MPV Market: A Chaotic Mess

The MPV market was once a relatively stable and even somewhat dull segment in China's automotive landscape.

At that time, models like the Buick GL8, Honda Odyssey, and Elysion formed a solid barrier, and the boundaries between commercial MPVs and family MPVs were also very clear. Of course, fuel power was undoubtedly the mainstream.

However, as the tide of the new energy vehicle era surges forward, this once "blue ocean" is evolving into the most fiercely competitive front line, characterized by diverse technological routes and exciting collisions of product concepts. From the initial dominance of fuel vehicles to the current scenario where fuel, plug-in hybrids, and pure electric vehicles are in a tug-of-war, the boundaries between household and commercial use are also no longer particularly clear.

In 2023, a watershed moment occurred as the Denza D9 achieved nearly 120,000 units in annual sales, surpassing established joint venture competitors like the Buick GL8, Honda Odyssey, and Toyota Sienna, becoming the annual sales champion across all MPV categories. While some may view this phenomenon as a coincidence, the Denza D9 once again claimed the title of MPV annual sales champion in 2024, exceeding 100,000 units in sales.

This is not to say that the Buick GL8 is no longer strong. On the contrary, whether in terms of leading the MPV market or in terms of cumulative sales volume, the Buick GL8 holds a very unique position in the Chinese MPV market.

However, the shift from fuel vehicles to new energy vehicles, as reflected in the changes in sales rankings and market trends, reveals that a transformation driven by technology and demand is quietly taking place in the MPV market.

01The "Three Kingdoms" of Technological Routes

In 2023, the Buick GL8 lost the title of annual MPV sales champion for the first time in recent years, an event widely interpreted by the industry at the time as a symbolic event marking the decline of traditional fuel MPVs.

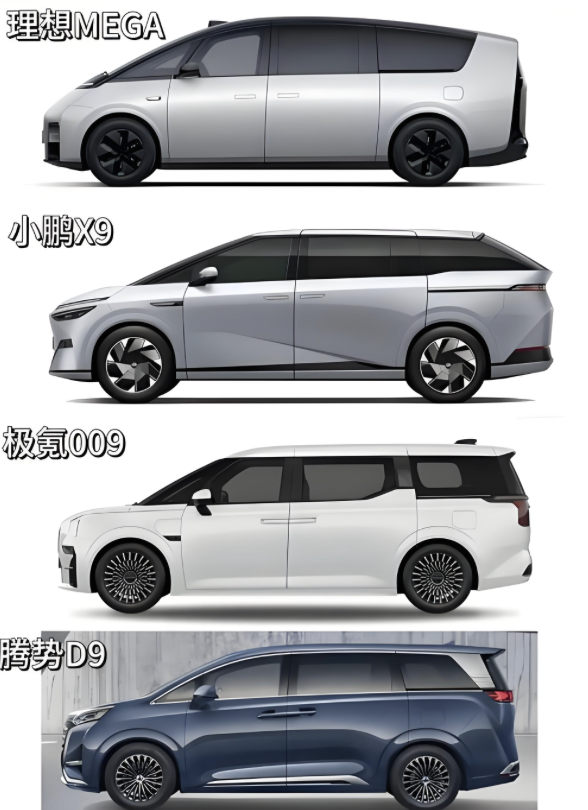

During that period, a large number of plug-in hybrid and pure electric MPVs, represented by models such as Denza D9, Zeekr 009, Li Auto MEGA, and XPeng X9, were launched successively, intensifying competition in this market with only about a 5% market share.

New energy MPVs attract the attention of many consumers with their intelligent features and electric power. They not only offer lower energy costs but also provide more advanced smart technology configurations, directly impacting traditional fuel MPVs. This is why traditional MPV leaders, represented by the Buick GL8, are the first to feel this pressure.

From fuel to plug-in hybrid, and then to pure electric, this technological route competition marks the first major change in the MPV market. These three technological routes coexist, akin to the tripartite division of Wei, Shu, and Wu, each holding its own advantages and vying for market share, resulting in an unprecedentedly complex competitive landscape.

In this situation, we are witnessing the rise of the new king of plug-in hybrid MPVs.

Currently, plug-in hybrid technology is undoubtedly the biggest variable and growth driver in the MPV market. It precisely addresses the pain points of high fuel consumption in traditional fuel MPVs and range anxiety in pure electric MPVs, achieving a balance between both. As a result, the Tengshi D9 has emerged as a strong competitor, surpassing the Buick GL8 in annual sales consistently.

Following the Denza D9, plug-in hybrid MPVs such as the Voyah Dreamer, WEY Gaoshan, and GAC E8/E9 have made their debut, creating a strong cluster effect. They not only innovate in terms of powertrains but also upgrade in design, cabin technology, and luxury features, delivering a disruptive impact on traditional fuel MPVs and offering consumers an unprecedented MPV driving experience.

The success of plug-in hybrid MPVs also marks a transition in the MPV market from merely meeting space needs to pursuing a comprehensive, high-quality travel experience.

At the same time, corresponding to the aggressive expansion of plug-in hybrid vehicles is the steadfast defense and counterattack of fuel-powered MPVs.

The fuel MPVs represented by Buick GL8 and Toyota Sienna are the traditional leaders in the market. They have been deeply rooted in the market for many years, relying on their reliable mechanical quality, extensive user base, comprehensive after-sales service system, and the lack of mileage anxiety. They still maintain strong competitiveness, especially in business reception and medium to long-distance travel scenarios.

Although the Buick GL8 was once dethroned from its sales throne, its image as the "land-based business class cabin" remains deeply rooted in people's minds. Through continuous updates and upgrades, it has consistently improved in comfort, intelligence, and luxury, still boasting a large customer base. The Toyota Sienna, on the other hand, has established a firm foothold in the family market thanks to its brand reputation, excellent fuel economy, and flexible space utilization.

Overall, the advantage of fuel-powered MPVs lies in their stability. They are not passively defensive but instead seek to prove, through enhanced product capabilities, that mature and reliable fuel power remains a pragmatic choice for many consumers in the era of new energy.

The effect of the counterattack is also quite good.

Since April, if plug-in hybrid, pure electric, and fuel vehicles are counted separately, the Toyota Sienna has been the sales champion in the domestic MPV market for five consecutive months, with the Denza D9 DM consistently following closely behind. However, if the plug-in hybrid, pure electric, and fuel versions of the same model are combined, it becomes evident that the champion is likely not either of the two mentioned above, but rather the Buick GL8. This means that after winning the championship in 2022, the Buick GL8 is highly likely to once again become the champion of the domestic MPV market this year.

In addition to plug-in hybrids and fuel vehicles competing with each other, pure electric MPVs are also exploring opportunities.

After all, in the eyes of many, pure electric MPVs represent the ultimate direction of MPV technological evolution. Thanks to the advantages of the pure electric platform, they excel in space utilization, cabin environment, vehicle cost, and intelligent potential.

For example, the Ideal MEGA has garnered considerable attention with its disruptive design and exploration of family user needs. The XPeng X9 showcases another possibility for pure electric MPVs with its agile handling brought by rear-wheel steering technology and its tech-savvy image. Moreover, models represented by the Zeekr 009 continue to make attempts in the high-end business and tech exploration fields.

Although limited by the completeness of charging infrastructure, relatively high prices, and consumers' confidence in long-distance range, pure electric MPVs are more often used as a showcase of technology and brand image, and are still in the exploratory stage in terms of sales. However, their existence greatly enriches the diversity of the MPV market and points out the future development direction.

At the same time, the competition among these three technological routes is not a simple zero-sum game, but a symbiotic and competitive relationship that meets different user needs during specific periods. Plug-in hybrid vehicles currently have significant advantages, becoming the main engine of market growth; fuel vehicles maintain a stable base; while pure electric vehicles are responsible for exploring the high-end and forward-looking markets.

This diversified technological landscape has stimulated the innovative vitality of car companies and provided consumers with an unprecedented array of choices.

02The "Land Grabbing Movement" of Market Positioning

In addition to the technical route competition, the second significant change in the MPV market has occurred at the user positioning level.

The clear boundary between traditional commercial MPVs and family MPVs is being broken, with an intense territorial competition surrounding user scenarios taking place. This has led to the emergence of "suitable for both business and family" as the biggest growth point, while also presenting new challenges for brands focused on niche markets.

In the past, commercial MPVs represented by the Buick GL8 primarily focused on brand image, riding comfort, spaciousness, and reliability. They were mainly targeted at corporate clients for business receptions and official travel. This market is relatively stable but has very high demands for product quality and service.

The long-term success of the GL8 is attributed to its precise understanding and continuous fulfillment of market demands. Despite facing challenges from new energy vehicles, professional commercial MPVs still hold irreplaceable value in the high-end business sector that emphasizes brand image and specific usage scenarios.

In contrast, the household MPV market has enormous potential with the relaxation of the two-child and three-child policies and the upgrading of household consumption.

GAC Trumpchi is a steadfast player in this field, consistently developing products that focus on the needs of family users for space, safety, comfort, and economy, from the M6 to the M8. Toyota Sienna and Honda Odyssey also possess strong family-oriented attributes. Family MPVs place greater emphasis on practicality, safety, and a warm interior atmosphere.

As the demand for MPVs becomes less clearly defined, the "business and family friendly" MPV has become the greatest common denominator in the new landscape.

The most fiercely competitive area in the current market is precisely the ambiguous zone of "suitable for both business and family use." This reflects the real needs of Chinese consumers, particularly the middle class and business professionals, whose work and life boundaries are increasingly merging. They require a vehicle that can meet the professional image demands of weekday business commuting and client reception, while also providing comfortable family outings on weekends.

Models like Denza D9, Voyah Dreamer, and Weipai Gaoshan all use "suitable for both business and family" as their core selling point. This positioning strategy expands the target user group and becomes the preferred track for many new entrants. However, it also requires the product to have stronger overall capability and balance, as any shortcomings in any aspect could lead to failure in the competition.

This integration and competition of positioning mean that car companies can no longer define their products with the simple mindset of "commercial or family." The successful ones are often those brands that can deeply understand the complex, diverse, and dynamically changing needs of Chinese users, and based on this, achieve precise product definition and marketing outreach.

For example, GAC Trumpchi, while adhering to the family vehicle market, is also expanding into the business sector with models like the M8 Master Edition; meanwhile, some brands that originally focused on commercial vehicles are beginning to inject more family-friendly elements into their models. As a result, we see the boundaries of the market being restructured.

Overall, the changes in the MPV market landscape are a microcosm of the transformation in China's automotive industry under the backdrop of new energy and intelligentization. The "three-way battle" of technological routes and the "territorial race" of market positioning are intertwined, jointly driving the market forward.

This change is intense and even brutal, as it signifies the loosening of the old order and the birth of new leaders. However, at the same time, this change is also positive and healthy, prompting automakers to focus on the user and produce more innovative and competitive products.

Moreover, the future MPV market will no longer be a competition of single technology or positioning, but a contest of comprehensive strength. Whoever can better integrate electric vehicle technology, smart cabins, and intelligent systems, and who can more accurately grasp and create user demands, will be able to dominate in this grand and tumultuous transformation.

It is certain that the MPV market has bid farewell to its past calm and ushered in a golden era of flourishing diversity and infinite possibilities. For consumers, this is undoubtedly the best of times, as they will have more and better choices. As for car companies and observers like us, this exciting drama has only just begun.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track