Net Profit Halved but Market Capitalization Hits One Trillion: Why Is Tesla Surging?

On one hand, net profit is halved; on the other hand, the stock price hits a new high.

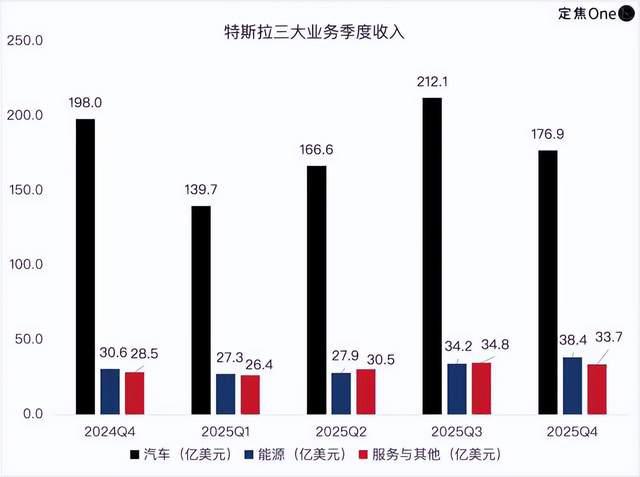

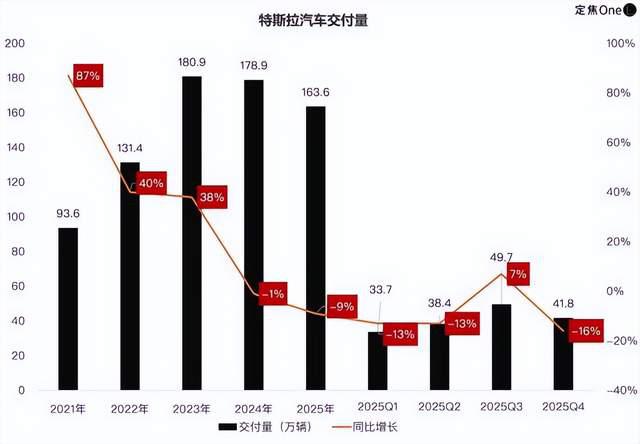

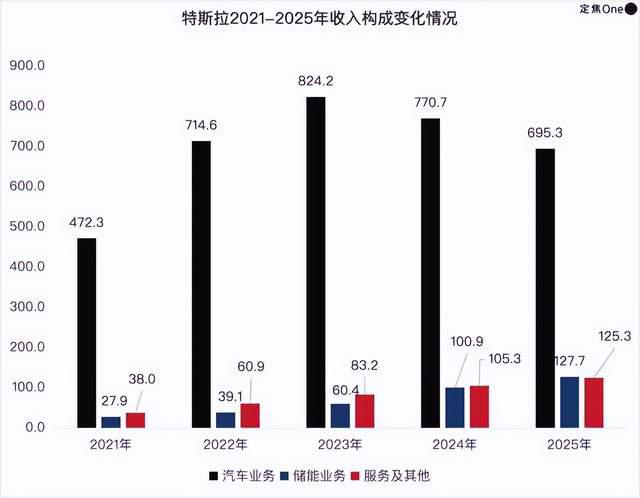

Here's the situation for Tesla in 2025. On January 29th, its Q4 and full-year 2025 financial report revealed that its core automotive business had completely stalled: full-year deliveries were 1.636 million vehicles, a decline for the second consecutive year; it lost its global EV sales crown to BYD; full-year revenue for the automotive business ($69.53 billion) decreased by 10% year-over-year, gross margin fell to 15.4% (excluding regulatory credit revenue), and per-vehicle gross profit was $4,742 (approximately 33,000 RMB).

During the earnings call, Musk announced the discontinuation of Model S and Model X production, streamlining the product line.

Amidst the shadow of a price war, Tesla's total annual revenue reached $94.83 billion, a year-on-year decrease of 3%; net profit (GAAP) was nearly halved, plummeting from $7.09 billion in 2024 to $3.79 billion.

Q4 performance was even more dismal, with revenue of $24.9 billion and net profit of only $840 million, a year-on-year plunge of 61%.

However, the capital market pushed Tesla's stock price to a historical high. From the beginning of 2025 to April, due to pressure on the company's fundamentals and Musk's "obsession" with politics, the stock price once fell to a low of $221. But the tide turned when Musk announced an increase in shareholding in April. Especially in the second half of the year, progress in Robotaxi road tests, FSD version updates, and the approval of the new compensation package at the shareholders' meeting... Musk relied on a series of operations to shift the market's focus from selling cars to AI. By December, the stock price once soared to $495, and the market value returned to one trillion dollars.

As of press time, Tesla's market capitalization has stabilized at around $1.43 trillion, corresponding to a price-to-earnings ratio of 280. The logic behind this is clear: the market no longer cares how many cars Tesla sells, but is betting on whether it can turn things around with AI tomorrow.

However, telling the AI story comes at a high cost. In 2025, Tesla's operating expenses surged by 23% to $12.74 billion, and its operating profit margin dropped from 7.2% to 4.6%. To support AI research and development, Tesla is building the Cortex 2 supercomputing center in Texas and developing AI5 and AI6 chips, all of which are continuously burning cash.

Fortunately, Tesla can still afford it. Free cash flow in 2025 is $6.22 billion (up 74% year-over-year), and total cash and investments are $44.06 billion (up 21% year-over-year).

Another easily overlooked change in this financial report is that the energy storage business, with approximately 13% of the revenue volume, contributed nearly a quarter of the overall profit. In 2025, the business achieved full-year revenue of $12.77 billion, a year-on-year increase of 27%.

What is Tesla's current situation? What's going on with its automotive business? And how many of the new stories supporting its trillion-dollar valuation – Energy Storage, FSD (Full Self-Driving), Robotics, and Robotaxi – will truly materialize? This article will analyze Tesla's Q4 and full-year 2025 financial results in an attempt to answer these questions.

Car slowdown: Deliveries and gross profit margin both decline, two models cut

Growth can solve most of a company's problems. But for Tesla, its once unstoppable automotive business has completely stalled.

Tesla's deliveries, after several years of rapid growth, experienced their first annual decline in 2024. In 2025, the decline widened to 9%.

Tesla's quarterly deliveries were pushed up to 497,000 units in Q3 due to a surge in demand pulled forward by the impending expiration of the U.S. federal electric vehicle tax credit at the end of September. However, after the policy incentive faded, Q4 deliveries plummeted to 418,000 units, a sequential drop of 16% and a year-over-year decrease of nearly 16%.

This indicates that, with the disappearance of policy stimuli and the absence of breakthrough new products, demand for Tesla's existing models is almost saturated.

During the earnings call, Musk announced that the Model S sedan and Model X SUV will be discontinued after the end of Q1 2026.

Model S and Model X belong to high-end, niche product lines with limited sales but high production complexity. They were once symbols of Tesla's brand power, but with the current pressure on the automotive business, the company is no longer willing to maintain these two product lines.

However, this contraction also exposes a point: Tesla's deployment in affordable models is still lagging behind.

As the mainstay models in sales, the Model 3, which debuted in 2016, didn't receive an update until 2023; and the Model Y, released in 2019, won't be updated until early 2025. In the Chinese market, where competitors are launching new models almost every year, Tesla's product cadence is clearly lagging behind the market, and its product competitiveness has also diminished significantly.

The highly anticipated new model, Cybertruck, clearly cannot bear the responsibility of driving growth. In Q4 2025, the total deliveries for the "Other Models" category, which includes Cybertruck, Model S, and Model X, were approximately 12,000 units, a year-on-year decrease of 51%.

It's like the smartphone market back in the day, when Apple's pace of innovation slowed down, consumers would turn their attention to Android manufacturers who offered more novelty and better value for money. The electric vehicle market today is even more competitive than the smartphone market was back then.

As one waxes and the other wanes, Tesla's market share is being continuously eroded. In the global market, its crown as the top-selling EV maker has been taken by BYD, which sold a staggering 2.257 million battery electric vehicles in 2025. In the Chinese market, it has slipped from its once absolute dominant position to fifth place. In the European market, Tesla's sales decreased by 27% year-on-year, even leading to layoffs at its Berlin factory.

The decline in deliveries is superficial; the deeper crisis is the sustained pressure on profitability. Although Tesla has worked to maintain profit margins through cost optimization, the downward trend is still evident.

In terms of gross profit margin, excluding regulatory credit revenue, Tesla's automotive gross profit margin has declined from a high of 27% in 2021 to 15.4% in 2025. Although the gross profit margin rebounded to 17.9% in Q4 due to cost control, it is still lower than BYD's 20.6% (Q3 automotive business) and new player Xiaomi Auto's 26.4% (first half of 2025).

A more intuitive figure is that Tesla's gross profit per vehicle in Q4 was $5,721 (approximately 40,000 RMB). While this is better than the annual average, the profit margin per car has already been significantly compressed.

At the same time, a pure profit source for Tesla—regulatory credit revenue—is disappearing. Starting in Q4 2025, due to changes in relevant regulations, Tesla will no longer benefit from the sale of CAFE carbon emission credits. The "cut-off" of credit revenue, combined with the price war, makes profit growth in the automotive business more challenging.

Looking at a longer timeline, Tesla's vehicle sales gross profit reached as high as $4.8 billion in Q4 2022, but by Q4 2025, this figure had fallen to less than $2 billion. Its proportion of the company's total gross profit also plummeted from 86.1% in 2021 to 45.8% in Q4 2025. This indicates that the automotive business's core position within Tesla has significantly diminished.

Energy Storage Rises: Catching the AI Wave, Supporting a Quarter of Profits

Just as the automotive business was mired in difficulties, a low-profile business—energy storage—unexpectedly rose.

Throughout 2025, Tesla's energy storage business generated revenues of $12.77 billion, a 27% year-over-year increase. Deployments reached a record 46.7 GWh, a substantial 49% year-over-year increase. Notably, in Q4, while the automotive business experienced an 11% year-over-year decline, energy storage revenue surged by 25% to $3.84 billion.

More importantly, this business is very profitable. In Q4 2025, the energy storage business achieved a record high gross profit of $1.1 billion, with a gross margin of 28.7%. Roughly estimated, the energy storage business, with less than 15% of revenue, contributed nearly a quarter of the company's overall profit, with a profitability efficiency almost twice that of the automotive business.

Why is energy storage so profitable? It starts with its business model and market landscape.

Unlike its automotive business, which directly faces C-end consumers and is mired in the "red ocean" of a global price war, Tesla's energy storage business is more B-end oriented. Its core products, such as Megapack for utilities and large-scale commercial projects, and Powerwall for residential energy storage, are sold as integrated energy solutions rather than just hardware. Customers in this line of business prioritize product performance and reliability over mere price.

Tesla's biggest moat here is its vertical integration capability, from upstream cell manufacturing to downstream system integration. The production cost of the upstream 4680 cells is continuously decreasing, and the downstream Megapack 3 product further reduces installation speed and cost. This advantage translates into tangible gross profit.

Ultimately, this business capitalized on two trends: the power demands of AI data centers and the global energy transition. The former directly boosted orders for Tesla's utility-scale energy storage product, Megapack, with orders currently booked until 2026. The latter drove the growth of its home energy storage product, Powerwall.

To this end, Tesla is aggressively expanding its production capacity. The energy storage Gigafactory in Shanghai is continuously ramping up production; a new factory in Houston is also planned to commence operations in 2026, with an annual Megapack production capacity of 50 GWh alone.

Despite the intense competition in the energy storage market, particularly the pressure from Chinese manufacturers, the industry as a whole remains in a high-growth "blue ocean" stage. Leveraging its advantages in branding, technology, and distribution channels in key markets such as North America, Tesla continues to hold a favorable competitive position.

Energy storage is Tesla's most certain growth point at present, and also a profit buffer after the slowdown of its automotive business.

AI is Overrated: Robotaxis are Still a Distant Dream, and Robot Mass Production is Far Off

In recent earnings calls, Musk himself has shown dwindling interest in the automotive business, preferring to talk about AI. The market's focus has also shifted to FSD (Full Self-Driving) subscription numbers, the timeline for Robotaxi deployment, and the progress of Optimus (humanoid robot).

How are these highly anticipated businesses progressing, particularly those related to AI? Can they truly justify such a high valuation?

First, let's look at FSD.

Tesla significantly cut the price of FSD, reducing the one-time purchase price from $12,000 to $8,000, and the monthly subscription fee from $199 to $99. This adjustment increased the user base: by the end of 2025, active FSD subscriptions globally grew by 38% to 1.1 million. However, compared to Tesla's cumulative fleet of 8.9 million vehicles delivered, the penetration rate is only about 12%.

Given that regulatory approvals for FSD in two major potential markets, Europe and China, remain without a clear timeline, its commercialization progress is not promising. Although FSD revenue is not separately disclosed in the financial reports, it can be indirectly observed that the growth of "other auxiliary sales" (including FSD subscriptions, software upgrades, etc.) within the automotive business is far from compensating for the revenue gap caused by declining vehicle sales.

Now, Tesla has eliminated the one-time purchase option and fully transitioned to a pure subscription model. This means Tesla is striving to transform its software features from a "one-off" purchase to a SaaS (Software as a Service)-like subscription business, replacing volatile one-time transactions with consistent recurring revenue.

Let's look next at Robotaxi, which is regarded as the ultimate form of FSD commercialization.

During Tesla's Q2 2025 earnings call, Elon Musk "painted a picture," claiming that by the end of the year, its Robotaxi service would "cover more than half of the U.S. population." However, the reality is that as of the end of 2025, the service only operates in Austin and the San Francisco Bay Area. In Austin, the service began removing safety supervisors in a limited capacity in January 2025, while the Bay Area still requires safety drivers.

However, during the latest earnings call, Musk provided a more specific expansion plan: Tesla plans to expand its Robotaxi service to seven new cities, including Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas, in the first half of 2026.

Meanwhile, he confirmed that the company will launch the mass production of Cybercab (designed specifically for Robotaxi, without a steering wheel or pedals) in April-May 2026, and plans to expand the fleet size to 1,000 vehicles by the end of that year.

Finally, looking at the most imaginative part of Tesla's AI story roadmap, the Optimus humanoid robot. Musk even stated that Optimus's long-term value could exceed the combined value of all other Tesla businesses. However, the real-world challenges for this story are also the greatest.

According to Musk's description during the earnings call, one of their core technology bottlenecks is the "dexterity of the hands" of the robots, with the engineering difficulty of the forearm and hand actuators exceeding the sum of all other parts of the robot.

Furthermore, unlike automobile manufacturing, which boasts a mature industry chain, the humanoid robot sector has almost no existing supply chain. This means Tesla must start from scratch and vertically integrate the production of all core components.

According to the latest financial report, Tesla's first Optimus production lines are being installed in preparation for mass production. During the conference call, management provided a clearer timeline: the third-generation (V3) prototype will be released in the first quarter of 2026, with plans to begin external sales by the end of 2027.

However, Musk also admitted in the previous earnings call that the final production ramp-up speed will "depend on the slowest, trickiest, and 'unluckiest' part out of 10,000 unique parts." Currently, it still appears to be a product in the early stages of technology validation, far from mass production and stable monetization.

The common characteristics of these AI stories are: technological progress, but unclear commercialization paths; timelines repeatedly delayed, with extremely high uncertainty. More importantly, even if these businesses proceed as planned, they cannot offset the huge gap caused by the decline in automotive business revenue in the short term.

The story of Tesla has indeed changed.

The automotive business is hitting the brakes. The halt in Model S/X production and the erosion of global market share indicate that Tesla is no longer pursuing growth in its once-core business, but rather maintaining cash flow to buy time for its AI transformation.

Energy storage has given Tesla some breathing room, but its scale is not yet large enough to fill the gap in its automotive business, let alone support a trillion-dollar valuation.

What truly underpins the valuation is the AI business.

In a Morgan Stanley report from October 2025, a price target of $410 for Tesla was broken down, with the core automotive business valued at only $74, while other businesses such as AI were valued as high as $336, accounting for over 80%.

The premise for this logic to hold true is that FSD (Full Self-Driving) needs to be rolled out in more markets, Robotaxi needs to scale up from pilot programs, and Optimus needs to move from prototype to mass production. However, based on current progress, the technical bottlenecks, regulatory hurdles, and supply chain challenges these businesses face are not short-term solvable.

What's more, competitors are catching up. Huawei and BYD are rapidly iterating in the field of intelligent driving, and Chinese robotics companies are accelerating their engineering and commercialization. Tesla's technological advantage is shrinking.

How long can the market wait?

Tesla needs its AI business to take off before its automotive business declines further. 2026 will be a critical year for verification. Can Robotaxi expand successfully? Can Cybercab be mass-produced as scheduled in April-May? Can Optimus's Gen3 prototype be released on time? And can the energy storage business continue to maintain high growth?

Based on the financial reports from at least 2025 onwards, Tesla is no longer a company that can achieve high-speed growth simply by selling cars. Until a new story is convincingly told, investors holding Tesla stock are more like a group of believers. They are not buying into present value, but rather a faith in the future.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories