Ministry Of Industry And Information Technology Holds Symposium On Battery Industry! International Oil Prices Surge 5%, Plastic Futures Plummet

1. Overnight crude oil market dynamics

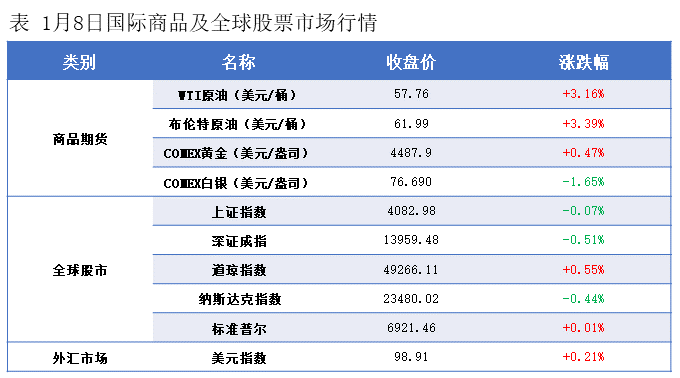

Geopolitical situations such as those between Russia and Ukraine, and Israel and Iran remain uncertain, with short-term potential supply risks continuing, leading to an increase in international oil prices. The NYMEX crude oil futures February contract rose by $1.77 per barrel to $57.76, a 3.16% increase compared to the previous period; the ICE Brent crude futures March contract rose by $2.03 per barrel to $61.99, a 3.39% increase compared to the previous period. The Chinese INE crude oil futures 2602 contract fell by 6.8 to 418 yuan per barrel, and rose by 6.6 to 424.6 yuan per barrel during the night session.

Market Forecast

On Thursday, the performance of oil prices was unexpected. Not only did crude oil end its two-day decline and rebound, but after the early morning settlement, prices continued to surge, with the highest increase at one point exceeding 5%. Against the backdrop of widespread significant commodity declines, last night's strong rise in oil prices surprised many bearish investors. This performance in oil prices was a correctional emotional release following excessive pessimism over the past few days. Earlier in the week, the market generally expected geopolitical tensions to bring a geopolitical premium to oil prices. However, as the Trump administration continued to assert its control over Venezuelan oil resources and announced a significant increase in production, with the U.S. Energy Secretary even claiming Venezuelan oil production could be increased by 50% within a year, oil prices fell instead of rising under this atmosphere. In the eyes of many industry insiders, this was clearly an unattainable goal. In fact, under the U.S. blockade, Venezuelan oil production had already begun to decline consecutively. Additionally, Iranian risks continuously pushed oil prices higher for the fourth day, starting to rally from the Middle East window trading and surging during the night session. Even after the night session closed, prices continued to rise sharply, with cumulative gains at one point exceeding 5%. Such a performance was particularly striking against the backdrop of widespread significant commodity declines and corrections.

This corrective behavior is precisely a reflection of investors continuously adjusting their judgment on oil prices under the influence of geopolitical factors. After stating that the U.S. will indefinitely control Venezuelan oil sales, U.S. Energy Secretary Wright expects Chevron's business in Venezuela to grow rapidly and emphasized that there are no plans to take any action against Iran. From the current situation, the U.S. is sending a large number of military aircraft to Europe, partly to control the transport of Venezuelan oil or sanctioned tankers, but exerting pressure on Iran is also visibly an option. In recent days, many countries have begun to warn their citizens in Israel and Iran to be aware of risks and to avoid traveling to these countries if possible, indicating that the risks in the Middle East are further brewing. Additionally, regarding how the U.S. forces the newly formed Venezuelan government to cooperate in ceding control over oil sales, the distribution of oil revenues is the biggest point of contention, and the related game is still ongoing.A series of aggressive actions by the United States against the interests of other countries has sparked global unease. Trump even declared that he does not need international law. On Wednesday evening local time, Trump stated that as Commander-in-Chief, his power is only limited by "his own moral standards" and disregarded international law and other mechanisms that restrain his use of military force, strikes against global nations, invasions, or pressure. As a global power, such a blatant violation of rules may seem strong in the short term, but the final outcome is already destined to respond to the saying, "Those who lack virtue do not deserve their position, and disaster will surely follow." The world has suffered from the United States for too long.

After several days of suppression, oil prices have finally seen an explosive surge. It can be initially judged as a correction of the geopolitical pricing from previous days. After the emotional release, the sustainability of this rebound is questionable. The supply and demand side indicates that global oil inventories are increasing again. While geopolitical disturbances will affect the rhythm of oil price movements, the core driver of oil prices remains the pressure of oversupply. Unless there is an escalation of risks in the Iranian region (which is indeed fermenting), the rebound potential for oil prices is limited and unlikely to be sustained. The factors influencing oil prices remain very complex, and the market still exhibits significant uncertainty and high volatility. In the first quarter, it is still recommended to maintain a short-selling strategy on oil prices at high points, with a primary focus on risk control, followed by seizing opportunities.

II. Macroeconomic Dynamics

1. Federal Reserve - ① Milan:It is expected that there will be approximately 150 basis points of interest rate cuts in 2026.Trump has decided on the next Federal Reserve chairman.Bessent urges the Federal Reserve to cut interest rates further.Additionally, it is expected that Trump will announce the candidate for the Federal Reserve Chair this month.

