heavy oil catalytic cracking unit in the country, with a unit scale of 3.2 million tons/year.

The downturn of polyolefins, combined with the release of refining capacity, will lead to continuous growth in production capacity. This will compress the gross profit margin of polyolefins.

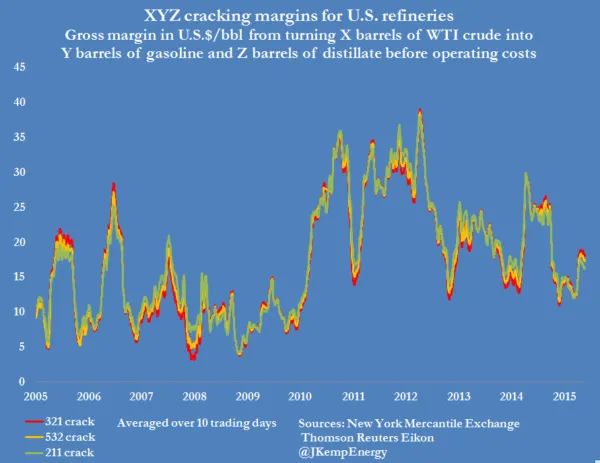

3. Polyolefin Gross Profit

Polyolefin gross profit (not necessarily accurate) reached its peak in 2015, reaching 2000 yuan/ton. After that, it remained above 1000 yuan/ton until the beginning of 2023, when the gross profit declined to below 1000 yuan/ton, reaching a low of 500 yuan/ton. In 2024, it further declined to 400 yuan/ton. By 2025, it dropped below 200 yuan/ton. According to media data, in April 2025, polyethylene experienced a loss of 176 yuan/ton, and in May 2025, polypropylene profits were less than 200 yuan/ton.

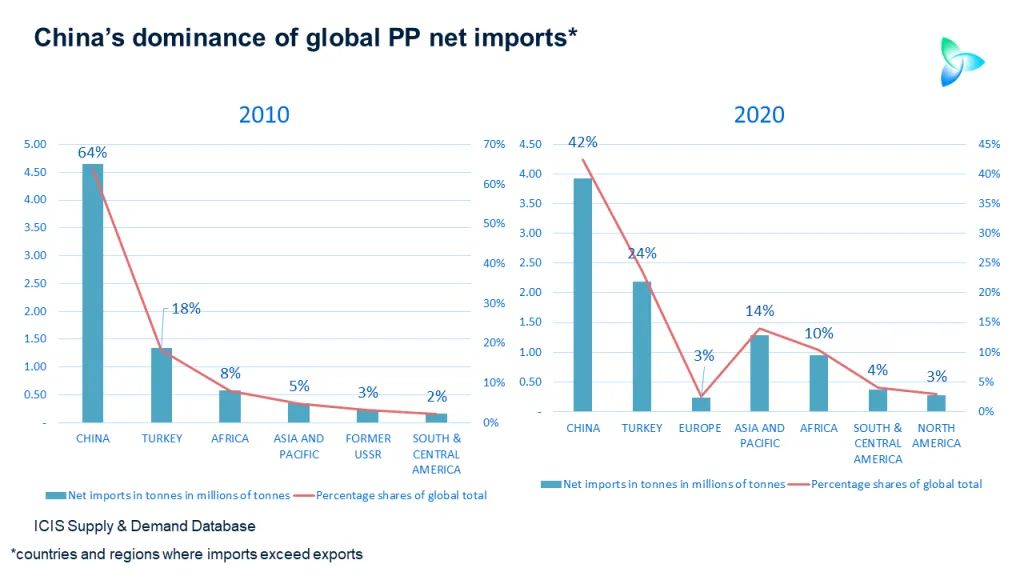

With the commissioning of refining and chemical units in the second half of the year, the gross profit for the latter half is quite challenging. Maintaining the levels seen in April-May would already be impressive. So, how does this relate to South Korea? One of the largest destinations for South Korean chemical and aromatic products is China, with the export dependency on aromatic products reaching 50%. Affected by the release of polyolefin capacity in Northeast Asia, South Korea's chemical product exports are expected to decline by more than 15% in 2023. If industry giants Wanhua and Hengli establish new capacities in South China, the capacity in Northeast Asia will further expand, and polyolefin gross profit is expected to remain at a low level for the long term, at less than 200 RMB/ton.

4. Summary

Everything is cyclical. Refining and polyolefin capacity in Northeast Asia will continue to expand in the future, leading to an oversupply of polyethylene and polypropylene in the region. Polyolefin margins are expected to remain low for a long period. It is estimated that margins may not recover until around 2028. In the next three years, there will be significant pressure for capacity rationalization, so companies need to implement cost reduction and efficiency improvement measures.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track