New Energy Penetration Rate Rises to 54% in July, But Why Did Extended-Range Vehicles Decline by 11.4%?

In the eyes of most people in the automotive industry, July has always been considered the so-called "off-season."

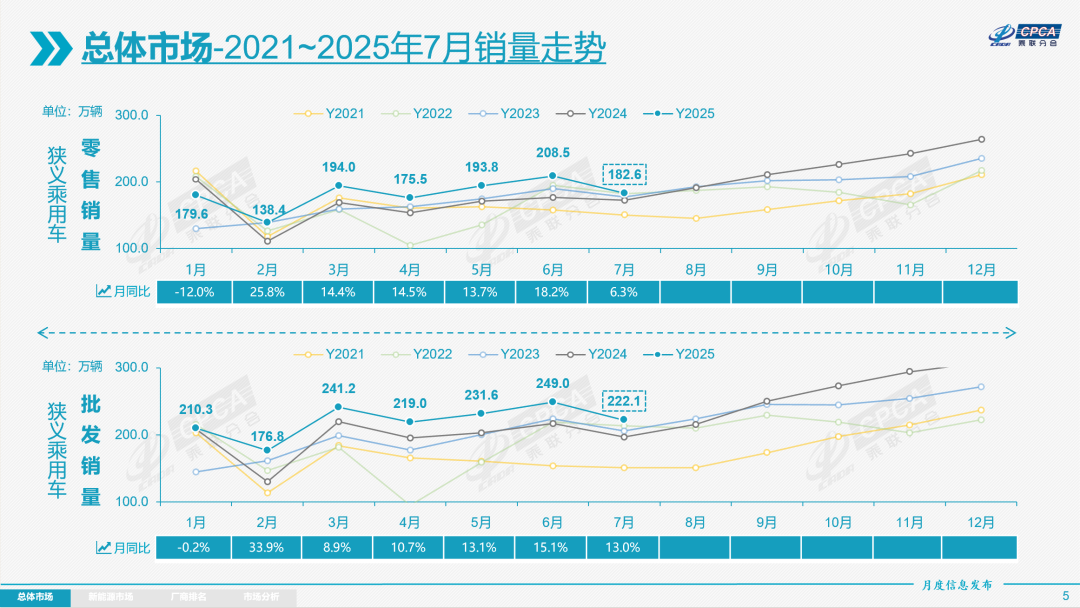

According to the terminal sales report just released by the China Passenger Car Association, this indeed confirms such a pattern. Specifically, the total retail sales reached 1.826 million vehicles, representing a 6.3% year-on-year increase compared to last year, but a 12.4% decline month-on-month from June.

Further breaking it down, retail sales of domestic brands in July reached 1.21 million units, up 14% year-on-year but down 10% month-on-month.

In contrast, mainstream joint-venture brands had retail sales of 50,000 units in July, representing a year-on-year increase of 1% and a month-on-month decrease of 12%. As for luxury cars, retail sales in July reached 170,000 units, down 20% year-on-year and down 29% month-on-month.

And this is the basic overview of the Chinese car market over the past 31 days.

From the perspective of an observer, if I were to choose the biggest highlight, I would, without hesitation, cast my vote for new energy vehicles. This is because, even during the "off-season," this group still demonstrates remarkable vitality.

The second half of the year has just begun and has quickly given traditional fuel vehicles a "setback". It has demonstrated through actions who truly represents the irreversible future.

Although the hardliners still stubbornly refuse to admit it, the glaring numbers do not lie. Having won the "Crossing of the Yangtze River" campaign, the protagonist of today's article, after a period of attritional warfare, is already advancing toward the enemy's heartland.

Therefore, here is the result directly.

When Retail Penetration Reaches a New Historical High

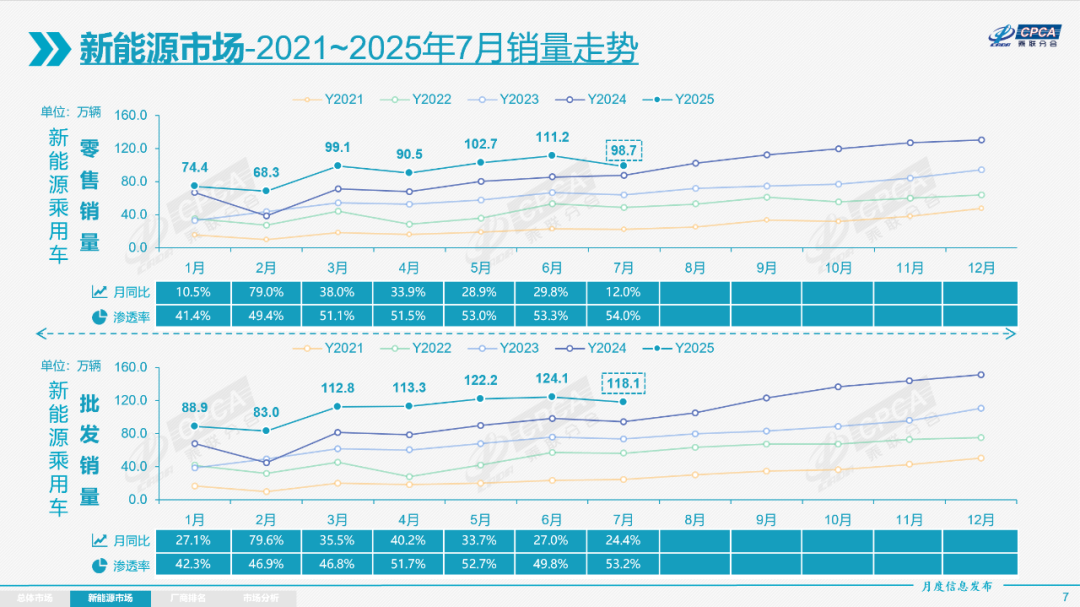

“41.5%、49.5%、51.1%、51.5%,52.9%、53.3%。”

Many readers are likely curious about the set of data presented at the beginning of this section, which, in my opinion, best demonstrates the status and situation of new energy vehicles in the Chinese car market—retail penetration rate.

From January to June, it is clearly a steadily rising curve.

In July, it is very gratifying that this figure once again reached a record high of 54.0%, an increase of 2.7 percentage points compared to the same period last year. Among them, the retail penetration rate of new energy vehicles from domestic brands soared to 74.9%.

Exaggerated, it's really too exaggerated.

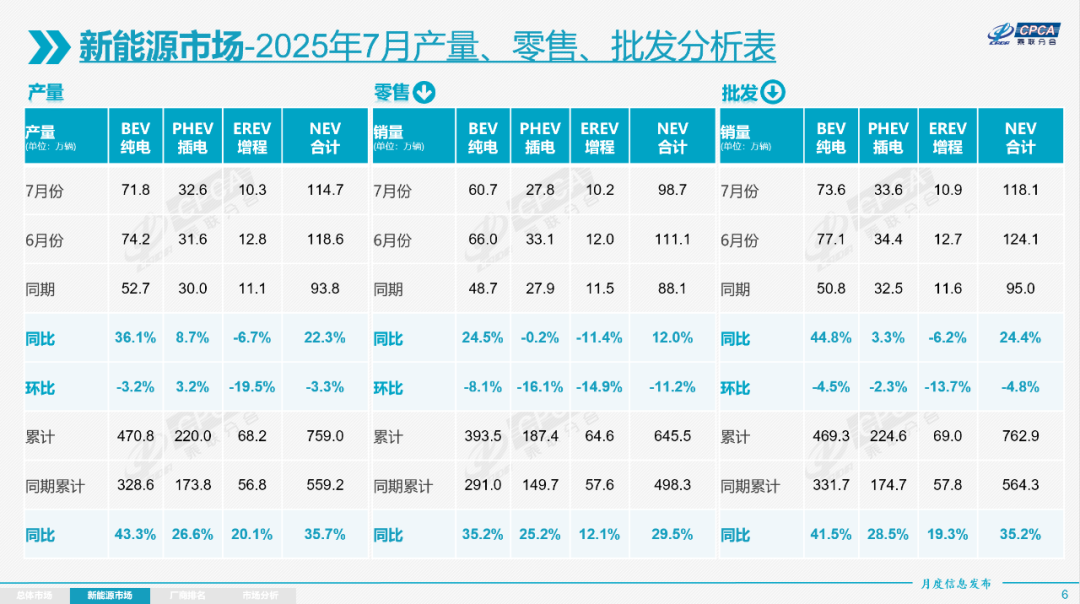

In addition, the production of new energy passenger vehicles in July reached 1.147 million units, a year-on-year increase of 22.3% and a month-on-month decrease of 3.3%. Wholesale sales of new energy passenger vehicles in July reached 1.181 million units, a year-on-year increase of 24.4% and a month-on-month decrease of 4.8%. Retail sales of new energy passenger vehicles in July reached 987,000 units, a year-on-year increase of 12.0% and a month-on-month decrease of 11.2%. Exports of new energy passenger vehicles in July reached 213,000 units, a year-on-year increase of 120.4% and a month-on-month increase of 7.6%.

Compared to the overall market trend, it shows a greater year-on-year increase and a smaller month-on-month decrease, reflecting a stronger risk resistance capability. Traditional fuel vehicles are still more deeply affected by the "off-season."

In July, it is also worth noting that the wholesale penetration rate of new energy passenger vehicles reached 53.2%, an increase of nearly 5 percentage points compared to the same period last year.

There are 17 passenger car models with wholesale sales exceeding 20,000 units.

The top ten are BYD Song with 52,648 units, Tesla Model Y with 45,838 units, BYD Seagull with 44,989 units, Geely Xingyuan with 44,286 units, BYD Seal 06 with 31,248 units, BYD Qin with 29,392 units, Nissan Sylphy with 29,000 units, Geely Boyue with 26,863 units, Wuling Hongguang MINI with 26,789 units, and Chery Tiggo 5X with 26,475 units.

Following are Chery Tiggo 8 with 26,166 units, Volkswagen Lavida with 24,706 units, BYD Qin L with 24,515 units, Xiaomi SU7 with 24,410 units, AITO M8 with 22,929 units, Tiggo 7 with 22,115 units, and Model 3 with 22,048 units.

A simple count shows that "green license plate" vehicles occupy 11 spots. The remaining 6 traditional fuel vehicles, without exception, are continuing to boost their sales by offering significant discounts. In contrast, the overall quality of new energy vehicles is better.

Additionally, it is quite interesting that in July, wholesale sales of pure electric vehicles reached 736,000 units, a year-on-year increase of 44.8%, but a month-on-month decrease of 4.5%; wholesale sales of narrow-sense plug-in hybrids in July were 336,000 units, a year-on-year increase of 3.3%, but a month-on-month decrease of 2.3%; wholesale sales of range-extended vehicles in July were 109,000 units, a year-on-year decrease of 6.2%, and a month-on-month decrease of 13.7%.

In the wholesale sales structure of new energy vehicles: pure electric vehicles account for 62.3% (year-on-year +8.8%, month-on-month +0.2%), narrow-sense plug-in hybrids account for 28.4% (year-on-year -5.8%, month-on-month +0.7%), and range-extended vehicles account for 9.2% (year-on-year -3.1%, month-on-month -1.0%).

Isn't it completely different from what you expected?

The power displayed by the "fuel tank" wasn't as explosive as imagined. It was expected that the combination of narrow-sense plug-in hybrids and extended-range vehicles could compete with pure electric vehicles in wholesale sales, but the latter quietly consolidated its leading advantage.

This precisely reflects the diverse demands of the Chinese automotive market.

It’s hard to sell pure electric cars, but if you sell them well, it’s very rewarding.

Pure electric, plug-in hybrid, and range-extended vehicles are very likely to achieve a stable situation of splitting the market into three equal shares.

Last year, in an article I wrote, I put forward the above judgment. Looking at the July report card released by the China Passenger Car Association, the first point is beyond doubt, while the second point, as mentioned at the end of the previous paragraph, seems to be gradually fading away.

This inevitably raises the question: why has China's new energy vehicle market this year seen a resurgence in pure electric vehicles, while the narrowly defined plug-in hybrids, once highly anticipated, have experienced the slowest growth, and range-extended vehicles have shown only lukewarm performance?

The most fundamental reason behind this is that, on one hand, the product strength of pure electric vehicles has been significantly upgraded, attracting more and more first-time buyers and those replacing their vehicles. It is often said that the next car for plug-in hybrid and extended-range vehicle owners will be pure electric, and this is becoming a reality.

On the other hand, there is a change in the supply and demand relationship at the consumer end. In other words, in the market below 200,000 yuan, the entrance of new all-electric models this year, which has been like a surge, has left potential consumers dazzled and further encroached on the original market share of plug-in hybrid vehicles.

Previously dominating the mid-to-high-end segment with an absolute advantage, the sector has started to show signs of loosening with the entry of popular models such as the revamped Tesla Model Y, Xiaomi YU7, and the Le Dao L90.

Anyway, I am becoming increasingly convinced that, with the passage of time and the advancement of technology, the mainstream market may eventually see pure electric vehicles taking the lead, with plug-in hybrids serving as a supplement; in the high-end market, range-extended vehicles will remain a force to be reckoned with for a long time. At the same time, supported by a mature charging infrastructure, the market share of pure electric vehicles will also gradually expand.

The subtitle of this section is advice for all OEMs.

Therefore, it is inevitable to speculate that the steady-state relationship among pure electric vehicles, narrowly defined plug-in hybrids, and range-extended vehicles in the Chinese car market may increasingly converge toward "70%, 15%, and 15%."

Of course, by then, new energy vehicles will have completely conquered the last stronghold of traditional fuel-powered cars.

A long time ago, BYD Chairman Wang Chuanfu personally predicted that there would be no major issue for the monthly retail penetration rate of new energy vehicles to eventually surpass 60% this year. NIO CEO William Li gave an even more aggressive estimate, believing it would leap past the 70% mark. Because of this, some people may feel that since it’s already July and the penetration rate has just surpassed 54%, things don’t seem as optimistic as the two industry leaders envisioned.

It must be admitted that, under the backdrop of traditional fuel vehicles engaging in aggressive price cuts, the pace of their decline has indeed been slowed to some extent. However, to speak rationally and objectively, such an unsustainable approach will inevitably lead to a complete collapse one day.

The protagonist of today's article has already shown overwhelming dominance in terms of marketing volume. It is often said that the scariest thing about car manufacturing is being gradually forgotten, which is quite similar to the current situation of traditional fuel vehicles.

Anyway, even if this year is not the moment for a full-scale offensive due to various reasons, with the continuous improvement and iteration of new energy vehicles themselves, the assembly call for the charge will eventually be sounded next year or the year after.

This point is beyond doubt.

At present, there is another point that cannot be ignored: the minds of many potential consumers in inland and lower-tier cities have not yet been fully captured by "green license plates."

Although the main subject of today's article has greatly surpassed traditional gasoline vehicles in terms of overall product experience, there is still a long way to go before users nationwide genuinely break their prejudices and willingly pay for it.

All automakers can do now is to make steady progress bit by bit, waiting for quantitative changes to trigger a greater qualitative transformation. The upcoming "Golden September and Silver October" is crucial for new energy vehicles.

On one hand, it is necessary to achieve overwhelming success in sales; on the other hand, it is essential to take the brand's visibility to the next level.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track