2. Venezuela Situation - ① U.S. Energy Secretary:Crude oil production may increase by 50% within 18 months.1. The U.S. Senate seeks to limit Trump's continued military actions in Venezuela. 2. Trump issues threats against five Republican lawmakers who "turned against" him. 3. U.S. media: Trump plans to take control of Venezuela's state-owned oil company.The goal is to lower the oil price to $50 per barrel.Venezuela reaffirms its commitment to deepening economic and trade agreements with China.The Venezuelan stock index has recently surged by 124%.Foreign investors are seeking entry opportunities.

CME Group announced that it will implement the above-mentioned changes after trading hours on January 9th, local time.Adjust the margin requirements for the futures spread and related spread contracts for gold, silver, platinum, and palladium.

In October 2025, the United States recorded a trade deficit of $29.4 billion, the smallest deficit since June 2009.

Market news: The U.S. Embassy has issued a warning.Ukraine may face a large-scale airstrike in the coming days.。

The Standing Committee of the Political Bureau of the Central Committee of the Communist Party of China held a meeting.

8. Industry insiders:The State Administration for Market Regulation has summoned six leading photovoltaic companies and industry associations.No agreements on production capacity and sales prices, etc.

9. The State Administration for Market Regulation reports monopoly risks in polysilicon? Relevant parties: All information disclosed by the government and enterprises shall be in accordance with legal and regulatory requirements.

The Ministry of Industry and Information Technology and other departments jointly held a symposium on the power and energy storage battery industry to deploy work on standardizing industry competition order.

State-owned Assets Supervision and Administration Commission (SASAC)China Petrochemical Corporation and China National Aviation Fuel Group Corporation have implemented a restructuring.。

The Ministry of Commerce responded to the review of Meta's acquisition of Manus: enterprises engaged in foreign investment and other activities must comply with Chinese laws and regulations.

On January 8, the Chinese Ambassador to Japan rejected the representation made by the Japanese Vice Minister for Foreign Affairs regarding China's strengthened export controls on dual-use items to Japan.

3. Early Morning Dynamics of the Plastic Market

Oil prices soared by 5%! Overnight, domestic plastic futures main contracts were all in the green:

Plastic contract 2601 is quoted at 6,622 yuan/ton, down 0.62% compared to the previous trading day.

The PP2601 contract is quoted at 6479 yuan/ton, down 0.26% compared to the previous trading day.

PVC2601 contract reported at 4849 yuan/ton, down 1.70% from the previous trading day.

Styrene contract 2601 reported at 6810 yuan/ton, down 0.26% compared to the previous trading day.

IV. Market Forecast

PE: The supply side is experiencing new changes as Ningxia Baofeng's PE plant, with an annual capacity of 400,000 tons, successfully restarts, and market supply pressure persists. The demand side is showing cautious behavior; although downstream segments such as film, injection molding, and hollow products maintain normal operational levels, they are constrained by insufficient order follow-up, leading to a slight decrease in operating rates compared to earlier periods. After completing phased replenishment operations, terminal enterprises generally shift to a wait-and-see approach, showing limited acceptance of current market prices and only maintaining a pace of replenishment based on actual needs. Traders are adjusting their operational strategies in response to market sentiment, often adopting a high-selling mode to accelerate inventory turnover, with actual transactions primarily based on negotiations. Despite market sentiment being temporarily in a strong range, the sustainability of the increase is questionable due to a lack of substantial demand support. In the short term, the polyethylene market is likely to exhibit a volatile consolidation trend. Fluctuations in crude oil prices and favorable macro policy expectations will provide some support to the market, but the supply increase from the plant restart and the downstream procurement model dominated by actual needs will significantly constrain the market's upward movement.

PP: The recovery in the emotional aspect is driving a temporary strengthening of the spot market, while the futures market opened high but fell into a period of fluctuation and consolidation. The performance in downstream segments is differentiated; traditional sectors such as plastic weaving and BOPP are affected by the end-of-year off-season and expectations of the Spring Festival holidays, resulting in a lack of follow-up on new orders. Companies generally maintain a cautious wait-and-see attitude, primarily engaging in low-price purchases for essential needs. In contrast, high-end sectors like modified injection molding for automotive and home appliance applications, as well as medical non-woven fabrics, remain relatively stable due to rigid demand, but the overall increment is limited, making it difficult to drive a rebound in overall market demand. Although inventory is decreasing at an accelerated pace, production facilities are operating at high capacity, and supply-side pressure still exists. In the short term, the core contradictions in the market have not fundamentally changed; the ongoing tug-of-war between cost support and weak demand will continue to dominate market trends. It is expected that the polypropylene market will likely maintain a range-bound fluctuation; without unexpected positive factors to boost it, the upward potential will remain constrained.

PVC: From the current supply and demand perspective, the overall operating rate of the PVC industry remains high, and the supply is relatively sufficient. Before the Spring Festival, upstream factories still face certain sales pressure, while demand remains sluggish with expectations of further weakening. The contradiction in supply and demand is a consensus, but the price adjustments in both the futures and spot markets, though originating from fundamentals, are relatively disconnected. Price adjustments are more influenced by policies and news stimuli. When policy and news factors arise, fundamentals are extremely weakened, whereas during market price declines, supply and demand fundamentals are revisited. However, after testing historical lows in 2025, the overall direction in 2026 is expected to maintain a positive outlook, as it is the beginning year of the Fifteenth Five-Year Plan. Nevertheless, price fluctuations in both markets may intensify, thus requiring cautious handling. Overall, in the short term, spot price adjustments may still appear in a wide range.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories